This version of the form is not currently in use and is provided for reference only. Download this version of

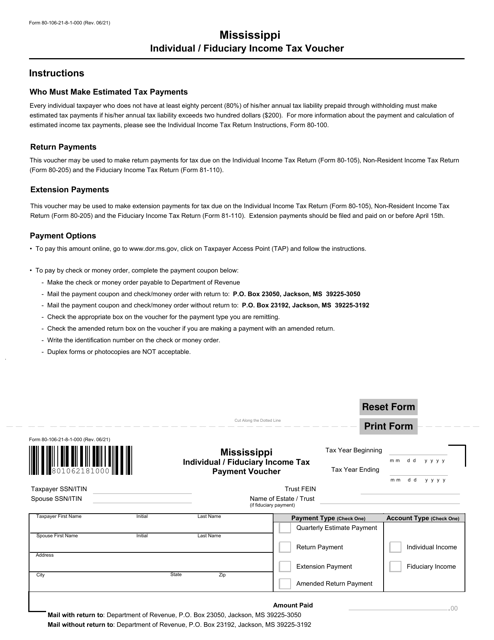

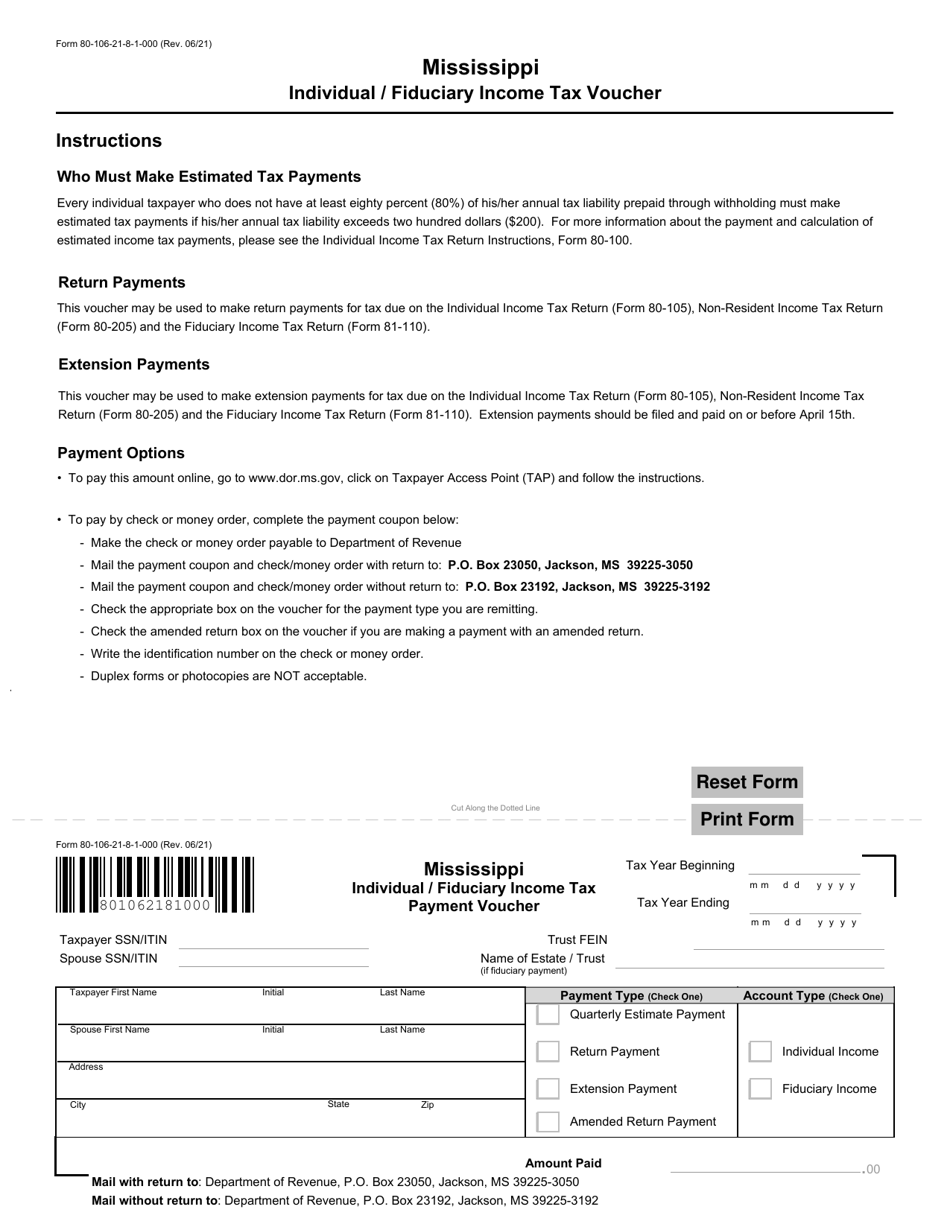

Form 80-106

for the current year.

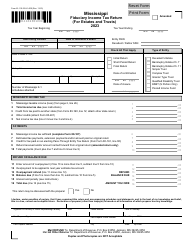

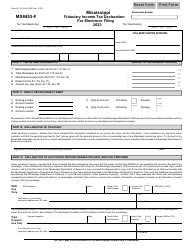

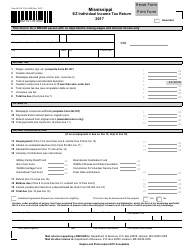

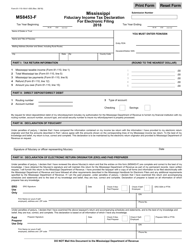

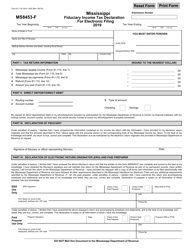

Form 80-106 Mississippi Individual / Fiduciary Income Tax Voucher - Mississippi

What Is Form 80-106?

This is a legal form that was released by the Mississippi Department of Revenue - a government authority operating within Mississippi. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 80-106?

A: Form 80-106 is the Mississippi Individual/Fiduciary Income Tax Voucher.

Q: Who needs to use Form 80-106?

A: Form 80-106 is used by individuals and fiduciaries in Mississippi to pay their income tax.

Q: What is the purpose of Form 80-106?

A: The purpose of Form 80-106 is to remit payment for income tax owed to the state of Mississippi.

Q: When is Form 80-106 due?

A: Form 80-106 is generally due on or before April 15th of each year.

Form Details:

- Released on June 1, 2021;

- The latest edition provided by the Mississippi Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 80-106 by clicking the link below or browse more documents and templates provided by the Mississippi Department of Revenue.