This version of the form is not currently in use and is provided for reference only. Download this version of

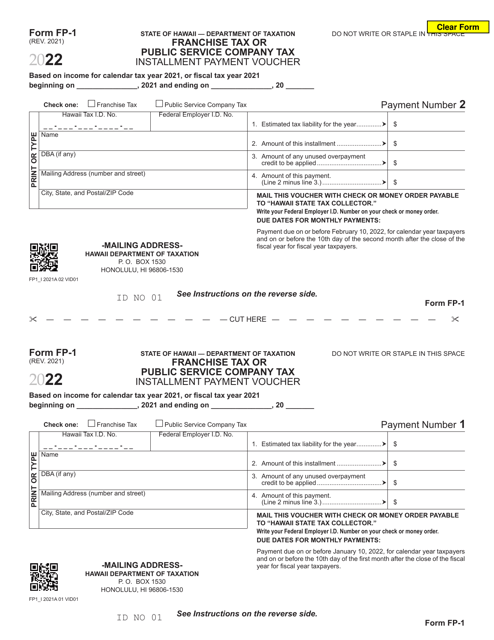

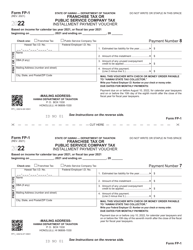

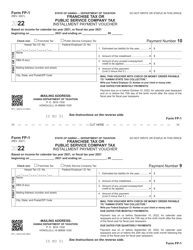

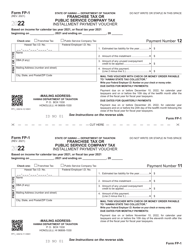

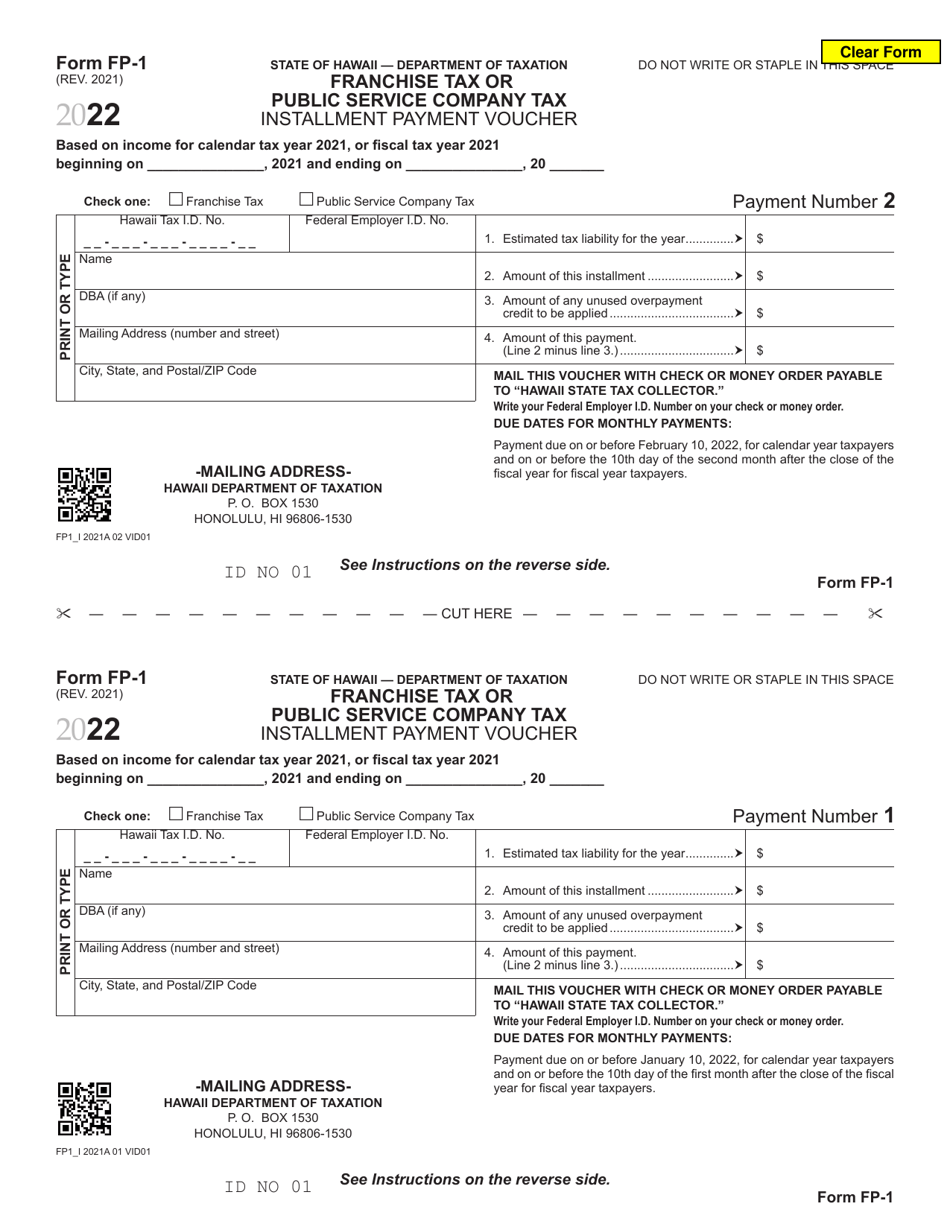

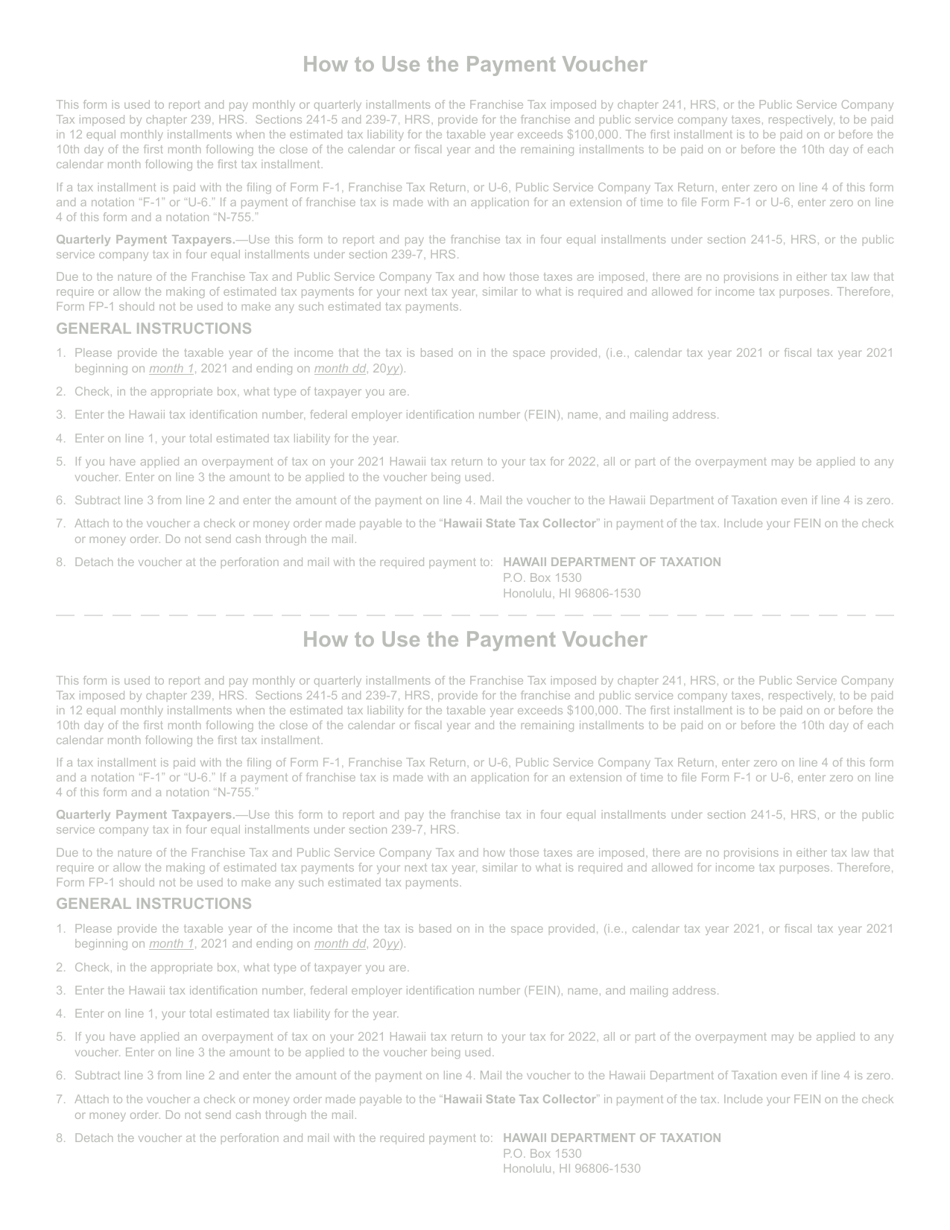

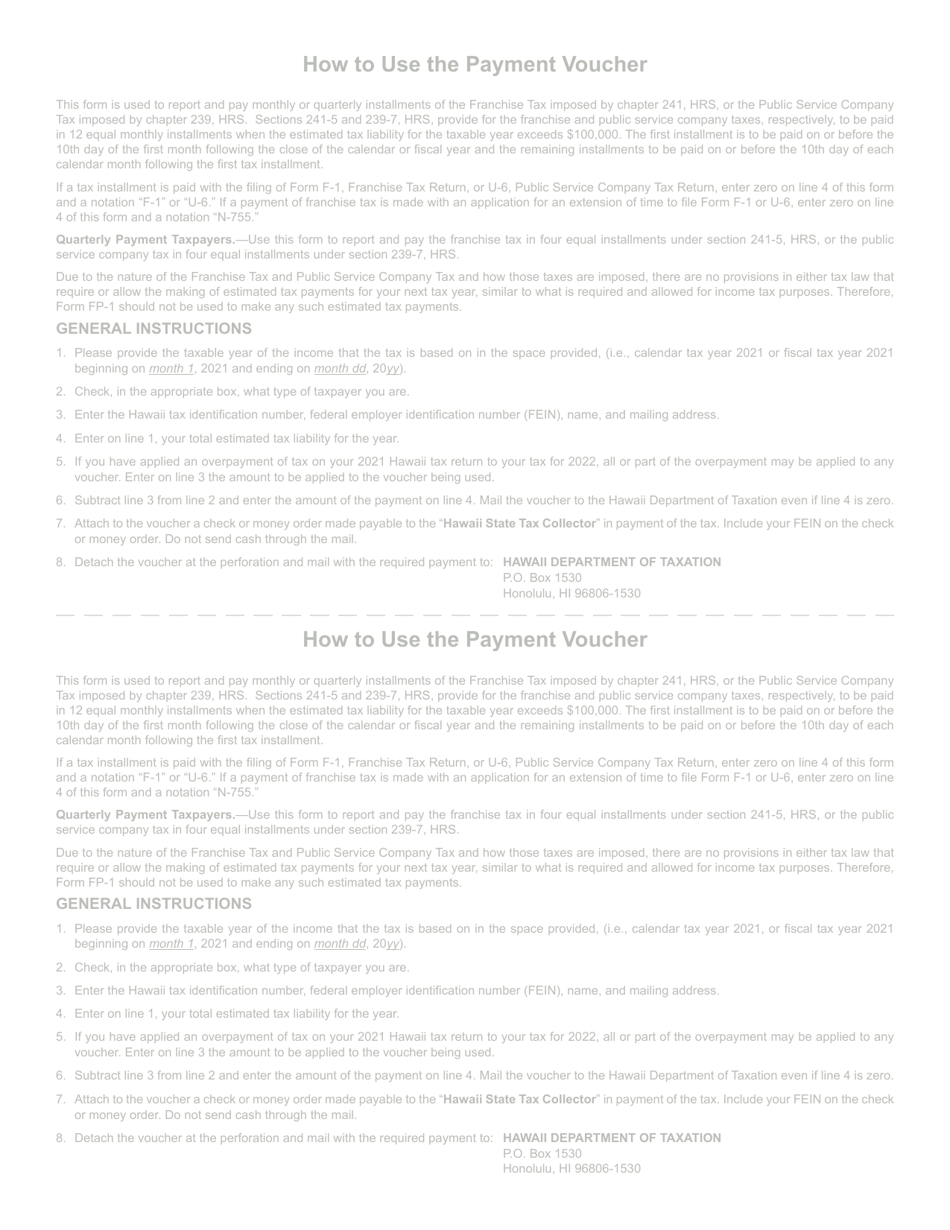

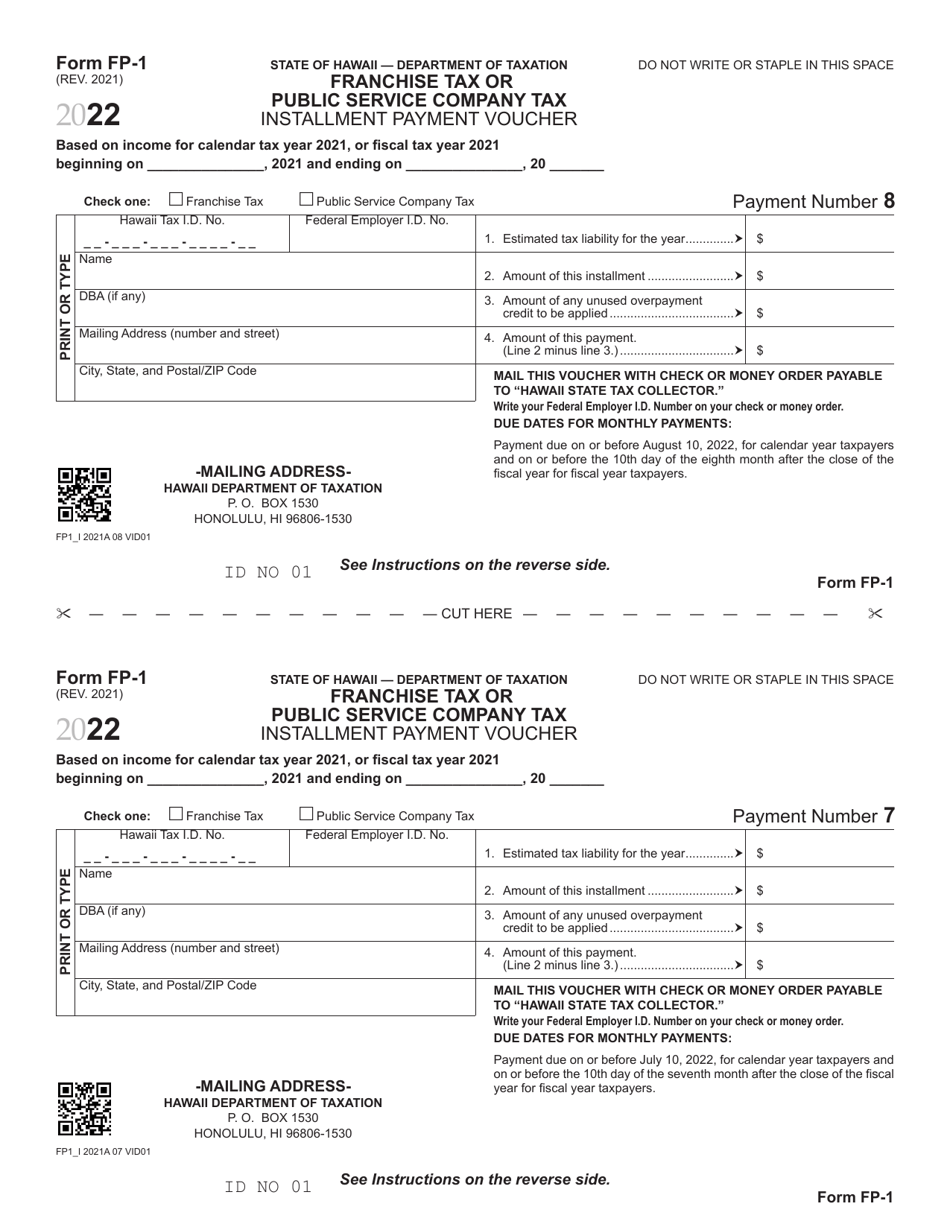

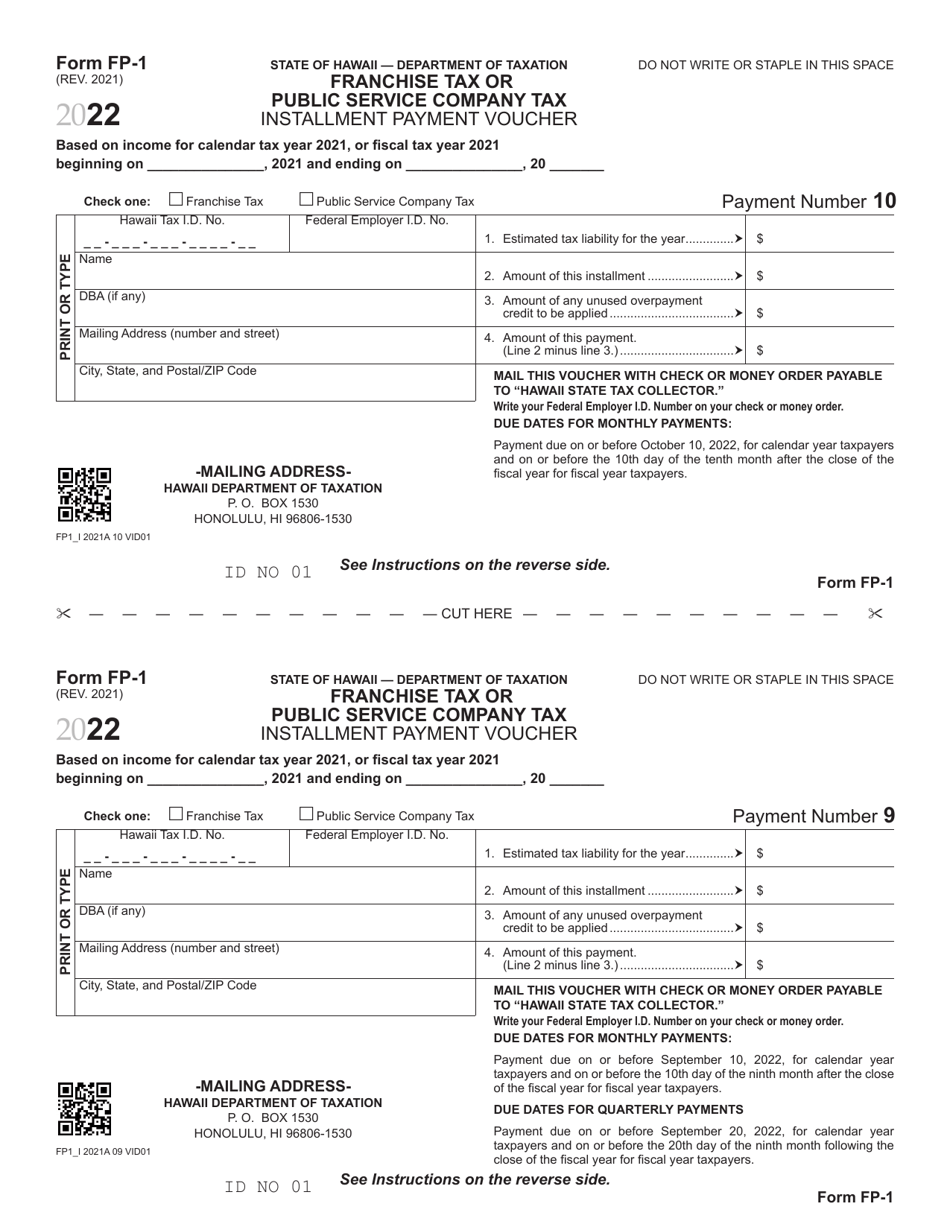

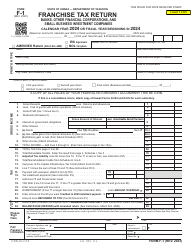

Form FP-1

for the current year.

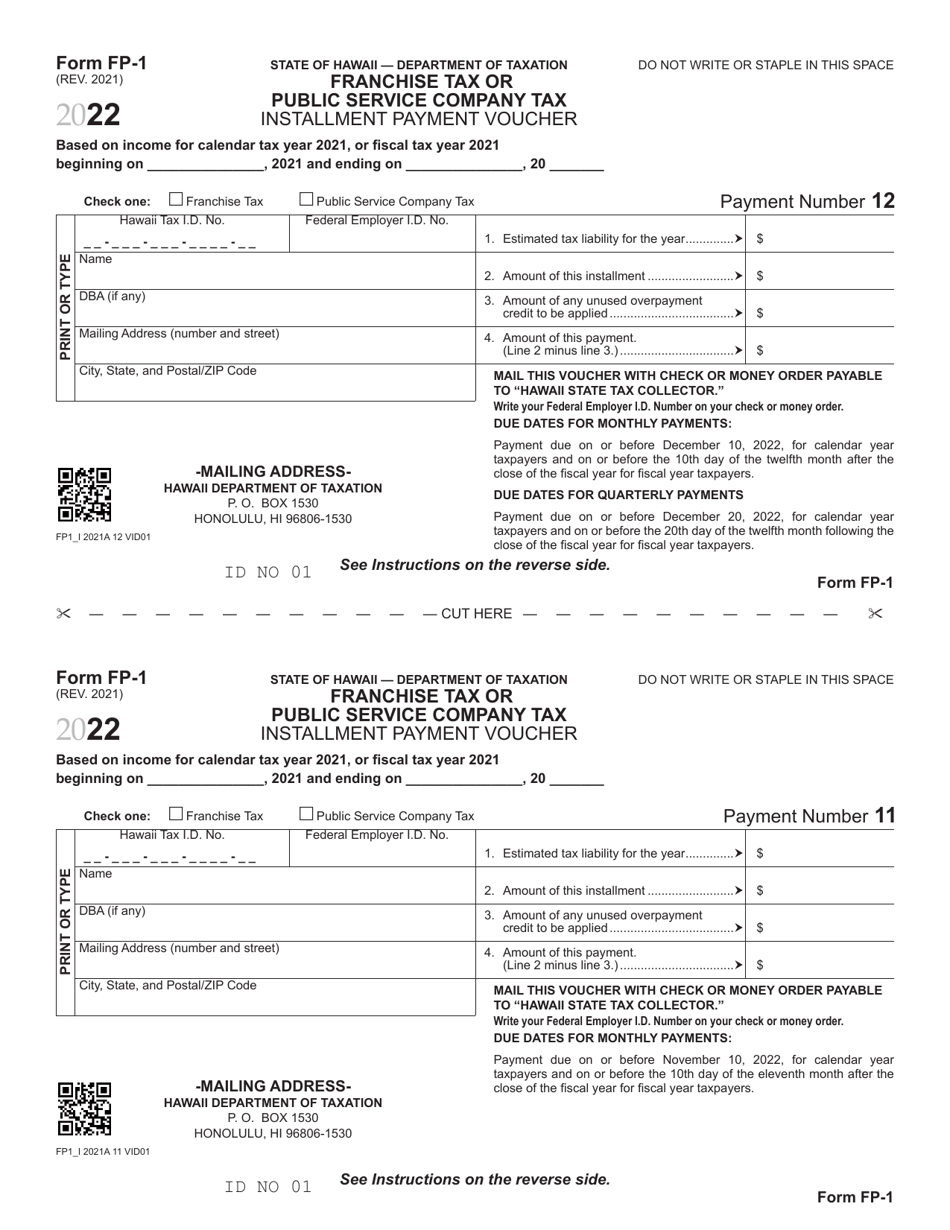

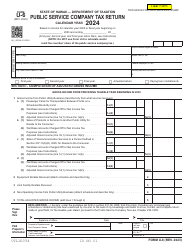

Form FP-1 Franchise Tax or Public Service Company Tax Installment Payment Voucher - Hawaii

What Is Form FP-1?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form FP-1?

A: Form FP-1 is a Franchise Tax or Public Service CompanyTax Installment Payment Voucher in Hawaii.

Q: What is Franchise Tax?

A: Franchise Tax is a tax imposed on businesses for the privilege of operating in Hawaii.

Q: What is Public Service Company Tax?

A: Public Service Company Tax is a tax imposed on public service companies for providing certain services in Hawaii.

Q: What is an installment payment voucher?

A: An installment payment voucher is a form used to make installment payments towards taxes owed.

Q: What information is required on Form FP-1?

A: Form FP-1 requires information such as taxpayer name, taxpayer identification number, and payment amount.

Q: When is Form FP-1 due?

A: Form FP-1 is due on the 20th day of the month following the end of the taxable period.

Q: What happens if I don't file or pay Form FP-1?

A: If you don't file or pay Form FP-1, you may be subject to penalties and interest on the unpaid taxes.

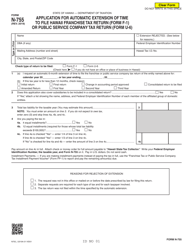

Q: Can I request an extension to file Form FP-1?

A: Yes, you can request an extension to file Form FP-1 by submitting Form EP-1 Extension Payment Voucher.

Form Details:

- Released on January 1, 2021;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form FP-1 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.