This version of the form is not currently in use and is provided for reference only. Download this version of

Form N-40 Schedule D

for the current year.

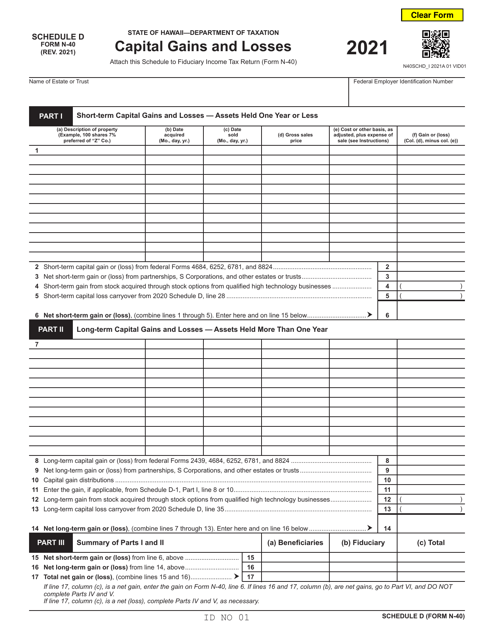

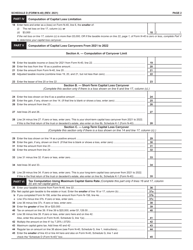

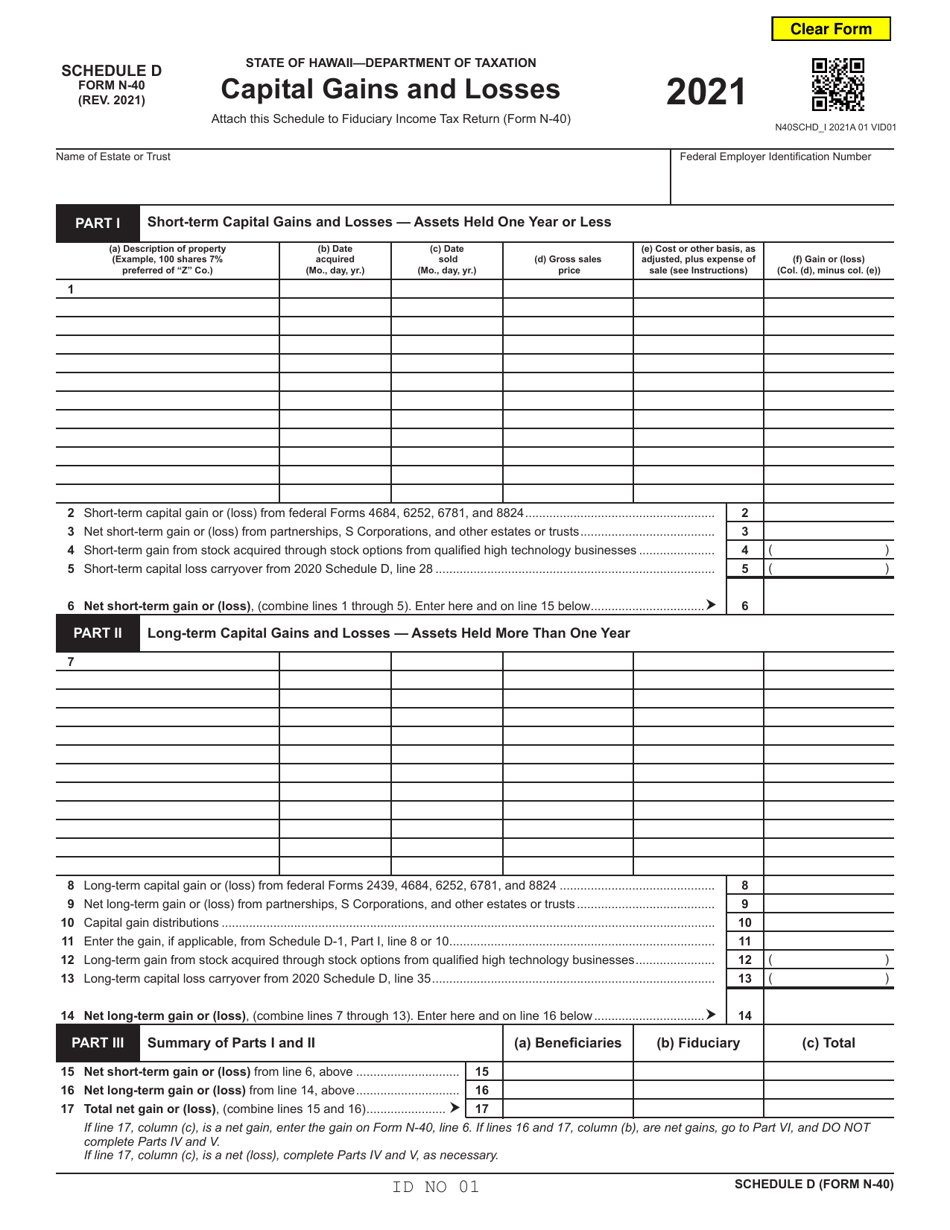

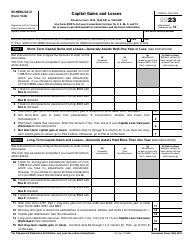

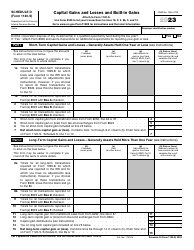

Form N-40 Schedule D Capital Gains and Losses - Hawaii

What Is Form N-40 Schedule D?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii.The document is a supplement to Form N-40, Fiduciary Income Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form N-40 Schedule D?

A: Form N-40 Schedule D is a document used by residents of Hawaii to report their capital gains and losses.

Q: Who needs to file Form N-40 Schedule D?

A: Hawaii residents who have realized capital gains or losses during the tax year need to file Form N-40 Schedule D.

Q: What information is required on Form N-40 Schedule D?

A: Form N-40 Schedule D requires the taxpayer to report details of their capital gains and losses, including the sale price, purchase price, and any adjustments.

Q: When is the deadline to file Form N-40 Schedule D?

A: The deadline to file Form N-40 Schedule D is usually April 20th of the following year.

Q: Are there any special rules or requirements for Form N-40 Schedule D?

A: It is important to consult the instructions for Form N-40 Schedule D to ensure compliance with any specific rules or requirements for filing the form.

Q: Do I need to file Form N-40 Schedule D if I didn't have any capital gains or losses?

A: If you did not have any capital gains or losses during the tax year, you may not need to file Form N-40 Schedule D. However, it is always advisable to consult with a tax professional or refer to the instructions for the form.

Q: Can I e-file Form N-40 Schedule D?

A: Yes, Form N-40 Schedule D can be e-filed along with the taxpayer's Hawaii state tax return. However, it is important to ensure that the e-file software or service supports the filing of this specific form.

Q: What happens if I do not file Form N-40 Schedule D?

A: Failure to file Form N-40 Schedule D when required may result in penalties or interest being imposed by the Hawaii Department of Taxation.

Form Details:

- Released on January 1, 2021;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form N-40 Schedule D by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.