This version of the form is not currently in use and is provided for reference only. Download this version of

Form M-18

for the current year.

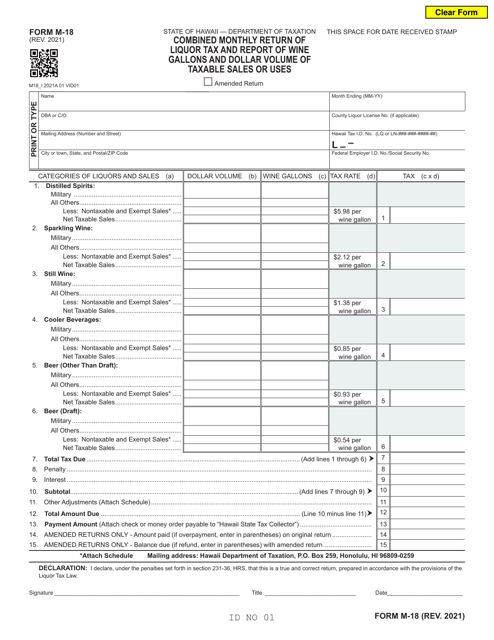

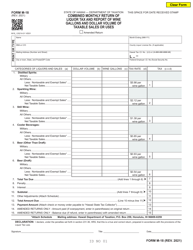

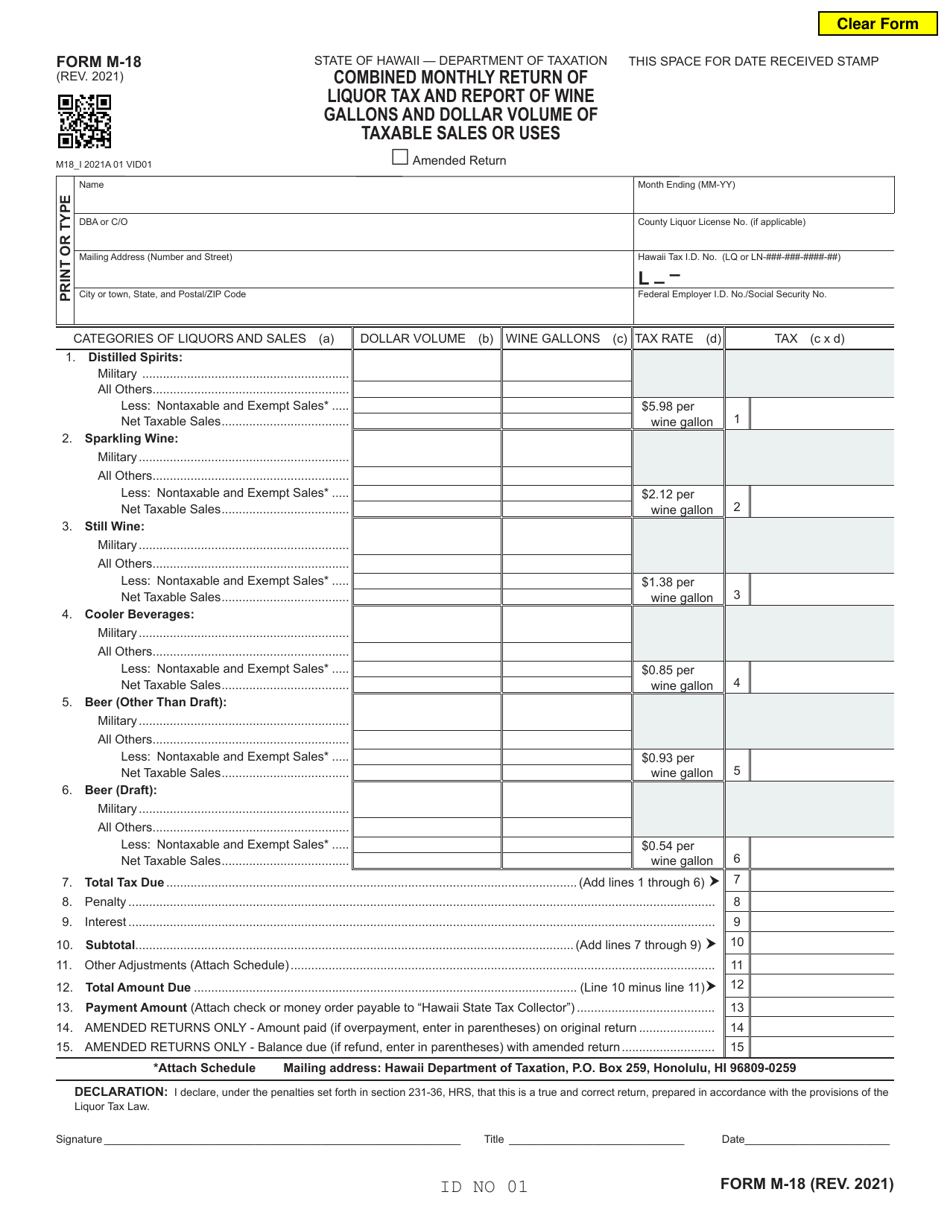

Form M-18 Combined Monthly Return of Liquor Tax and Report of Wine Gallons and Dollar Volume of Taxable Sales or Uses - Hawaii

What Is Form M-18?

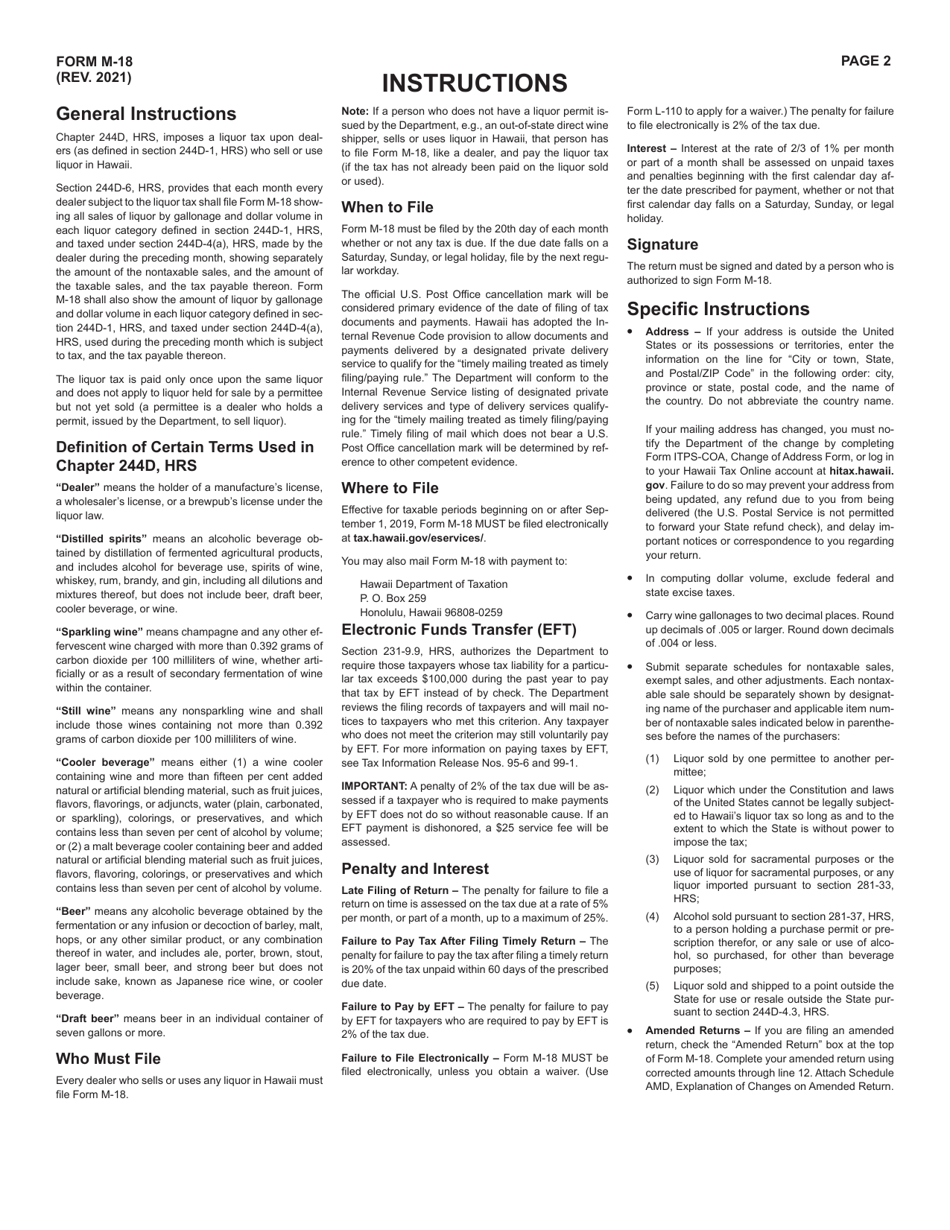

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form M-18?

A: Form M-18 is a combined monthly return used to report liquor tax and wine gallons and dollar volume of taxable sales or uses in Hawaii.

Q: Who needs to file Form M-18?

A: Anyone engaged in the sale or use of liquor in Hawaii needs to file Form M-18.

Q: What information is reported on Form M-18?

A: Form M-18 requires reporting of liquor tax and the gallons and dollar volume of taxable sales or uses of wine.

Q: How often should Form M-18 be filed?

A: Form M-18 should be filed monthly.

Q: Are there any penalties for late filing of Form M-18?

A: Yes, there are penalties for late filing of Form M-18. It is important to file the form on time to avoid these penalties.

Form Details:

- Released on January 1, 2021;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form M-18 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.