This version of the form is not currently in use and is provided for reference only. Download this version of

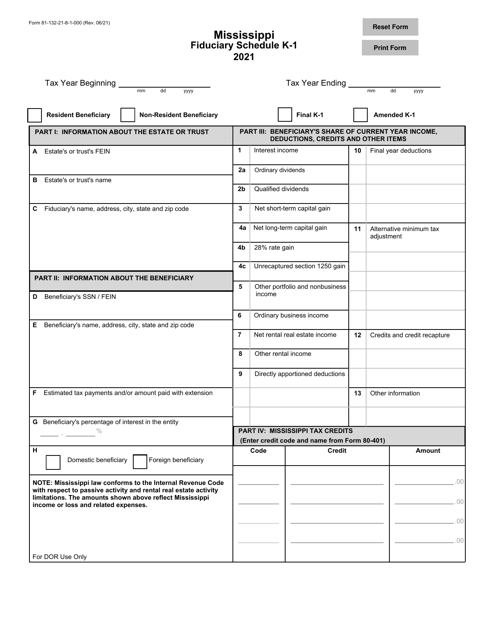

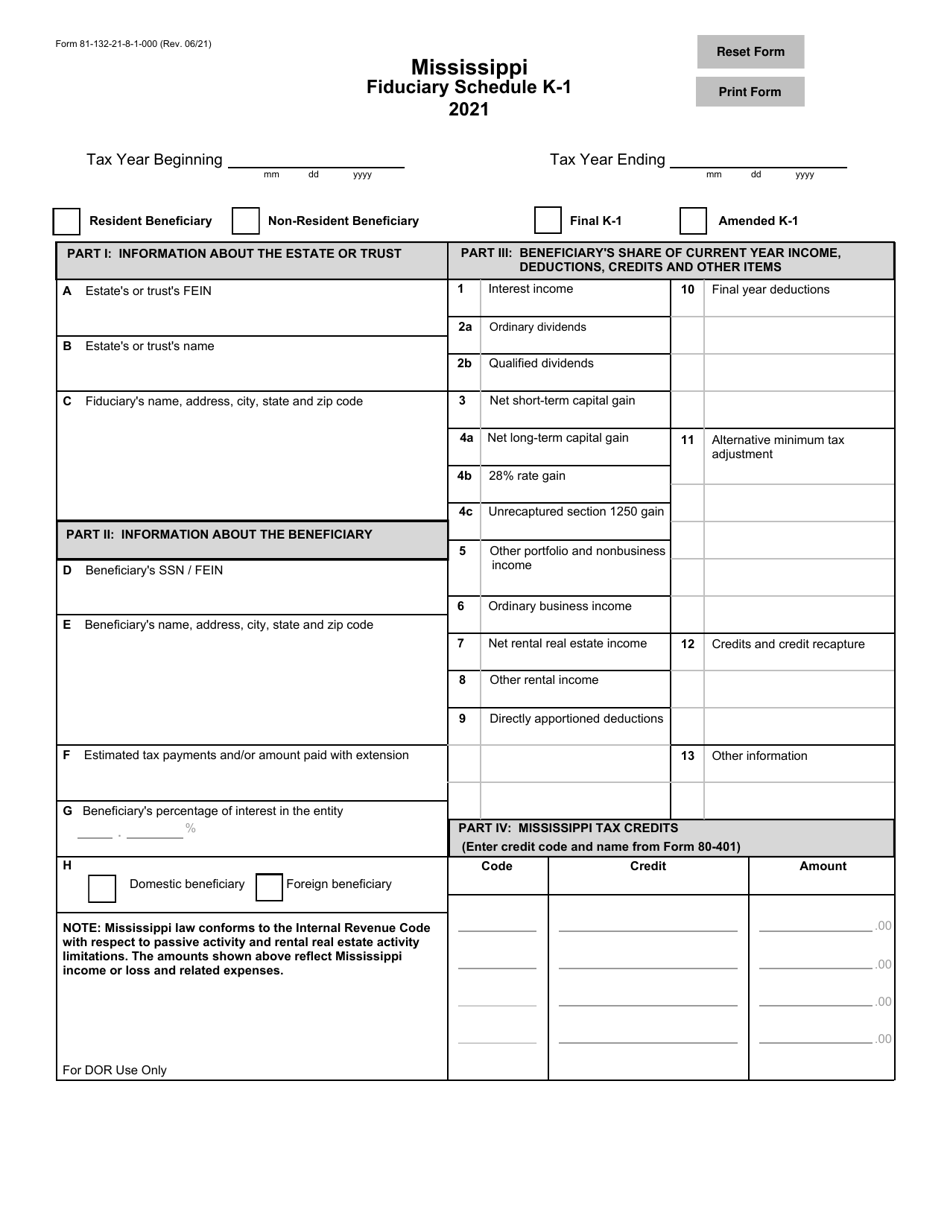

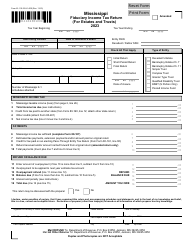

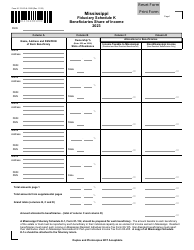

Form 81-132 Schedule K-1

for the current year.

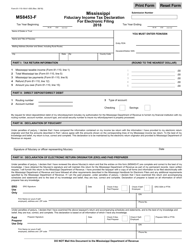

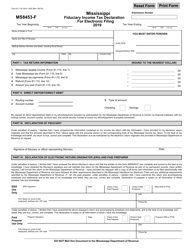

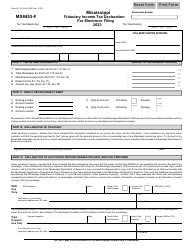

Form 81-132 Schedule K-1 Fiduciary Schedule - Mississippi

What Is Form 81-132 Schedule K-1?

This is a legal form that was released by the Mississippi Department of Revenue - a government authority operating within Mississippi. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 81-132 Schedule K-1?

A: Form 81-132 Schedule K-1 is a fiduciary schedule used in Mississippi to report information about beneficiaries in a trust or estate.

Q: Who needs to file Form 81-132 Schedule K-1?

A: Form 81-132 Schedule K-1 must be filed by fiduciaries who are responsible for distributing income to beneficiaries from a trust or estate in Mississippi.

Q: What information is reported on Form 81-132 Schedule K-1?

A: Form 81-132 Schedule K-1 reports the income, deductions, and credits allocated to each beneficiary, as well as the beneficiary's share of estate or trust items.

Q: When is Form 81-132 Schedule K-1 due?

A: Form 81-132 Schedule K-1 is due on or before the 15th day of the fourth month following the close of the trust or estate's tax year.

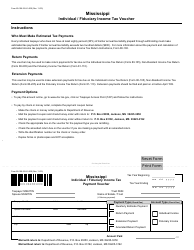

Form Details:

- Released on June 1, 2021;

- The latest edition provided by the Mississippi Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 81-132 Schedule K-1 by clicking the link below or browse more documents and templates provided by the Mississippi Department of Revenue.