This version of the form is not currently in use and is provided for reference only. Download this version of

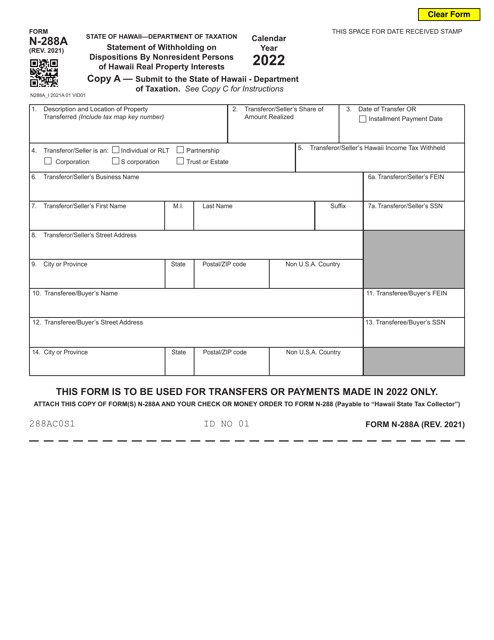

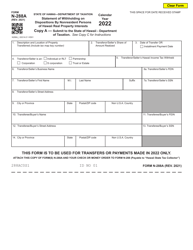

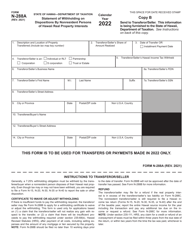

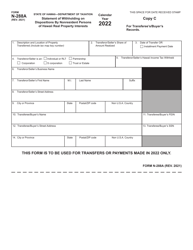

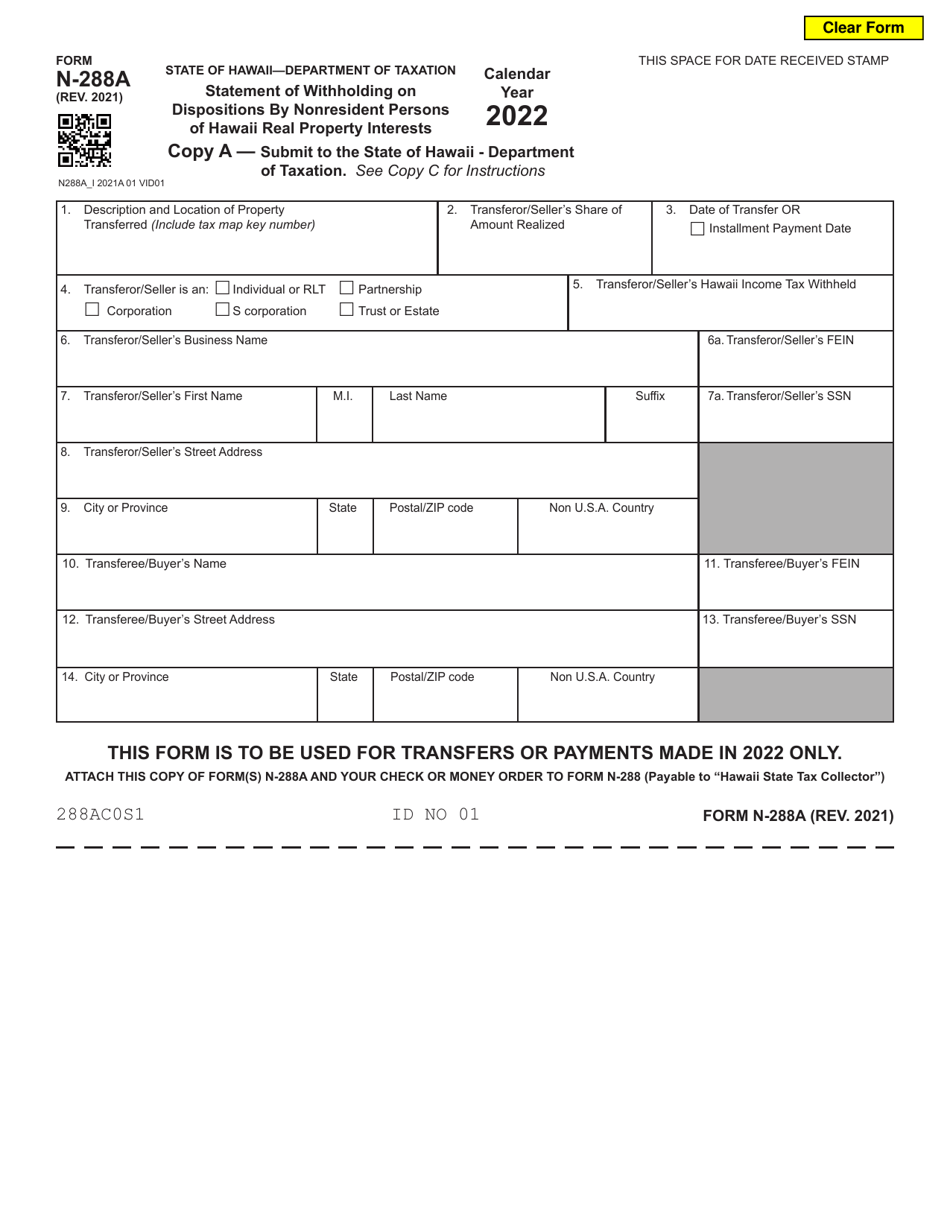

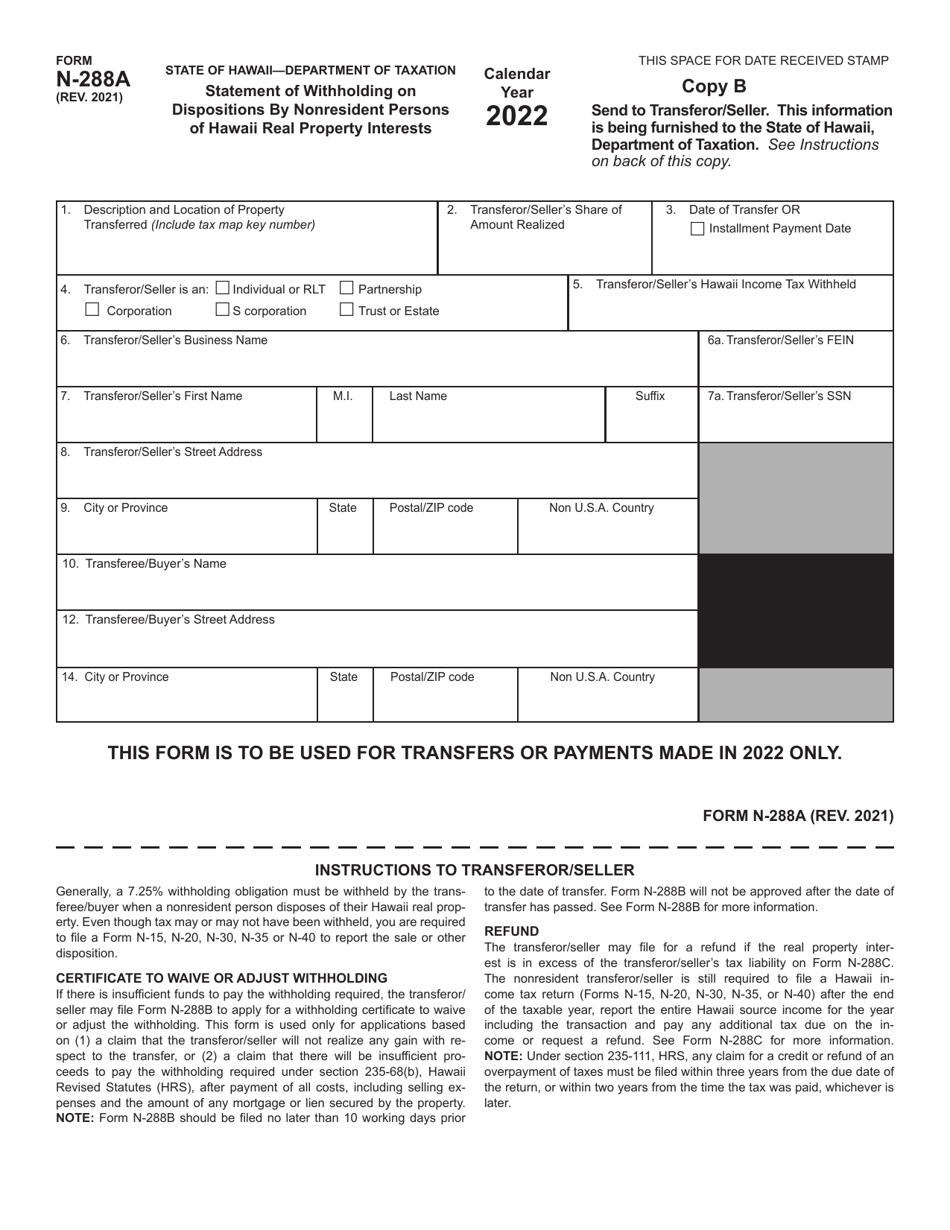

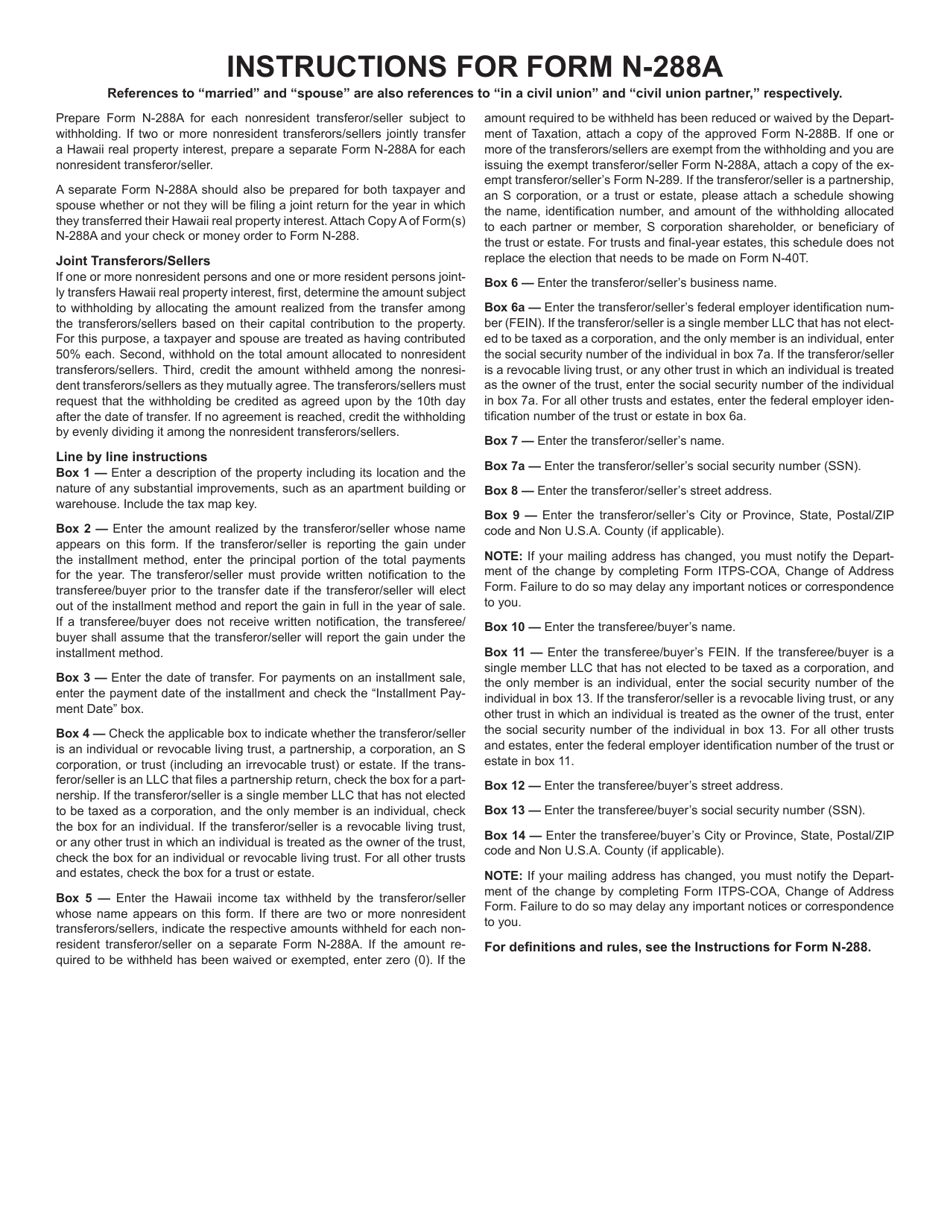

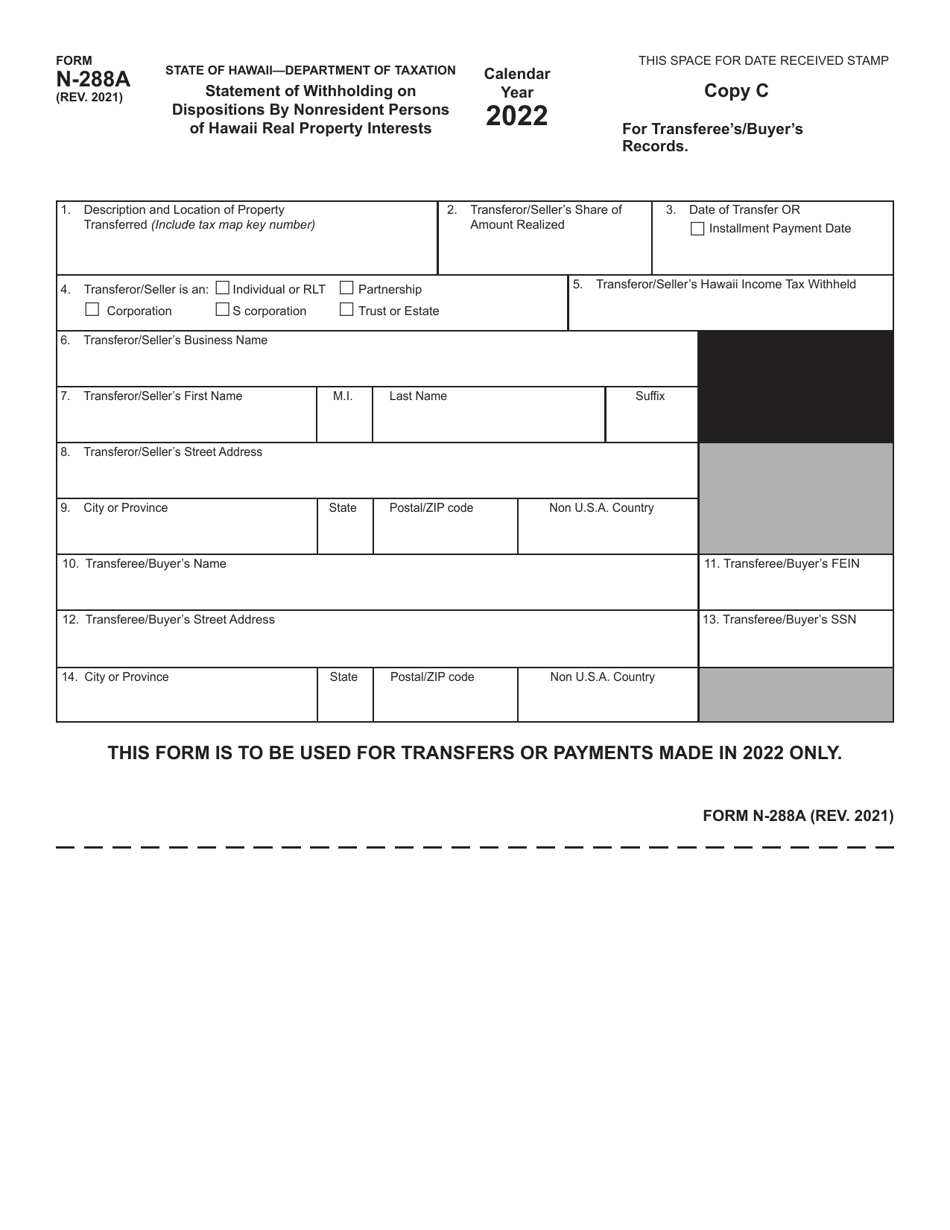

Form N-288A

for the current year.

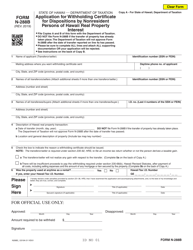

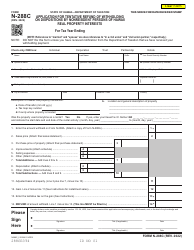

Form N-288A Statement of Withholding on Dispositions by Nonresident Persons of Hawaii Real Property Interests - Hawaii

What Is Form N-288A?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form N-288A?

A: Form N-288A is the Statement of Withholding on Dispositions by Nonresident Persons of Hawaii Real Property Interests.

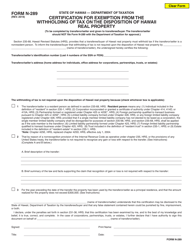

Q: Who needs to file Form N-288A?

A: Nonresident persons who are disposing of Hawaii real property interests need to file Form N-288A.

Q: What is the purpose of Form N-288A?

A: The purpose of Form N-288A is to report and withhold taxes on the dispositions of Hawaii real property interests by nonresident persons.

Q: What information is required on Form N-288A?

A: Form N-288A requires information such as the seller's name, address, social security or employer identification number, and details about the property disposition.

Q: When should Form N-288A be filed?

A: Form N-288A should be filed within 10 days after the disposition of the Hawaii real property interest.

Q: How much withholding is required on the disposition of Hawaii real property interests?

A: The withholding amount is generally 7.25% of the sales price or fair market value of the property, unless an exemption applies.

Q: Are there any exemptions to the withholding requirement?

A: Yes, there are certain exemptions that may apply, such as if the seller is a U.S. citizen or resident alien, or if the sales price is below a certain threshold.

Form Details:

- Released on January 1, 2021;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form N-288A by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.