This version of the form is not currently in use and is provided for reference only. Download this version of

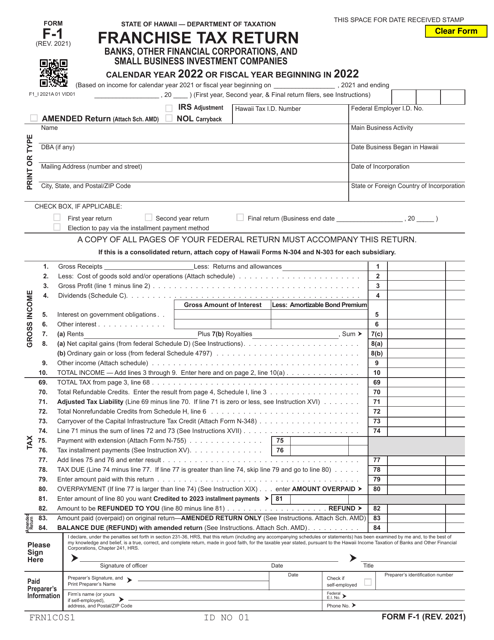

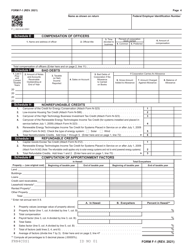

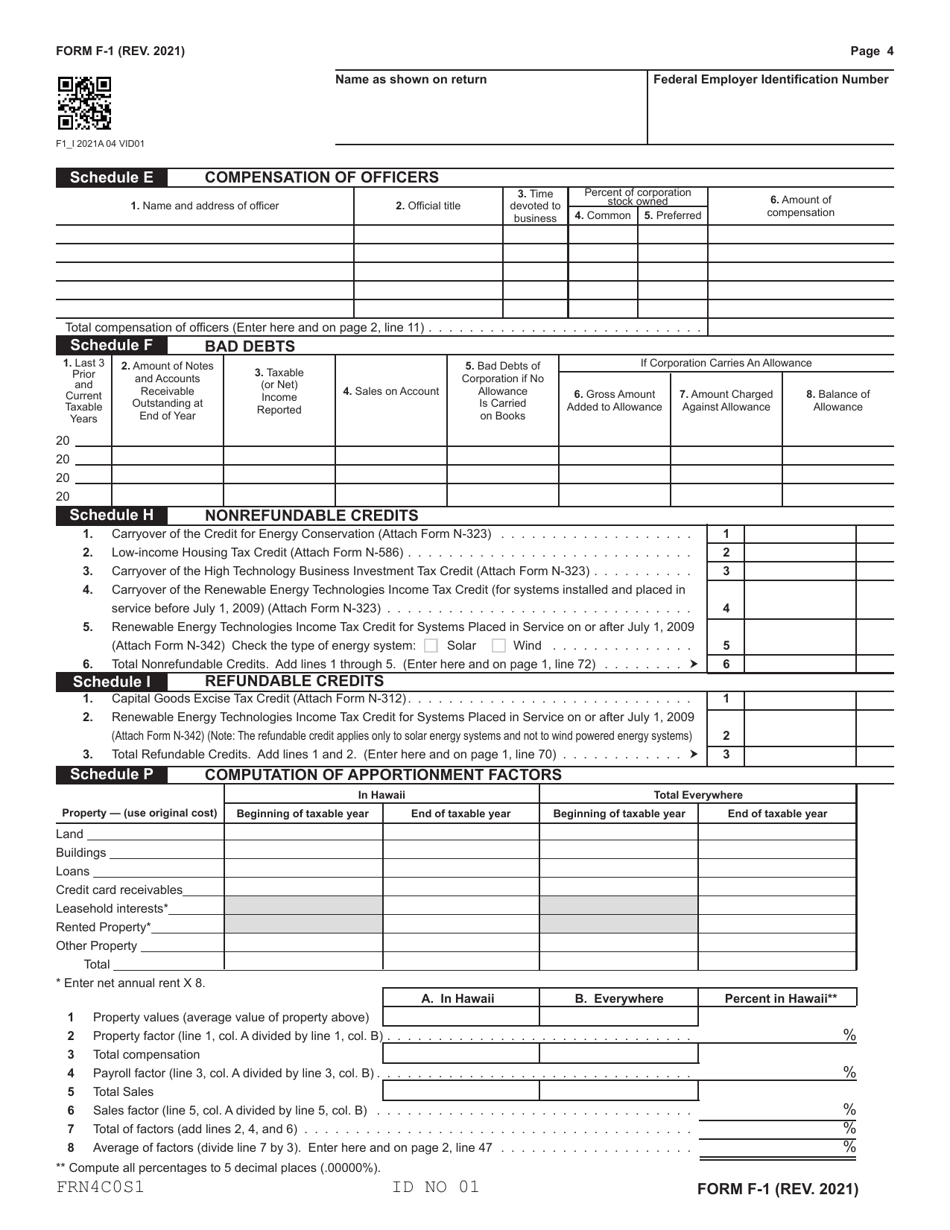

Form F-1

for the current year.

Form F-1 Franchise Tax Return - Hawaii

What Is Form F-1?

This is a legal form that was released by the Hawaii Department of Taxation - a government authority operating within Hawaii. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form F-1?

A: Form F-1 is the Franchise Tax Return for the state of Hawaii.

Q: Who needs to file Form F-1?

A: Any corporation or partnership subject to Hawaii's franchise tax must file Form F-1.

Q: What is the purpose of Form F-1?

A: Form F-1 is used to calculate and report the franchise tax owed by a corporation or partnership in Hawaii.

Q: When is the deadline for filing Form F-1?

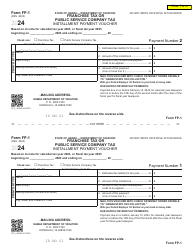

A: The deadline for filing Form F-1 is on or before the 20th day of the fourth month following the close of the taxpayer's taxable year.

Q: Are there any penalties for late filing of Form F-1?

A: Yes, there are penalties for late filing of Form F-1. The penalty is 5% of the tax due for each month or part of a month that the return is late, up to a maximum of 25%.

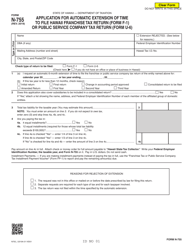

Q: What if I need an extension to file Form F-1?

A: To request an extension to file Form F-1, you need to file Form F-1EXT and pay at least 90% of the estimated franchise tax due by the original due date of the return.

Form Details:

- Released on January 1, 2021;

- The latest edition provided by the Hawaii Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form F-1 by clicking the link below or browse more documents and templates provided by the Hawaii Department of Taxation.