This version of the form is not currently in use and is provided for reference only. Download this version of

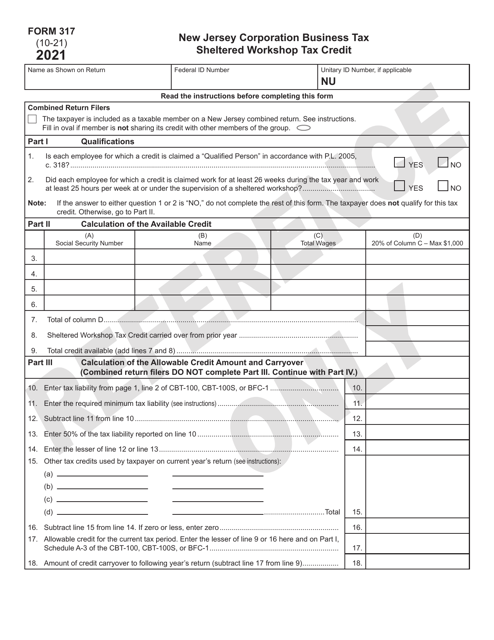

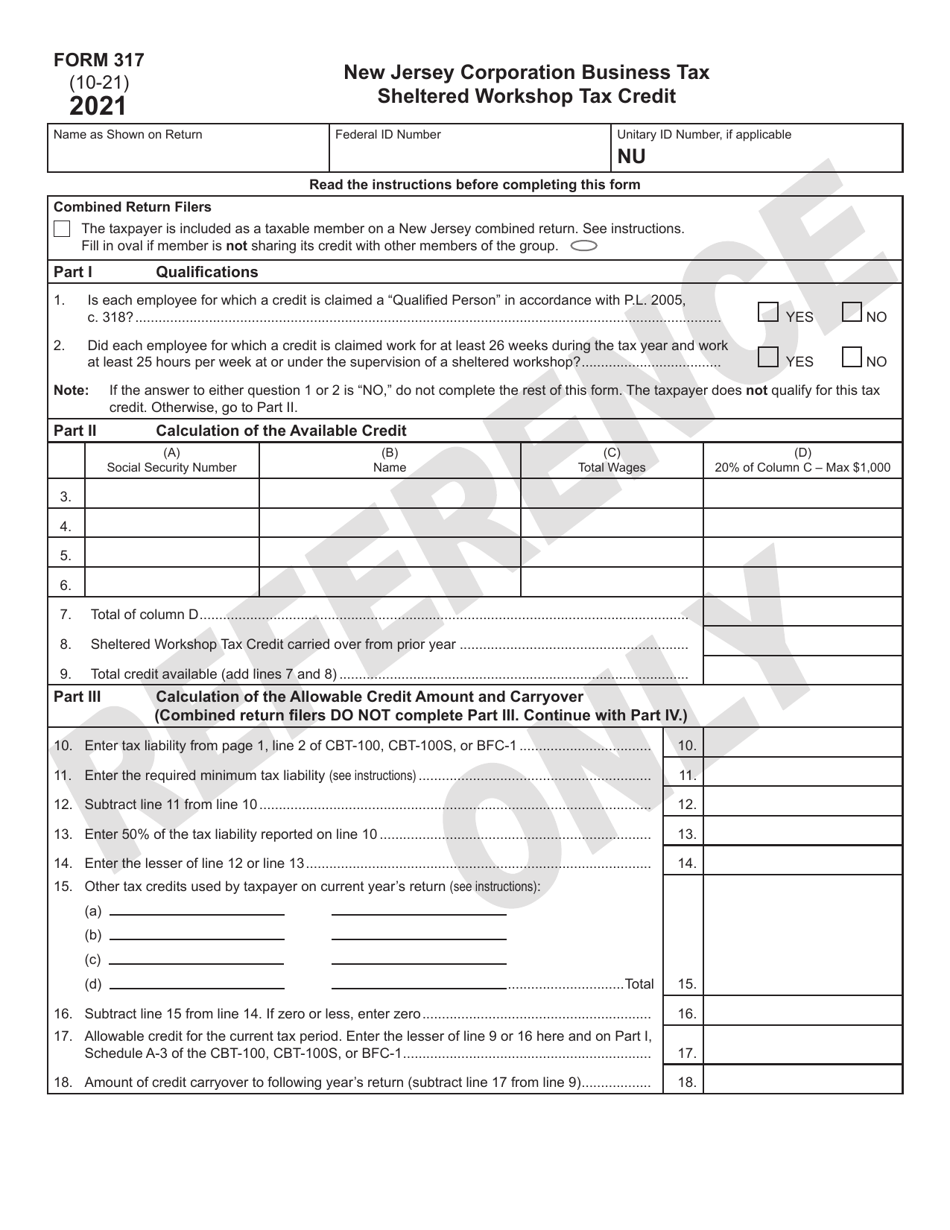

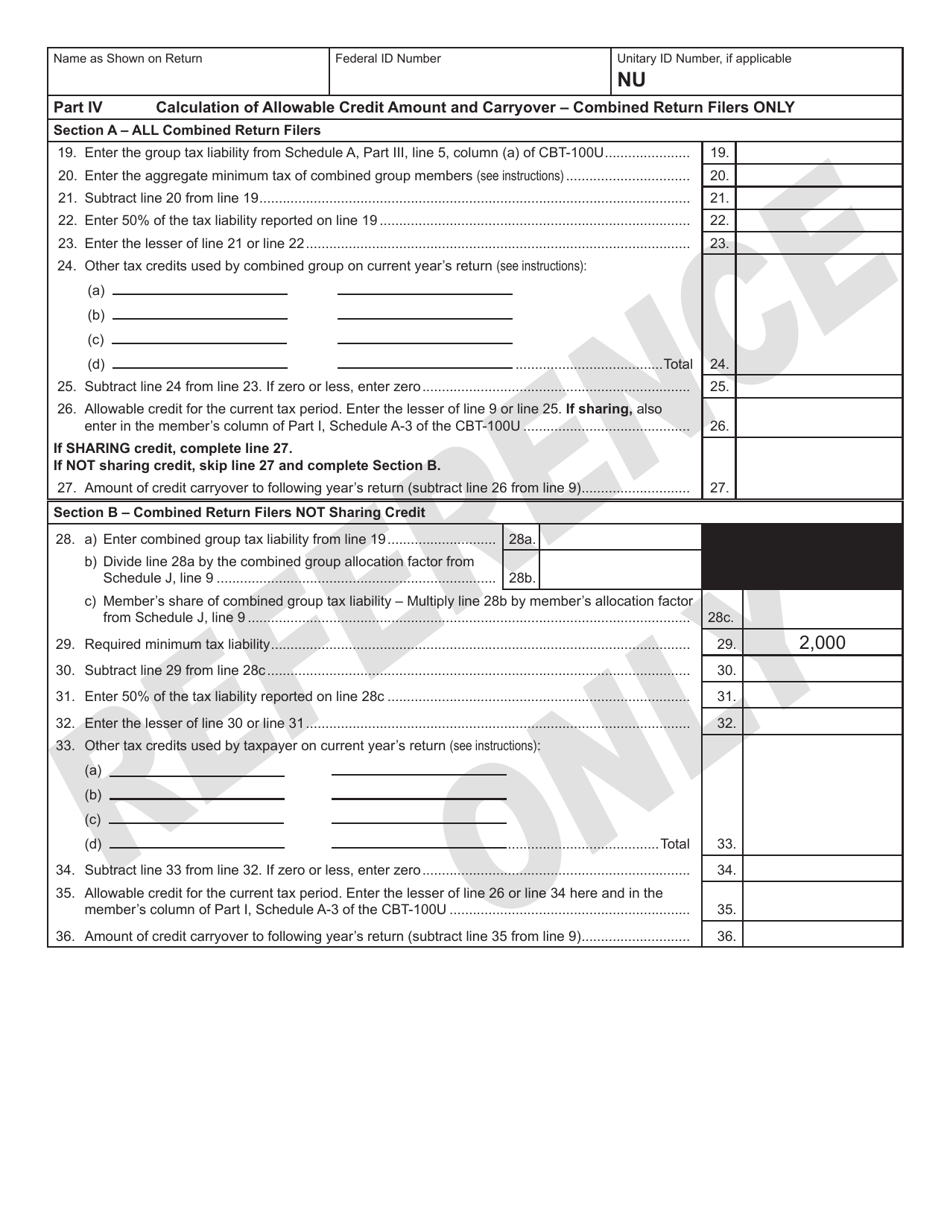

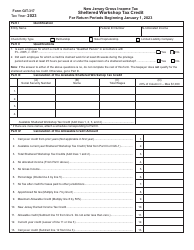

Form 317

for the current year.

Form 317 Sheltered Workshop Tax Credit - New Jersey

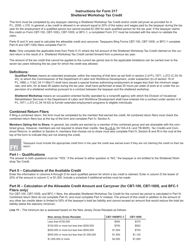

What Is Form 317?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

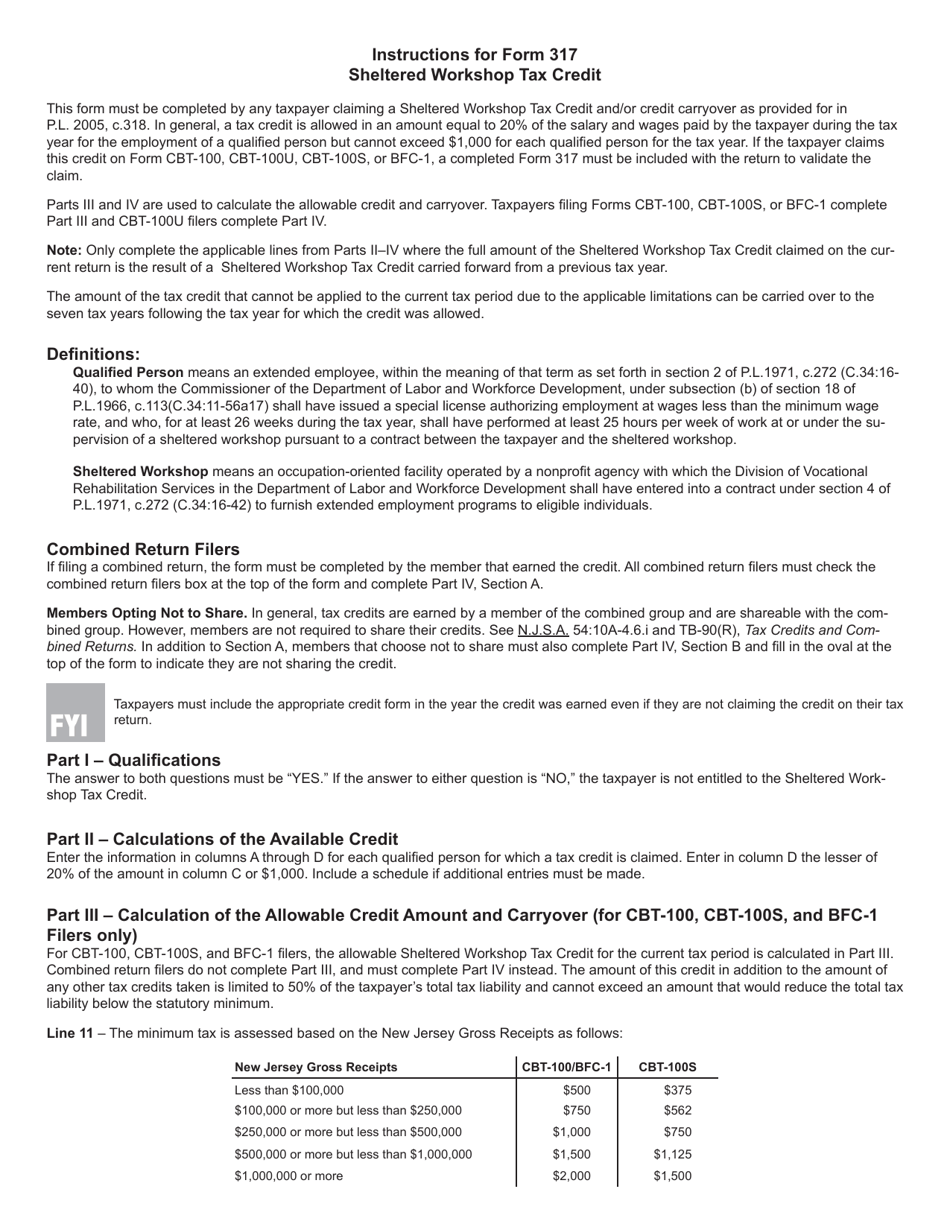

Q: What is Form 317 Sheltered Workshop Tax Credit?

A: Form 317 Sheltered Workshop Tax Credit is a tax credit available in New Jersey.

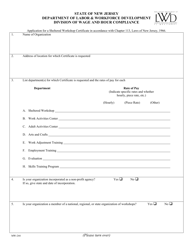

Q: What is a sheltered workshop?

A: A sheltered workshop is a vocational program that provides employment and training opportunities for individuals with disabilities.

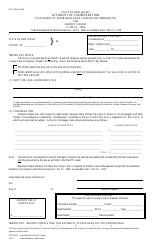

Q: Who is eligible for the Form 317 Sheltered Workshop Tax Credit?

A: Employers who employ individuals with disabilities in a sheltered workshop in New Jersey are eligible for the tax credit.

Q: What is the purpose of the tax credit?

A: The tax credit encourages employers to hire and retain individuals with disabilities in sheltered workshops.

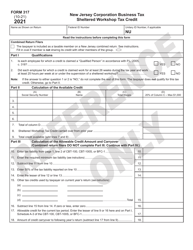

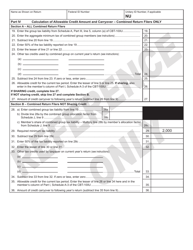

Q: How much is the tax credit?

A: The tax credit is equal to 50% of the eligible wages paid to individuals with disabilities in a sheltered workshop.

Q: What are eligible wages?

A: Eligible wages are the wages paid to individuals with disabilities in a sheltered workshop that meet certain criteria.

Q: Are there any limitations to the tax credit?

A: Yes, the tax credit is subject to certain limitations, including a maximum credit amount and a cap on the total credits that can be claimed by all employers in a given year.

Q: How can employers claim the tax credit?

A: Employers must complete and file Form 317 with the New Jersey Division of Taxation to claim the tax credit.

Q: Is there a deadline for filing Form 317?

A: Yes, Form 317 must be filed on or before the 15th day of the fourth month following the close of the tax year.

Form Details:

- Released on October 1, 2021;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 317 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.