This version of the form is not currently in use and is provided for reference only. Download this version of

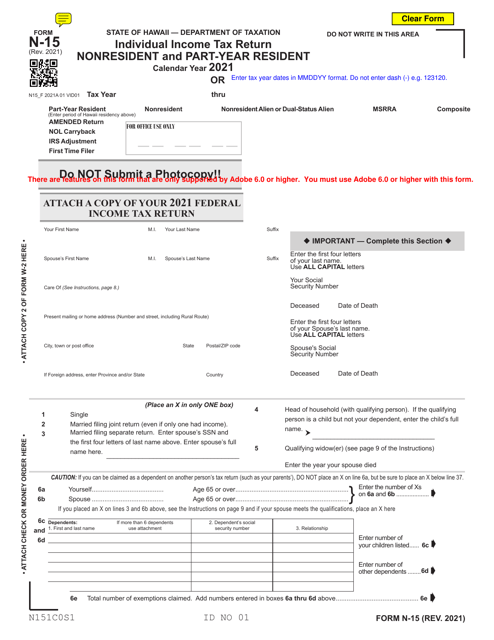

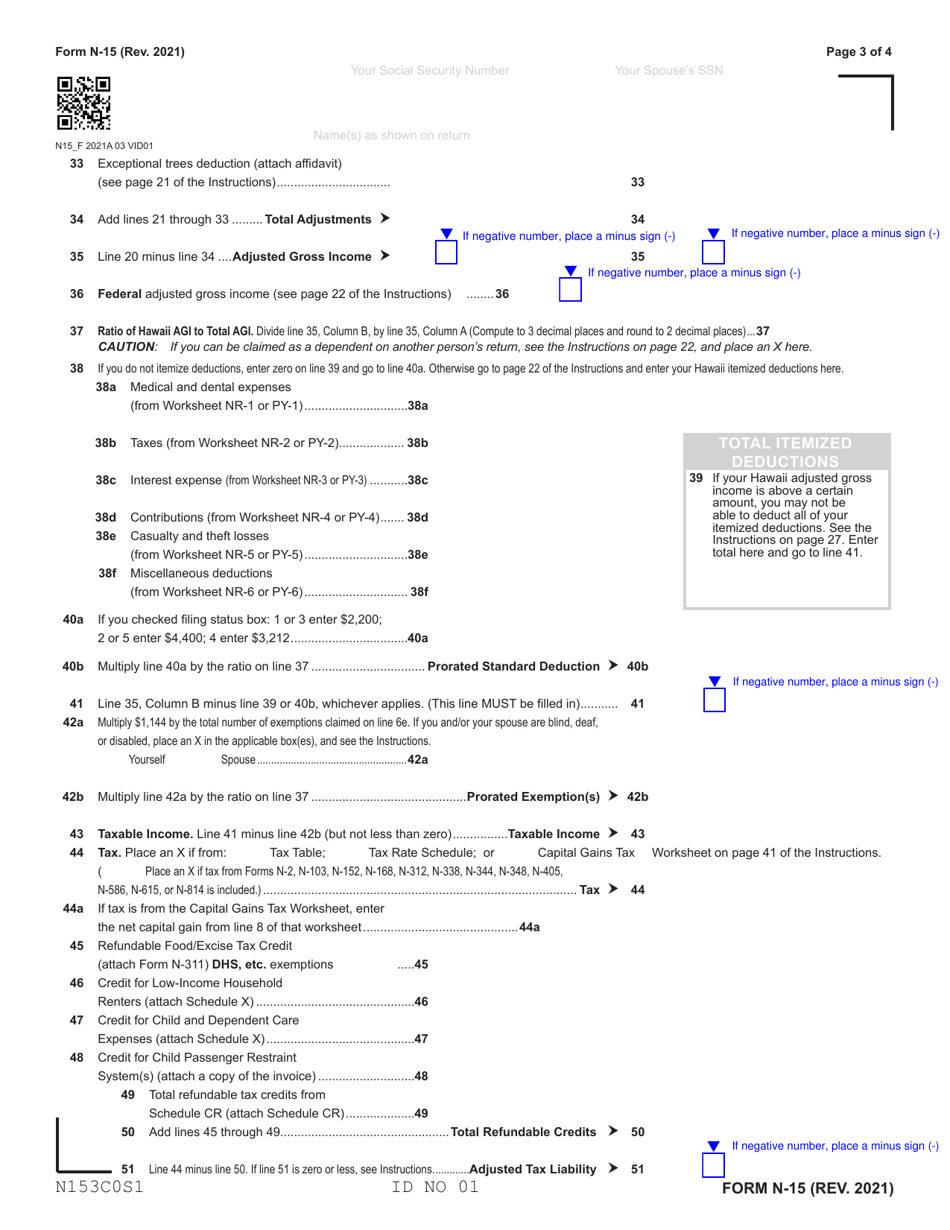

Form N-15

for the current year.

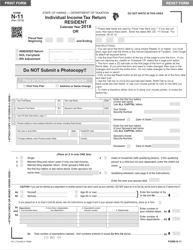

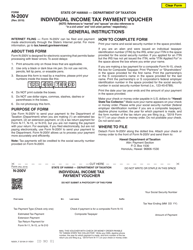

Form N-15 Individual Income Tax Return (Nonresidents and Part-Year Residents) - Hawaii

What Is Form N-15?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

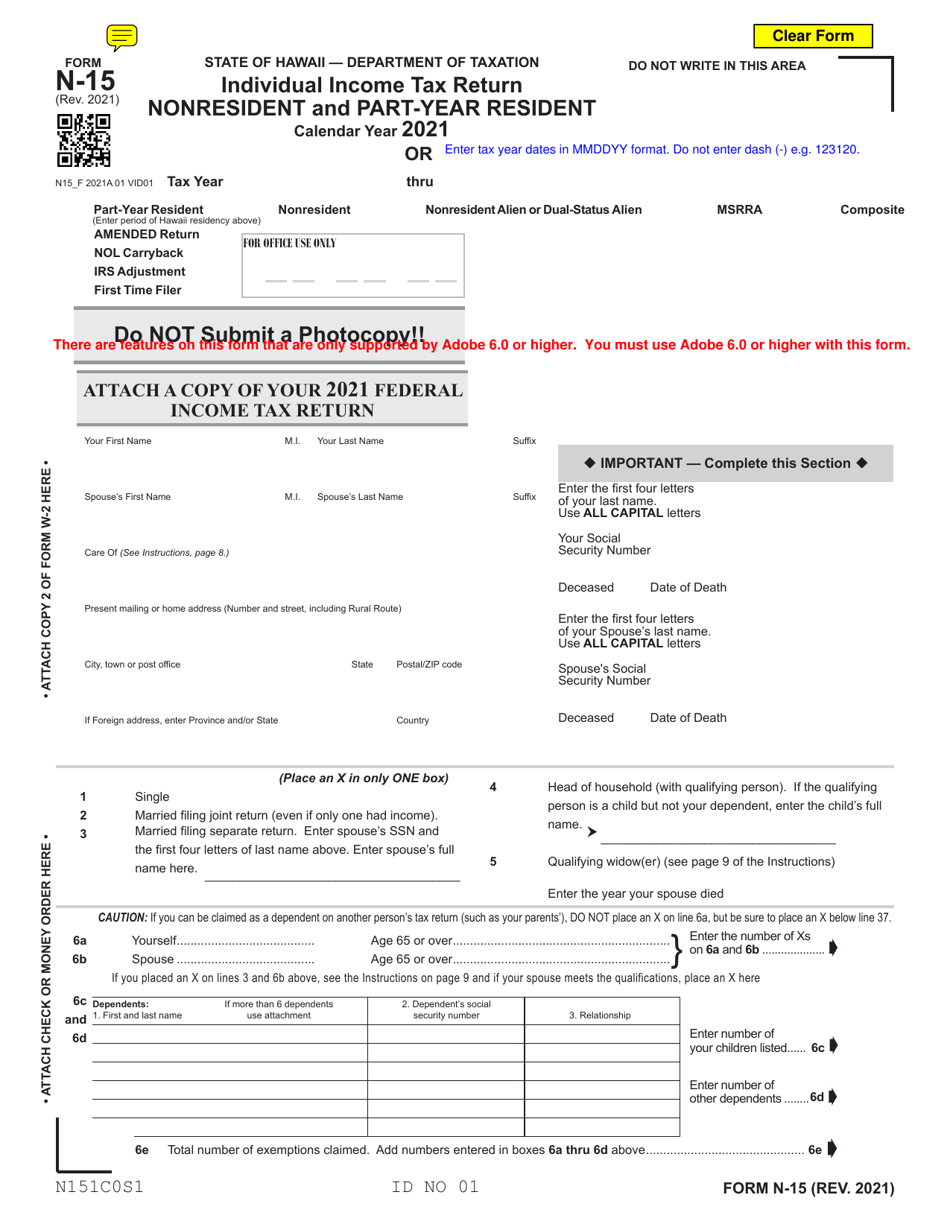

Q: Who needs to file Form N-15?

A: Nonresidents and part-year residents of Hawaii need to file Form N-15.

Q: What is Form N-15?

A: Form N-15 is the Individual Income Tax Return for nonresidents and part-year residents of Hawaii.

Q: What should I include when filing Form N-15?

A: You should include any income earned in Hawaii during the tax year.

Q: Do I need to file Form N-15 if I have no Hawaii source income?

A: You may still need to file Form N-15 if you meet certain requirements.

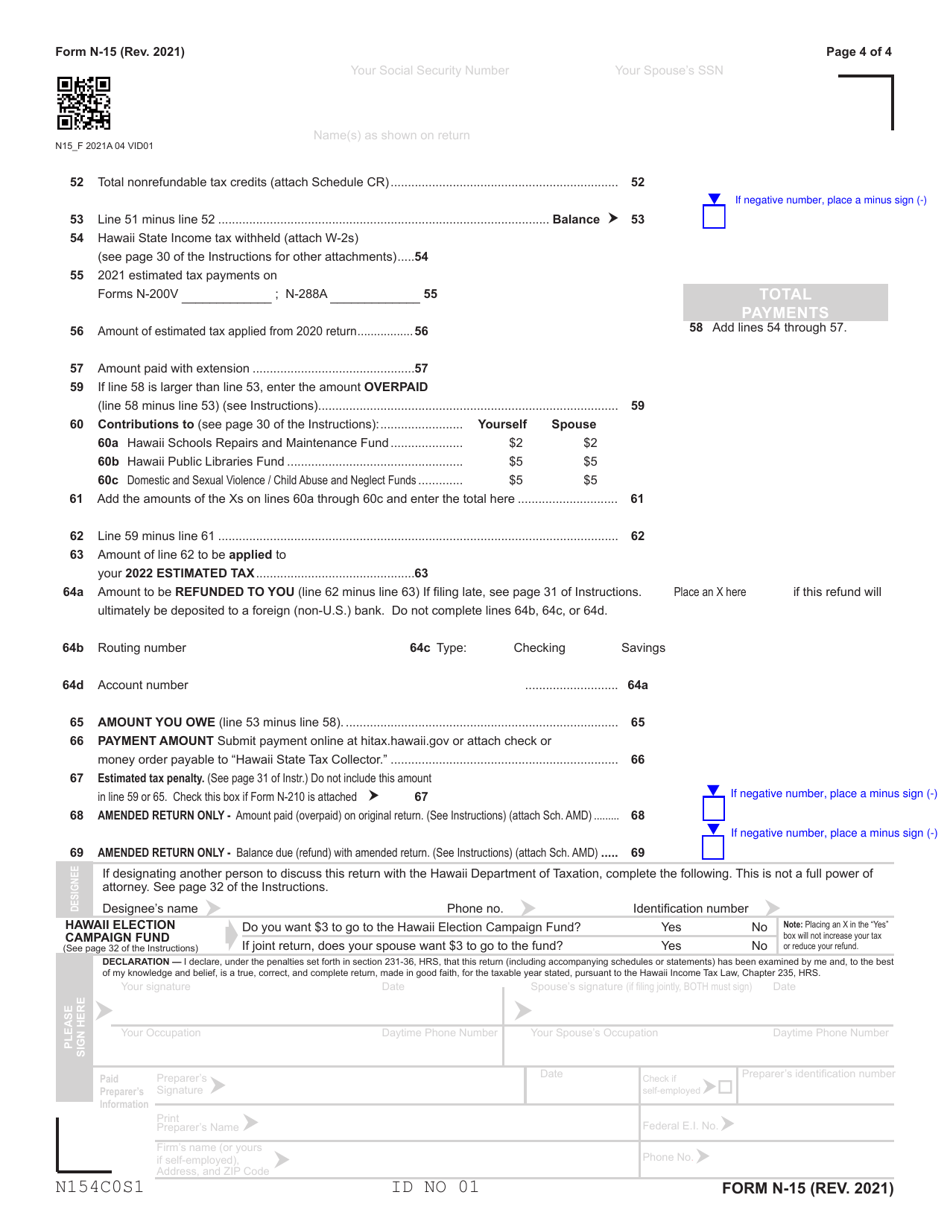

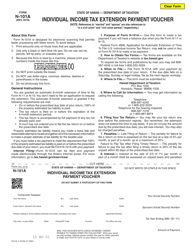

Q: What is the filing deadline for Form N-15?

A: The filing deadline for Form N-15 is April 20th.

Q: Can I file Form N-15 electronically?

A: Yes, you can file Form N-15 electronically.

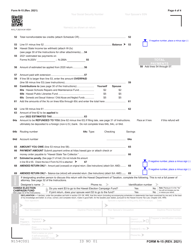

Q: Are there any deductions or credits available for nonresidents and part-year residents?

A: Yes, nonresidents and part-year residents may be eligible for certain deductions and credits.

Q: How do I pay any tax owed with Form N-15?

A: You can pay any tax owed with Form N-15 by check or money order.

Q: What happens if I don't file Form N-15?

A: If you don't file Form N-15, you may be subject to penalties and interest.

Form Details:

- Released on January 1, 2021;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form N-15 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.