This version of the form is not currently in use and is provided for reference only. Download this version of

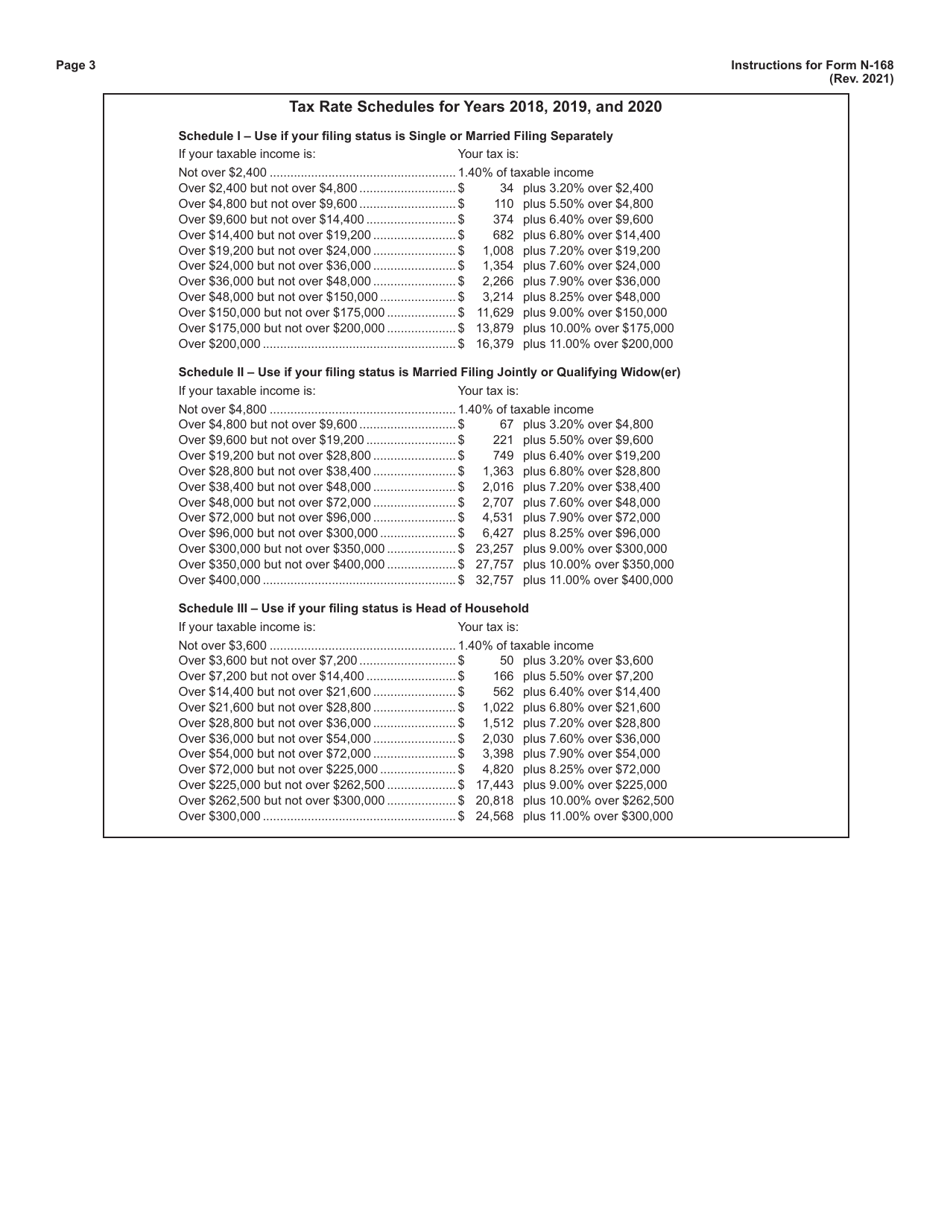

Instructions for Form N-168

for the current year.

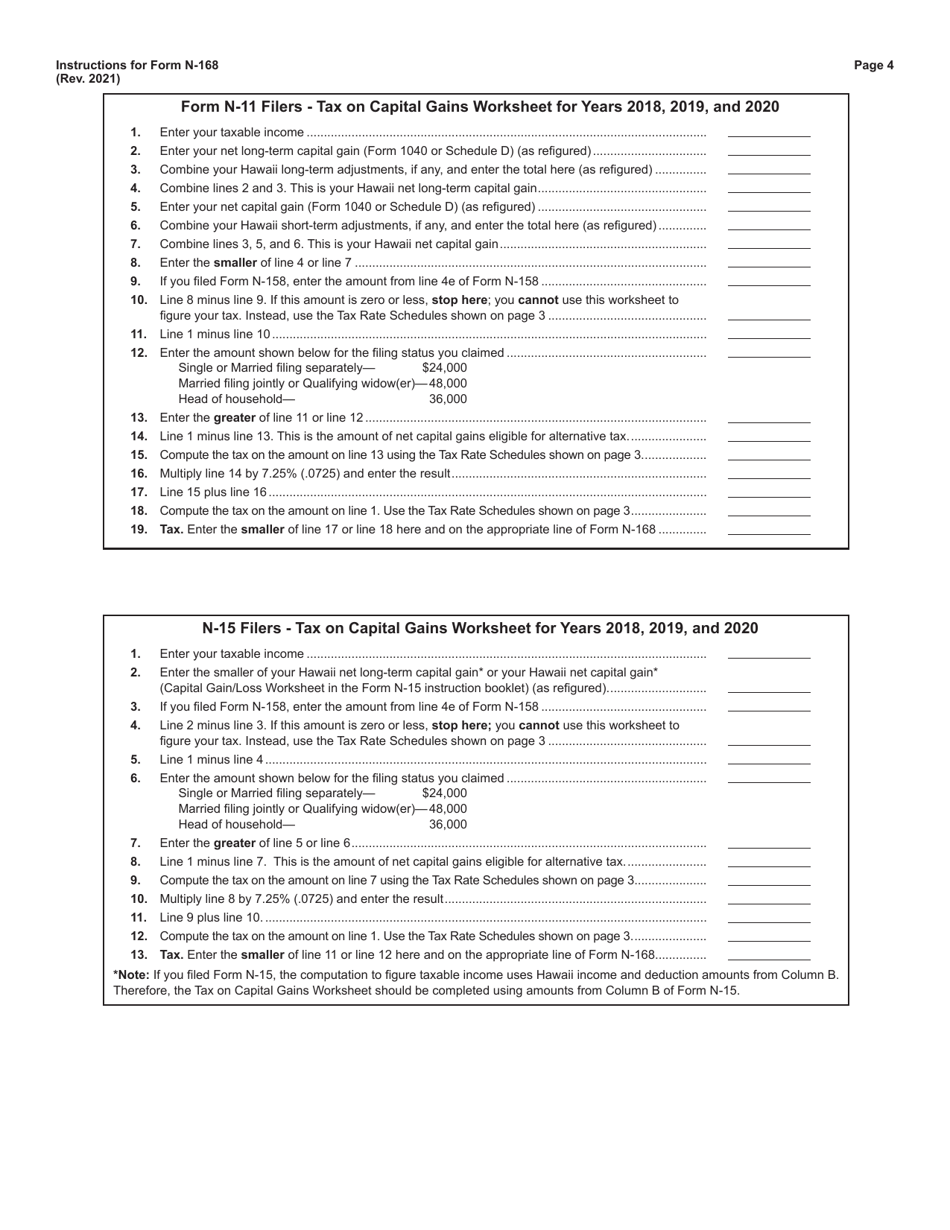

Instructions for Form N-168 Income Averaging for Farmers and Fishermen - Hawaii

This document contains official instructions for Form N-168 , Income Averaging for Farmers and Fishermen - a form released and collected by the Hawaii Department of Taxation. An up-to-date fillable Form N-168 is available for download through this link.

FAQ

Q: What is Form N-168?

A: Form N-168 is a specific tax form used for income averaging for farmers and fishermen in Hawaii.

Q: Who is eligible to use Form N-168?

A: Farmers and fishermen in Hawaii are eligible to use Form N-168 to apply for income averaging.

Q: What is income averaging?

A: Income averaging is a method used to reduce the tax burden on farmers and fishermen by spreading their income evenly over a period of years.

Q: How does income averaging work?

A: Income averaging allows farmers and fishermen to calculate their tax liability based on the average of their income over a designated period of up to four years.

Q: What are the benefits of using Form N-168?

A: Using Form N-168 allows farmers and fishermen to potentially lower their tax liability by averaging their income over multiple years.

Q: Are there any restrictions on using Form N-168?

A: Yes, there are certain restrictions on using Form N-168, such as the requirement to have a majority of income derived from farming or fishing activities.

Q: When should I file Form N-168?

A: Form N-168 should be filed by the due date of your individual income tax return, which is typically April 20th or the 20th day of the 4th month following the close of your tax year.

Q: Is there a fee to file Form N-168?

A: No, there is no fee to file Form N-168. It is a free form provided by the Hawaii Department of Taxation.

Instruction Details:

- This 4-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Hawaii Department of Taxation.