This version of the form is not currently in use and is provided for reference only. Download this version of

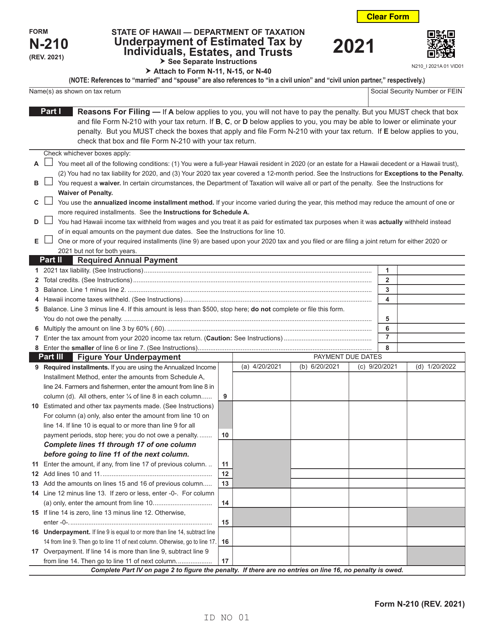

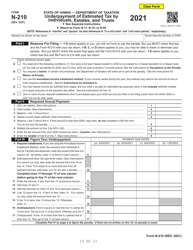

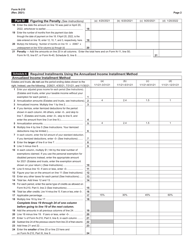

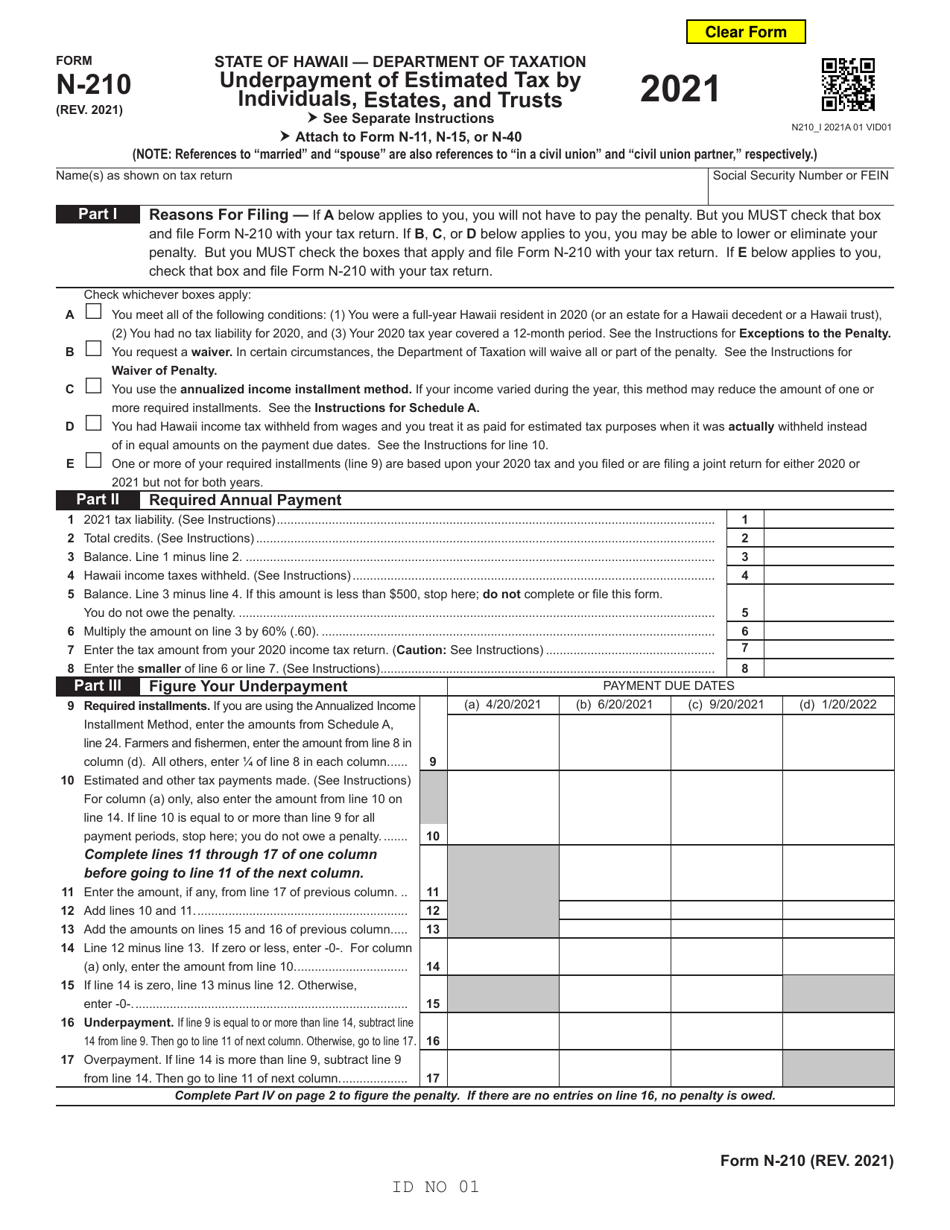

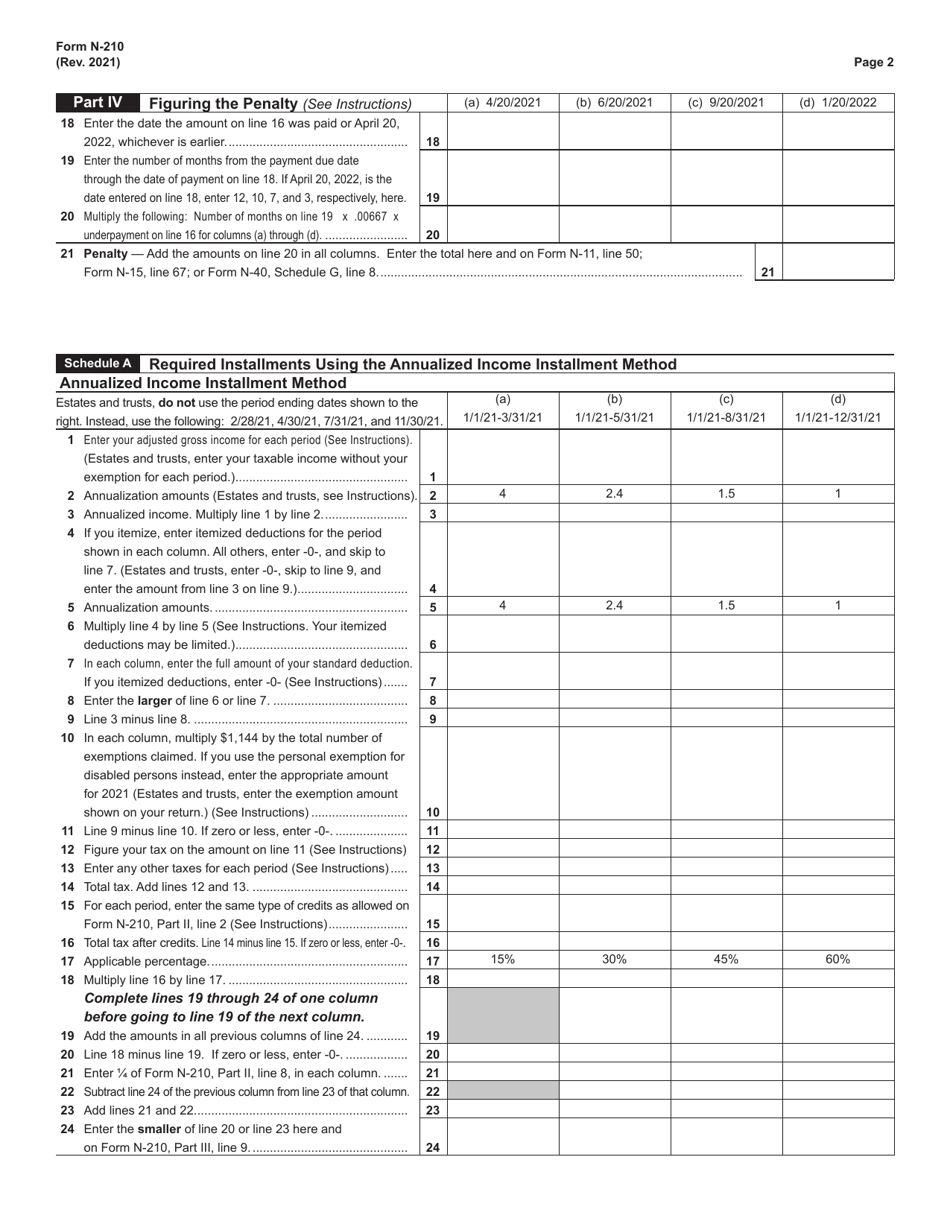

Form N-210

for the current year.

Form N-210 Underpayment of Estimated Tax by Individuals, Estates, and Trusts - Hawaii

What Is Form N-210?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form N-210?

A: Form N-210 is used to calculate and report underpayment of estimated tax by individuals, estates, and trusts in Hawaii.

Q: Who needs to file Form N-210?

A: Individuals, estates, and trusts in Hawaii who have underpaid their estimated tax obligations need to file Form N-210.

Q: What is the purpose of Form N-210?

A: The purpose of Form N-210 is to calculate the amount of underpayment of estimated tax and to report it to the state of Hawaii.

Q: When is Form N-210 due?

A: Form N-210 is due on or before the 20th day of the fourth month following the close of the taxable year.

Q: Are there any penalties for underpayment of estimated tax in Hawaii?

A: Yes, if you underpay your estimated tax in Hawaii, you may be subject to penalties and interest.

Q: What supporting documents do I need to include with Form N-210?

A: You do not need to include any supporting documents with Form N-210, but you should keep records of your estimated tax payments for your own records.

Q: Is Form N-210 the same as Form 1040?

A: No, Form N-210 is specific to Hawaii and is used to report underpayment of estimated tax, while Form 1040 is a federal tax form used to report income and calculate federal taxes.

Q: Can I file Form N-210 if I haven't underpaid my estimated tax?

A: No, Form N-210 is only necessary if you have underpaid your estimated tax obligations in Hawaii.

Form Details:

- Released on January 1, 2021;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form N-210 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.