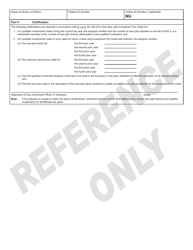

This version of the form is not currently in use and is provided for reference only. Download this version of

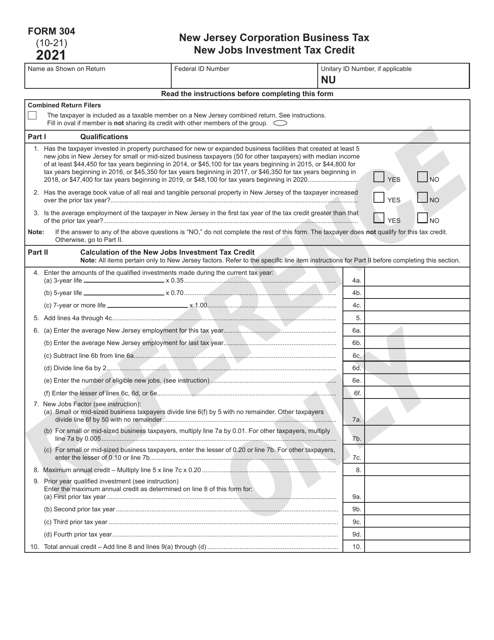

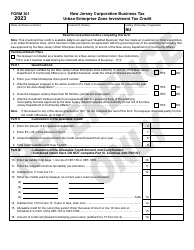

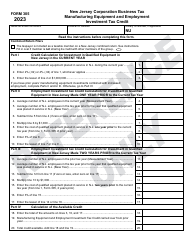

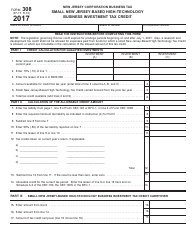

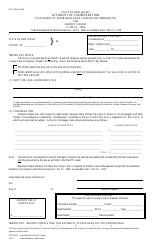

Form 304

for the current year.

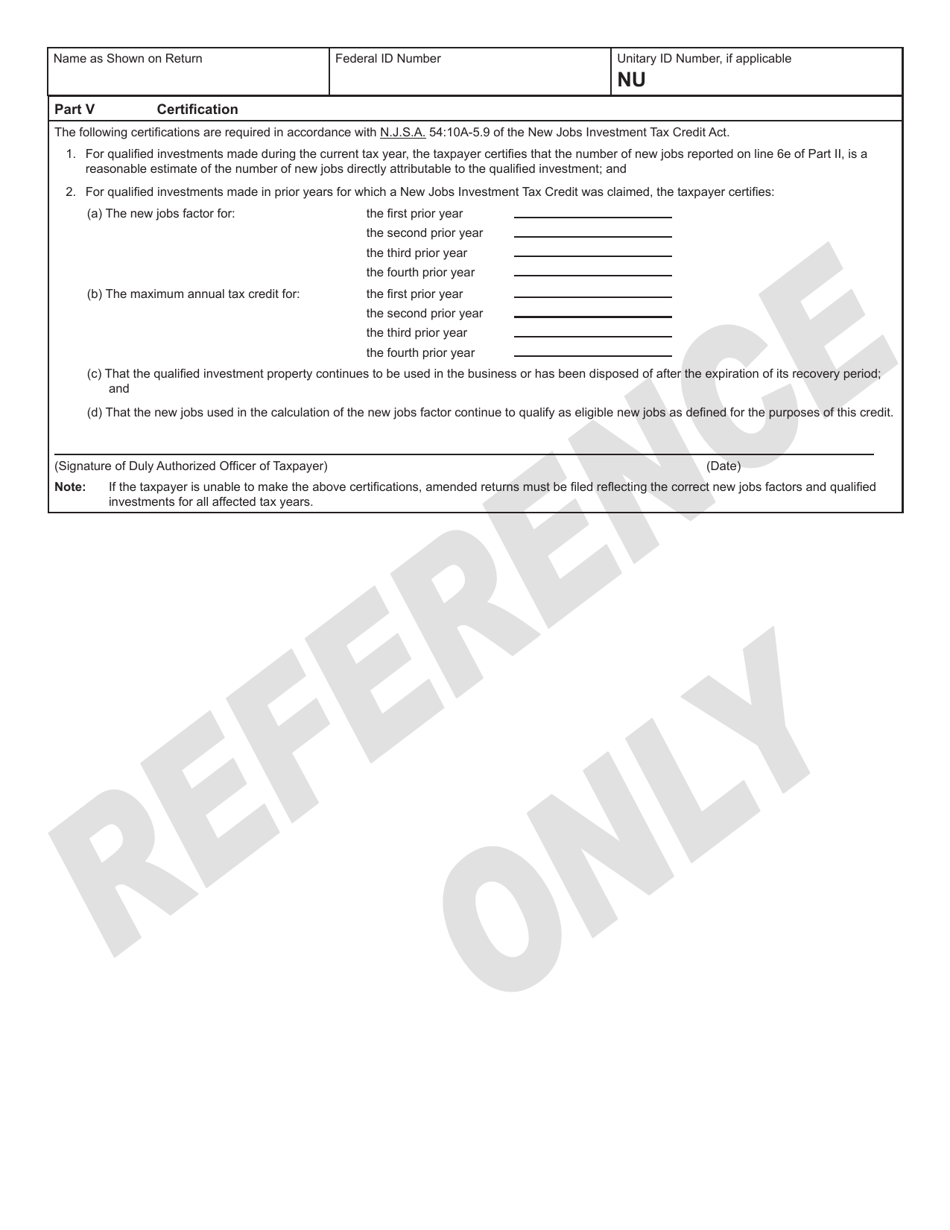

Form 304 New Jobs Investment Tax Credit - New Jersey

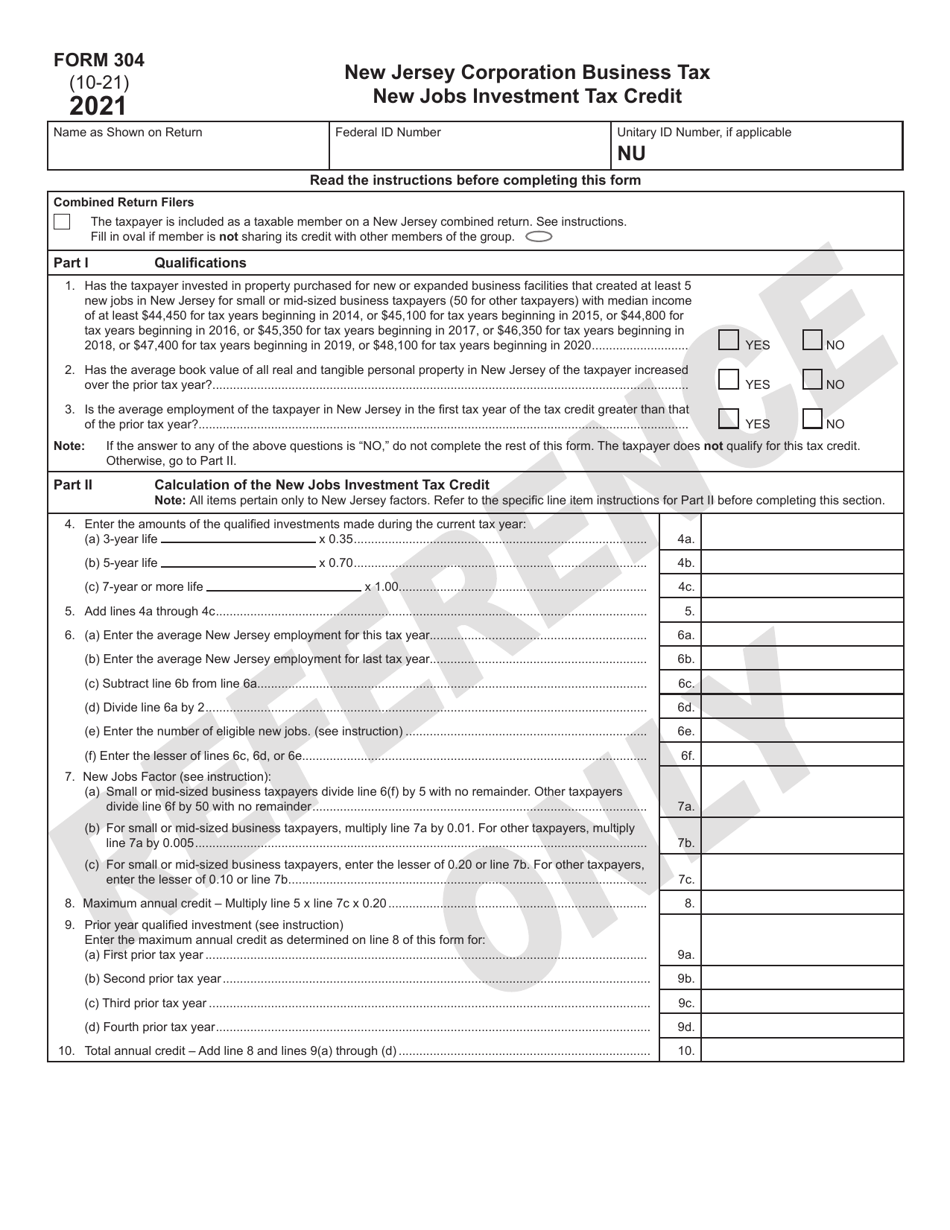

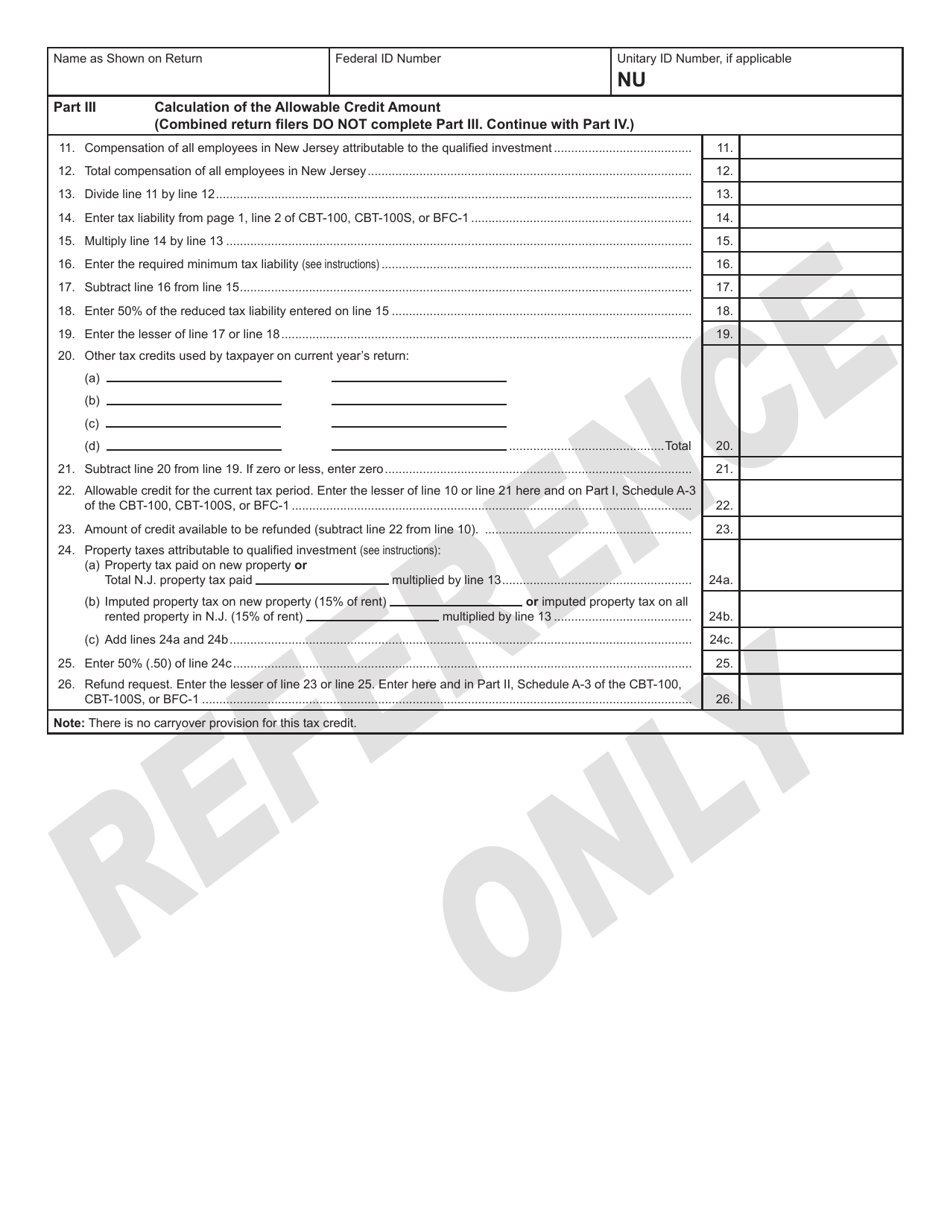

What Is Form 304?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

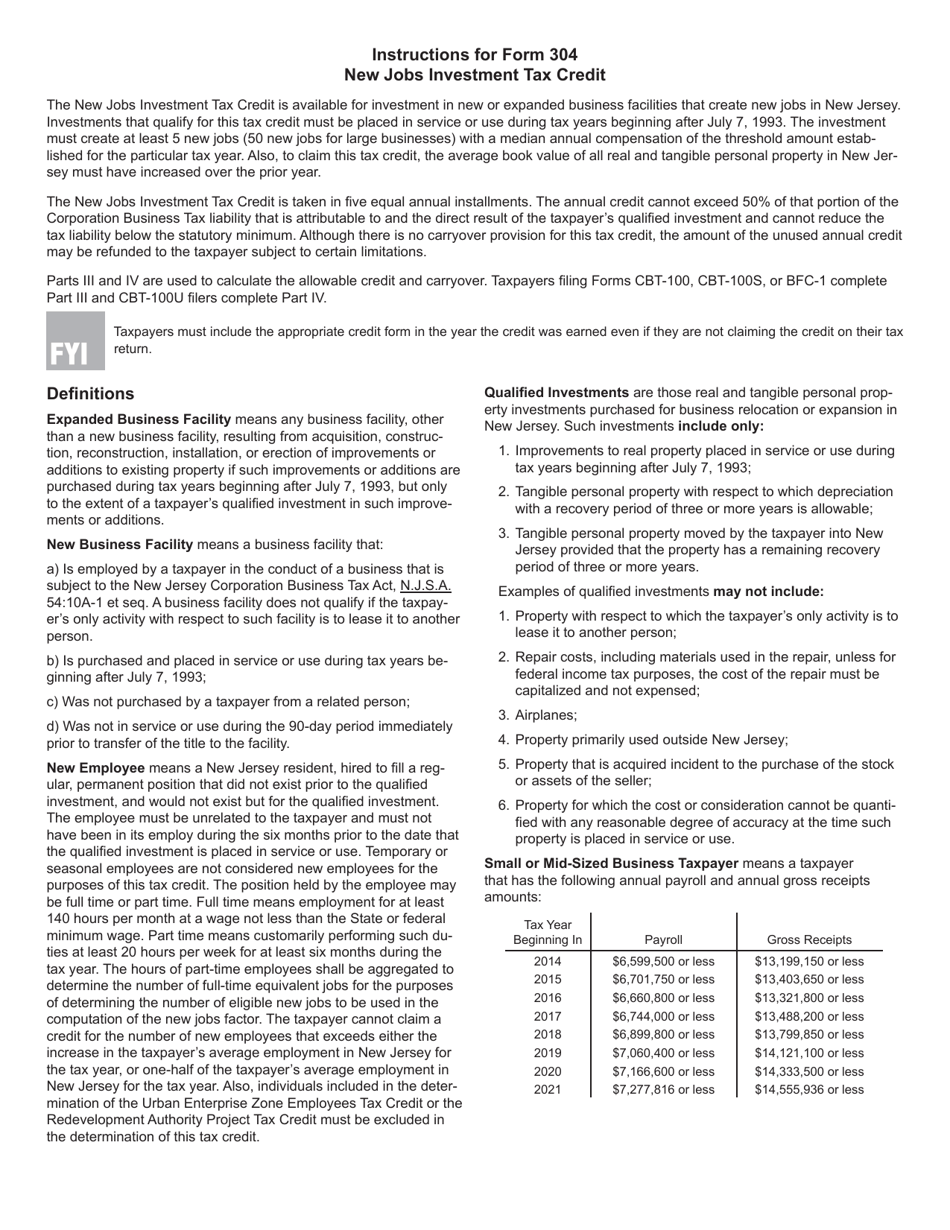

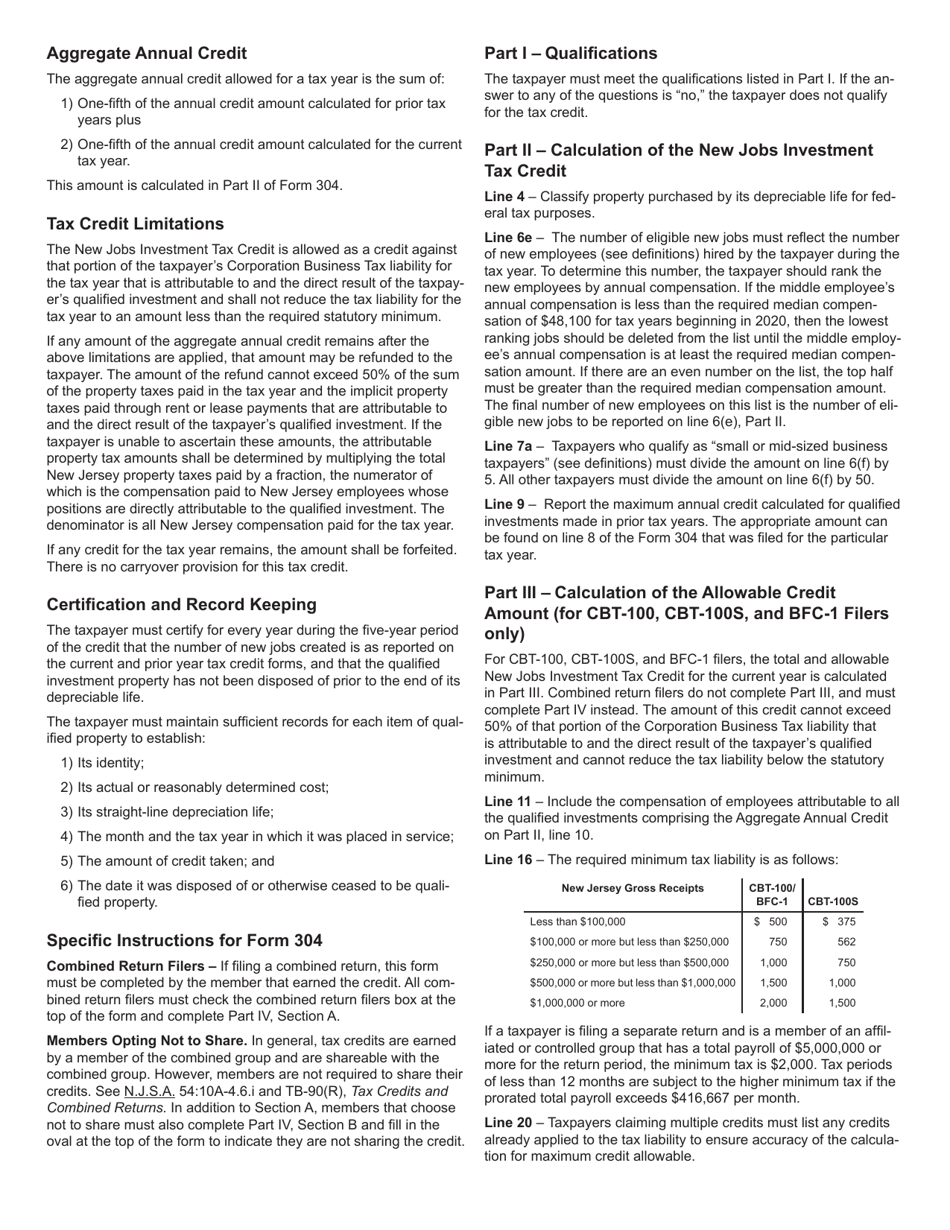

Q: What is the Form 304 New JobsInvestment Tax Credit?

A: The Form 304 New Jobs Investment Tax Credit is a tax credit program in New Jersey that provides incentives for businesses to create new jobs and make investments in certain qualifying industries.

Q: Who is eligible for the Form 304 New Jobs Investment Tax Credit?

A: Businesses that create new full-time jobs and make qualifying investments in eligible industries in New Jersey may be eligible for the Form 304 New Jobs Investment Tax Credit.

Q: What are the qualifying industries for the Form 304 New Jobs Investment Tax Credit?

A: The Form 304 New Jobs Investment Tax Credit is available for businesses in industries such as manufacturing, technology, clean energy, biotechnology, and certain other high-growth sectors.

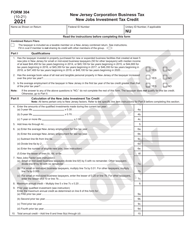

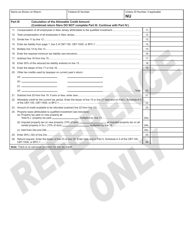

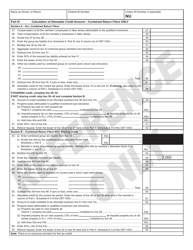

Q: How much is the tax credit offered by the Form 304 New Jobs Investment Tax Credit?

A: The amount of the tax credit offered by the Form 304 New Jobs Investment Tax Credit can vary, but it can be worth up to $5,000 per new full-time job created.

Q: How can businesses apply for the Form 304 New Jobs Investment Tax Credit?

A: Businesses can apply for the Form 304 New Jobs Investment Tax Credit by completing the appropriate forms and submitting them to the New Jersey Division of Taxation.

Q: Are there any deadlines for applying for the Form 304 New Jobs Investment Tax Credit?

A: Yes, there are deadlines for applying for the Form 304 New Jobs Investment Tax Credit. It is recommended to check with the New Jersey Division of Taxation for the most up-to-date information on deadlines.

Q: What are the benefits of the Form 304 New Jobs Investment Tax Credit?

A: The benefits of the Form 304 New Jobs Investment Tax Credit include incentives for businesses to create new jobs and make investments in qualifying industries, which can help stimulate economic growth and development in New Jersey.

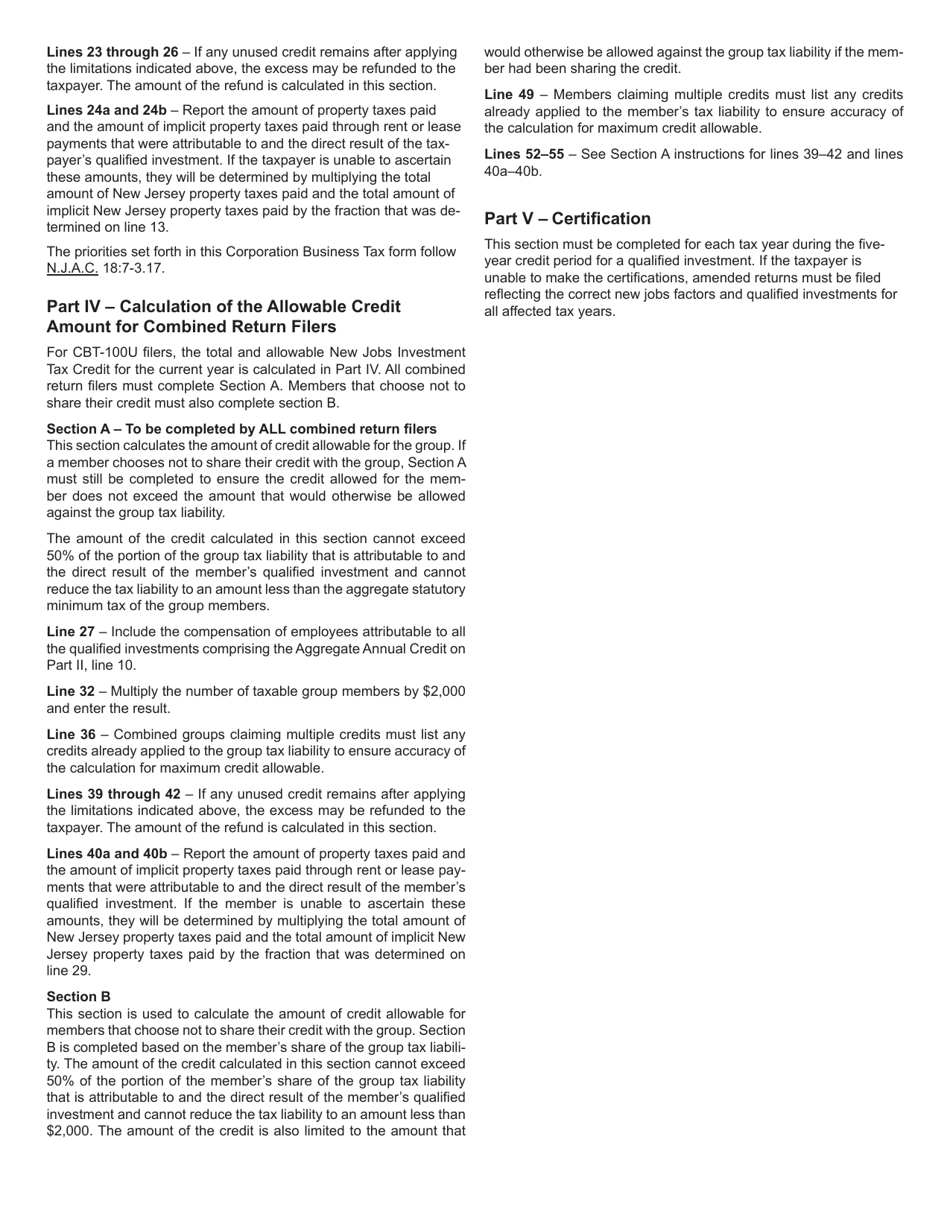

Q: Are there any limitations or restrictions for the Form 304 New Jobs Investment Tax Credit?

A: Yes, there may be limitations or restrictions for the Form 304 New Jobs Investment Tax Credit. It is recommended to review the program guidelines and consult with the New Jersey Division of Taxation for specific details.

Form Details:

- Released on October 1, 2021;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 304 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.