This version of the form is not currently in use and is provided for reference only. Download this version of

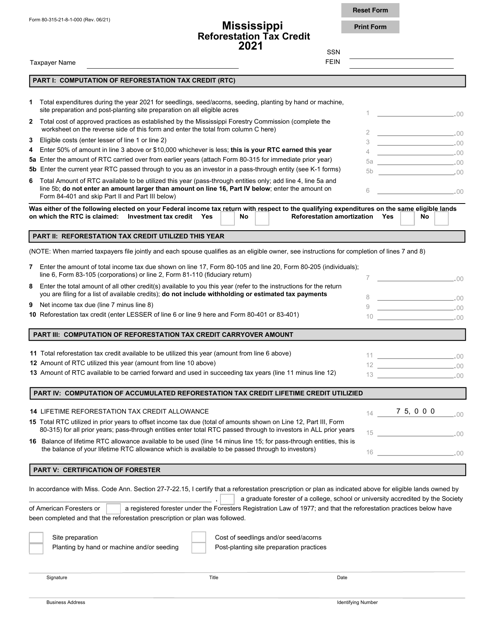

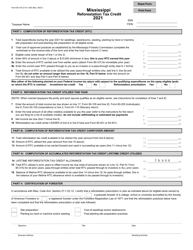

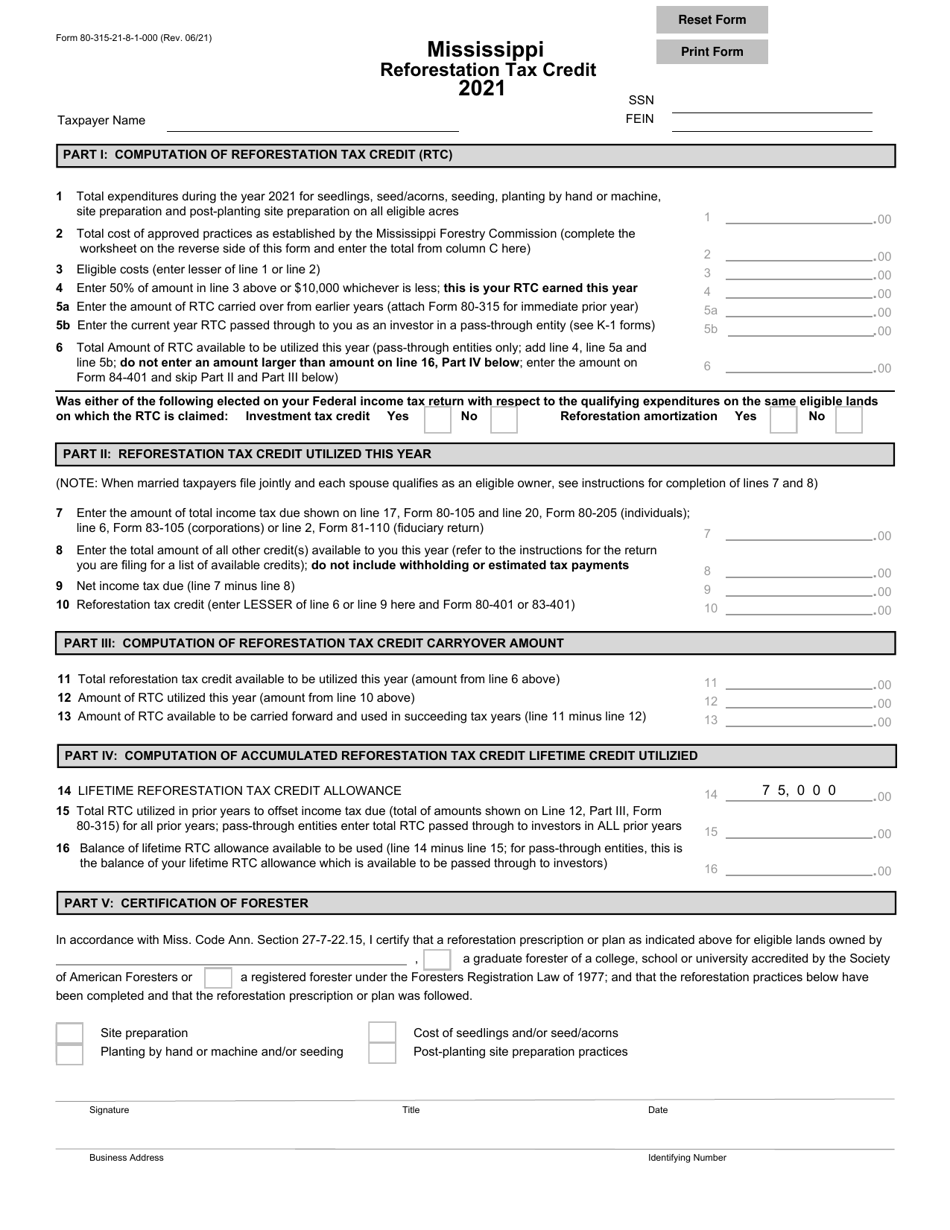

Form 80-315

for the current year.

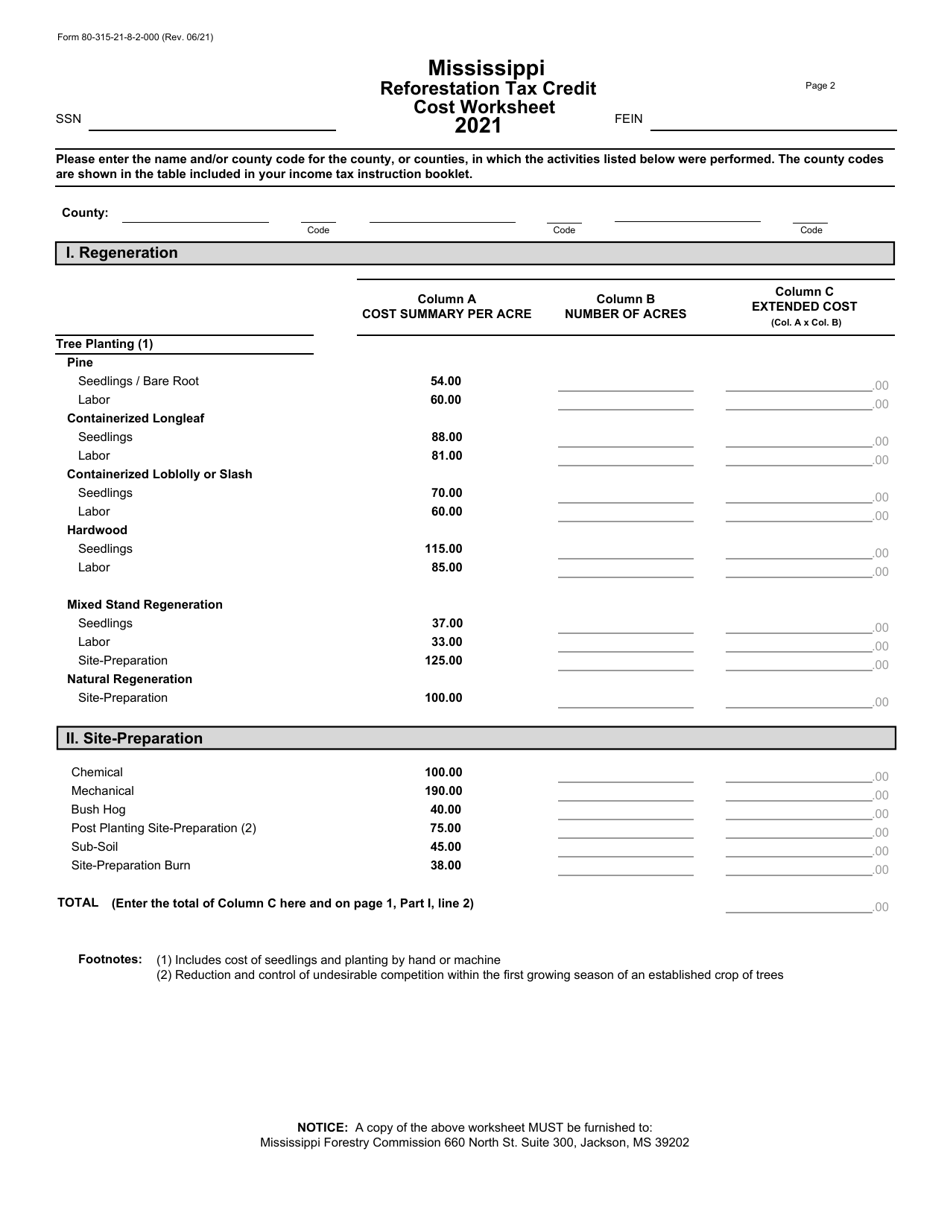

Form 80-315 Reforestation Tax Credit - Mississippi

What Is Form 80-315?

This is a legal form that was released by the Mississippi Department of Revenue - a government authority operating within Mississippi. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 80-315?

A: Form 80-315 is the official form used to claim the Reforestation Tax Credit in Mississippi.

Q: What is the Reforestation Tax Credit?

A: The Reforestation Tax Credit is a tax incentive provided by the state of Mississippi to encourage reforestation efforts.

Q: Who is eligible for the Reforestation Tax Credit?

A: Individuals, corporations, and partnerships engaged in reforestation activities in Mississippi may be eligible for this tax credit.

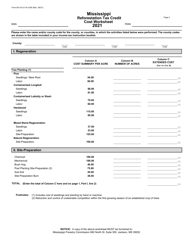

Q: What expenses can be claimed under this tax credit?

A: Expenses related to the establishment and maintenance of reforestation activities, such as seedlings, labor, and equipment costs, may be claimed under this tax credit.

Q: What is the process for claiming the Reforestation Tax Credit?

A: To claim the tax credit, taxpayers must complete and file Form 80-315 with the Mississippi Department of Revenue.

Q: Is there a limit to the amount of the tax credit?

A: Yes, the maximum tax credit allowable per acre of reforested land is $100.

Q: Can the tax credit be carried forward or transferred?

A: Yes, unused tax credits can be carried forward for up to 5 years or transferred to another eligible taxpayer.

Q: Are there any deadlines for claiming the Reforestation Tax Credit?

A: Yes, the tax credit must be claimed within 3 years from the end of the tax year in which the reforestation expenses were incurred.

Form Details:

- Released on June 1, 2021;

- The latest edition provided by the Mississippi Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 80-315 by clicking the link below or browse more documents and templates provided by the Mississippi Department of Revenue.