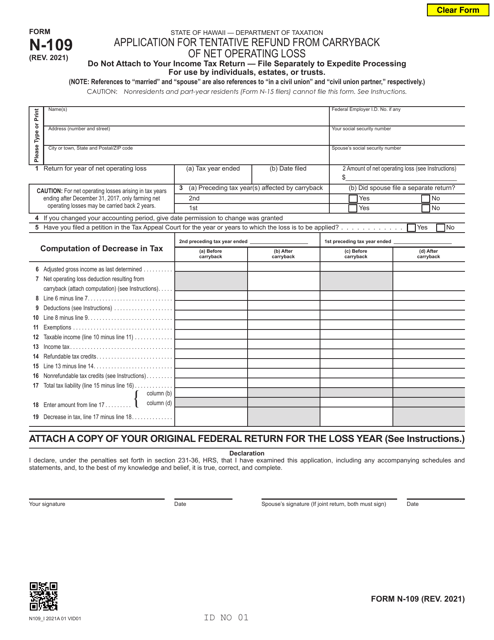

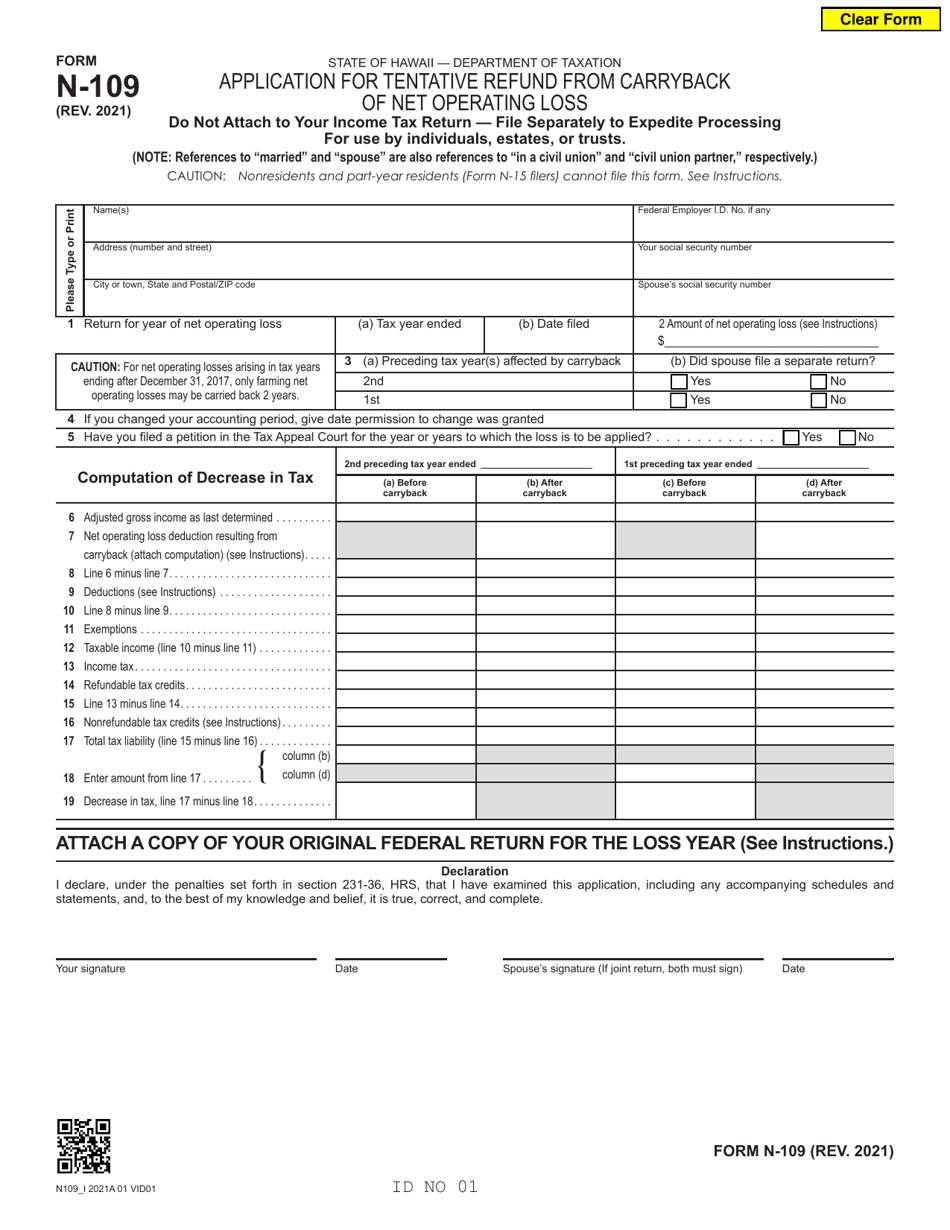

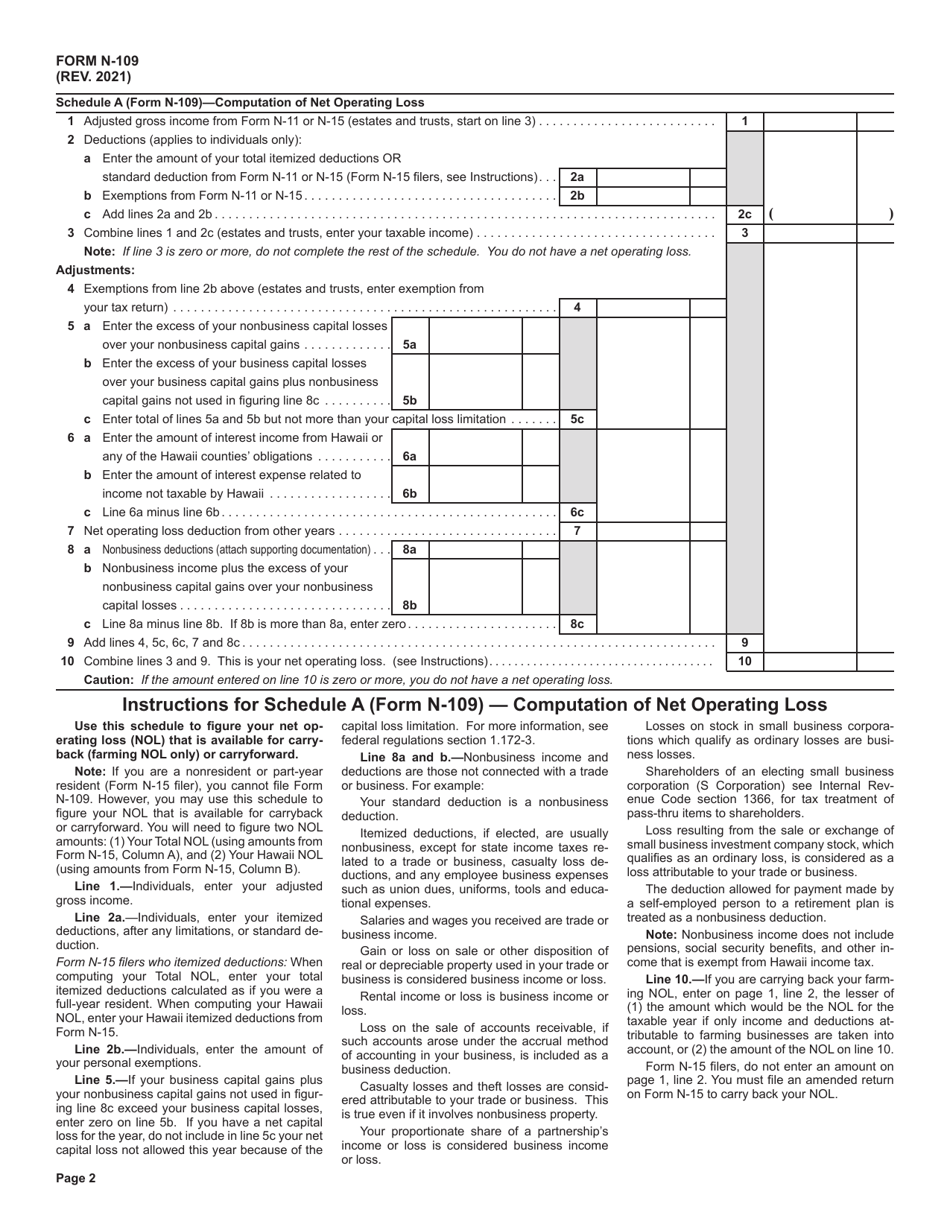

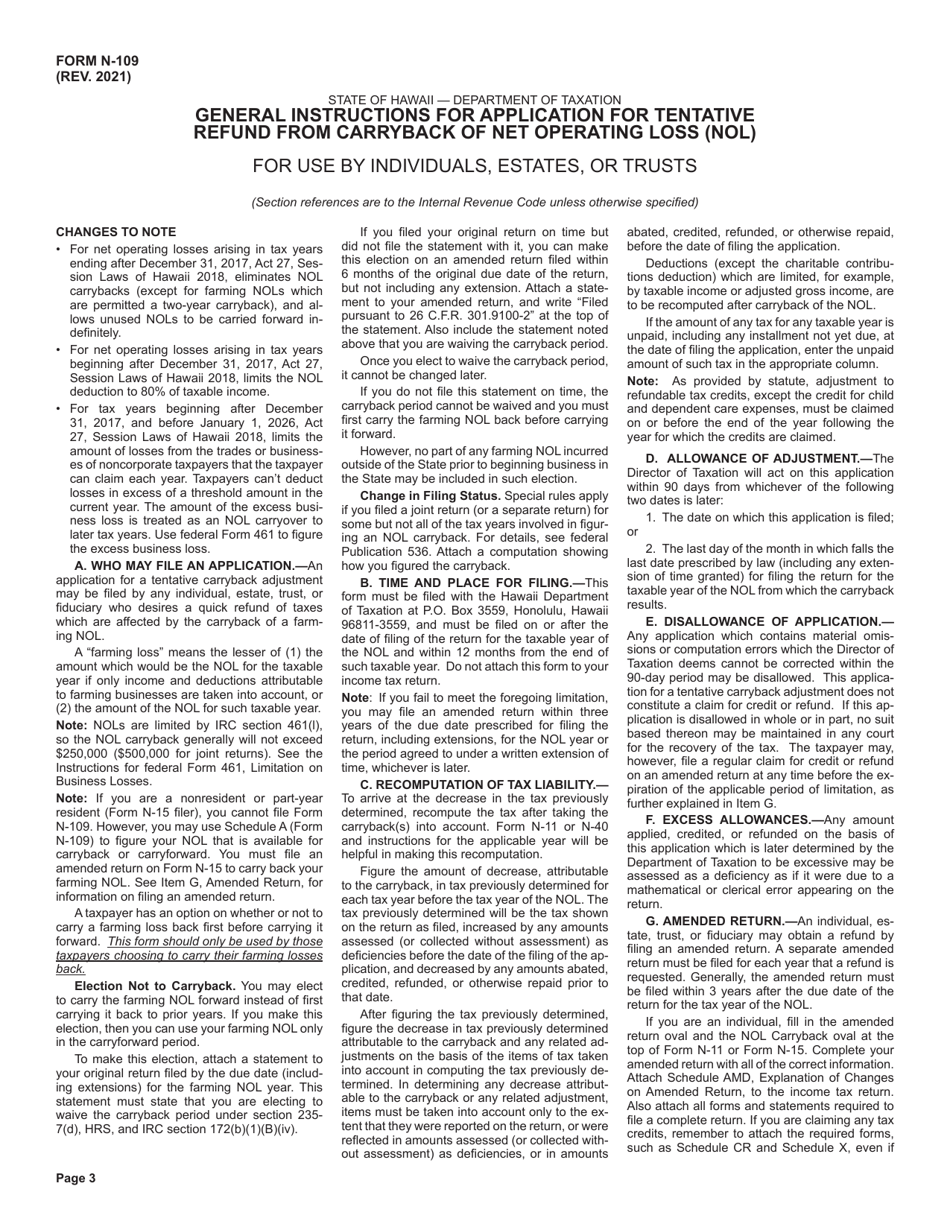

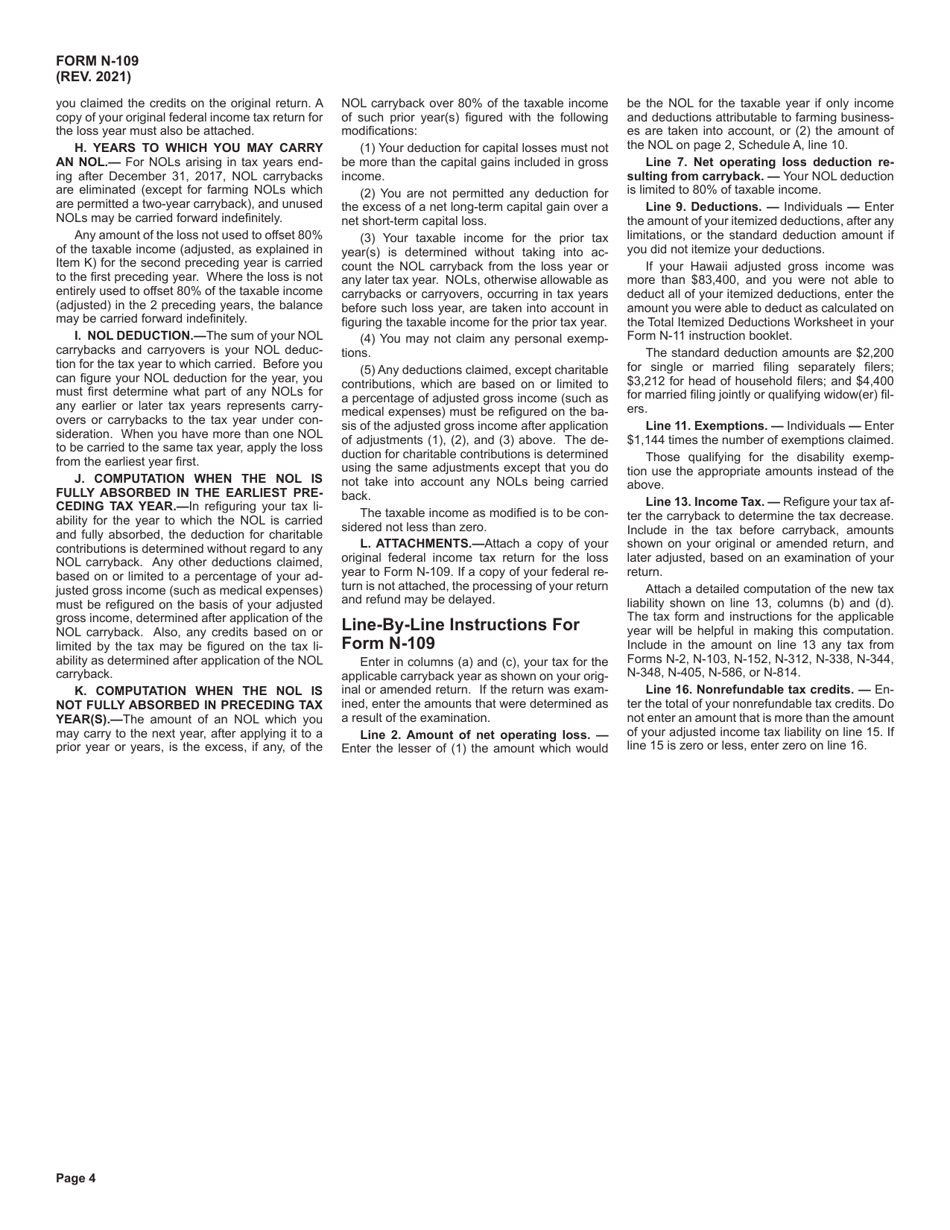

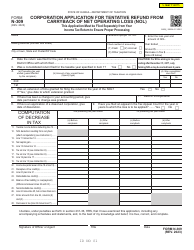

Form N-109 Application for Tentative Refund From Carryback of Net Operating Loss - Hawaii

What Is Form N-109?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form N-109?

A: Form N-109 is an application for a tentative refund from carryback of net operating loss in Hawaii.

Q: What is a net operating loss?

A: A net operating loss occurs when a company's allowable deductions exceed its taxable income.

Q: Who is eligible to use Form N-109?

A: Taxpayers in Hawaii who have a net operating loss that they want to carry back and claim a refund.

Q: What is a carryback of a net operating loss?

A: A carryback of a net operating loss is when a taxpayer applies a current year's loss to a prior year's taxable income.

Q: What is a tentative refund?

A: A tentative refund is a refund that is claimed based on an estimated amount and is subject to verification.

Q: What supporting documents are required for Form N-109?

A: You generally need to include a copy of your federal net operating loss carryback application and any other relevant supporting documentation.

Q: What is the deadline for filing Form N-109?

A: The deadline for filing Form N-109 is generally within three years from the due date of the original return or the date the return was filed, whichever is later.

Q: Is there a fee for filing Form N-109?

A: No, there is no fee for filing Form N-109.

Form Details:

- Released on January 1, 2021;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form N-109 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.