This version of the form is not currently in use and is provided for reference only. Download this version of

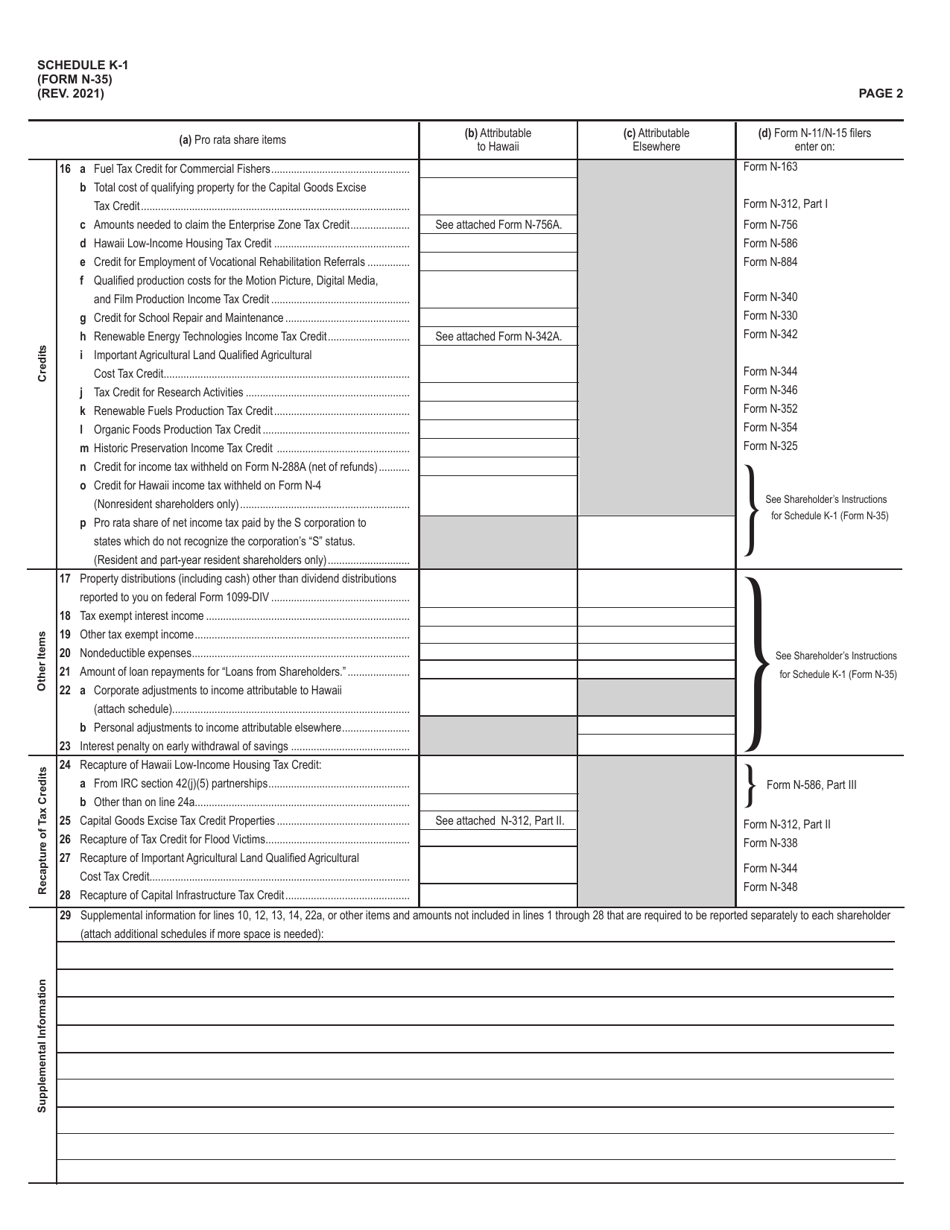

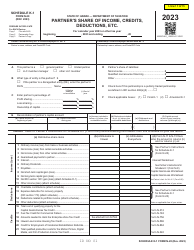

Form N-35 Schedule K-1

for the current year.

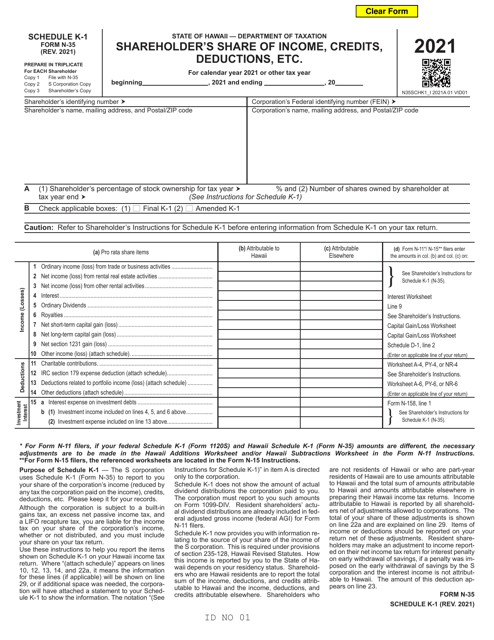

Form N-35 Schedule K-1 Shareholder's Share of Income, Credits, Deductions, Etc. - Hawaii

What Is Form N-35 Schedule K-1?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii.The document is a supplement to Form N-35, S Corporation Income Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form N-35 Schedule K-1?

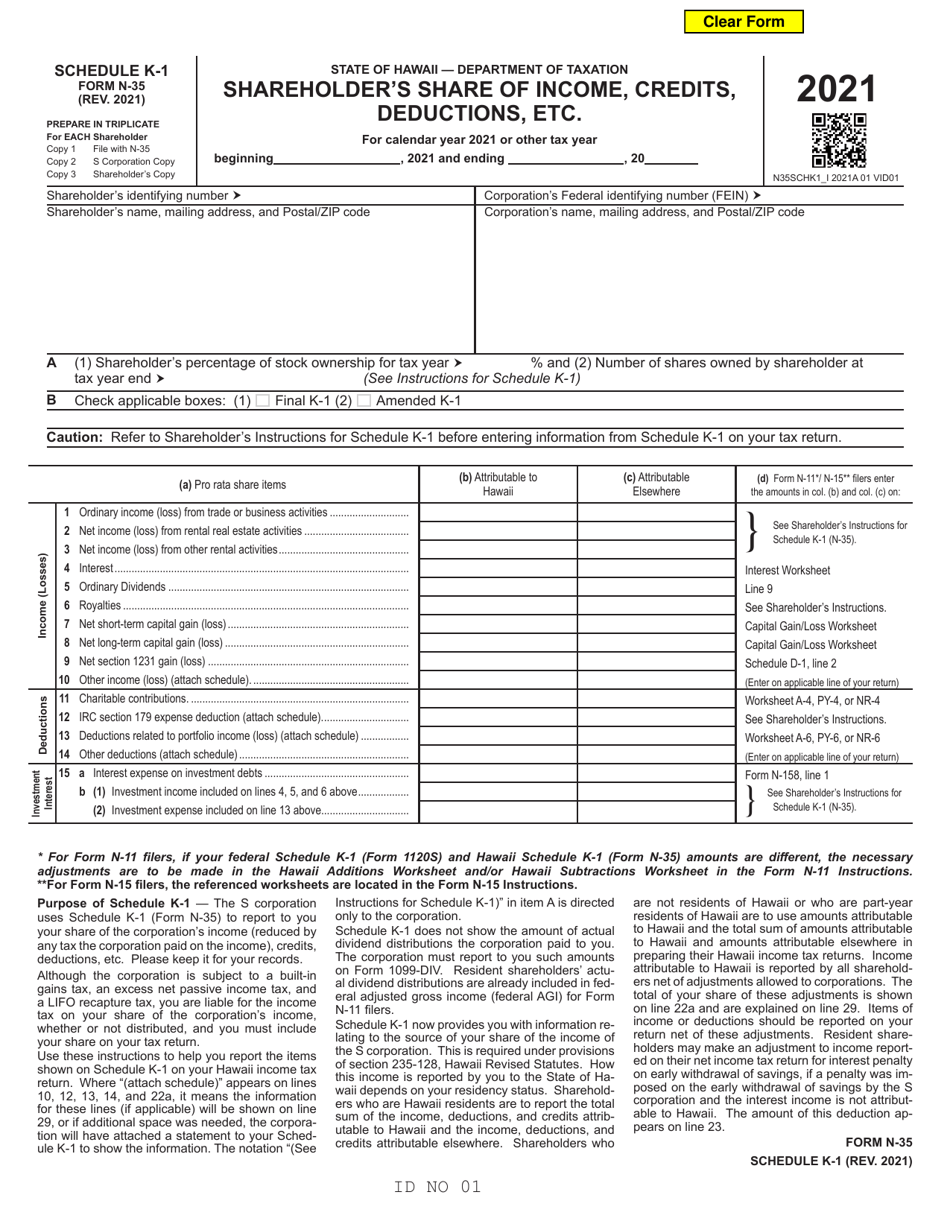

A: Form N-35 Schedule K-1 is a tax form used by shareholders of Hawaii corporations to report their share of income, credits, deductions, and other tax information.

Q: Who needs to file Form N-35 Schedule K-1?

A: Shareholders of Hawaii corporations who are allocated income, deductions, and credits need to file Form N-35 Schedule K-1.

Q: What information does Form N-35 Schedule K-1 report?

A: Form N-35 Schedule K-1 reports a shareholder's allocated income, deductions, credits, taxes, and other tax-related information.

Q: When is the deadline for filing Form N-35 Schedule K-1?

A: The deadline for filing Form N-35 Schedule K-1 is typically the same as the due date for the Hawaii income tax return, which is April 20th.

Q: Are there any penalties for late filing of Form N-35 Schedule K-1?

A: Yes, there may be penalties for late filing of Form N-35 Schedule K-1, so it is important to file on time.

Q: Is Form N-35 Schedule K-1 required for federal tax purposes?

A: No, Form N-35 Schedule K-1 is specific to Hawaii state tax purposes and is not required for federal tax purposes.

Q: Do I need to include Form N-35 Schedule K-1 with my federal tax return?

A: No, Form N-35 Schedule K-1 should only be filed with your Hawaii state tax return and does not need to be included with your federal tax return.

Form Details:

- Released on January 1, 2021;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form N-35 Schedule K-1 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.