This version of the form is not currently in use and is provided for reference only. Download this version of

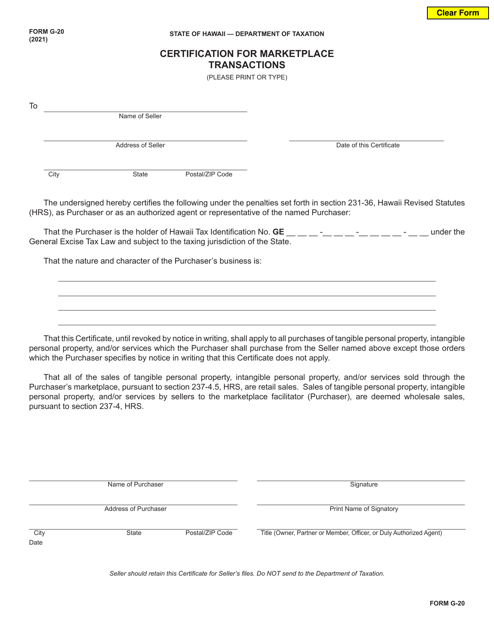

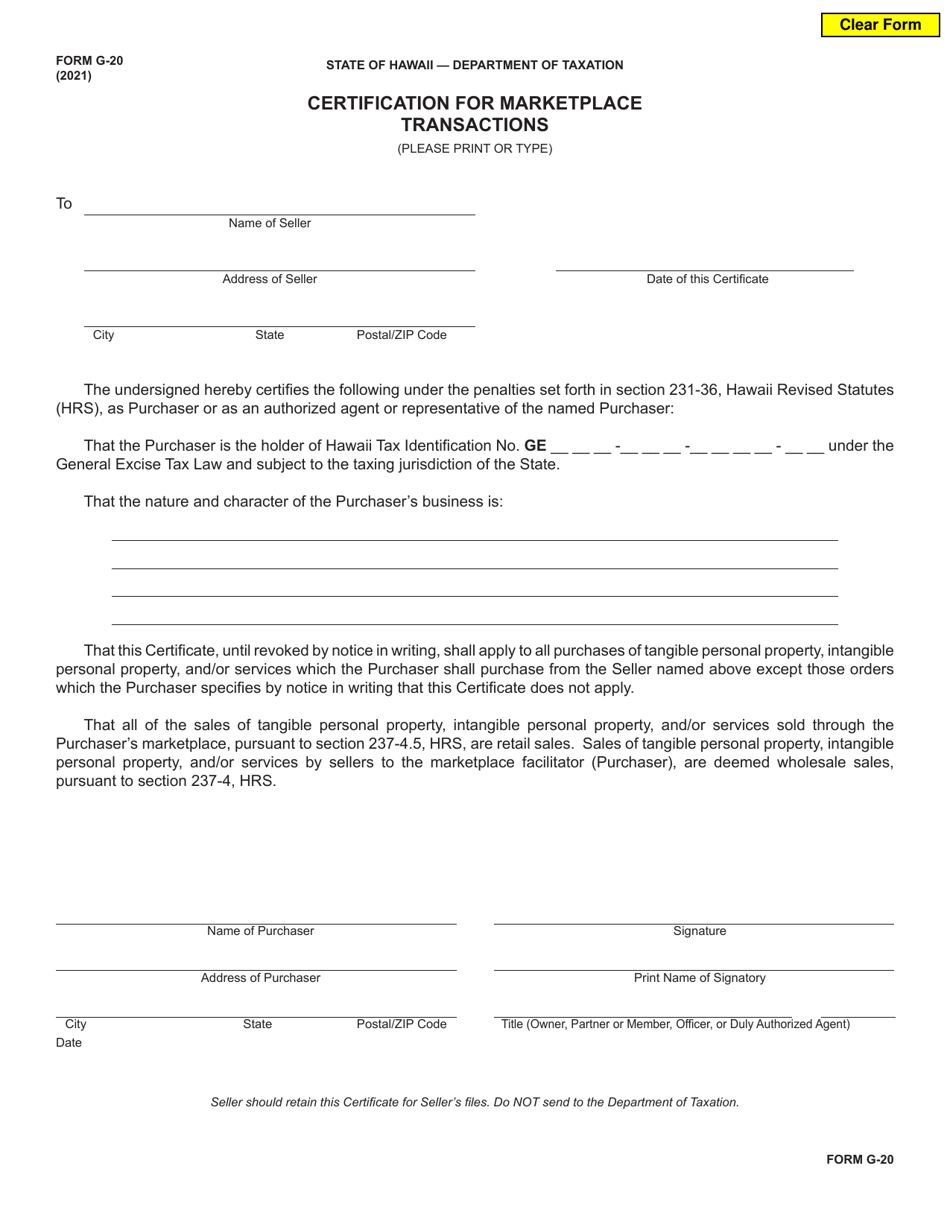

Form G-20

for the current year.

Form G-20 Certification for Marketplace Transactions - Hawaii

What Is Form G-20?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form G-20 Certification for Marketplace Transactions?

A: Form G-20 Certification for Marketplace Transactions is a legal document used in Hawaii.

Q: Who needs to submit Form G-20?

A: Individuals or businesses engaged in marketplace transactions in Hawaii may need to submit Form G-20.

Q: What is the purpose of Form G-20?

A: The purpose of Form G-20 is to certify that the seller is not required to obtain a general excise tax license for marketplace transactions in Hawaii.

Q: Is there a deadline for submitting Form G-20?

A: Yes, Form G-20 should be submitted by the 20th day of the month following the end of the calendar quarter in which the marketplace transactions occurred.

Q: Are there any penalties for not submitting Form G-20?

A: Yes, failure to submit Form G-20 may result in penalties imposed by the Hawaii Department of Taxation.

Form Details:

- Released on January 1, 2021;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form G-20 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.