This version of the form is not currently in use and is provided for reference only. Download this version of

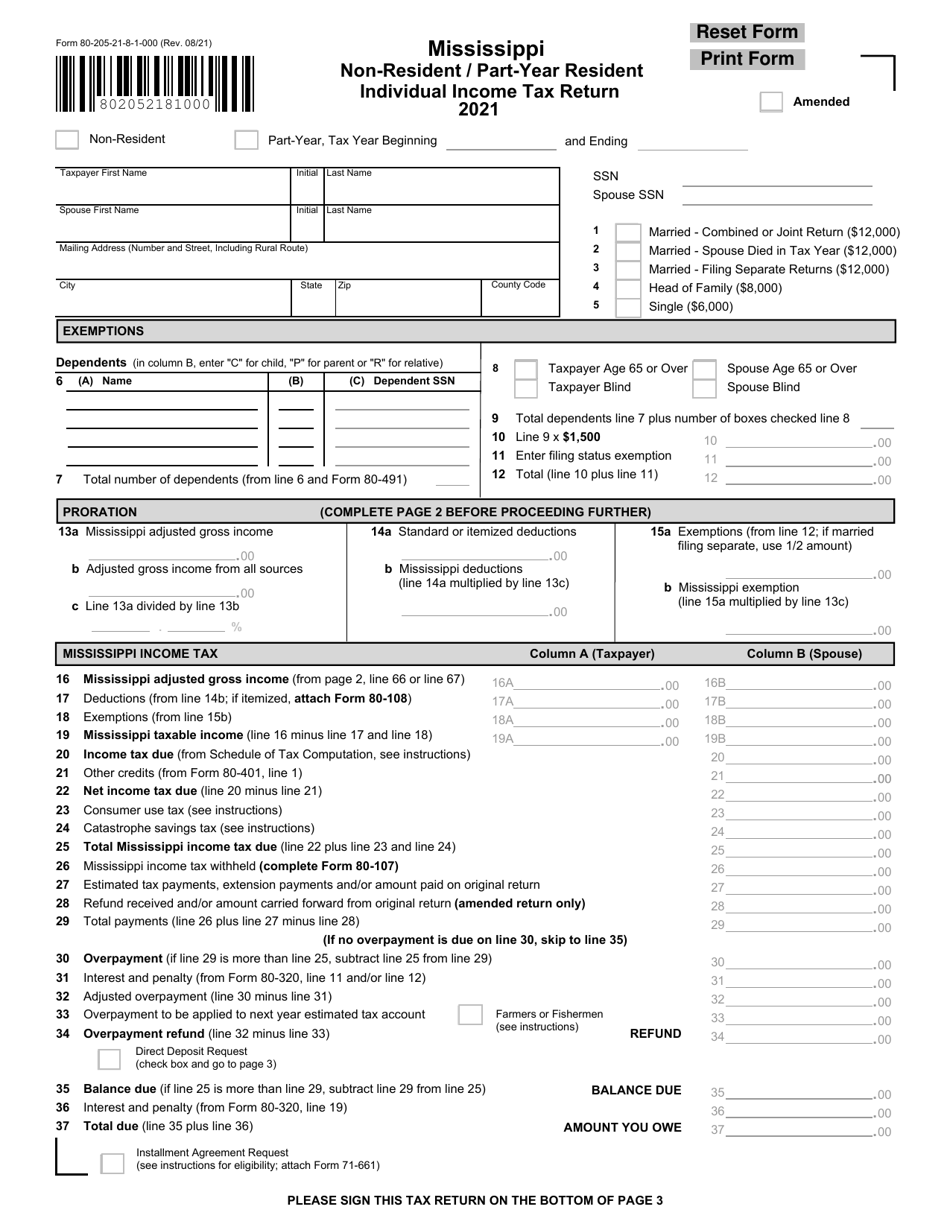

Form 80-205

for the current year.

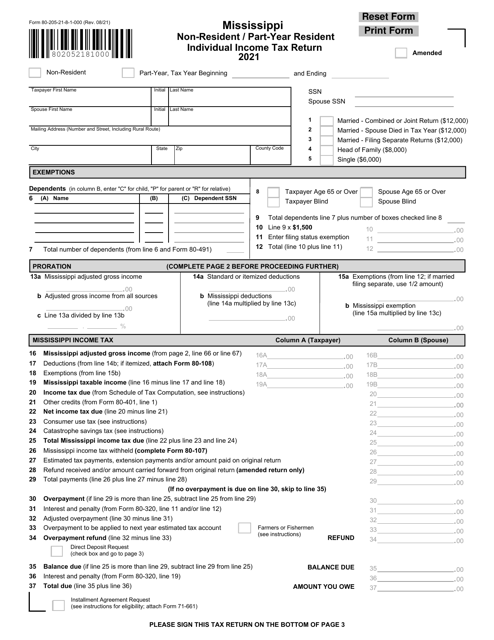

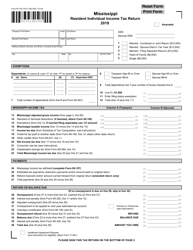

Form 80-205 Mississippi Non-resident / Part-Year Resident Individual Income Tax Return - Mississippi

What Is Form 80-205?

This is a legal form that was released by the Mississippi Department of Revenue - a government authority operating within Mississippi. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 80-205?

A: Form 80-205 is the Mississippi Non-resident/Part-Year Resident Individual Income Tax Return.

Q: Who needs to file Form 80-205?

A: Non-residents and part-year residents of Mississippi who earned income in the state during the tax year need to file Form 80-205.

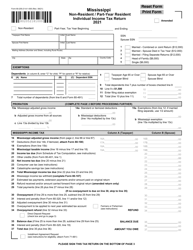

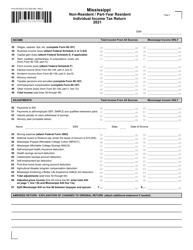

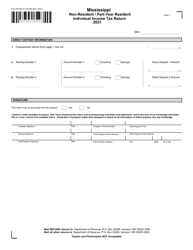

Q: What information is required on Form 80-205?

A: Form 80-205 requires you to provide your personal information, income details, deductions, and credits.

Q: When is the deadline to file Form 80-205?

A: The deadline to file Form 80-205 is April 15th, or the next business day if April 15th falls on a weekend or holiday.

Q: What if I can't file Form 80-205 by the deadline?

A: If you can't file Form 80-205 by the deadline, you can request an extension using Form 80-108.

Q: Do I need to include a copy of my federal tax return with Form 80-205?

A: No, you do not need to include a copy of your federal tax return with Form 80-205.

Q: Is there a penalty for filing Form 80-205 late?

A: Yes, there may be a penalty for filing Form 80-205 late. It is important to file by the deadline to avoid penalties.

Q: Can I file Form 80-205 if I had no income in Mississippi?

A: If you had no income in Mississippi during the tax year, you do not need to file Form 80-205.

Form Details:

- Released on August 1, 2021;

- The latest edition provided by the Mississippi Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 80-205 by clicking the link below or browse more documents and templates provided by the Mississippi Department of Revenue.