This version of the form is not currently in use and is provided for reference only. Download this version of

Form 80-108

for the current year.

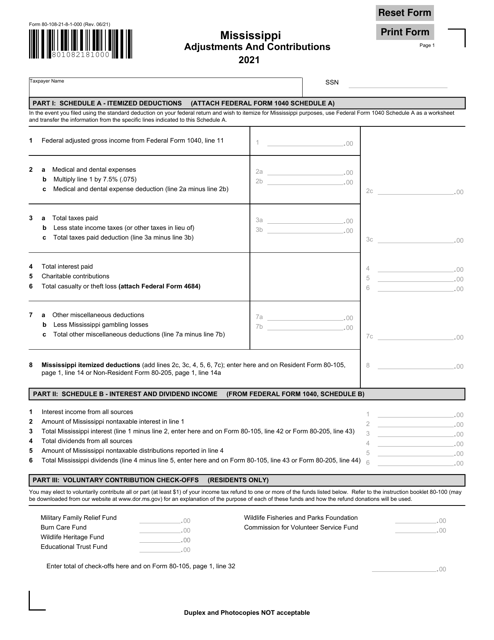

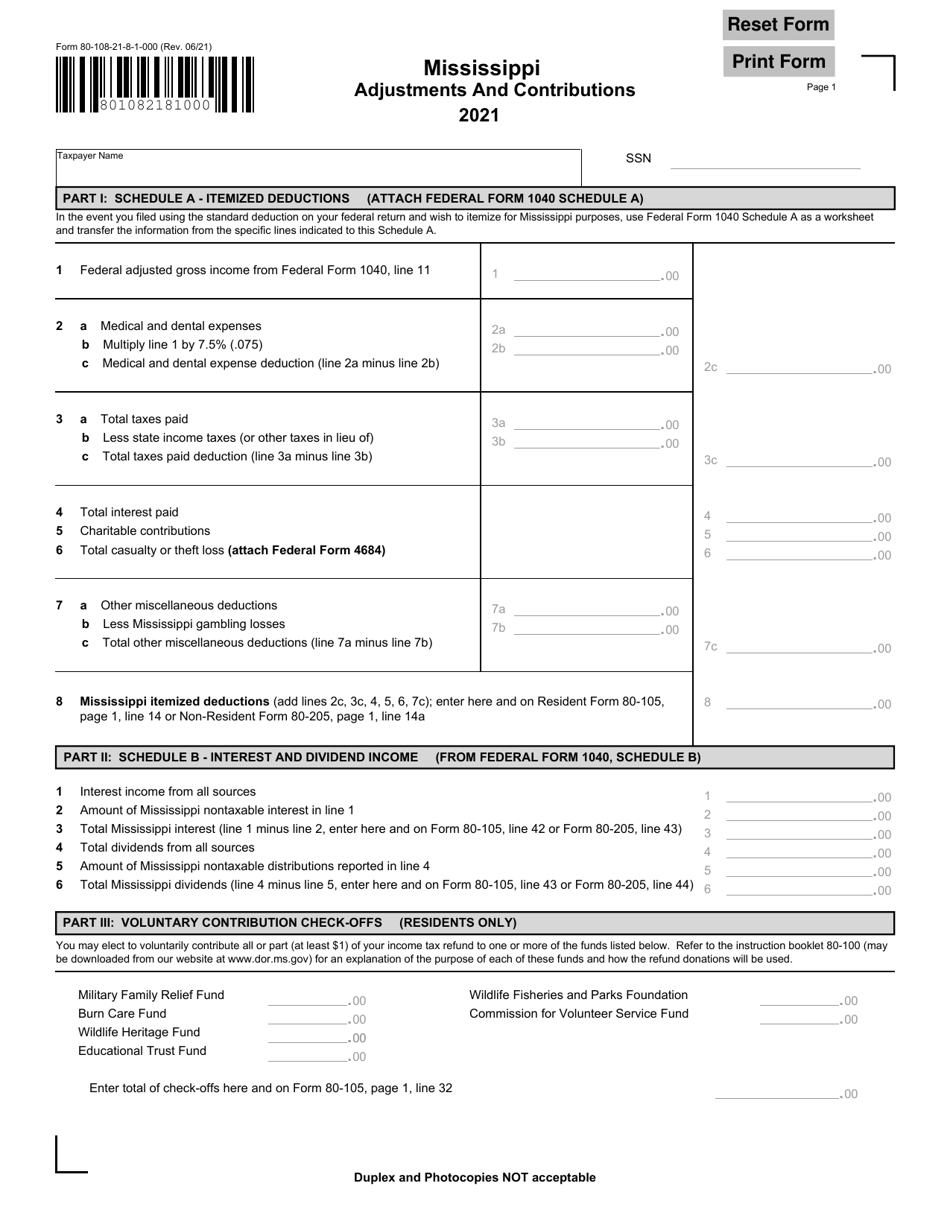

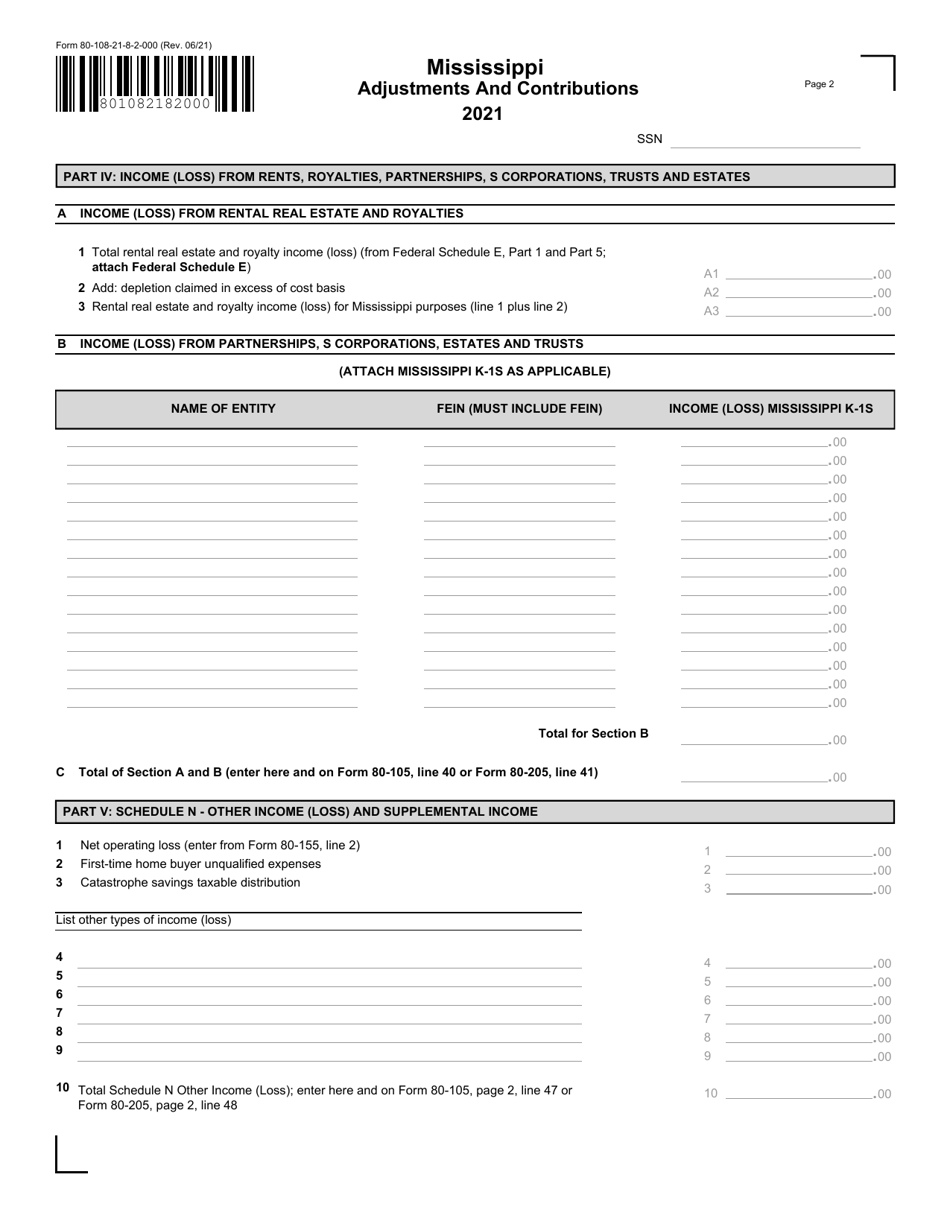

Form 80-108 Adjustments and Contributions - Mississippi

What Is Form 80-108?

This is a legal form that was released by the Mississippi Department of Revenue - a government authority operating within Mississippi. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 80-108?

A: Form 80-108 is a document used in Mississippi for reporting adjustments and contributions.

Q: Who needs to file Form 80-108?

A: Individuals or businesses in Mississippi who have made adjustments or contributions during the tax year may need to file Form 80-108.

Q: What should be reported on Form 80-108?

A: Form 80-108 should be used to report adjustments and contributions made during the tax year in Mississippi.

Q: When is the deadline to file Form 80-108?

A: The deadline to file Form 80-108 in Mississippi is typically April 15th, or the next business day if that falls on a weekend or holiday.

Q: Are there any fees or penalties for late filing of Form 80-108?

A: Yes, there may be penalties and interest for late filing of Form 80-108 in Mississippi. It is best to file the form by the deadline to avoid any potential fees.

Q: Can I file an amended Form 80-108?

A: Yes, if you need to make changes to a previously filed Form 80-108, you can file an amended form. Be sure to include the changes and the reason for the amendment.

Q: What happens after I file Form 80-108?

A: After you file Form 80-108, the Mississippi Department of Revenue will review your form and process your adjustments or contributions accordingly.

Q: Do I need to keep a copy of Form 80-108 for my records?

A: Yes, it is recommended to keep a copy of Form 80-108 and any supporting documents for your records in case of future inquiries or audits.

Form Details:

- Released on June 1, 2021;

- The latest edition provided by the Mississippi Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 80-108 by clicking the link below or browse more documents and templates provided by the Mississippi Department of Revenue.