This version of the form is not currently in use and is provided for reference only. Download this version of

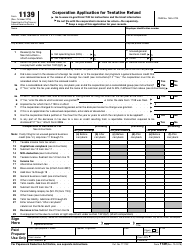

Form N-309

for the current year.

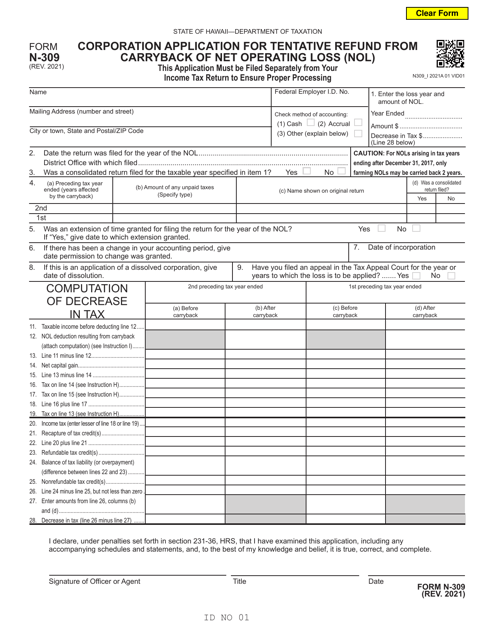

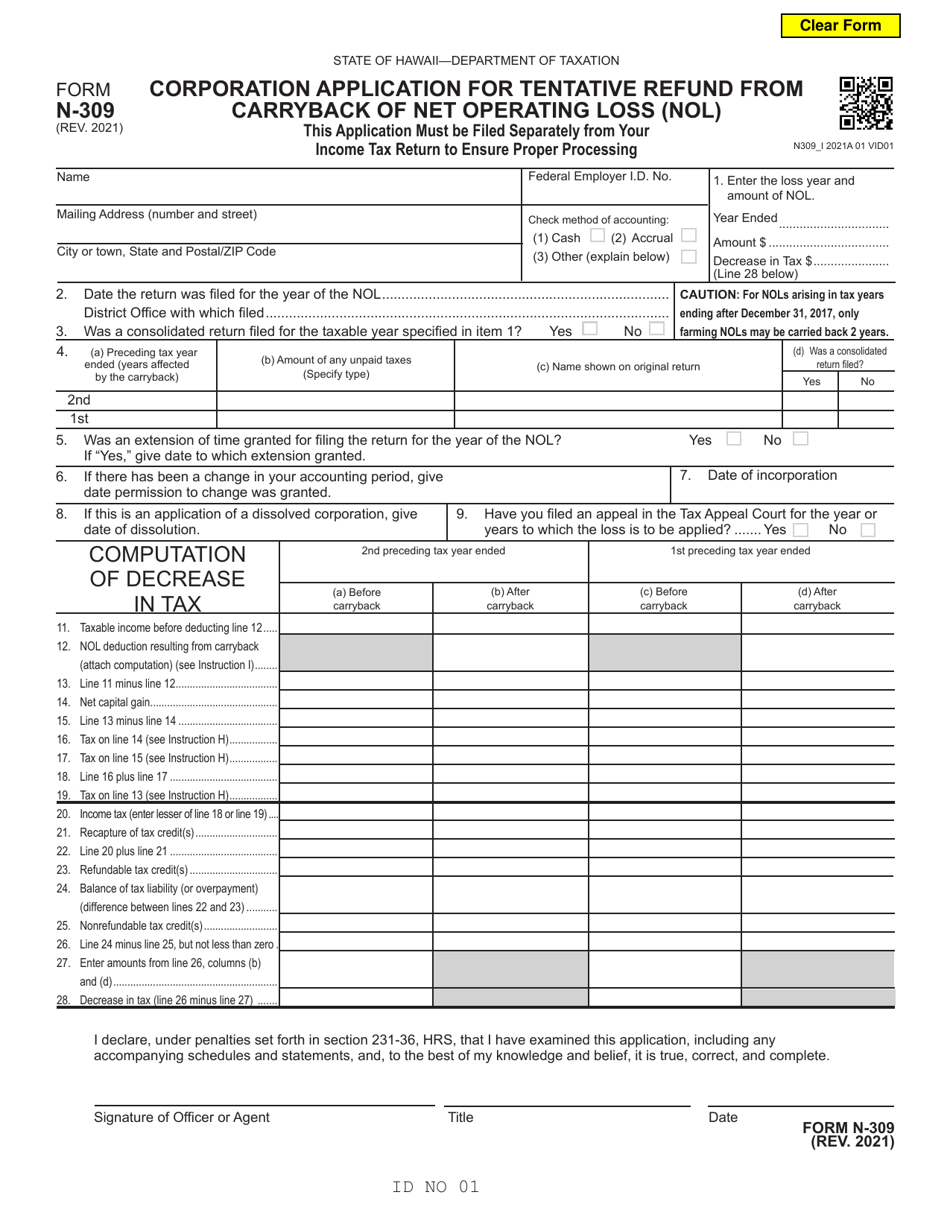

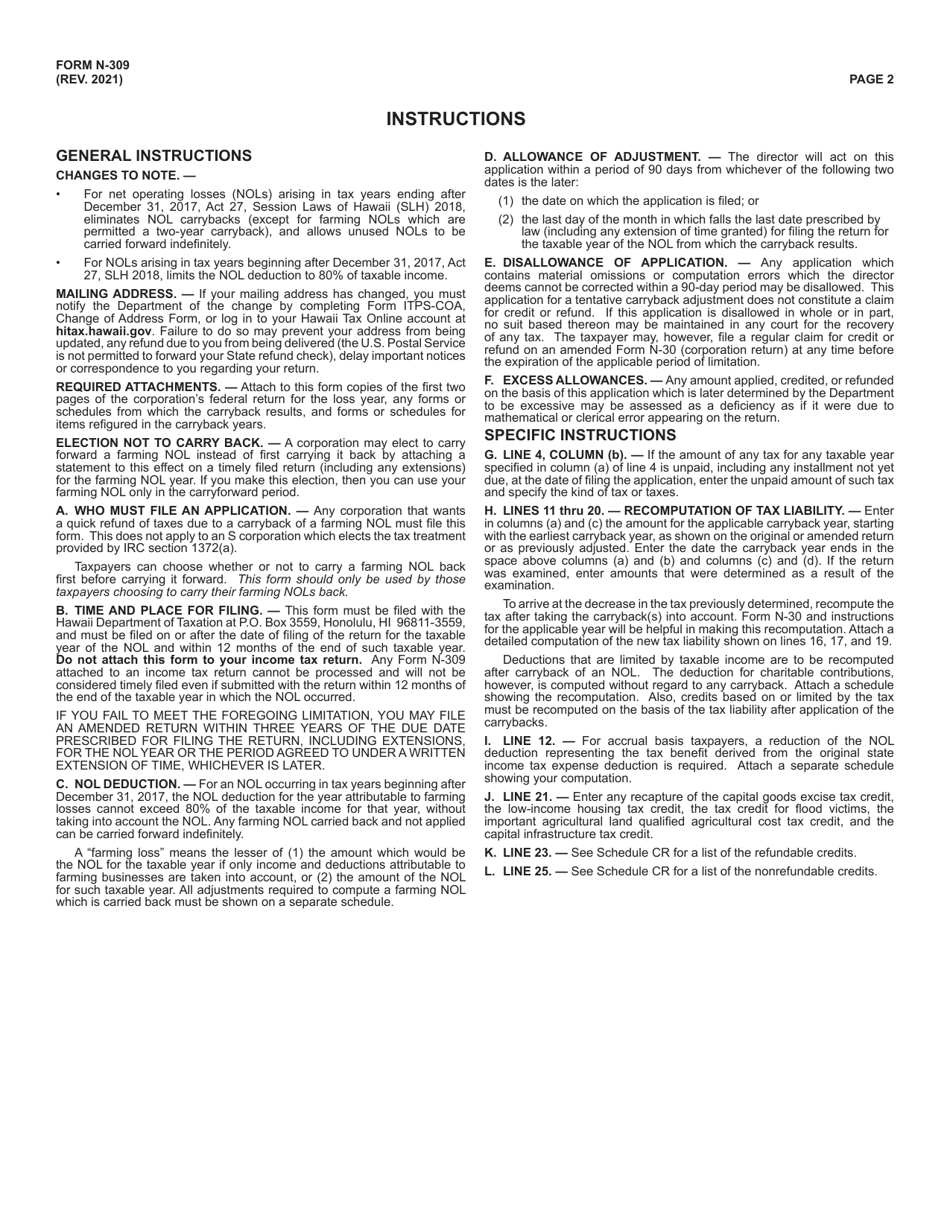

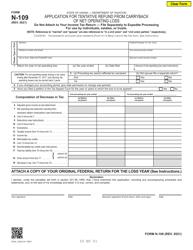

Form N-309 Corporation Application for Tentative Refund From Carryback of Net Operating Loss (Nol) - Hawaii

What Is Form N-309?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form N-309?

A: Form N-309 is the Corporation Application for Tentative Refund from Carryback of Net Operating Loss (NOL) in Hawaii.

Q: What is the purpose of Form N-309?

A: The purpose of Form N-309 is to apply for a tentative refund from carrying back a net operating loss (NOL) in Hawaii for corporations.

Q: Who needs to file Form N-309?

A: Corporations in Hawaii that have a net operating loss (NOL) and want to apply for a tentative refund by carrying back the loss need to file Form N-309.

Q: What is a net operating loss (NOL)?

A: A net operating loss (NOL) occurs when a corporation's allowable deductions exceed its taxable income in a given year.

Q: How does Form N-309 help corporations with net operating losses?

A: Form N-309 allows corporations to apply for a tentative refund by carrying back a net operating loss (NOL) in Hawaii to offset taxable income from previous years.

Form Details:

- Released on January 1, 2021;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form N-309 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.