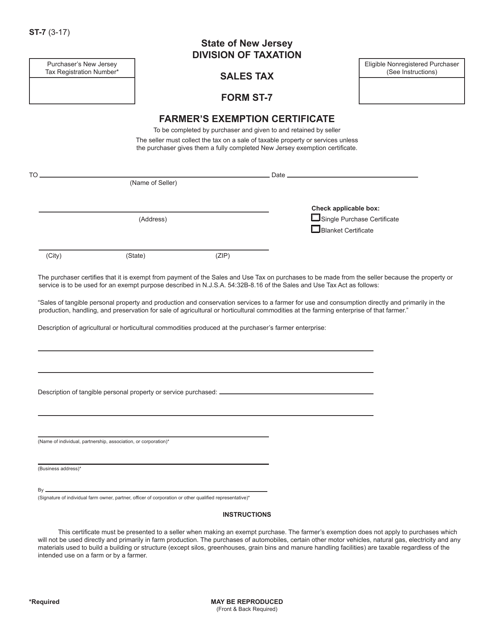

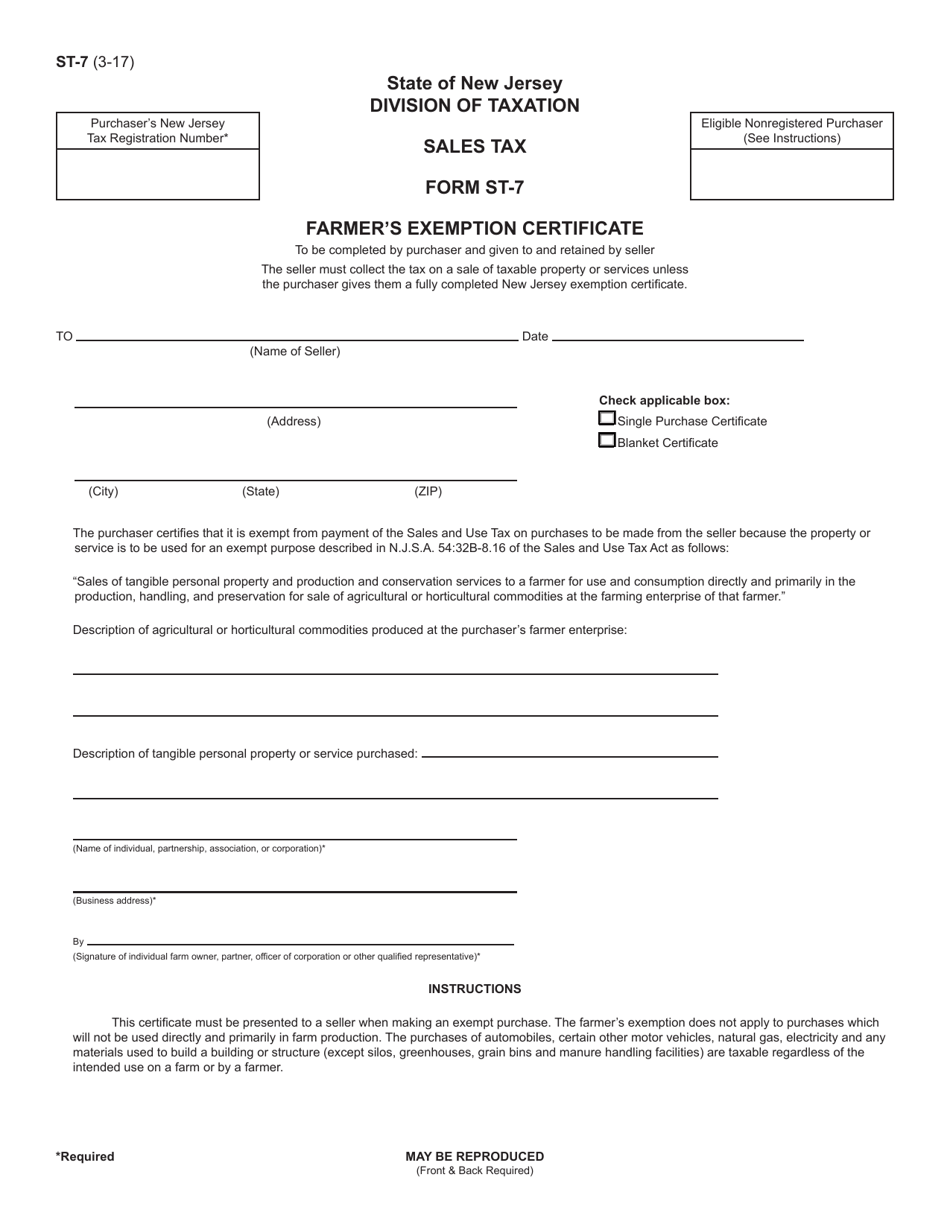

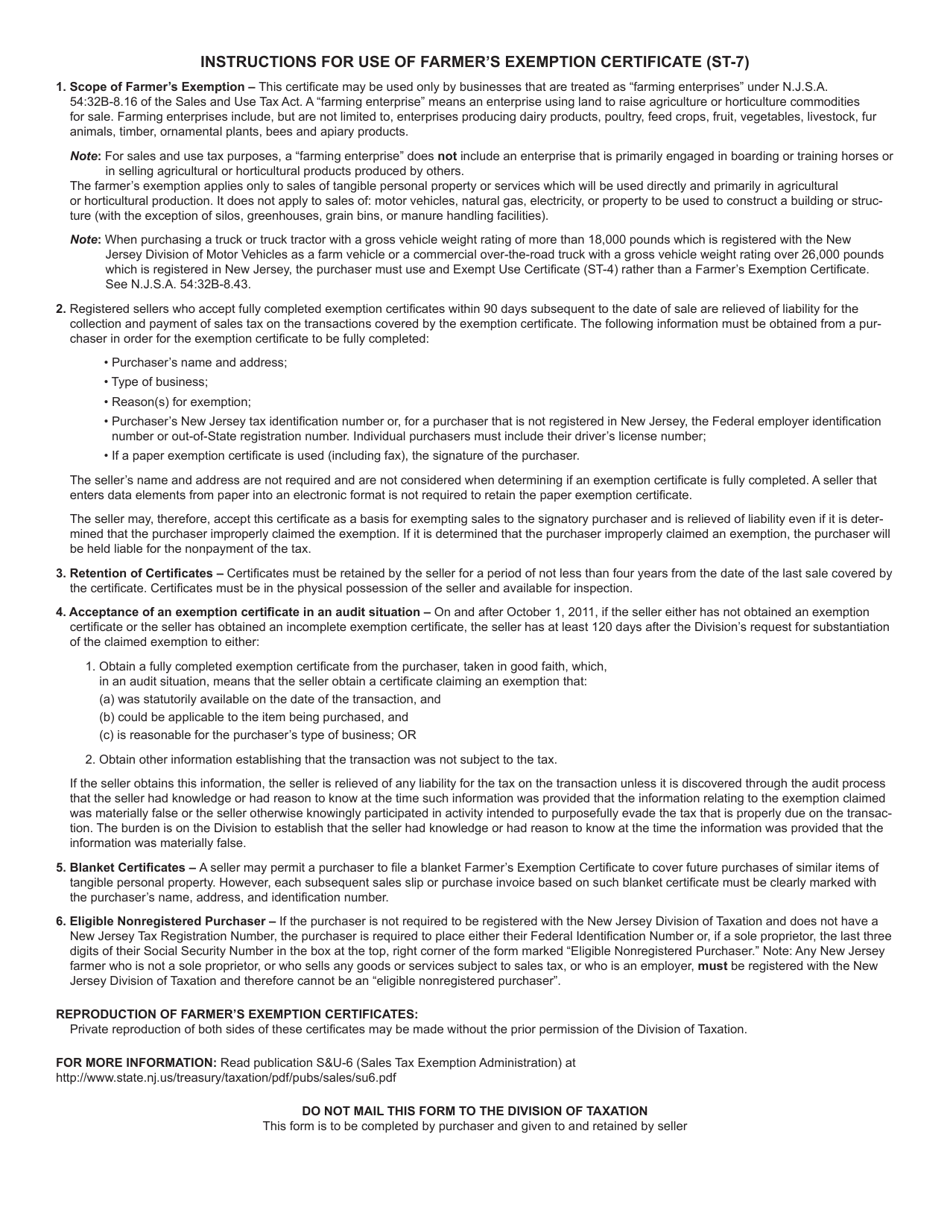

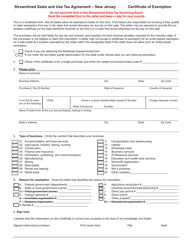

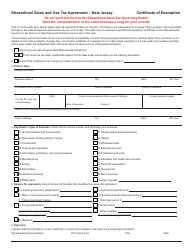

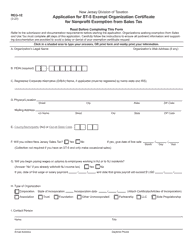

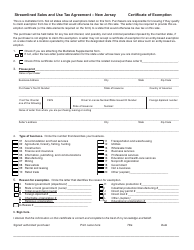

Form ST-7 Farmer's Exemption Certificate - New Jersey

What Is Form ST-7?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the Form ST-7?

A: The Form ST-7 is a Farmer's Exemption Certificate in New Jersey.

Q: What is the purpose of the Form ST-7?

A: The purpose of the Form ST-7 is to certify that a farmer is eligible for sales tax exemption on certain purchases.

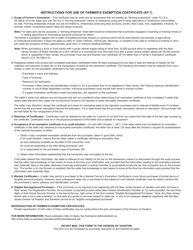

Q: Who is eligible to use the Form ST-7?

A: Farmers who meet specific criteria, such as producing agricultural products for sale, are eligible to use the Form ST-7.

Q: What types of purchases are exempt with the Form ST-7?

A: The Form ST-7 allows for sales tax exemption on purchases of certain goods and services directly used in farming activities.

Q: Do I need to renew the Form ST-7?

A: Yes, the Form ST-7 needs to be renewed every three years to maintain the sales tax exemption.

Q: Are there any penalties for misusing the Form ST-7?

A: Yes, misusing the Form ST-7 can result in penalties, including paying back the sales tax that should have been collected.

Q: Can I use the Form ST-7 for personal purchases?

A: No, the Form ST-7 can only be used for purchases related to farming activities.

Q: Are there any other requirements to claim the Farmer's Exemption?

A: Yes, there are other requirements, such as registering as a farmer with the New Jersey Department of Agriculture.

Form Details:

- Released on March 1, 2017;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form ST-7 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.