This version of the form is not currently in use and is provided for reference only. Download this version of

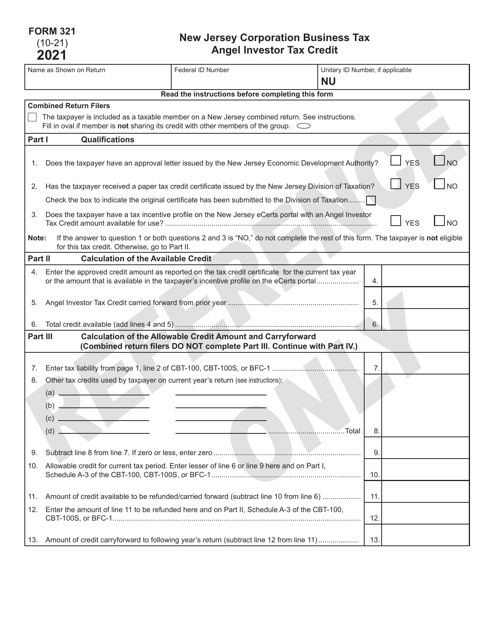

Form 321

for the current year.

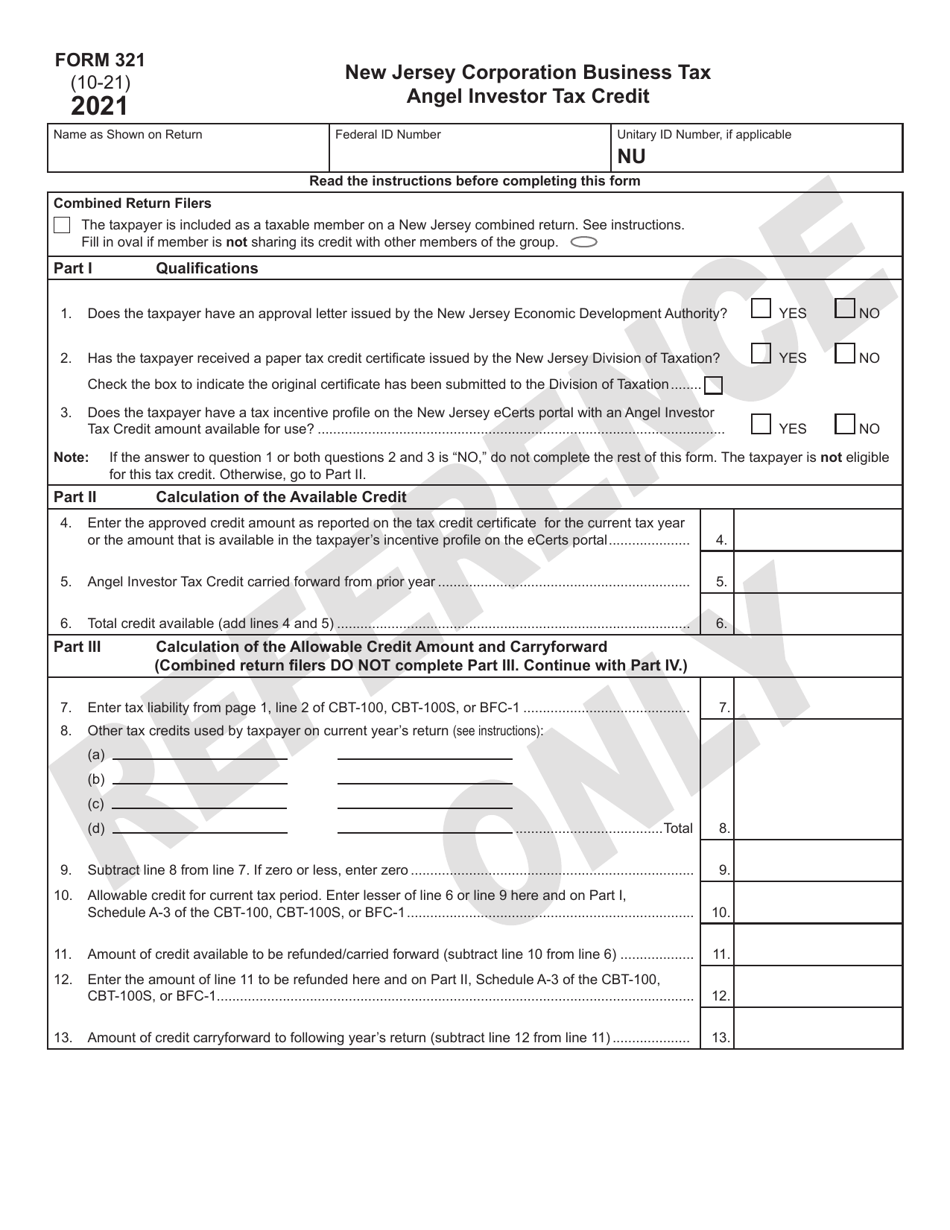

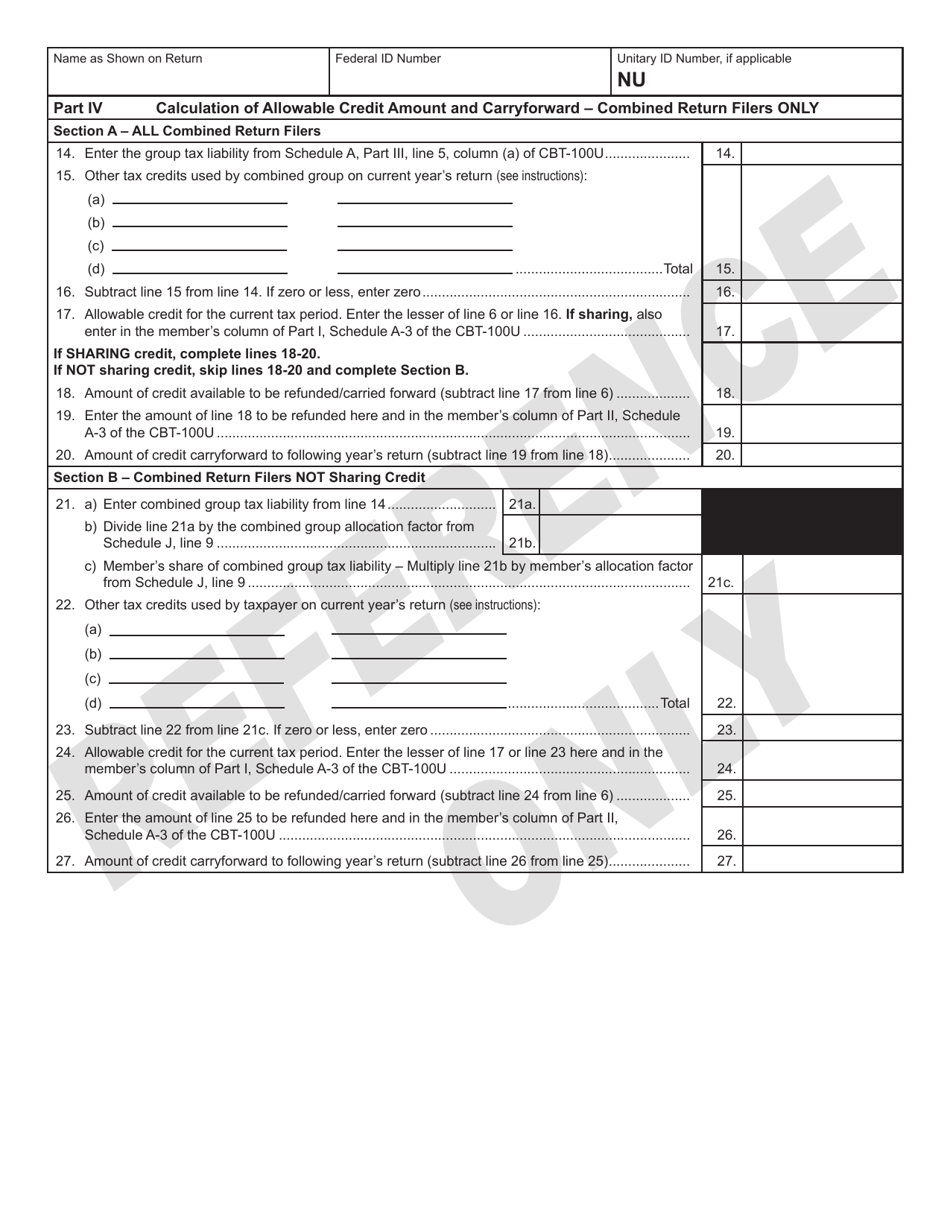

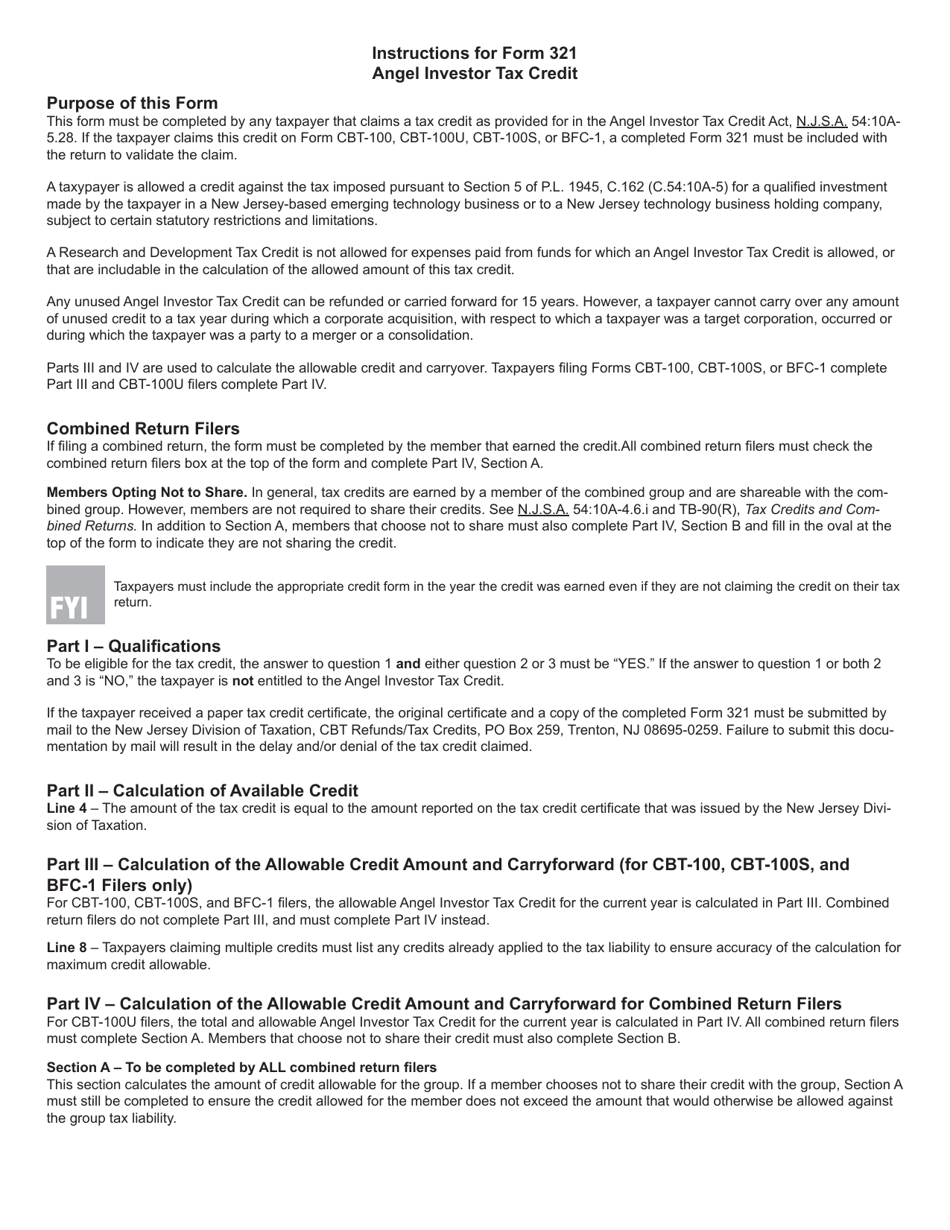

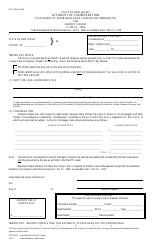

Form 321 Angel Investor Tax Credit - New Jersey

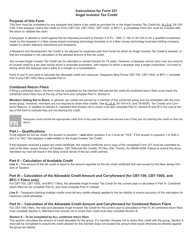

What Is Form 321?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 321 Angel Investor Tax Credit?

A: Form 321 Angel Investor Tax Credit is a tax credit program in New Jersey that aims to encourage investments in technology and life science businesses.

Q: Who is eligible to claim the Form 321 Angel Investor Tax Credit?

A: Individual and corporate taxpayers who make qualified investments in eligible businesses in New Jersey can claim the tax credit.

Q: What is the benefit of claiming Form 321 Angel Investor Tax Credit?

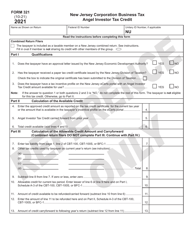

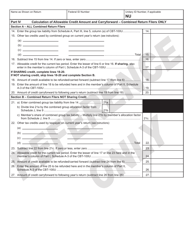

A: By claiming Form 321 Angel Investor Tax Credit, taxpayers can receive a tax credit equal to 10% of their qualified investments in eligible businesses.

Q: What are the requirements for businesses to be eligible for the Form 321 Angel Investor Tax Credit?

A: To be eligible, businesses must be engaged in technology or life sciences industry, have fewer than 225 employees, and be certified by the New Jersey Economic Development Authority.

Q: Is there a limit to the amount of tax credit that can be claimed?

A: No, there is no limit to the amount of tax credit that can be claimed. However, the total amount of tax credits issued in a fiscal year is subject to a cap set by the New Jersey Economic Development Authority.

Q: How can taxpayers claim the Form 321 Angel Investor Tax Credit?

A: Taxpayers must complete and submit Form 321 along with their New Jersey state tax return to claim the tax credit.

Q: Are there any deadlines for claiming the Form 321 Angel Investor Tax Credit?

A: Yes, taxpayers must claim the tax credit within three years from the end of the taxable year in which the investment was made.

Q: Is the Form 321 Angel Investor Tax Credit refundable?

A: No, the tax credit is nonrefundable. However, any unused portion of the credit can be carried forward for up to 15 years.

Form Details:

- Released on October 1, 2021;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 321 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.