This version of the form is not currently in use and is provided for reference only. Download this version of

Form CBT-150

for the current year.

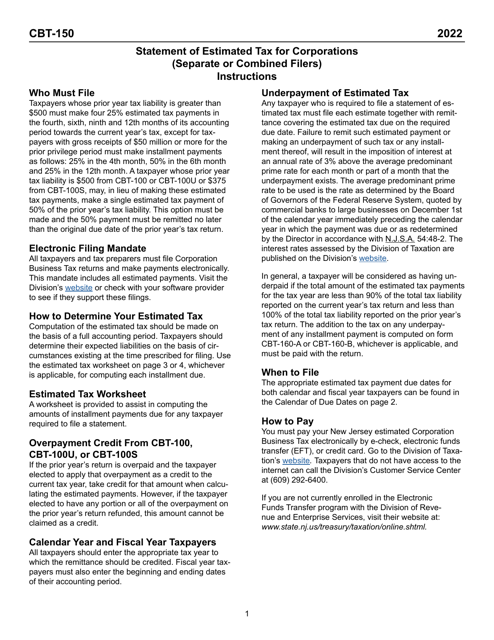

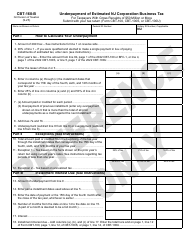

Form CBT-150 Statement of Estimated Tax for Corporations - New Jersey

What Is Form CBT-150?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

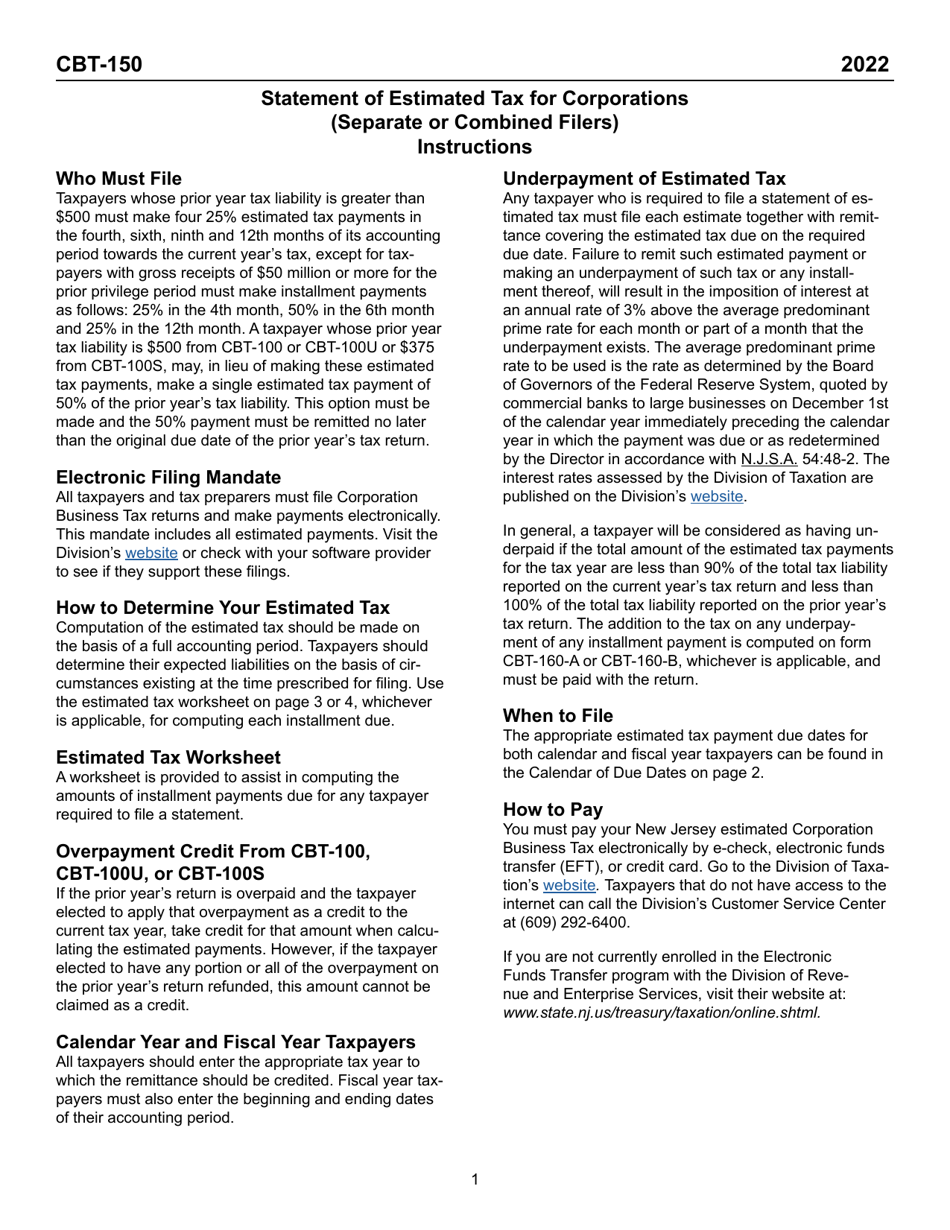

Q: What is Form CBT-150?

A: Form CBT-150 is the Statement of Estimated Tax for Corporations in New Jersey.

Q: Who needs to file Form CBT-150?

A: Corporations in New Jersey that are required to make estimated tax payments need to file Form CBT-150.

Q: What is the purpose of Form CBT-150?

A: Form CBT-150 is used to calculate and report estimated tax payments for corporations in New Jersey.

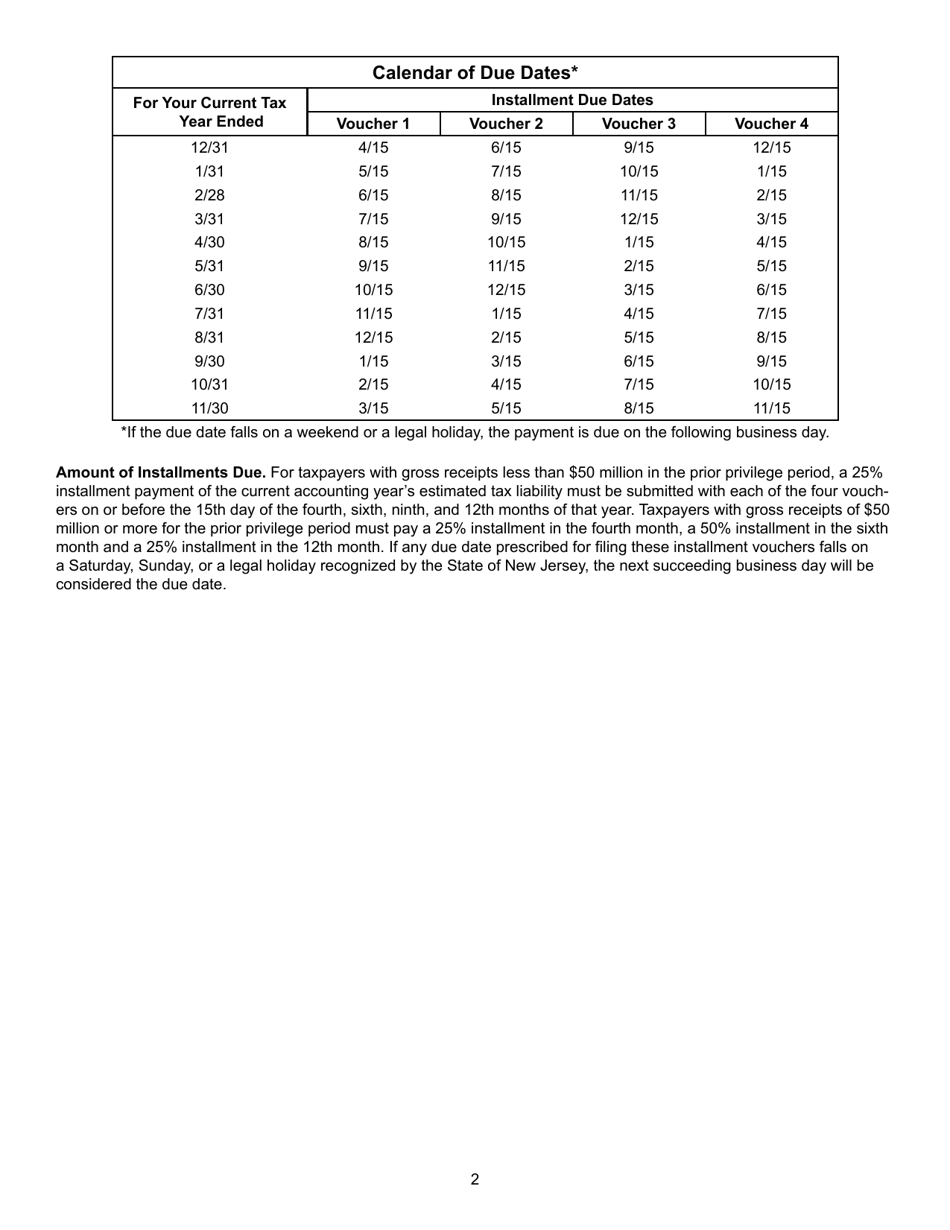

Q: When is Form CBT-150 due?

A: Form CBT-150 is due on or before the 15th day of the third month following the close of the corporation's taxable year.

Q: Are there any penalties for not filing Form CBT-150?

A: Yes, failure to file Form CBT-150 or pay estimated tax when due may result in penalties and interest.

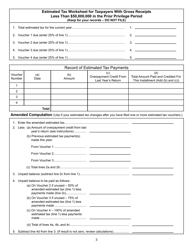

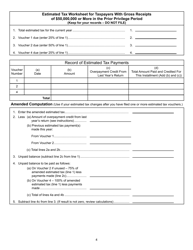

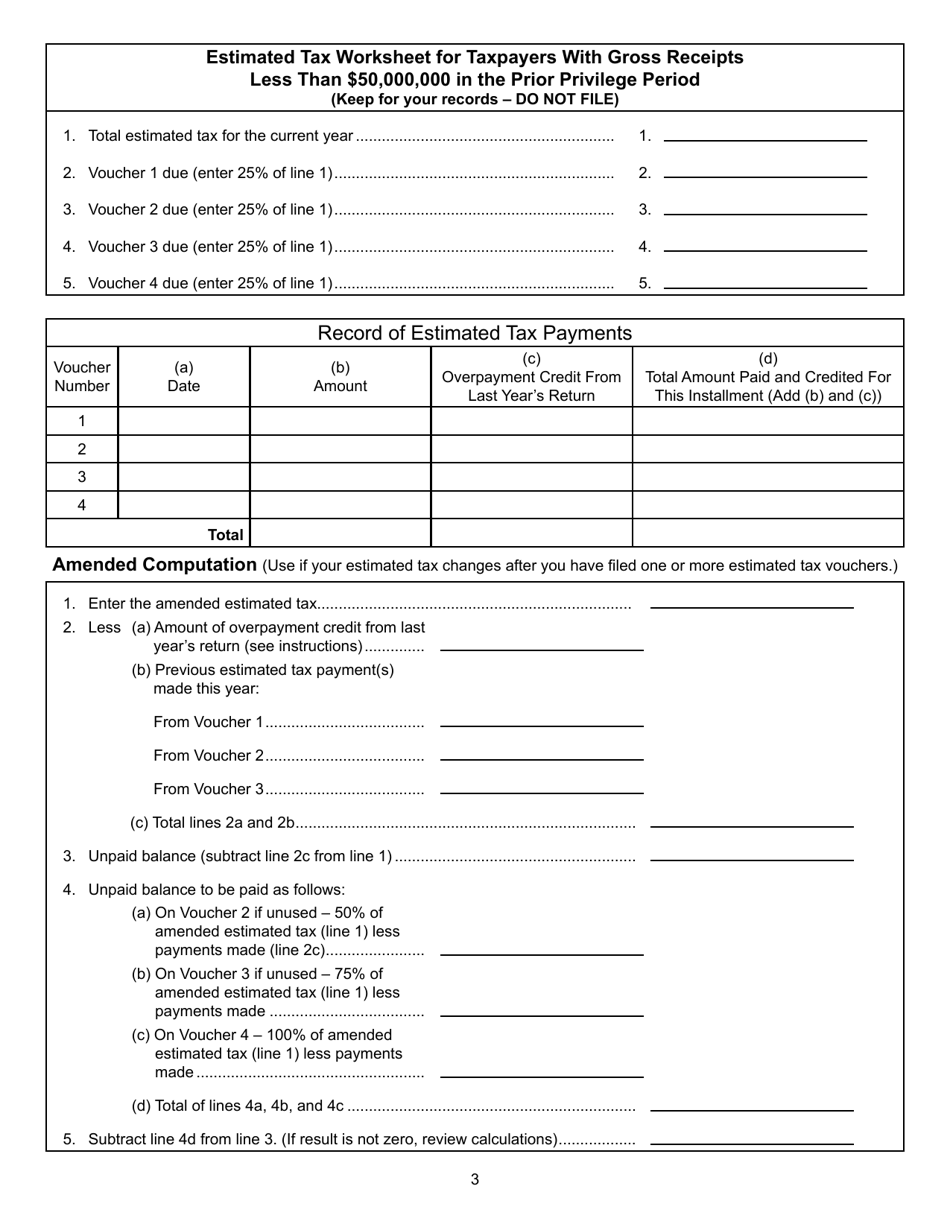

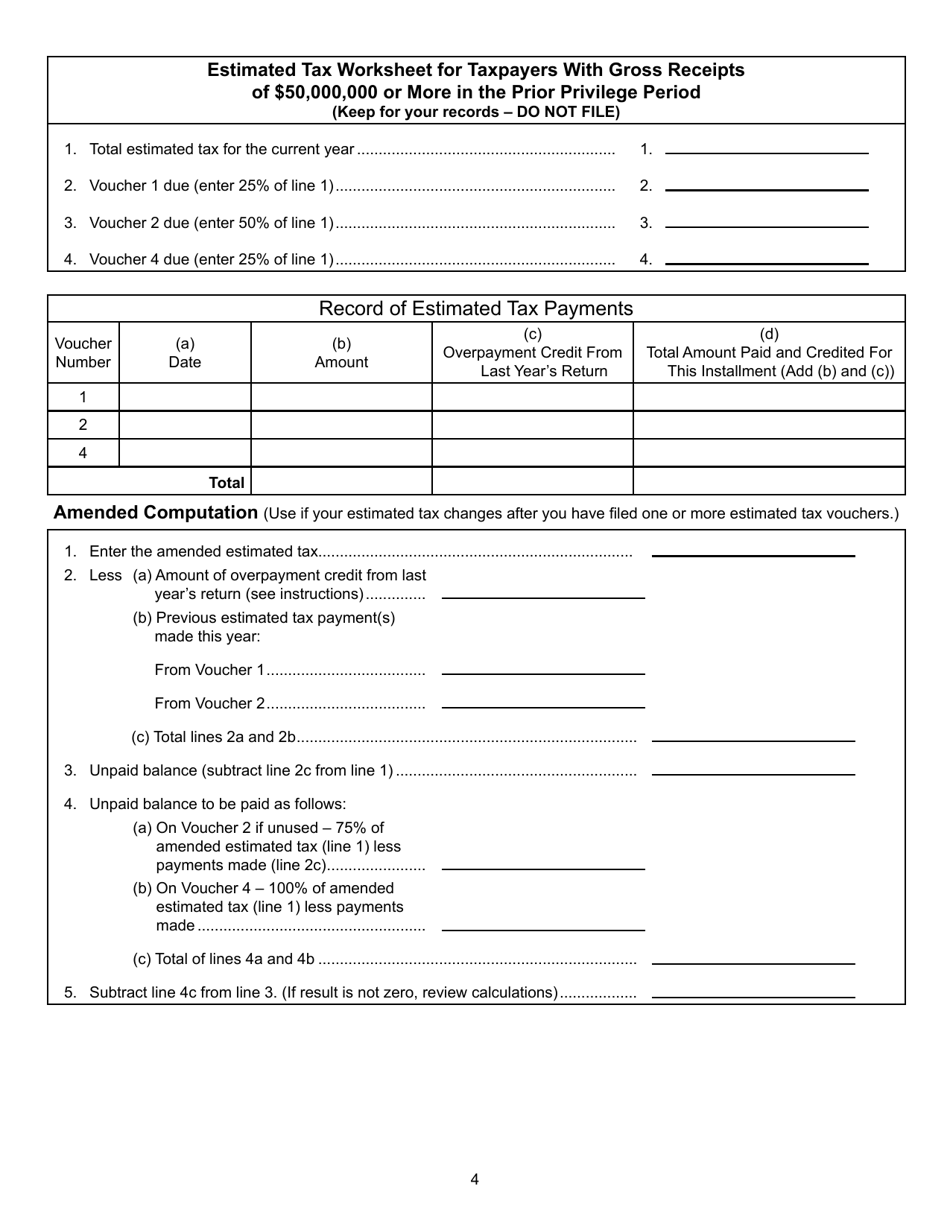

Q: What information do I need to complete Form CBT-150?

A: You will need to provide your corporation's basic information, estimated tax liability, and payment details.

Q: Can I make changes to my estimated tax payments after filing Form CBT-150?

A: Yes, if your corporation's estimated tax liability changes, you may need to file an amended Form CBT-150 to adjust your payments.

Form Details:

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form CBT-150 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.