This version of the form is not currently in use and is provided for reference only. Download this version of

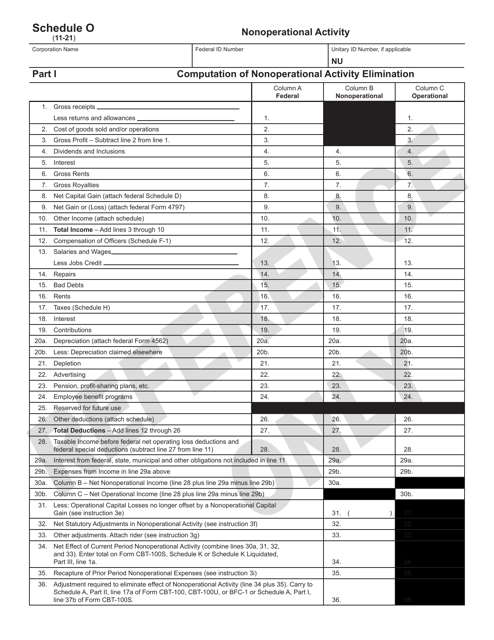

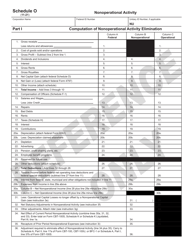

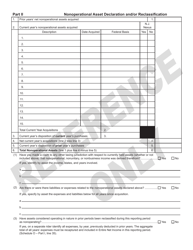

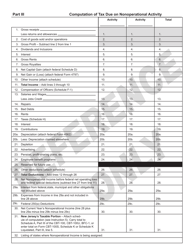

Schedule O

for the current year.

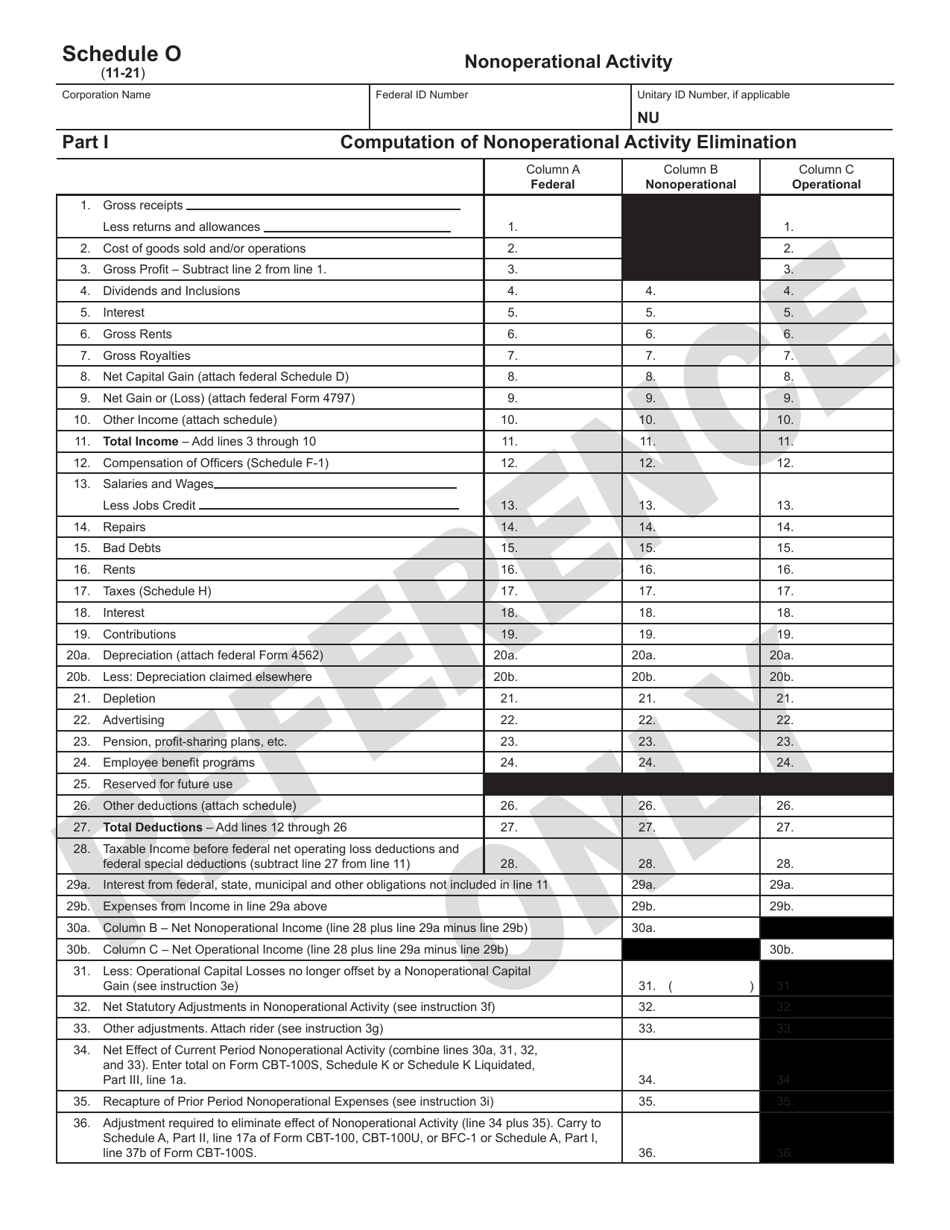

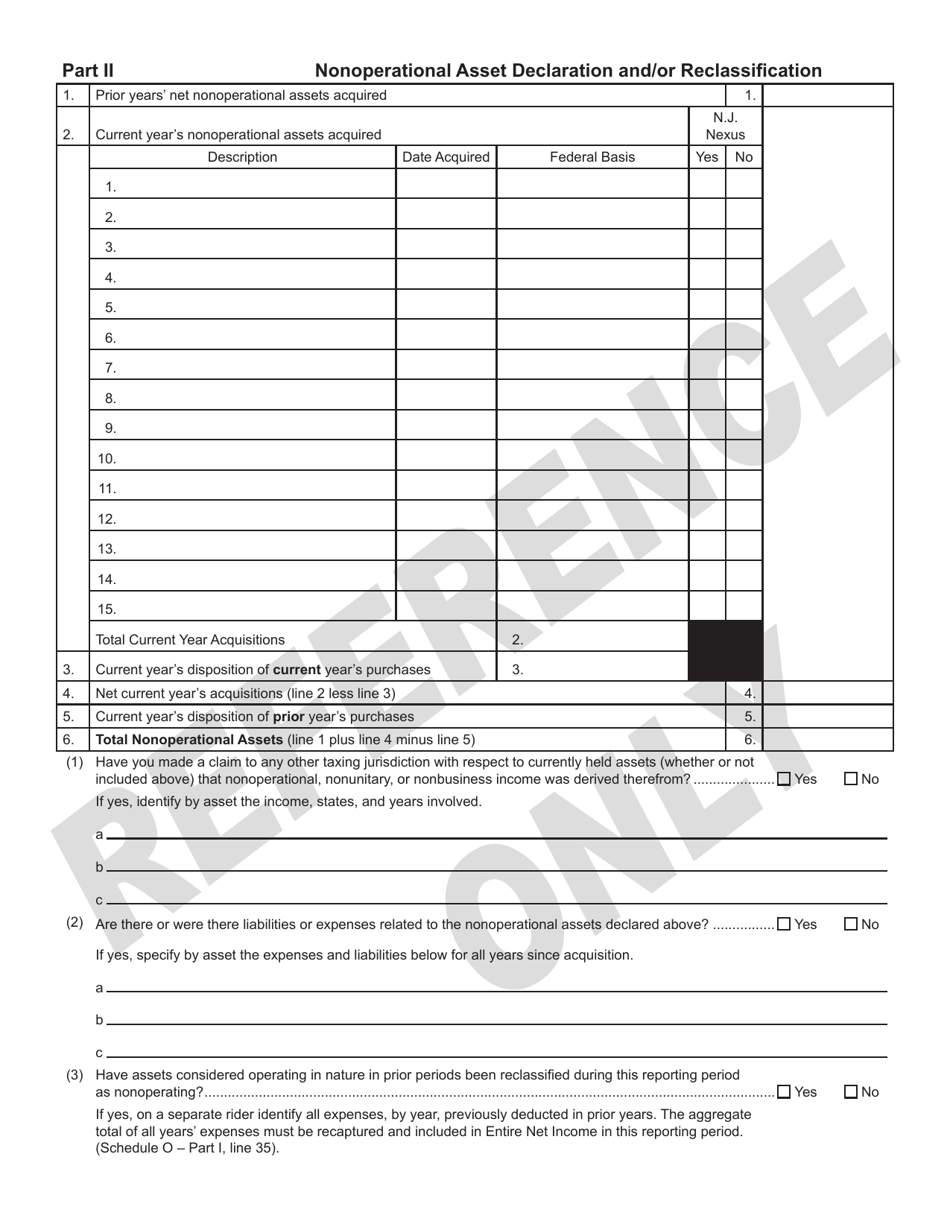

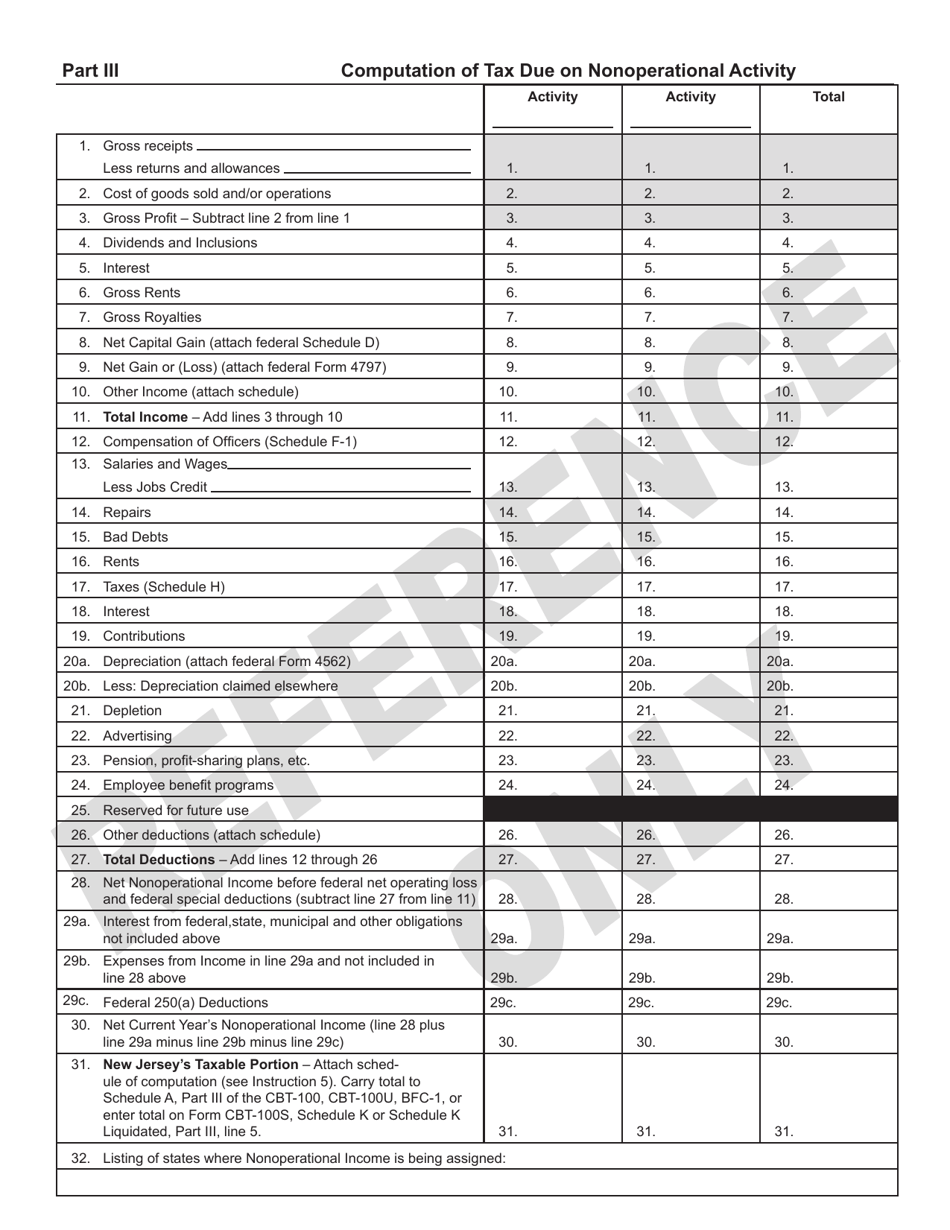

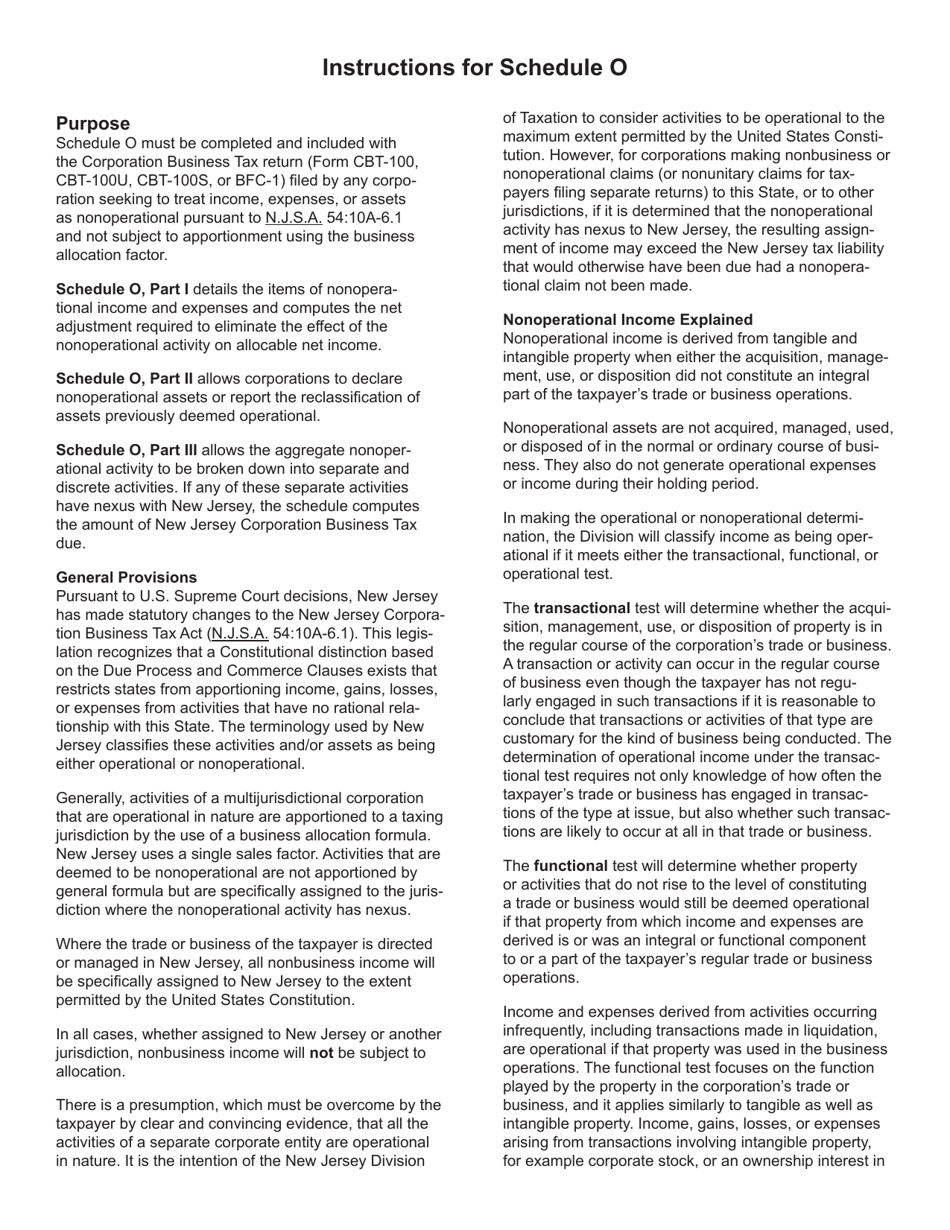

Schedule O Nonoperational Activity - New Jersey

What Is Schedule O?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Schedule O?

A: Schedule O is a form used to report nonoperational activity in New Jersey.

Q: What is nonoperational activity?

A: Nonoperational activity refers to any income or expenses that are not related to the normal operations of a business or organization.

Q: Why is Schedule O required in New Jersey?

A: Schedule O is required to accurately report all income and expenses, including nonoperational activity, for tax purposes.

Q: Who needs to file Schedule O in New Jersey?

A: Any business or organization that has nonoperational activity in New Jersey needs to file Schedule O.

Q: What type of nonoperational activity should be reported on Schedule O?

A: Examples of nonoperational activity include rental income, investment income, and non-deductible expenses.

Q: When is Schedule O due?

A: The due date for Schedule O is usually the same as the due date for the corresponding tax return.

Q: Are there any penalties for not filing Schedule O?

A: Yes, failure to file Schedule O or filing it late can result in penalties and interest charges.

Q: Do I need to include any supporting documentation with Schedule O?

A: You may be required to attach supporting documentation, such as rental income statements or investment income statements, depending on the type of nonoperational activity you are reporting.

Form Details:

- Released on November 1, 2021;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Schedule O by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.