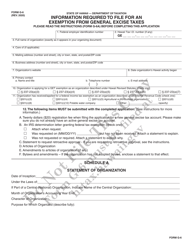

This version of the form is not currently in use and is provided for reference only. Download this version of

Form G-45 (G-49) Schedule GE

for the current year.

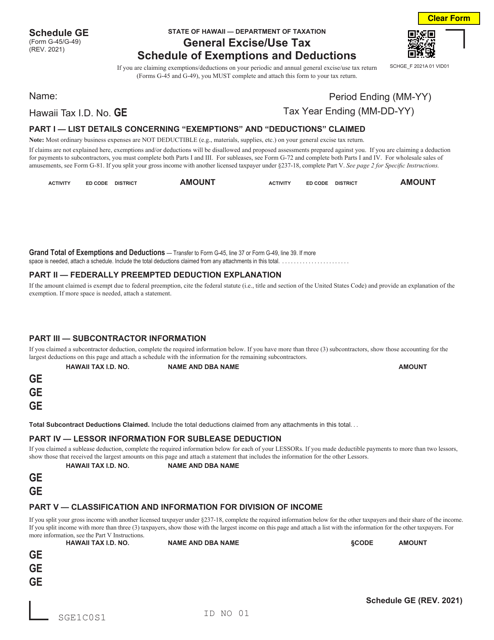

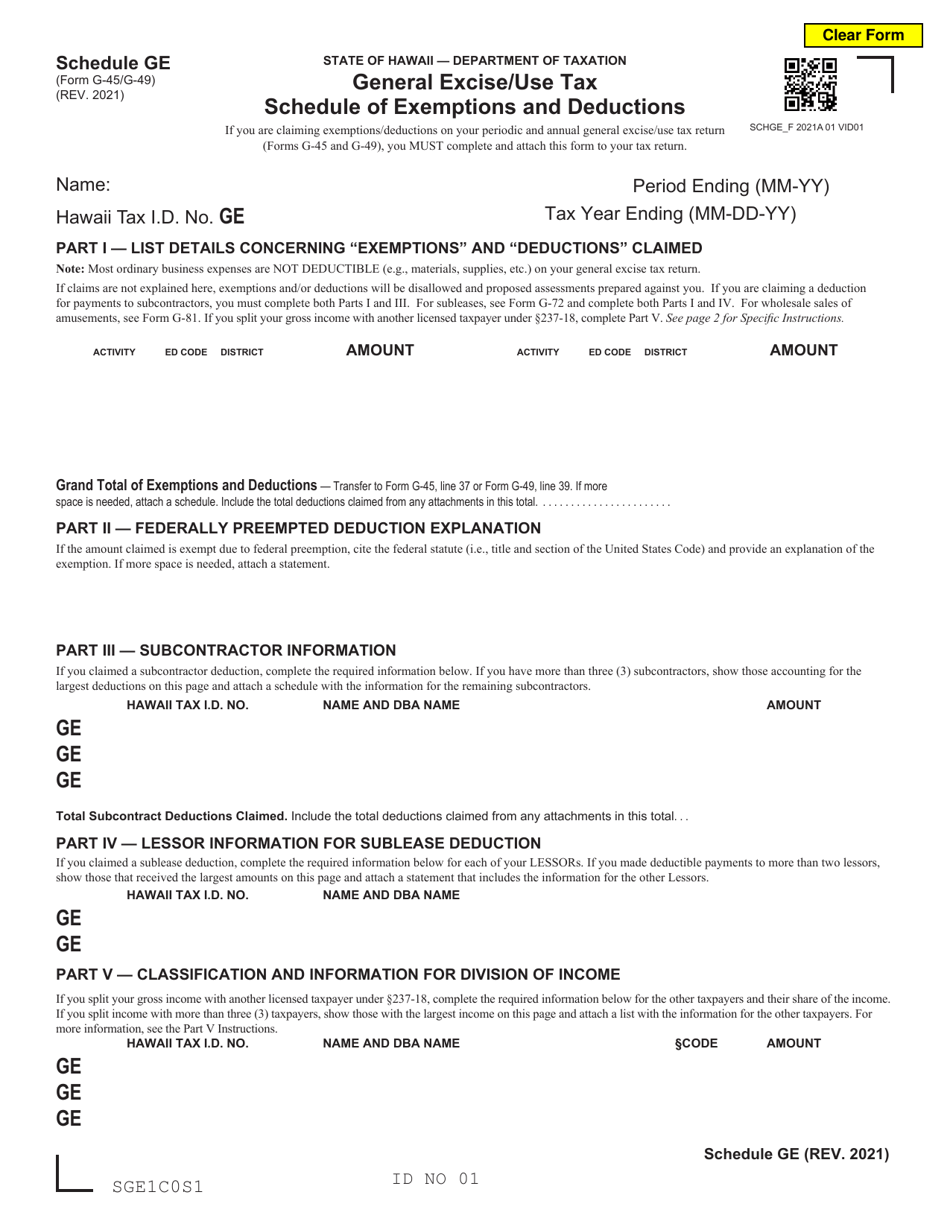

Form G-45 (G-49) Schedule GE General Excise / Use Tax Schedule of Exemptions and Deductions - Hawaii

What Is Form G-45 (G-49) Schedule GE?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii.The document is a supplement to Form G-45, and Form G-49. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form G-45 (G-49)?

A: Form G-45 (G-49) is the General Excise/Use Tax Schedule of Exemptions and Deductions in Hawaii.

Q: What is the purpose of Form G-45 (G-49)?

A: The purpose of Form G-45 (G-49) is to claim exemptions and deductions for the General Excise/Use Tax in Hawaii.

Q: What is the General Excise/Use Tax in Hawaii?

A: The General Excise/Use Tax is a tax on business activities or the use of goods and services in Hawaii.

Q: Who needs to file Form G-45 (G-49)?

A: Businesses in Hawaii that are subject to the General Excise/Use Tax may need to file Form G-45 (G-49).

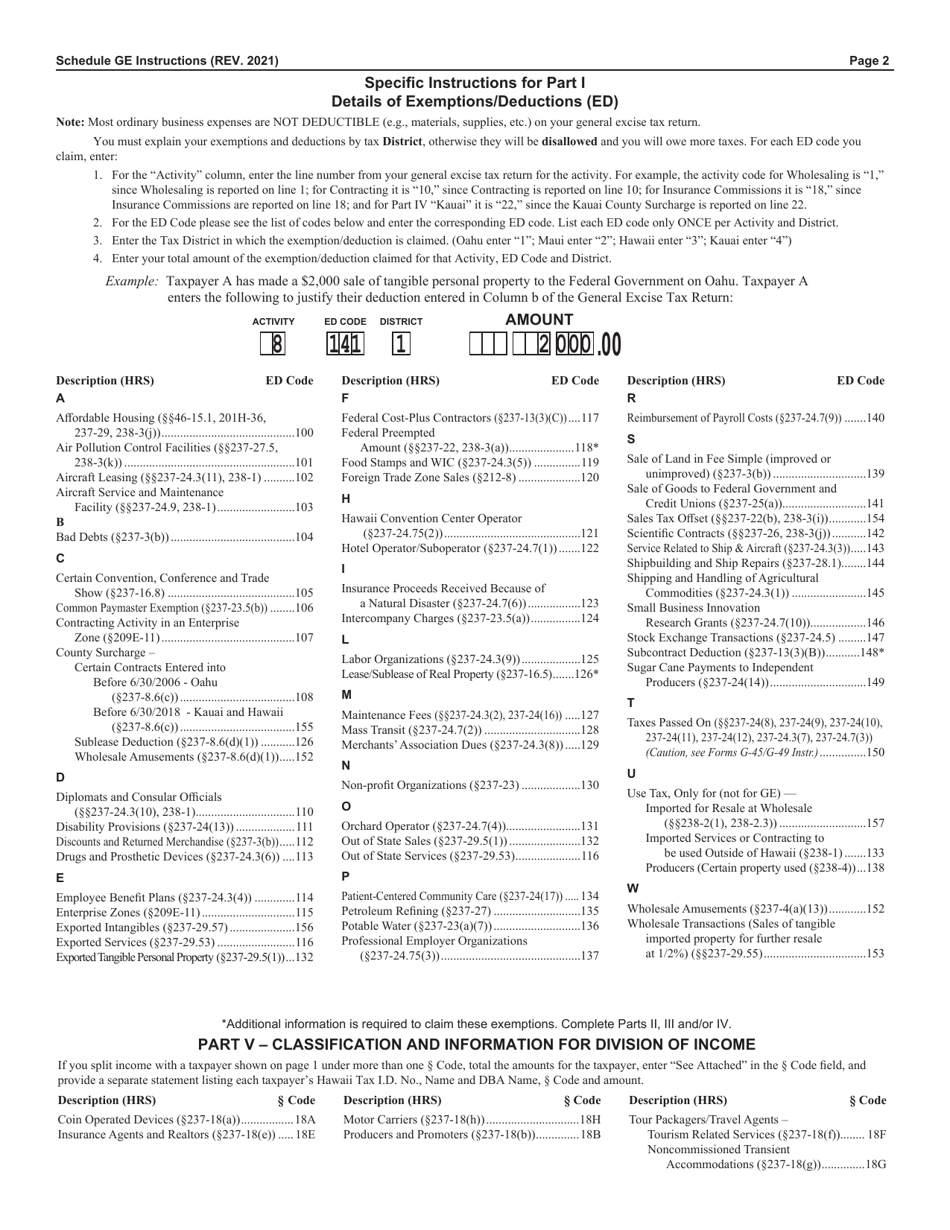

Q: What exemptions and deductions can be claimed on Form G-45 (G-49)?

A: Form G-45 (G-49) allows businesses to claim various exemptions and deductions related to the General Excise/Use Tax in Hawaii.

Q: Is Form G-45 (G-49) only for business entities?

A: Yes, Form G-45 (G-49) is primarily for business entities subject to the General Excise/Use Tax in Hawaii.

Q: When is the deadline to file Form G-45 (G-49)?

A: The deadline to file Form G-45 (G-49) in Hawaii depends on the taxpayer's filing frequency, but it is usually on a monthly or quarterly basis.

Q: What happens if Form G-45 (G-49) is not filed or filed late?

A: Failure to file Form G-45 (G-49) or filing it late may result in penalties and interest charges in Hawaii.

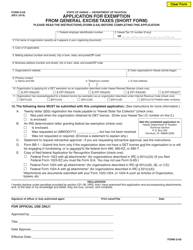

Form Details:

- Released on January 1, 2021;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form G-45 (G-49) Schedule GE by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.