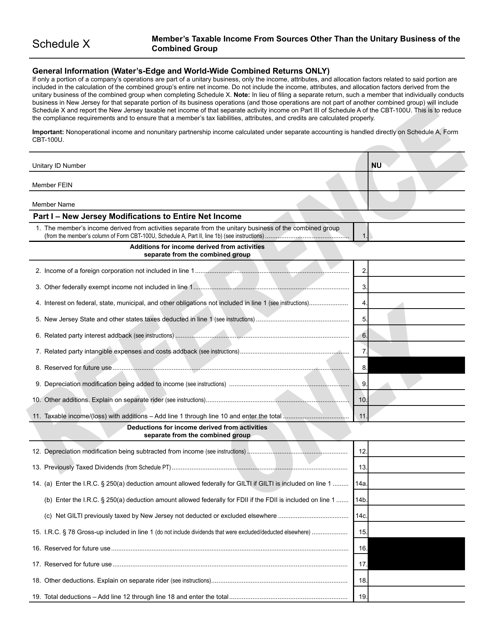

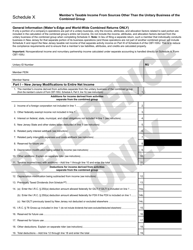

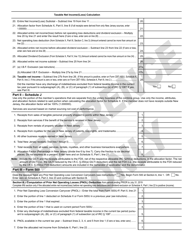

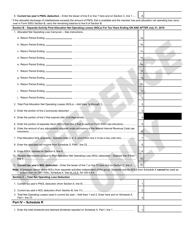

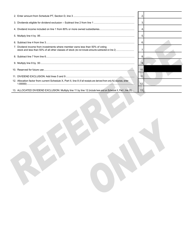

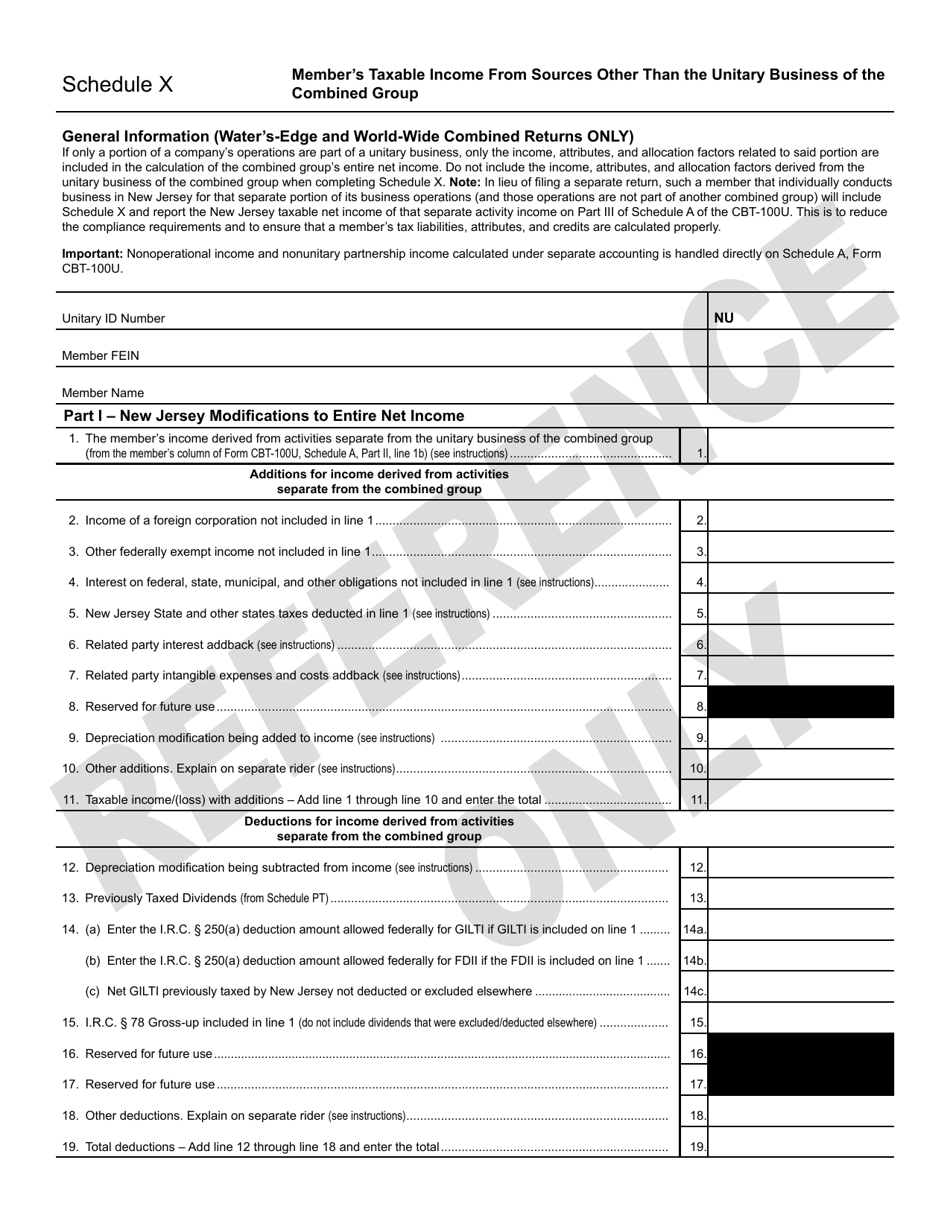

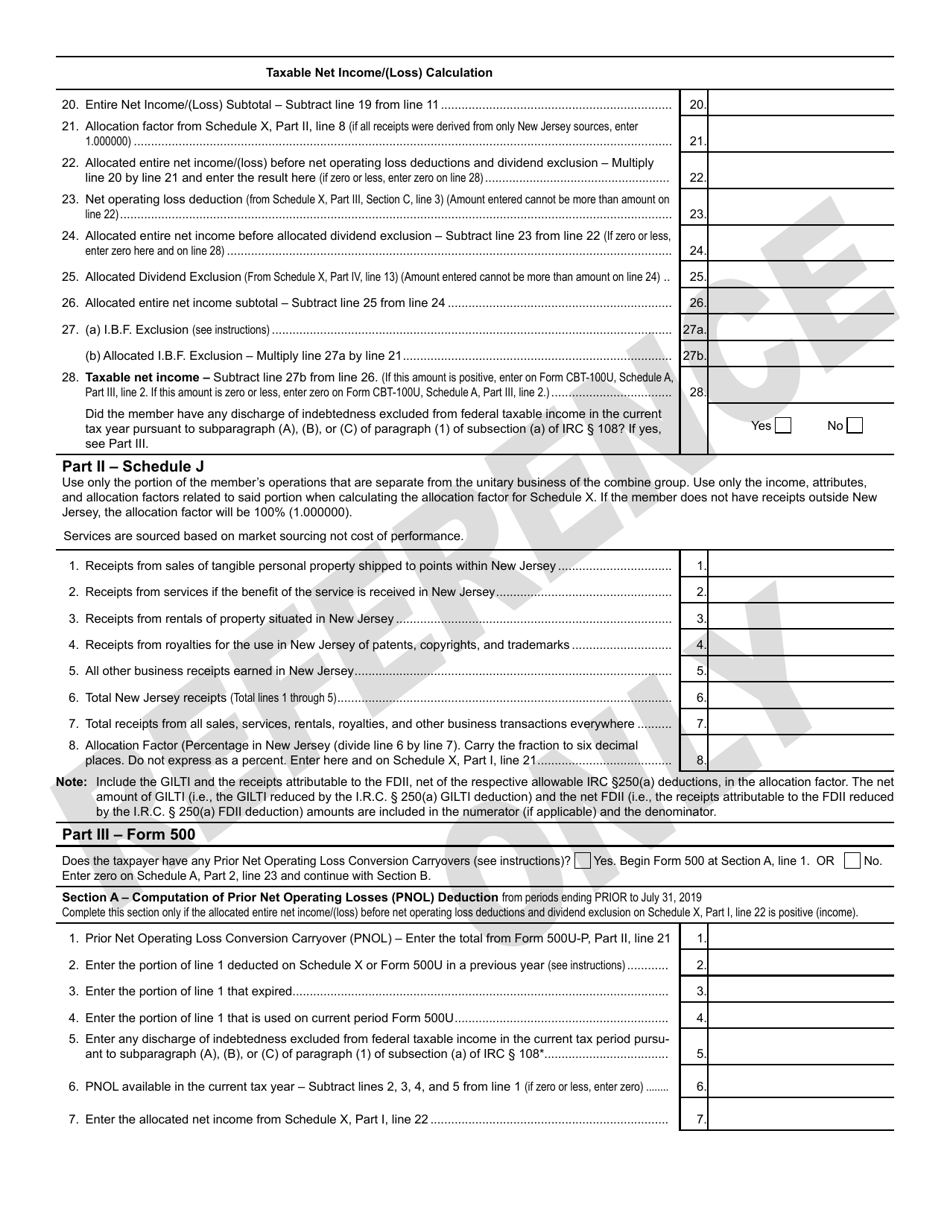

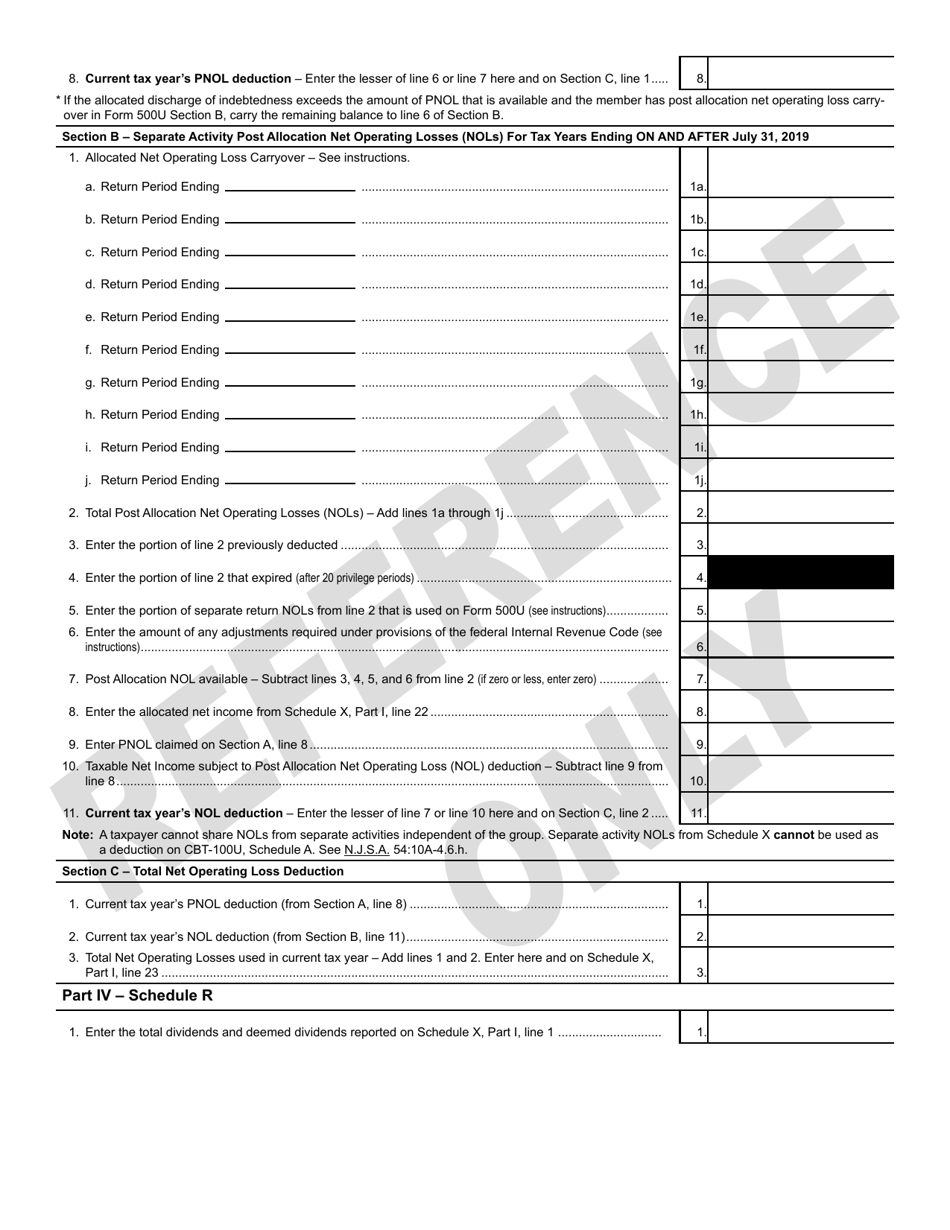

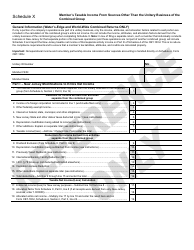

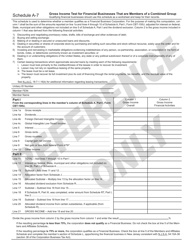

Form CBT-100U Schedule X Member's Taxable Income From Sources Other Than the Unitary Business of the Combined Group - New Jersey

What Is Form CBT-100U Schedule X?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form CBT-100U Schedule X?

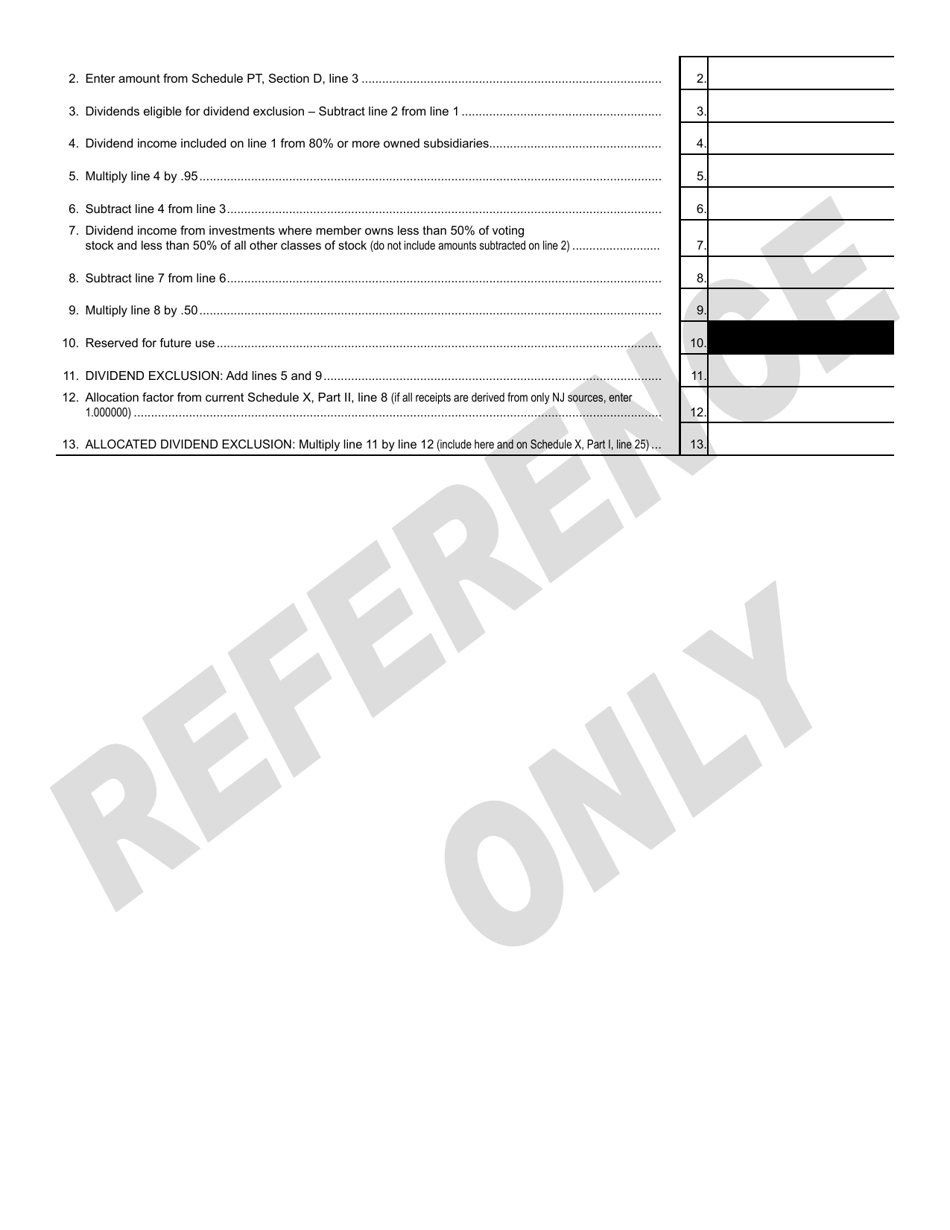

A: Form CBT-100U Schedule X is a form used in New Jersey to report a member's taxable income from sources other than the unitary business of the combined group.

Q: When is Form CBT-100U Schedule X used?

A: Form CBT-100U Schedule X is used when a member of a combined group in New Jersey has taxable income from sources other than the unitary business.

Q: What information is reported on Form CBT-100U Schedule X?

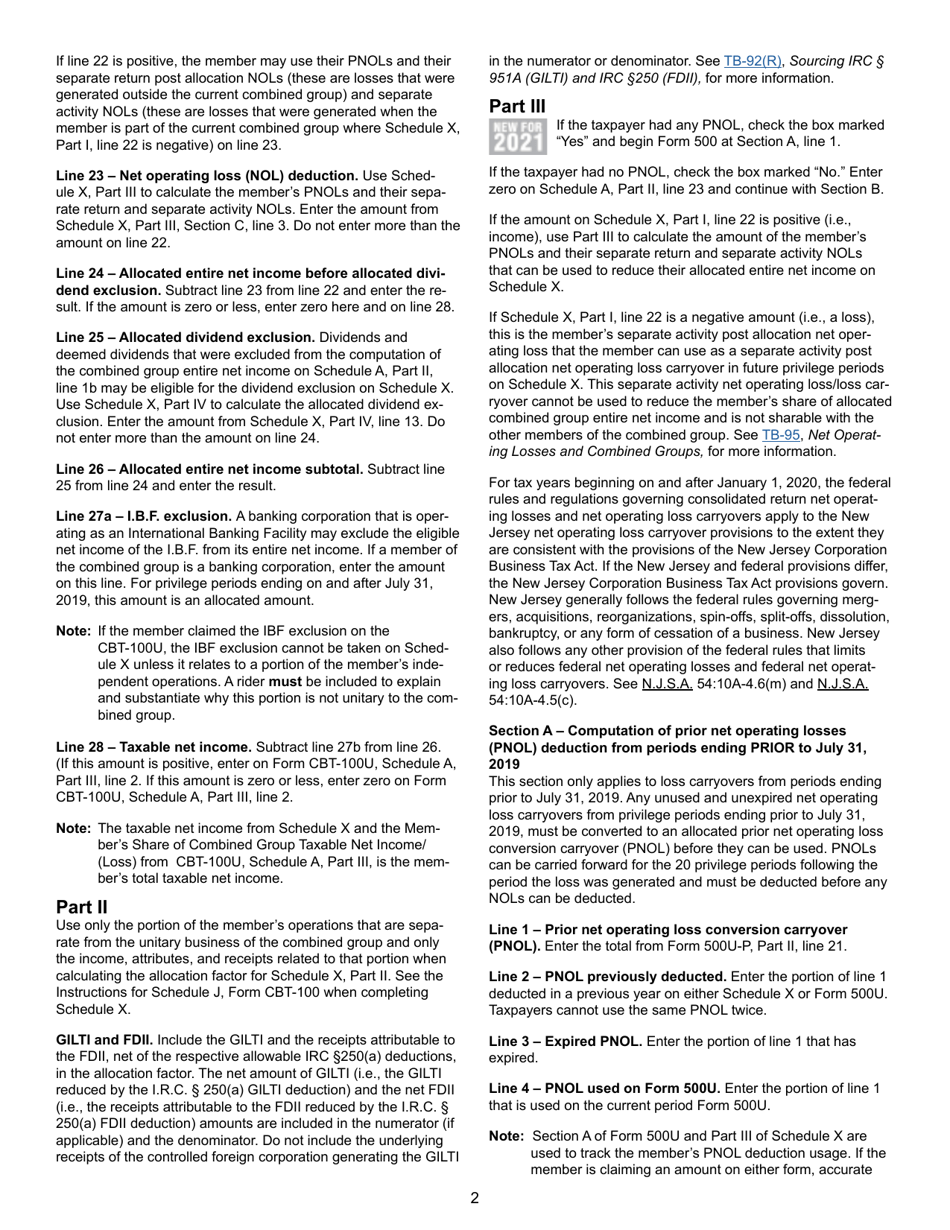

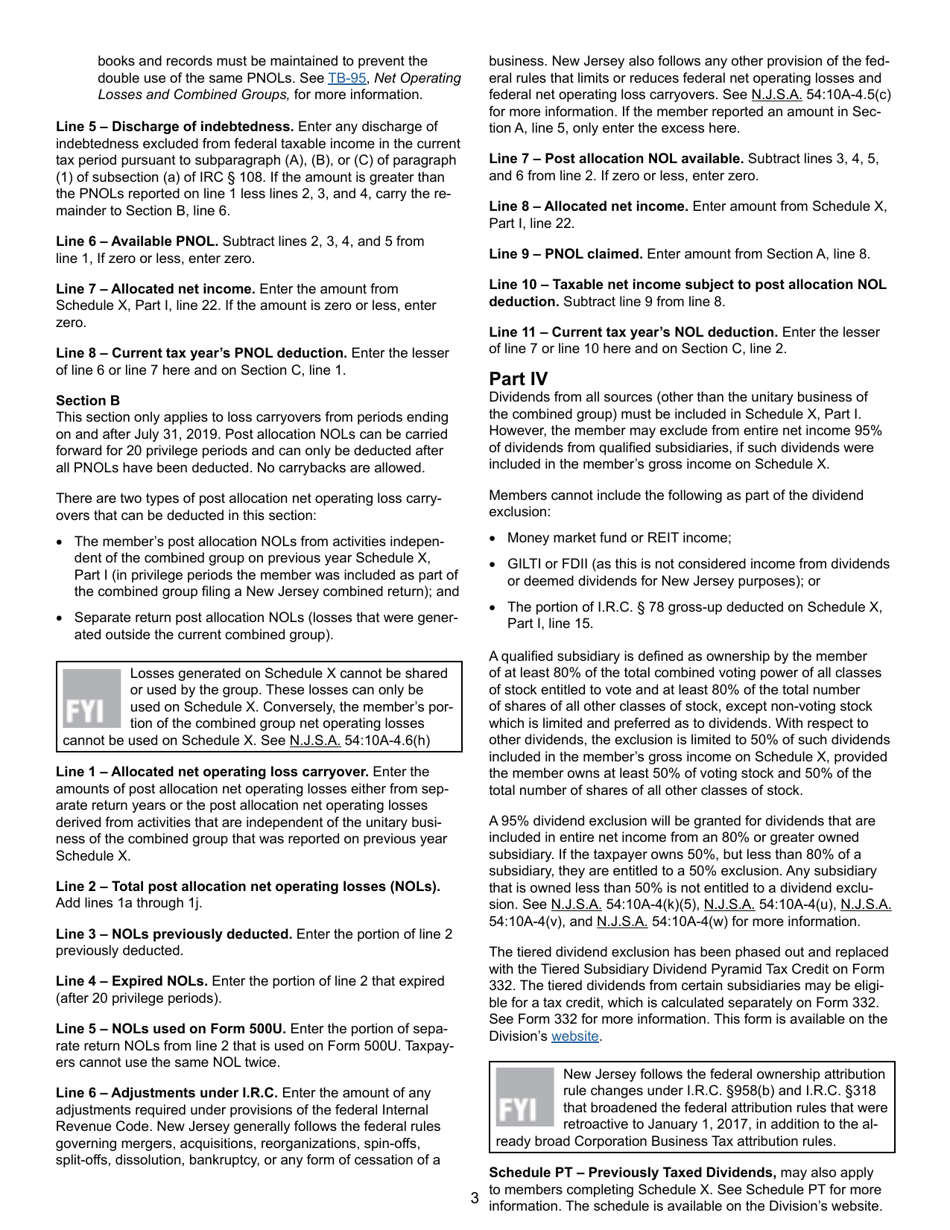

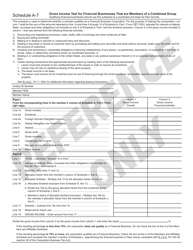

A: Form CBT-100U Schedule X is used to report details of taxable income earned by a member of a combined group in New Jersey from sources other than the unitary business, including specific adjustments and deductions.

Q: Do I need to file Form CBT-100U Schedule X?

A: You need to file Form CBT-100U Schedule X if you are a member of a combined group in New Jersey and have taxable income from sources other than the unitary business.

Q: What should I do if I have questions about Form CBT-100U Schedule X?

A: If you have questions about Form CBT-100U Schedule X, it is recommended to consult with a tax professional or contact the New Jersey Division of Taxation for assistance.

Form Details:

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CBT-100U Schedule X by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.