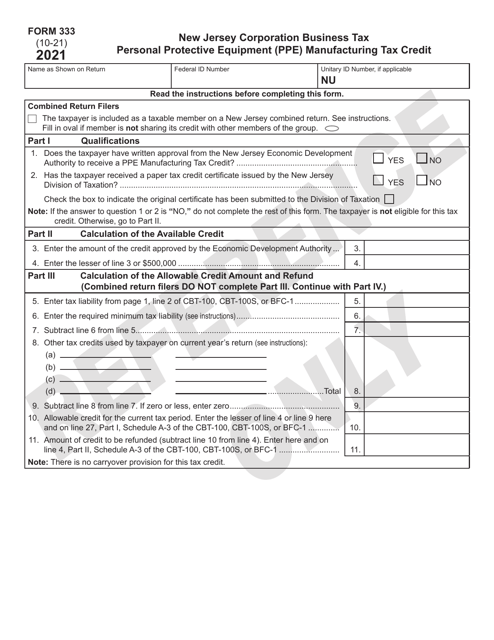

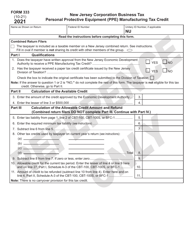

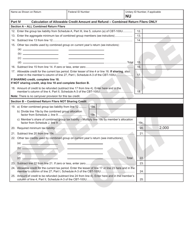

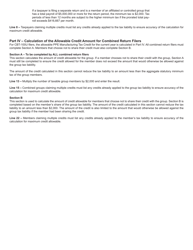

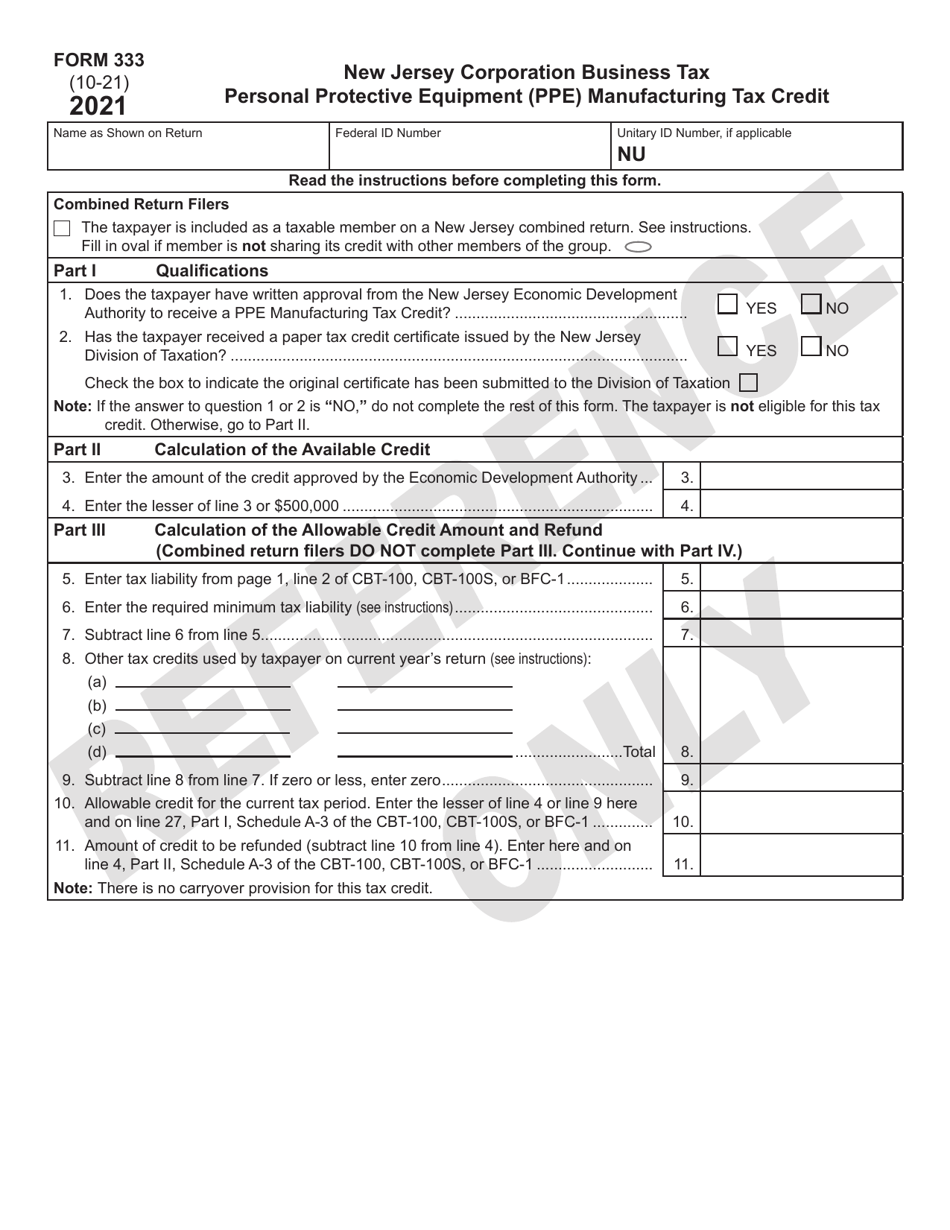

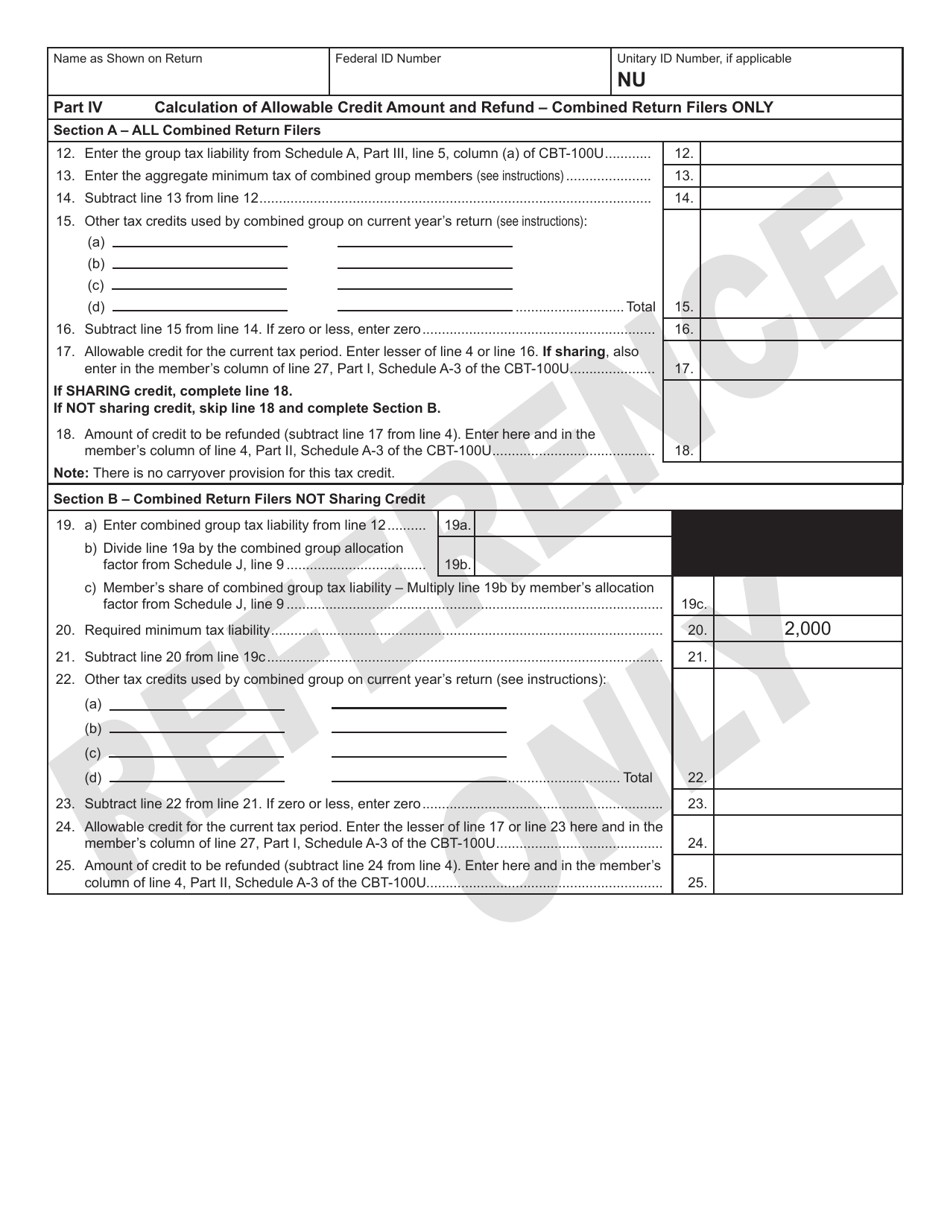

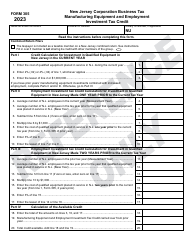

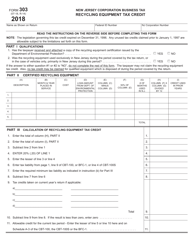

Form 333 Personal Protective Equipment (Ppe) Manufacturing Tax Credit - New Jersey

What Is Form 333?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 333?

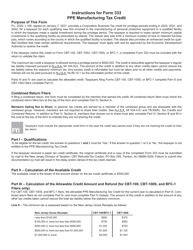

A: Form 333 is a form used for claiming the Personal Protective Equipment (PPE) Manufacturing Tax Credit in New Jersey.

Q: What is the Personal Protective Equipment (PPE) Manufacturing Tax Credit?

A: The PPE Manufacturing Tax Credit is a tax credit available to businesses in New Jersey that manufacture PPE.

Q: Who is eligible to claim the PPE Manufacturing Tax Credit?

A: Businesses in New Jersey that manufacture PPE are eligible to claim the tax credit.

Q: What is the purpose of the PPE Manufacturing Tax Credit?

A: The purpose of the tax credit is to incentivize and support the production of PPE in New Jersey.

Q: How do I claim the PPE Manufacturing Tax Credit?

A: To claim the tax credit, businesses need to complete and submit Form 333 to the New Jersey Division of Taxation.

Q: Are there any specific requirements for claiming the PPE Manufacturing Tax Credit?

A: Yes, businesses need to meet certain criteria, such as being registered with the Division of Revenue and Enterprise Services and meeting production and employment requirements.

Q: Is there a deadline for filing Form 333?

A: Yes, the deadline for filing Form 333 is specified by the New Jersey Division of Taxation.

Form Details:

- Released on October 1, 2021;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 333 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.