This version of the form is not currently in use and is provided for reference only. Download this version of

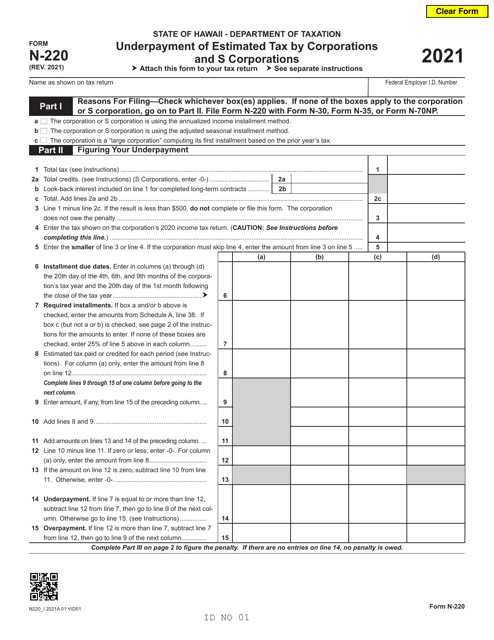

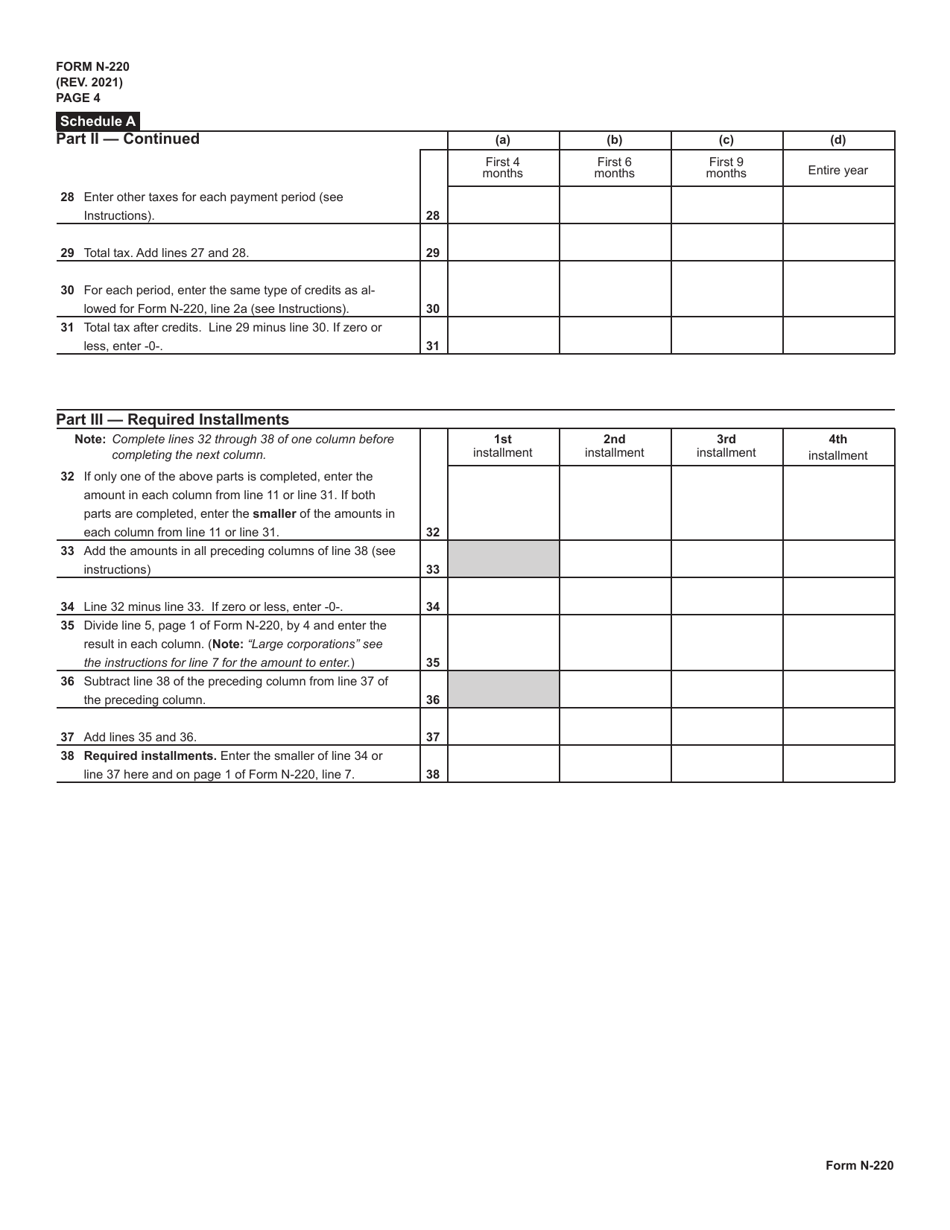

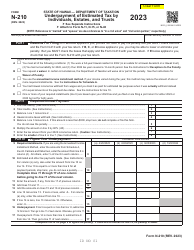

Form N-220

for the current year.

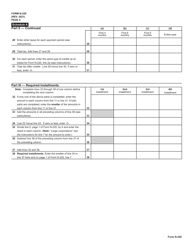

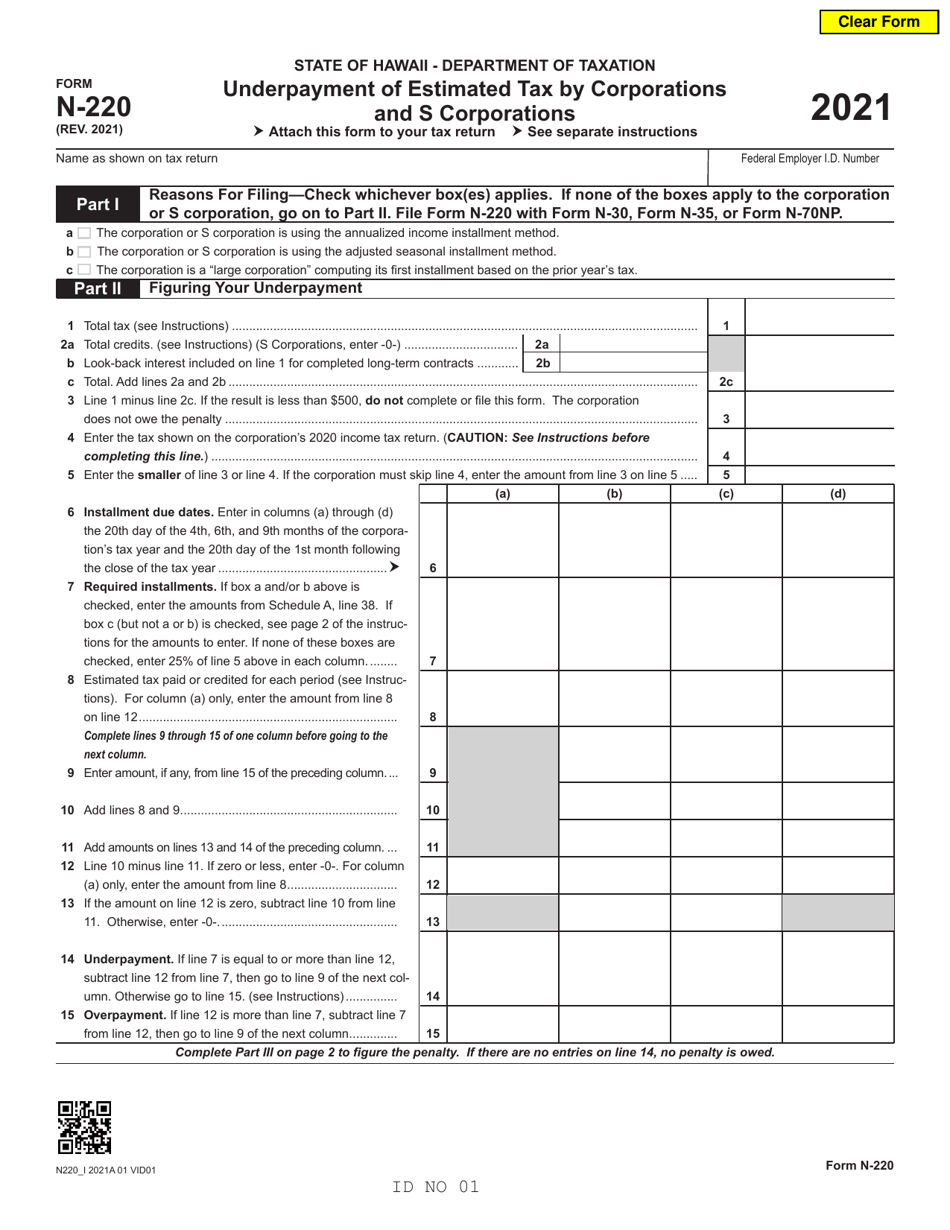

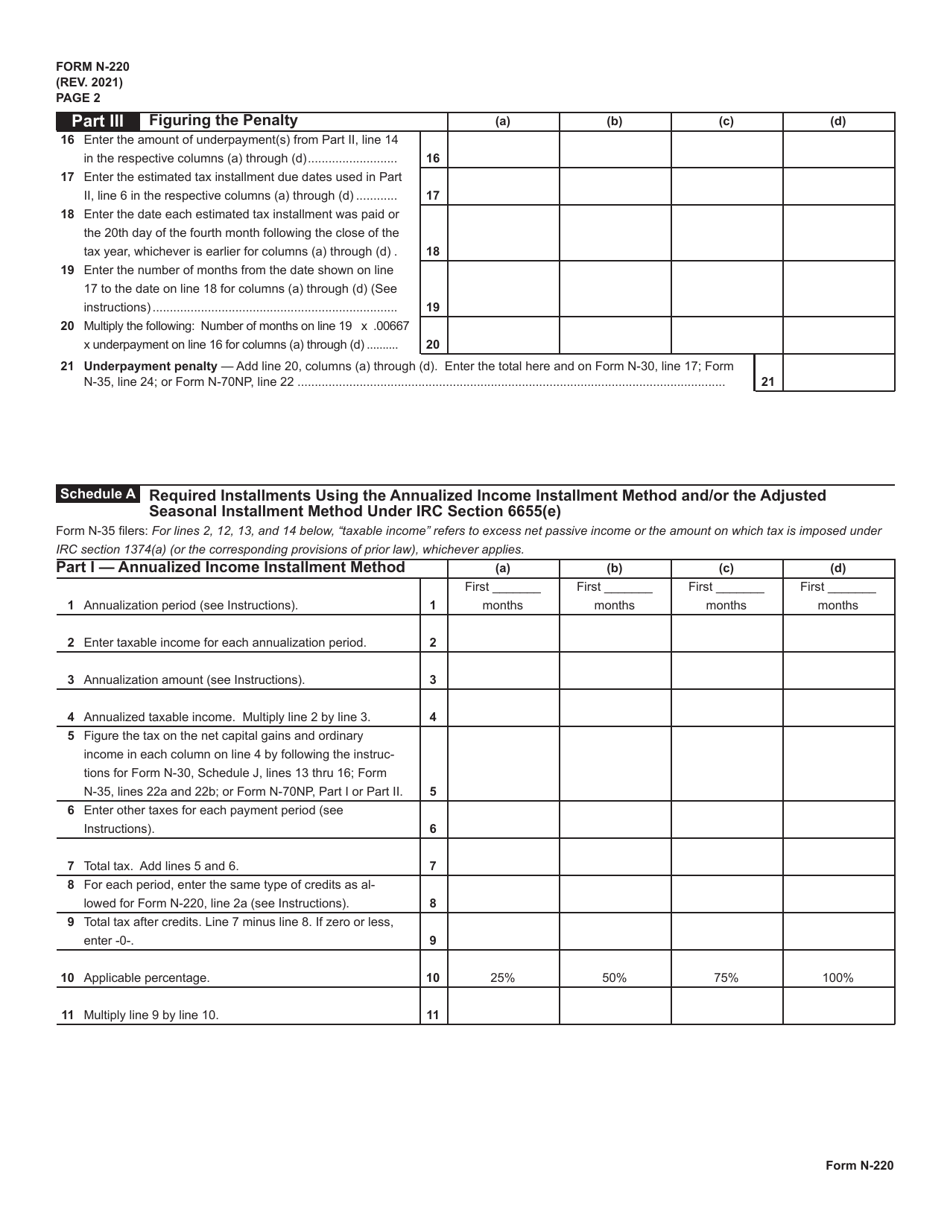

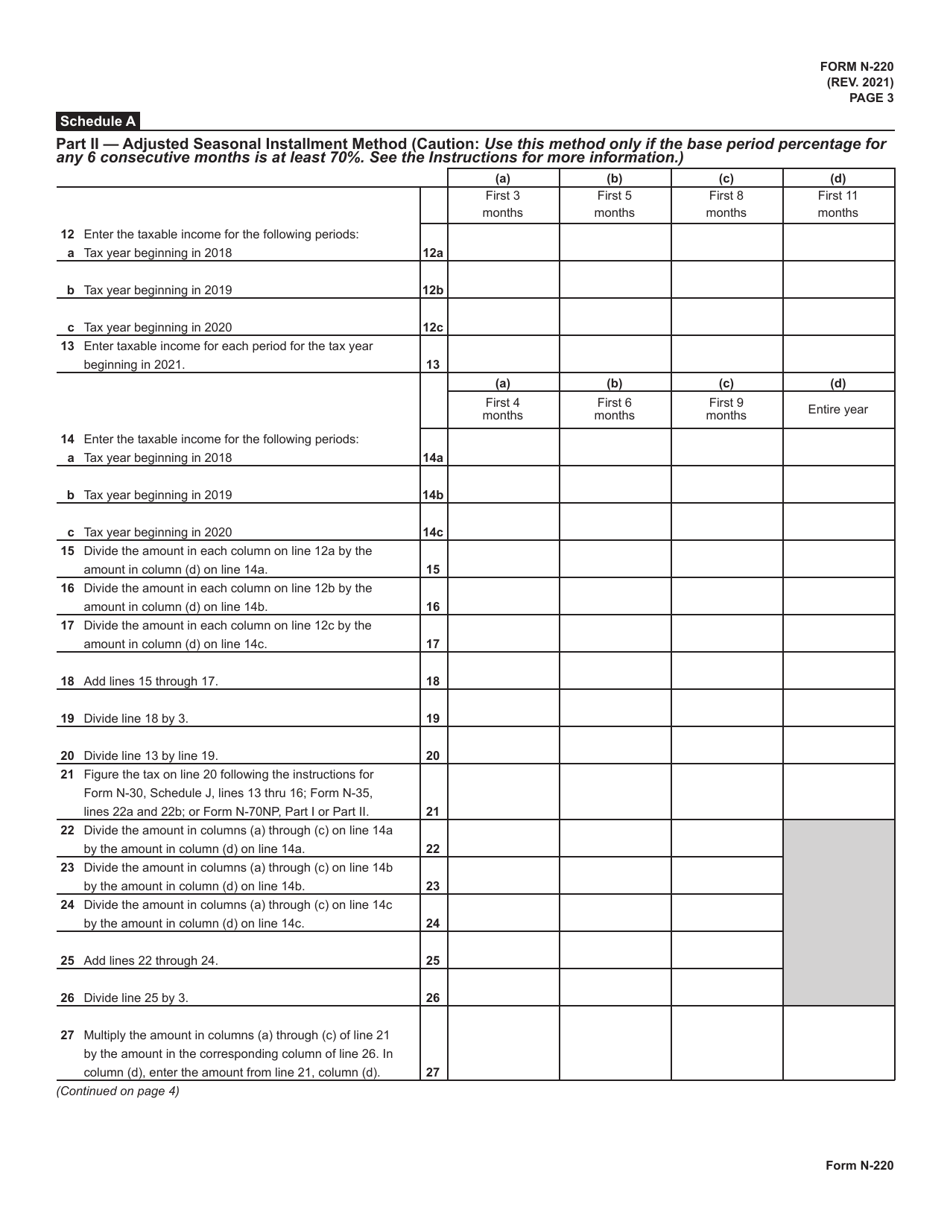

Form N-220 Underpayment of Estimated Tax by Corporations and S Corporations - Hawaii

What Is Form N-220?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form N-220?

A: Form N-220 is used to calculate and report underpayment of estimated tax by Corporations and S Corporations in Hawaii.

Q: Who needs to file Form N-220?

A: Corporations and S Corporations in Hawaii who have underpaid their estimated tax need to file Form N-220.

Q: Why would a corporation or S corporation need to file Form N-220?

A: A corporation or S corporation in Hawaii may need to file Form N-220 if they have underpaid their estimated tax.

Q: What is the purpose of Form N-220?

A: The purpose of Form N-220 is to determine the amount of underpayment of estimated tax by a corporation or S corporation in Hawaii.

Q: When is Form N-220 due?

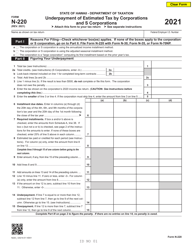

A: Form N-220 is generally due on the 15th day of the 4th month following the close of the taxable year.

Q: Are there any penalties for failing to file Form N-220?

A: Yes, there may be penalties for failing to file Form N-220 or for underpaying estimated tax.

Q: Is Form N-220 only for corporations and S corporations in Hawaii?

A: Yes, Form N-220 is specifically for corporations and S corporations in Hawaii.

Q: Is Form N-220 the same as federal Form 2220?

A: No, Form N-220 is specific to Hawaii and is not the same as federal Form 2220.

Form Details:

- Released on January 1, 2021;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form N-220 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.