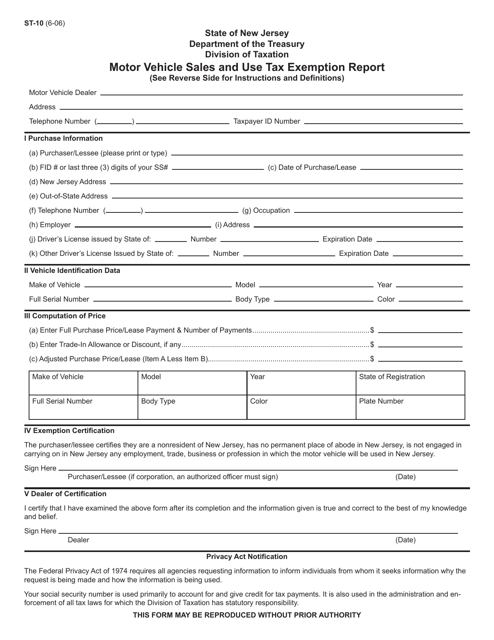

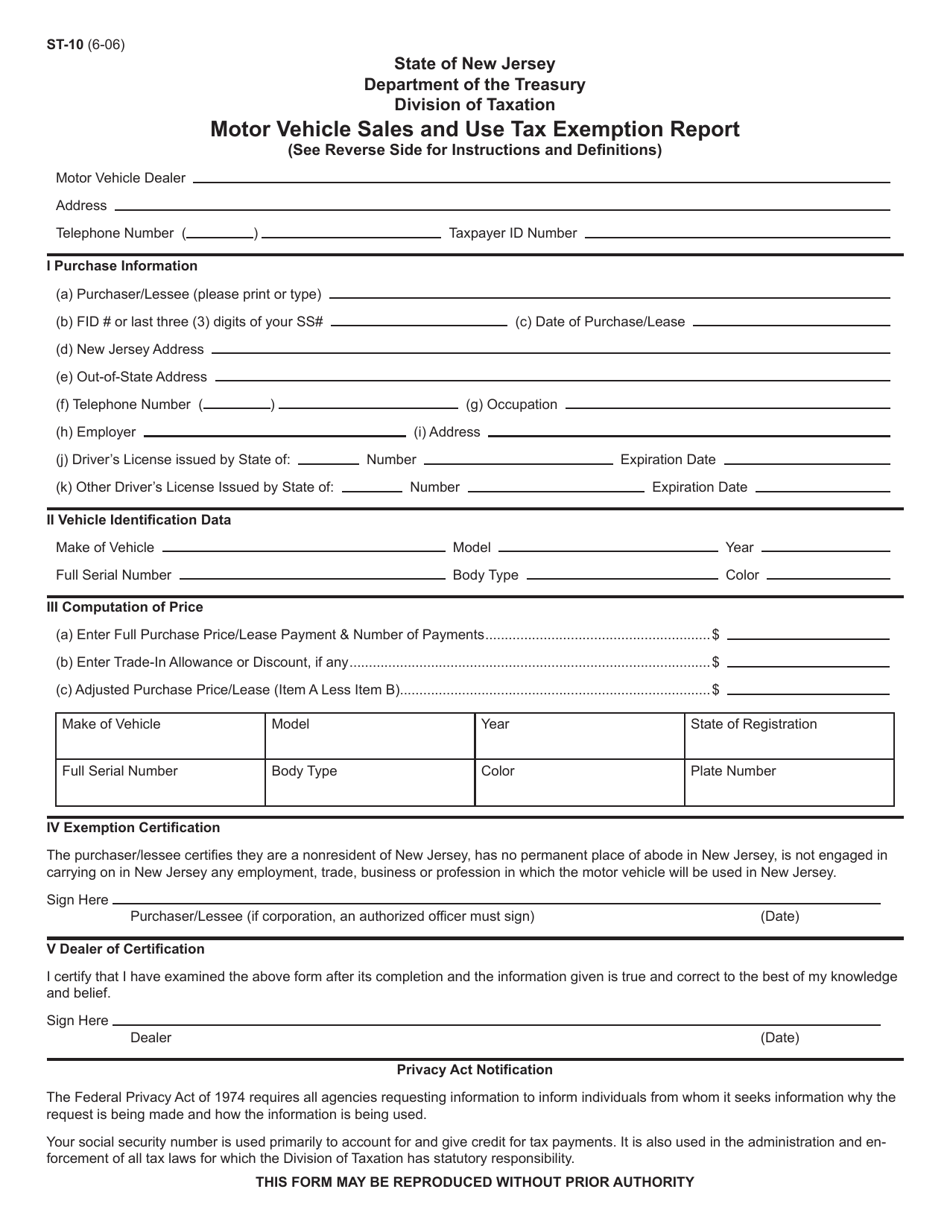

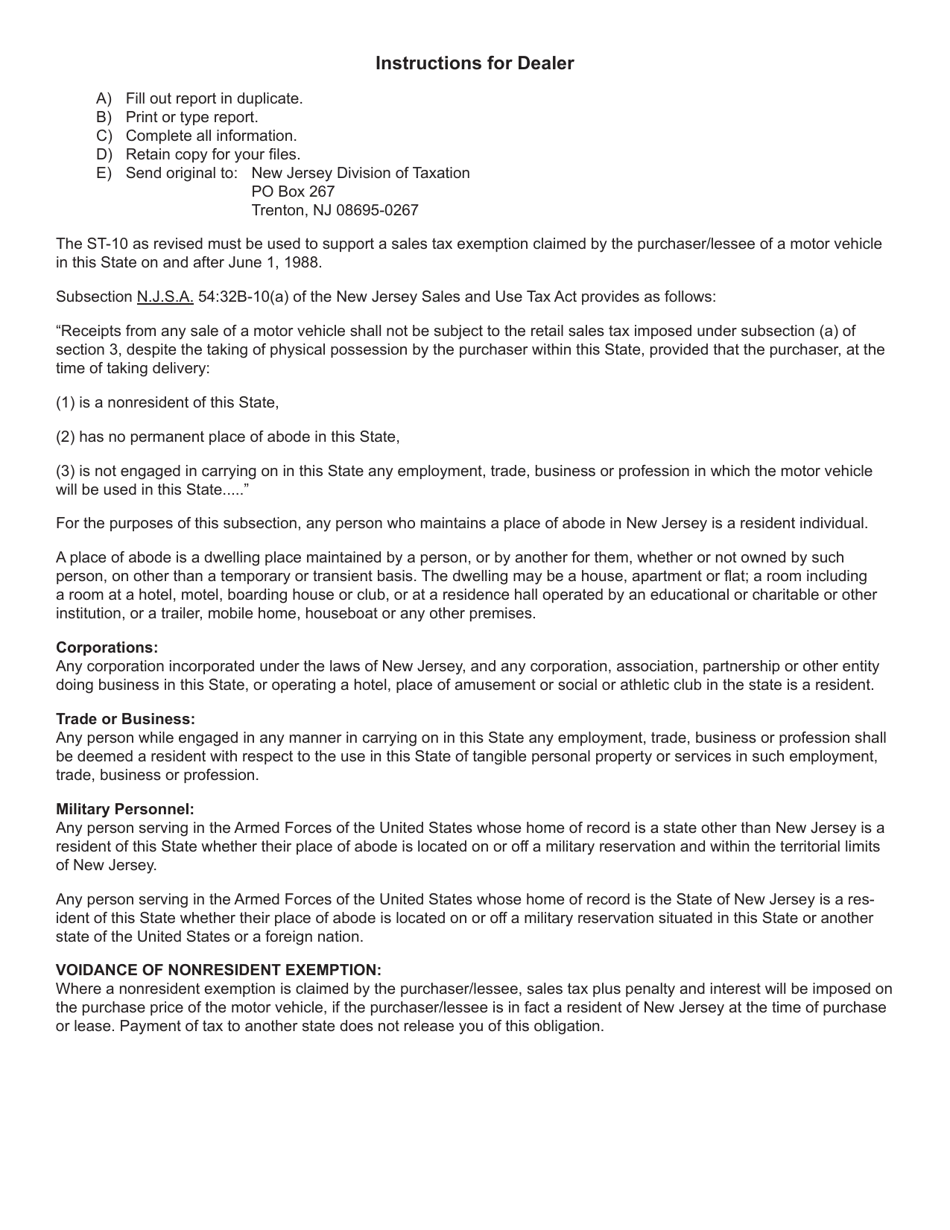

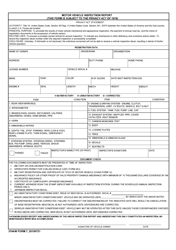

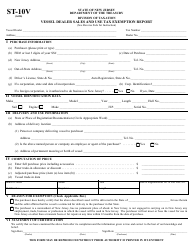

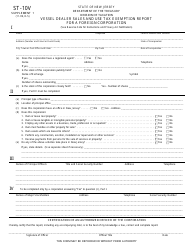

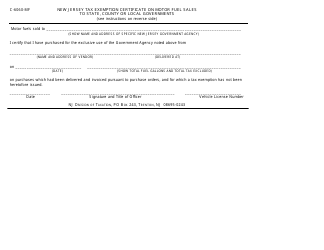

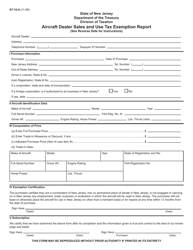

Form ST-10 Motor Vehicle Sales and Use Tax Exemption Report - New Jersey

What Is Form ST-10?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

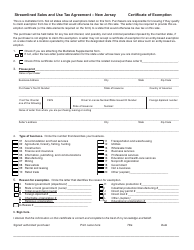

Q: What is Form ST-10?

A: Form ST-10 is the Motor Vehicle Sales and Use TaxExemption Report in New Jersey.

Q: What is the purpose of Form ST-10?

A: The purpose of Form ST-10 is to report exemptions from motor vehiclesales and use tax in New Jersey.

Q: Who needs to file Form ST-10?

A: Individuals or businesses who qualify for exemptions from motor vehicle sales and use tax in New Jersey need to file Form ST-10.

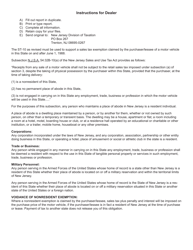

Q: Do I need to attach any supporting documentation with Form ST-10?

A: Yes, you may need to attach certain supporting documentation depending on the exemption you are claiming. Refer to the instructions provided with the form for more information.

Q: When is the deadline to file Form ST-10?

A: The deadline to file Form ST-10 is generally within 30 days after the date of purchase or acquisition of the motor vehicle.

Q: Are there any penalties for late filing or non-filing of Form ST-10?

A: Yes, there may be penalties for late filing or non-filing of Form ST-10. It is important to file the form on time to avoid any penalties.

Q: Is there a fee to file Form ST-10?

A: No, there is no fee to file Form ST-10.

Form Details:

- Released on June 1, 2006;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ST-10 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.