This version of the form is not currently in use and is provided for reference only. Download this version of

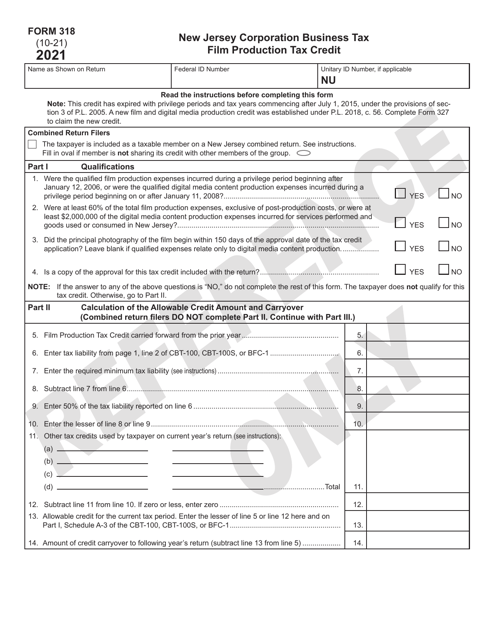

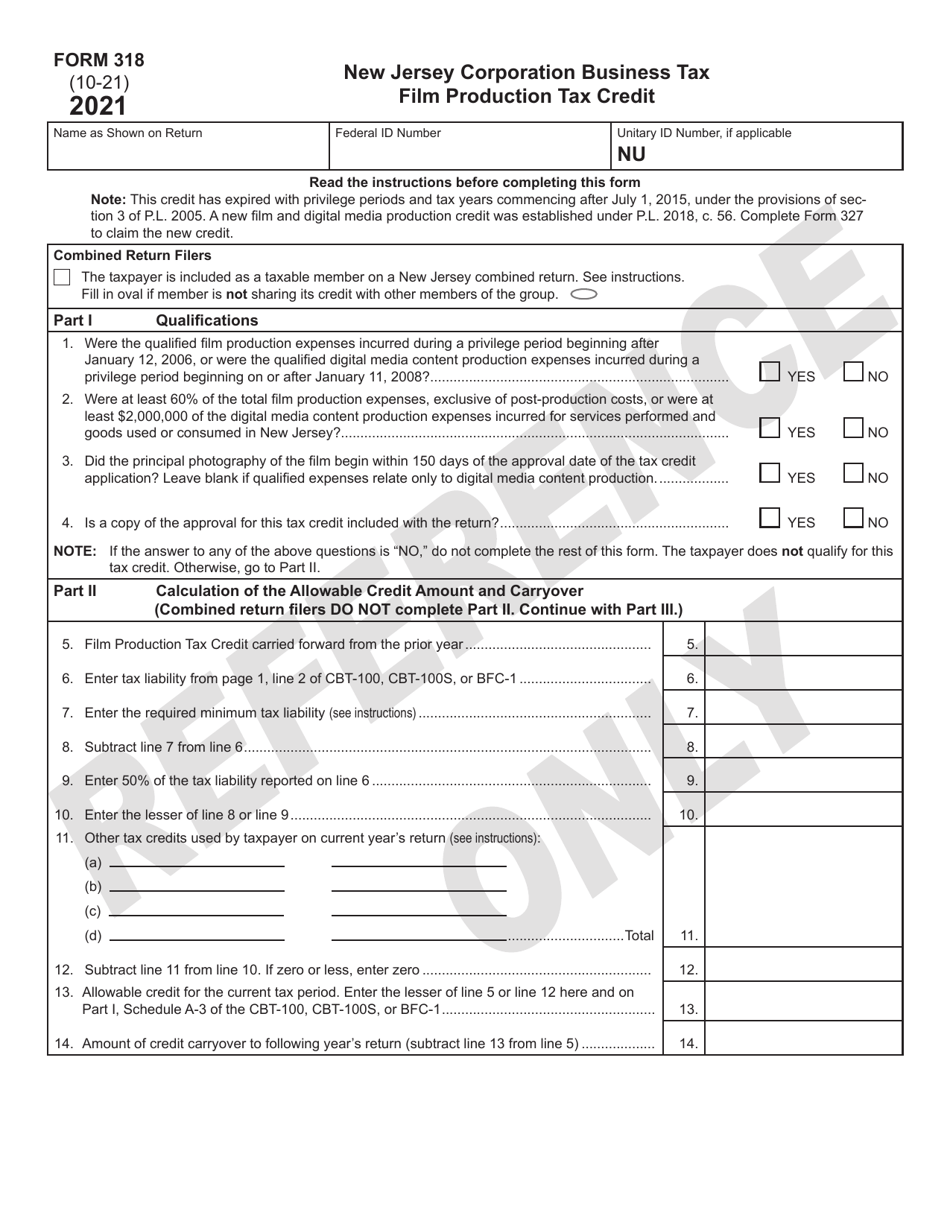

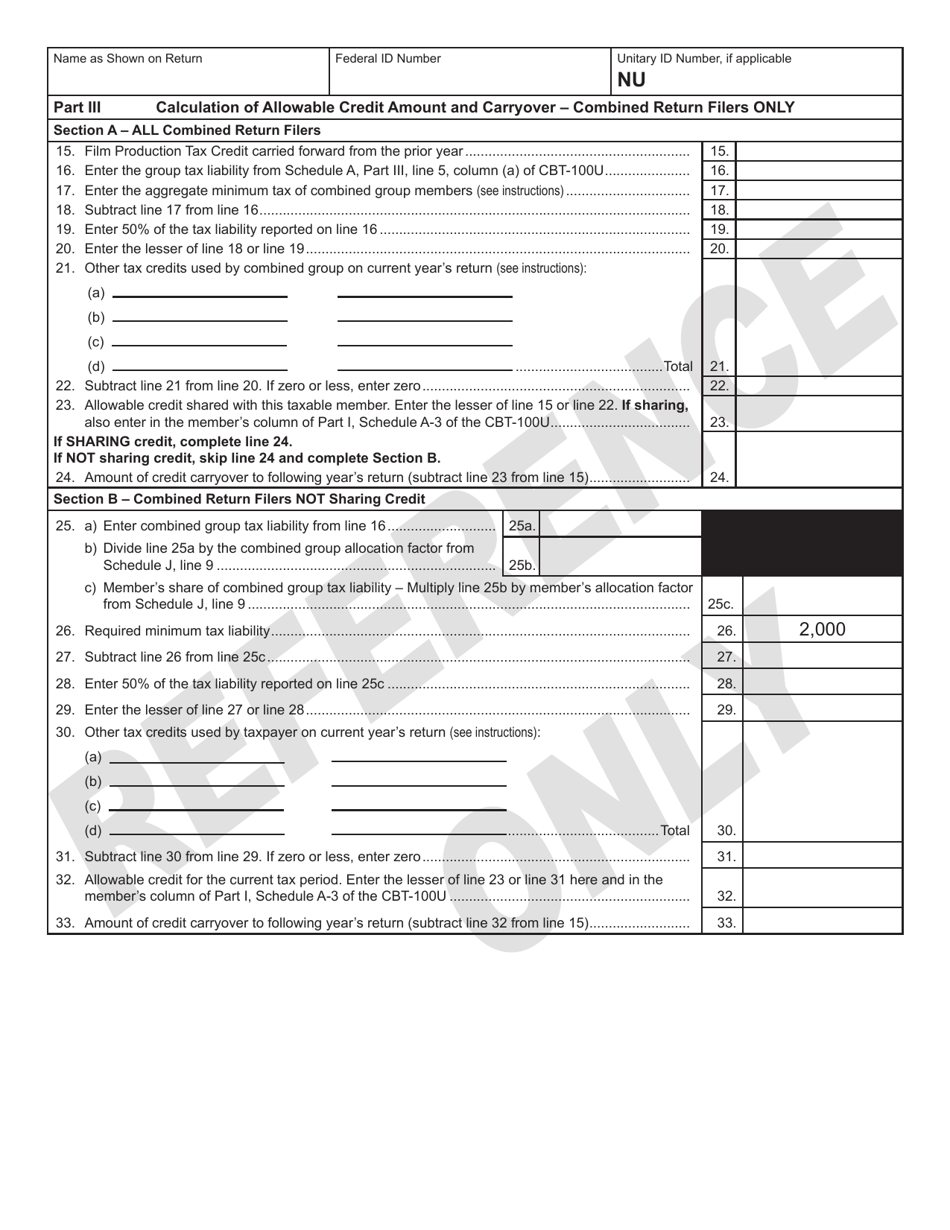

Form 318

for the current year.

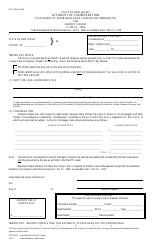

Form 318 Film Production Tax Credit - New Jersey

What Is Form 318?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

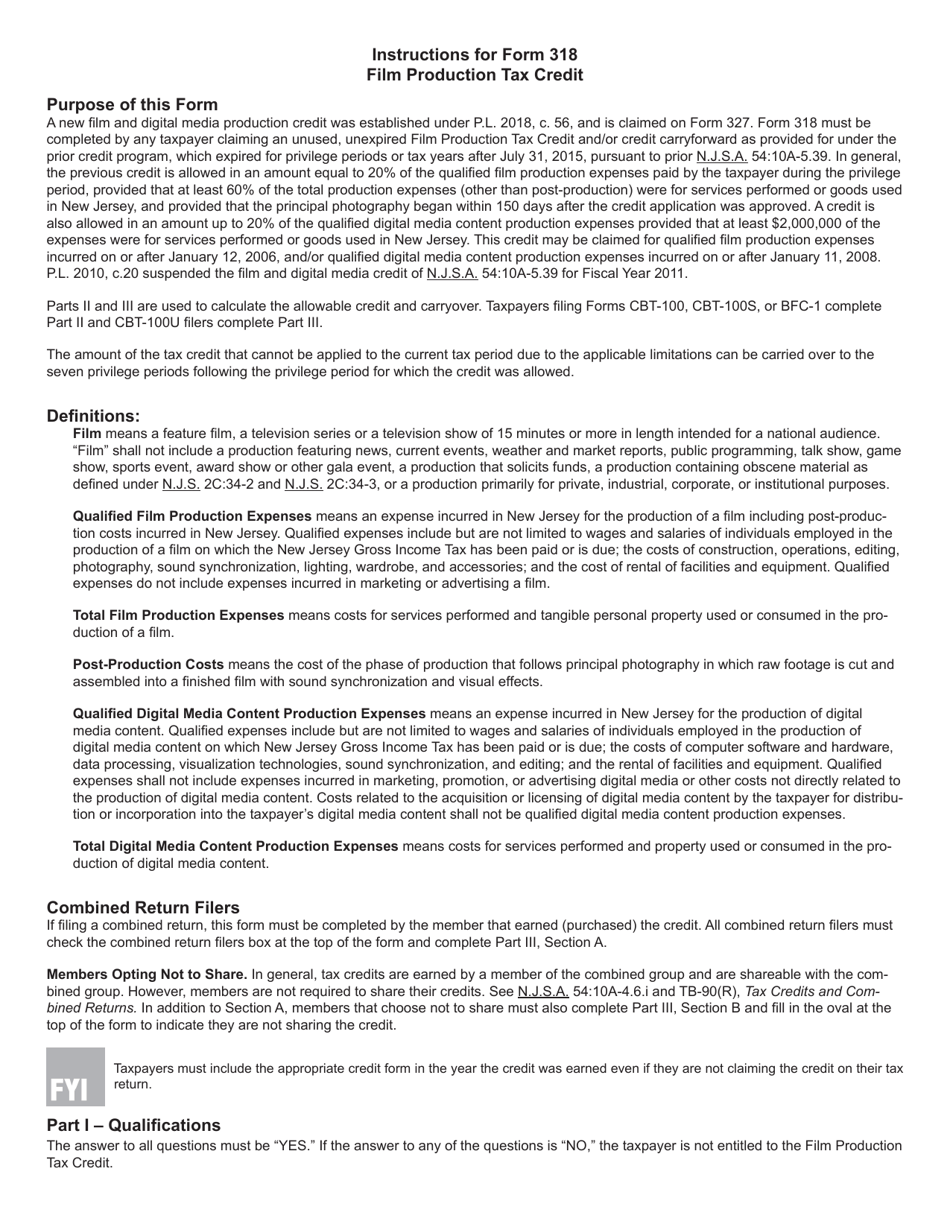

Q: What is Form 318 Film Production Tax Credit?

A: Form 318 Film Production Tax Credit is a tax credit program in the state of New Jersey that provides financial incentives to qualifying film productions.

Q: Who is eligible to claim the Film Production Tax Credit?

A: Eligible entities include film production companies that meet certain criteria set by the New Jersey Economic Development Authority.

Q: How do I apply for the Film Production Tax Credit?

A: To apply for the Film Production Tax Credit, you need to complete and submit Form 318 to the New Jersey Economic Development Authority.

Q: What expenses are eligible for the tax credit?

A: Eligible expenses include qualified film production expenses incurred in New Jersey, such as payroll, goods and services purchased from New Jersey vendors, and certain other costs.

Q: What is the maximum amount of tax credit that can be claimed?

A: The maximum amount of tax credit that can be claimed is 35% of eligible expenses incurred in New Jersey.

Q: Are there any limitations on the tax credit?

A: Yes, there are certain limitations on the tax credit, including a cap on the total amount of credits that can be issued each year and a minimum spending requirement.

Q: How can the tax credit be used?

A: The tax credit can be used to offset the corporation business tax liability or sold or transferred to another taxpayer.

Q: Is there a deadline for submitting the application?

A: Yes, there is a deadline for submitting the application, which is usually specified by the New Jersey Economic Development Authority.

Form Details:

- Released on October 1, 2021;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 318 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.