This version of the form is not currently in use and is provided for reference only. Download this version of

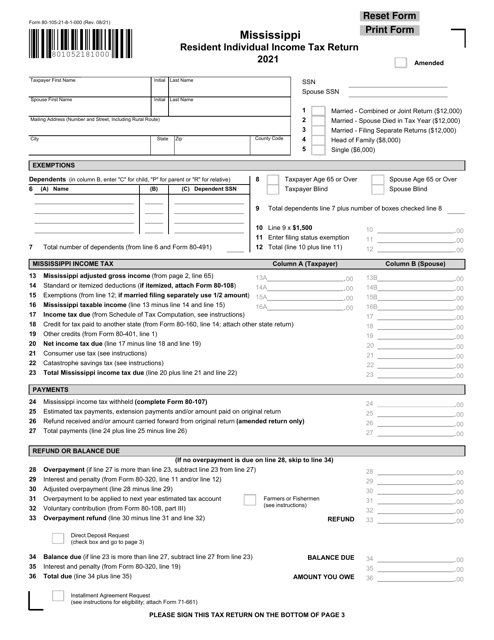

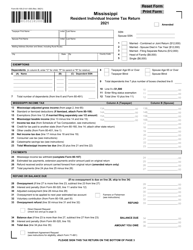

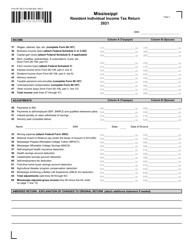

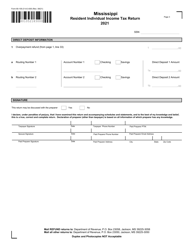

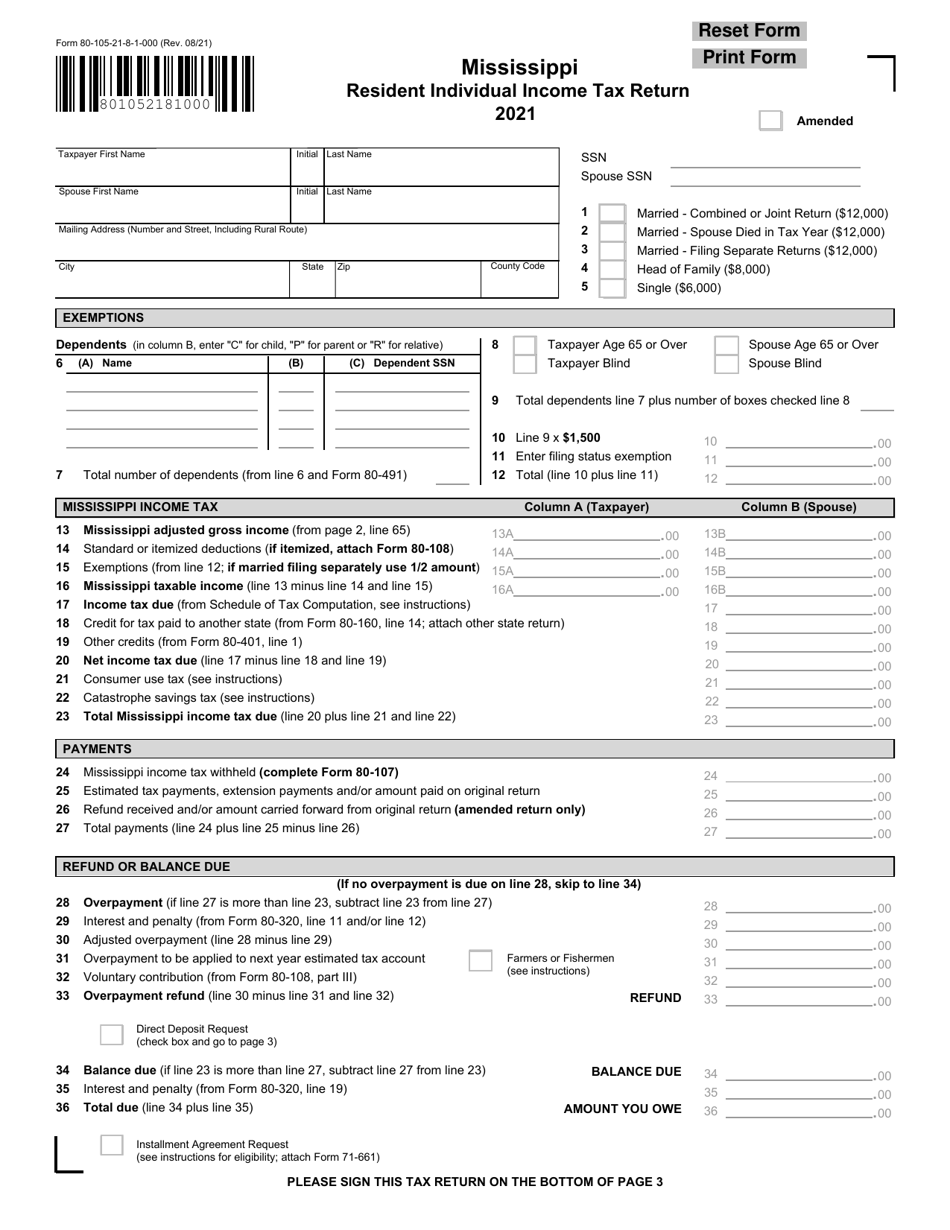

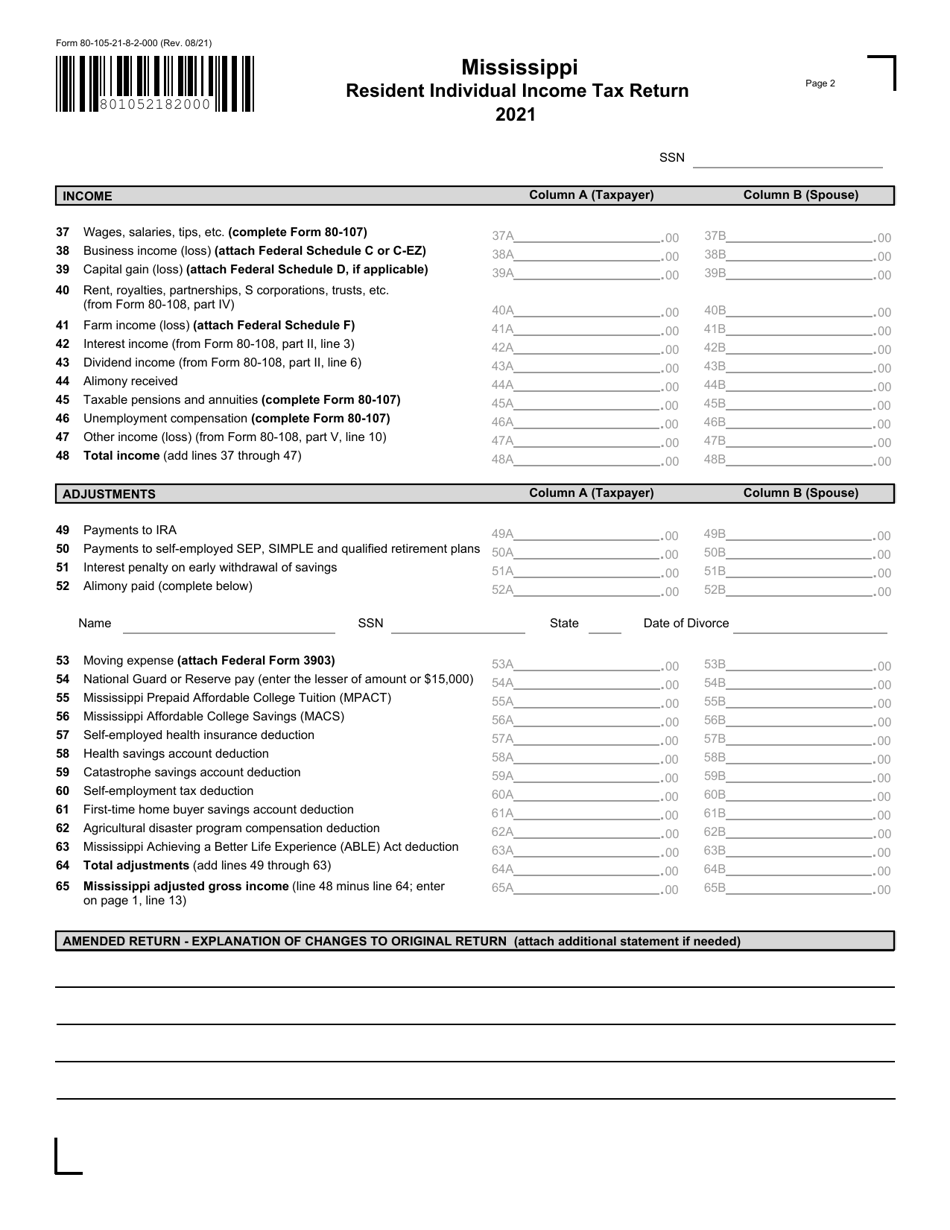

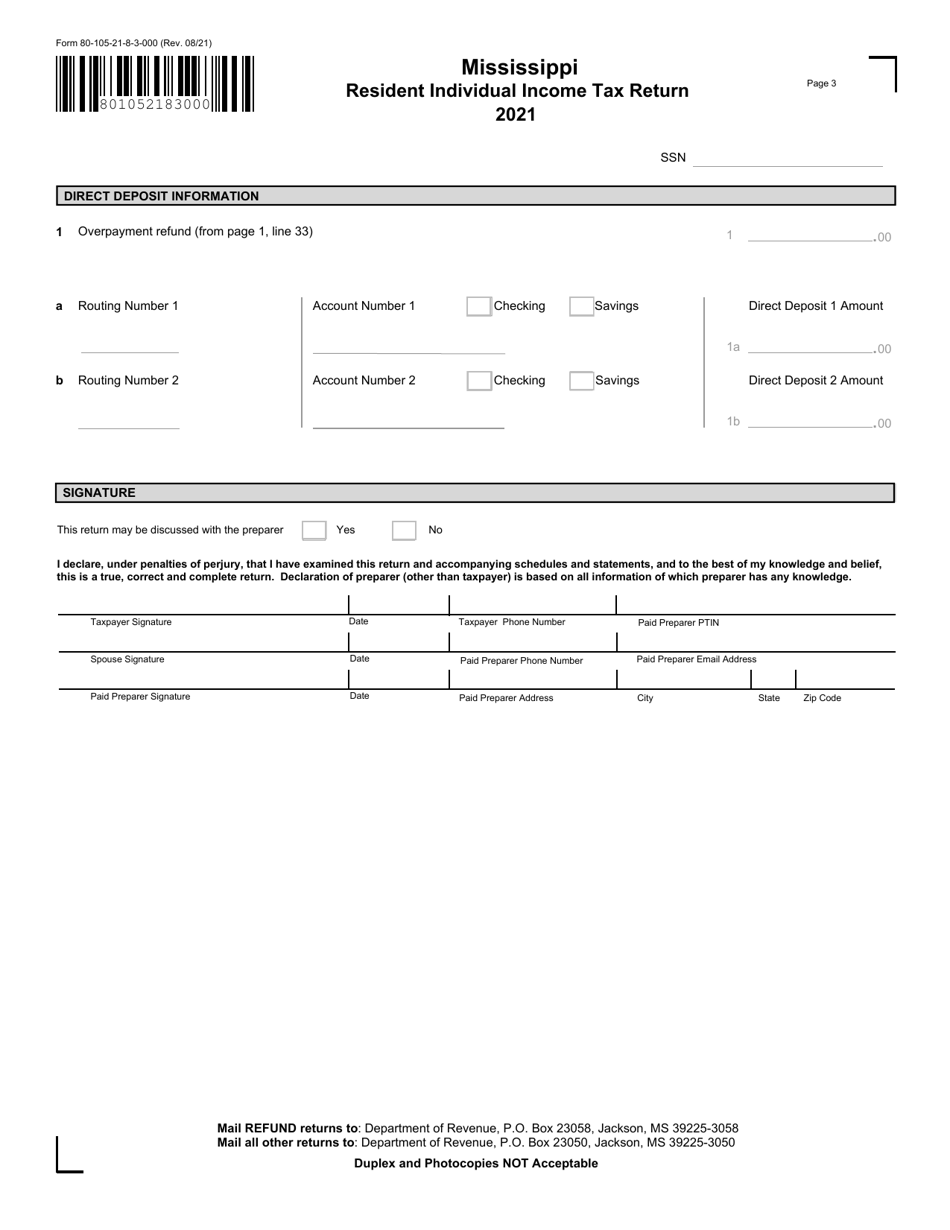

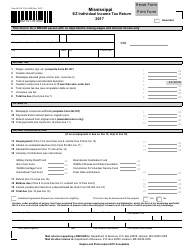

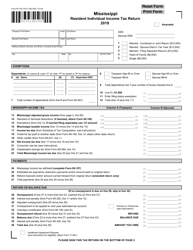

Form 80-105

for the current year.

Form 80-105 Resident Individual Income Tax Return - Mississippi

What Is Form 80-105?

This is a legal form that was released by the Mississippi Department of Revenue - a government authority operating within Mississippi. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 80-105?

A: Form 80-105 is the Resident Individual Income Tax Return for Mississippi residents.

Q: Who needs to file Form 80-105?

A: Mississippi residents who have income and meet certain filing requirements need to file Form 80-105.

Q: What information do I need to complete Form 80-105?

A: You will need your personal information, income details, deductions, and any applicable credits to complete Form 80-105.

Q: When is the deadline to file Form 80-105?

A: The deadline to file Form 80-105 is typically April 15th, but it may vary depending on weekends and holidays.

Q: Are there any penalties for filing Form 80-105 late?

A: Yes, if you fail to file Form 80-105 or pay the taxes owed by the deadline, you may be subject to penalties and interest.

Q: Can I get an extension to file Form 80-105?

A: Yes, you can request an extension to file Form 80-105, but you will still need to pay any taxes owed by the original deadline.

Q: Do I need to include supporting documents with Form 80-105?

A: You generally do not need to include supporting documents with your initial filing, but you should keep them for your records in case of an audit.

Q: How long does it take to receive a refund after filing Form 80-105?

A: It typically takes 4-6 weeks to receive a refund after filing Form 80-105, but it may take longer during peak filing season.

Form Details:

- Released on August 1, 2021;

- The latest edition provided by the Mississippi Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 80-105 by clicking the link below or browse more documents and templates provided by the Mississippi Department of Revenue.