This version of the form is not currently in use and is provided for reference only. Download this version of

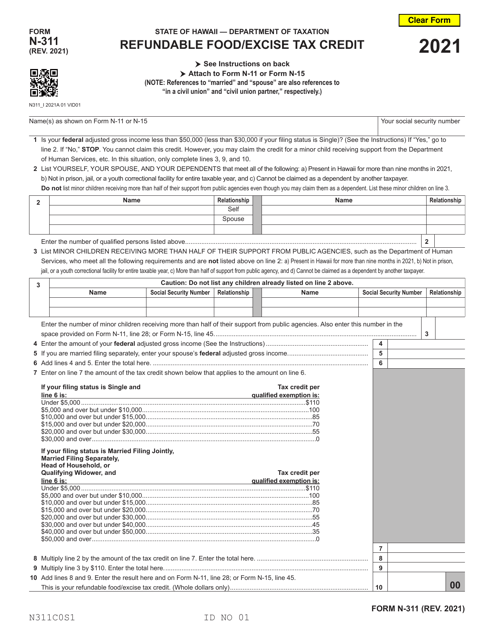

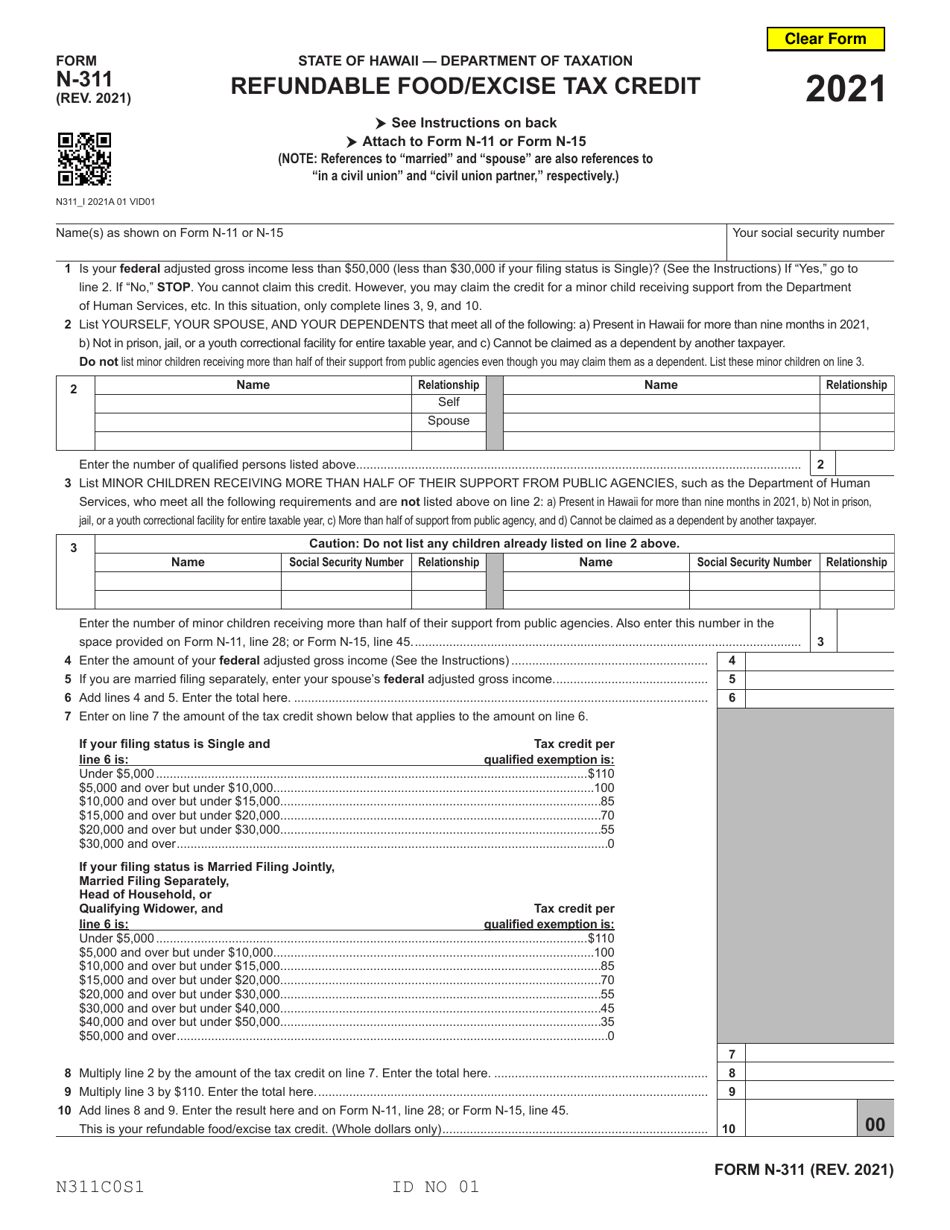

Form N-311

for the current year.

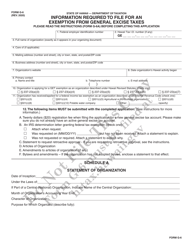

Form N-311 Refundable Food / Excise Tax Credit - Hawaii

What Is Form N-311?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form N-311?

A: Form N-311 is a form used to claim the refundable food/excise tax credit in the state of Hawaii.

Q: What is the purpose of the refundable food/excise tax credit?

A: The purpose of the refundable food/excise tax credit is to provide financial assistance to low-income individuals and families in Hawaii.

Q: Who can claim the refundable food/excise tax credit?

A: Residents of Hawaii who meet certain income requirements and have paid food/excise taxes are eligible to claim the credit.

Q: How do I claim the refundable food/excise tax credit?

A: To claim the refundable food/excise tax credit, you need to fill out Form N-311 and submit it to the Hawaii Department of Taxation.

Q: Is the refundable food/excise tax credit available in other states?

A: No, the refundable food/excise tax credit is specific to the state of Hawaii.

Q: What documentation do I need to submit with Form N-311?

A: You may be required to submit certain documents such as proof of income and food/excise tax receipts along with Form N-311.

Q: When is the deadline to submit Form N-311?

A: The deadline to submit Form N-311 is usually April 20th of the following year.

Q: How long does it take to receive the refundable food/excise tax credit?

A: The processing time for the refundable food/excise tax credit can vary, but it typically takes several weeks to receive the credit.

Q: Can I claim the refundable food/excise tax credit if I don't have any income?

A: No, you must have some form of income to be eligible for the refundable food/excise tax credit.

Form Details:

- Released on January 1, 2021;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form N-311 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.