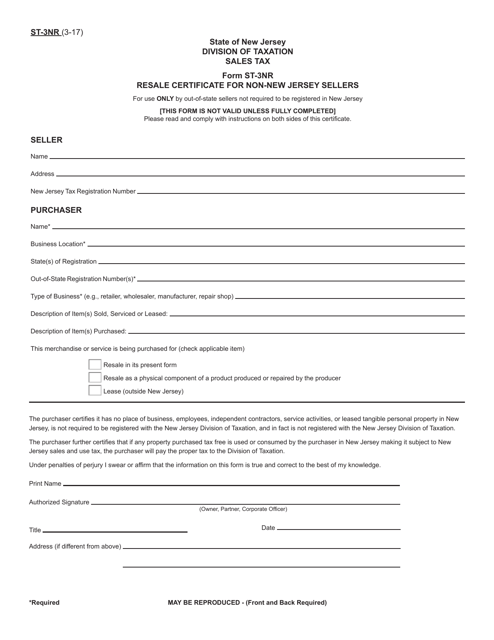

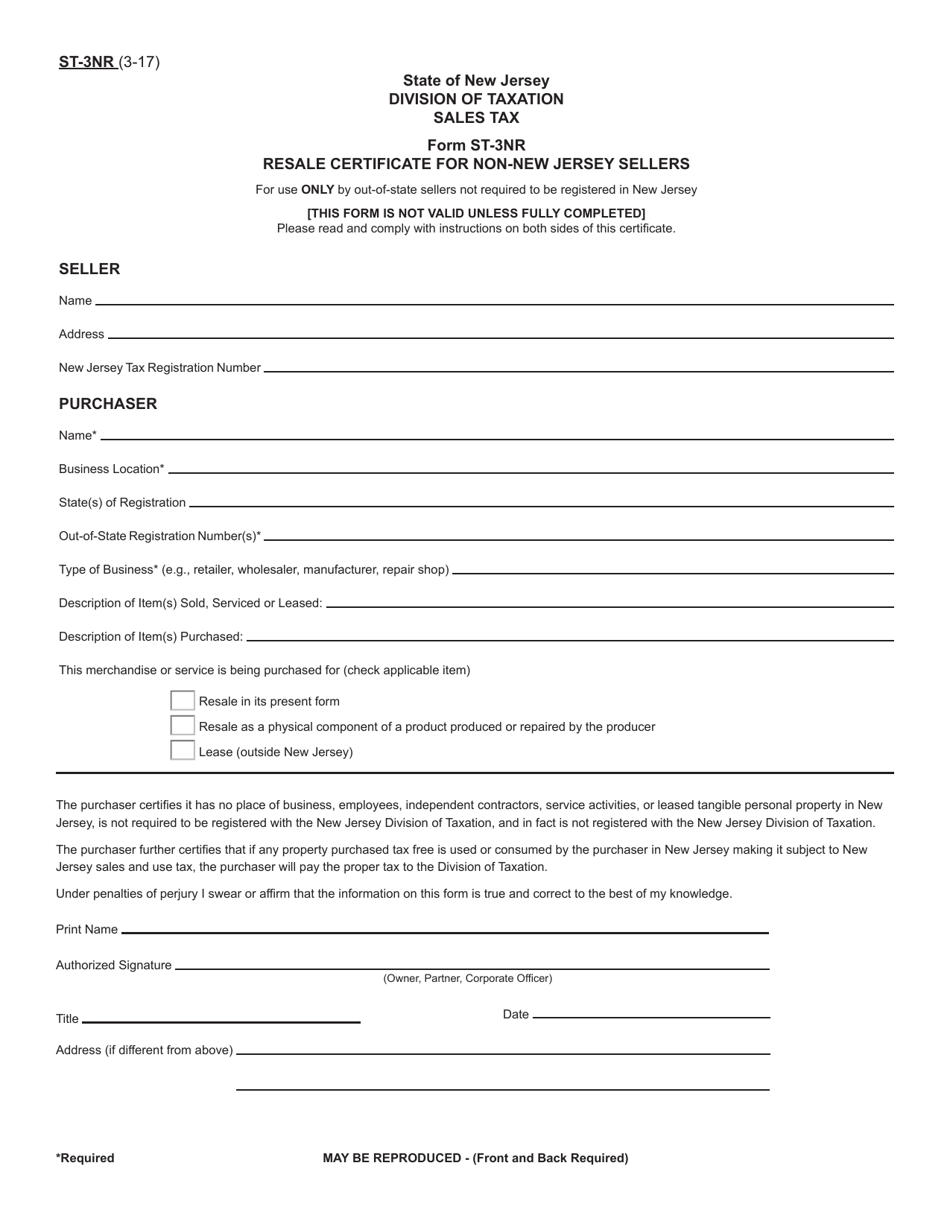

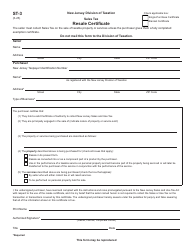

Form ST-3NR Resale Certificate for Non-new Jersey Sellers - New Jersey

What Is Form ST-3NR?

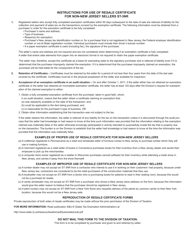

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form ST-3NR?

A: Form ST-3NR is a Resale Certificate for Non-New Jersey Sellers.

Q: Who needs to use Form ST-3NR?

A: Non-New Jersey sellers who want to claim exemption from New Jersey sales tax need to use Form ST-3NR.

Q: What is the purpose of Form ST-3NR?

A: The purpose of Form ST-3NR is to certify that the seller is not a New Jersey seller and is eligible for sales tax exemption.

Q: What information do I need to provide on Form ST-3NR?

A: You will need to provide your business name, address, taxpayer identification number, and other required information.

Q: Can I use Form ST-3NR for all types of sales?

A: No, Form ST-3NR is specifically for resale transactions and cannot be used for other types of sales.

Q: Is Form ST-3NR valid for a specific period of time?

A: No, Form ST-3NR does not expire and can be used until there is a change in your business status.

Q: Do I need to register with the New Jersey Division of Taxation to use Form ST-3NR?

A: No, you do not need to register with the New Jersey Division of Taxation to use Form ST-3NR, but you may need to register if you have other tax obligations in the state.

Form Details:

- Released on March 1, 2017;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ST-3NR by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.