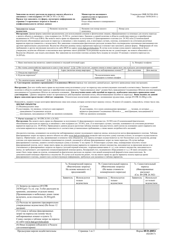

This version of the form is not currently in use and is provided for reference only. Download this version of

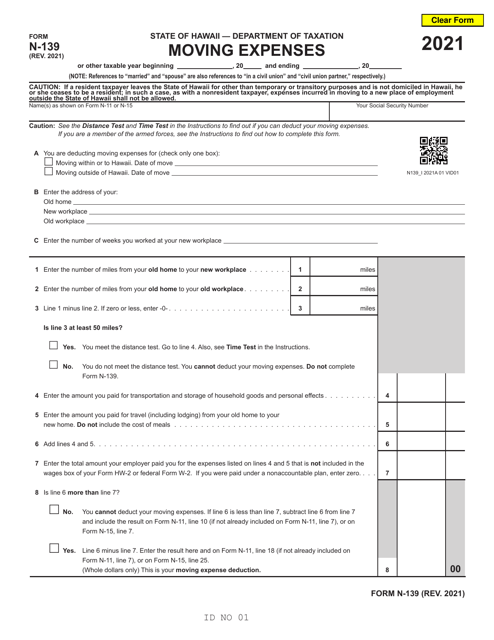

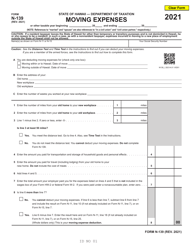

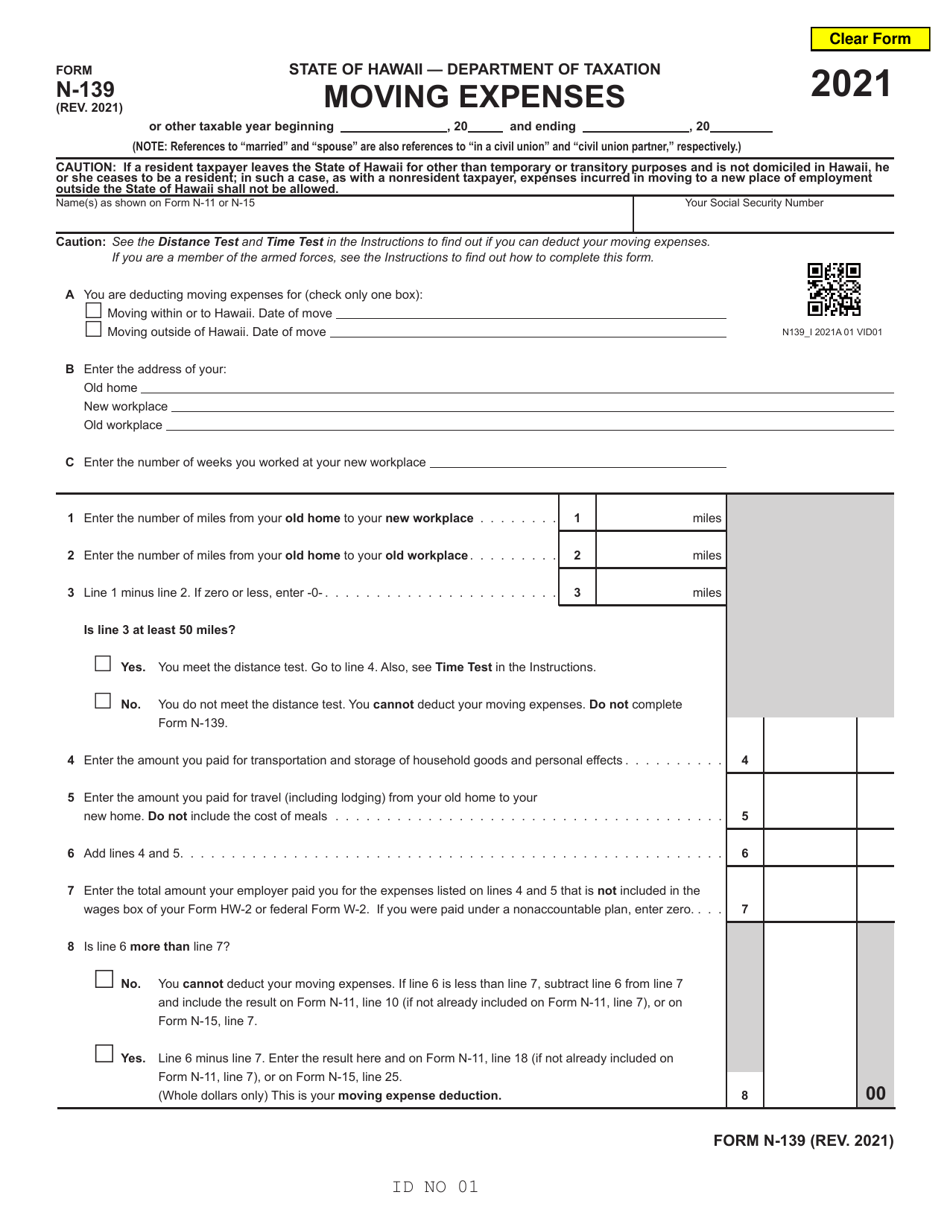

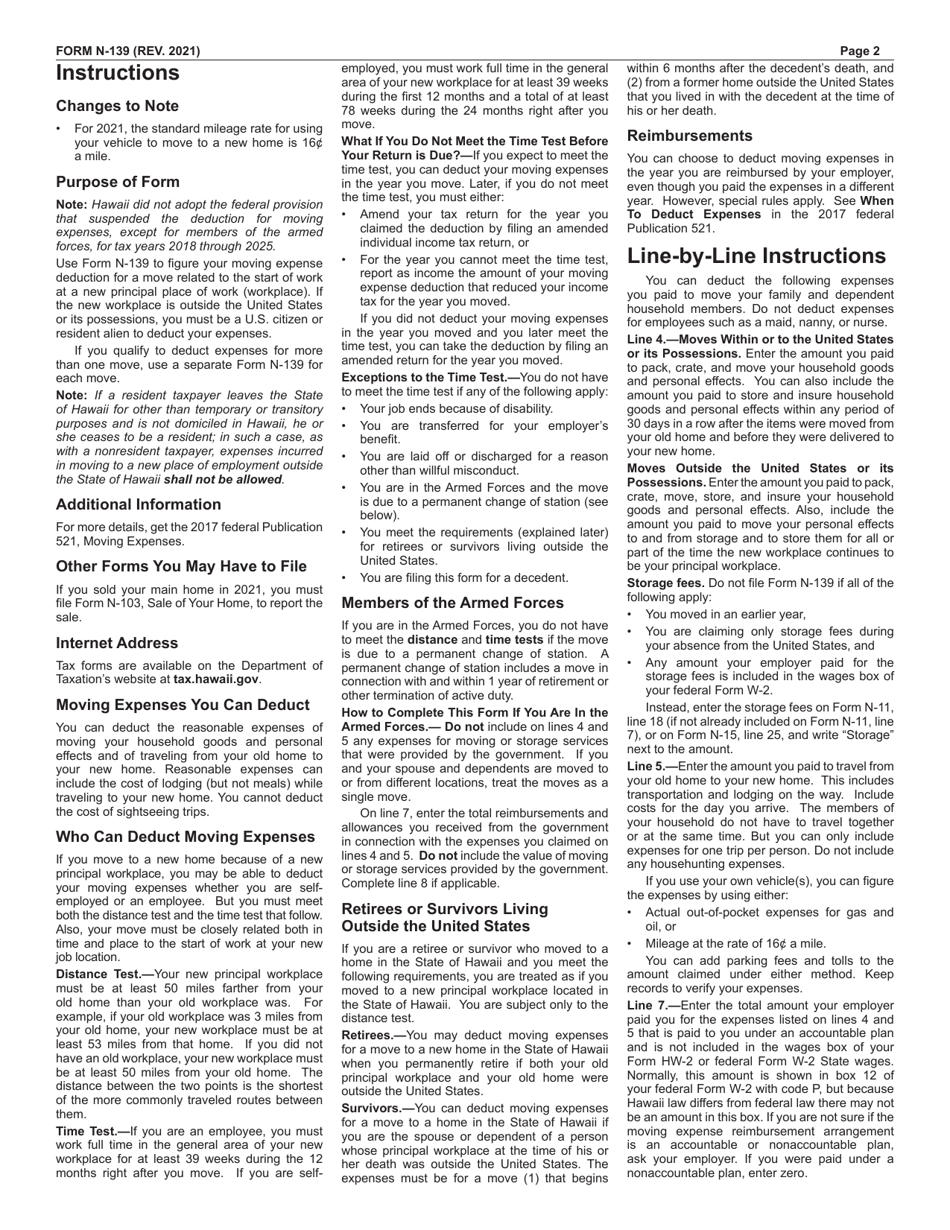

Form N-139

for the current year.

Form N-139 Moving Expenses - Hawaii

What Is Form N-139?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

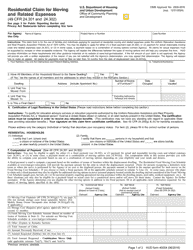

Q: What is Form N-139?

A: Form N-139 is a tax form used for reporting moving expenses for individuals who have moved to or from Hawaii.

Q: Who needs to file Form N-139?

A: Individuals who have moved to or from Hawaii and have eligible moving expenses to report need to file Form N-139.

Q: What are eligible moving expenses?

A: Eligible moving expenses include transportation costs, storage fees, and lodging expenses incurred as a result of moving to a new residence in Hawaii.

Q: Can I deduct all of my moving expenses?

A: No, you can only deduct eligible moving expenses that are not reimbursed by your employer or any other source.

Q: When is the deadline to file Form N-139?

A: The deadline to file Form N-139 is usually April 20th of the year following the tax year in which the moving expenses were incurred.

Q: Do I need to include supporting documents with Form N-139?

A: Yes, you need to include copies of invoices, receipts, and any other relevant documents that substantiate your eligible moving expenses.

Q: Is there a fee for filing Form N-139?

A: No, there is no fee for filing Form N-139.

Form Details:

- Released on January 1, 2021;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form N-139 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.