This version of the form is not currently in use and is provided for reference only. Download this version of

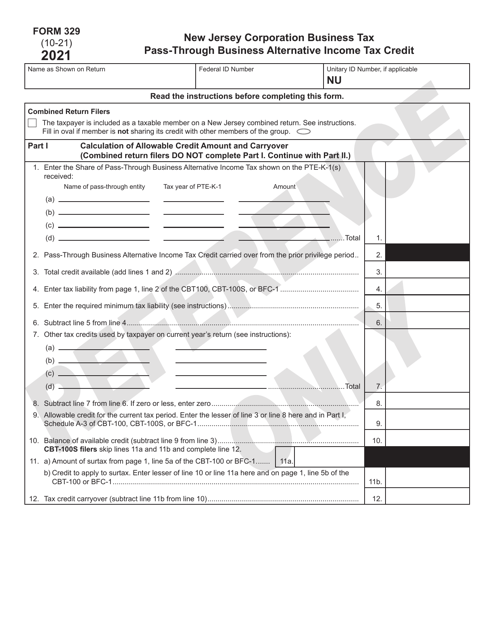

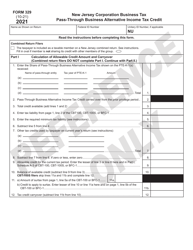

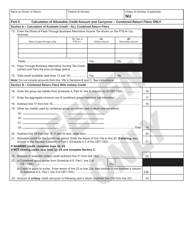

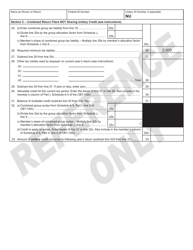

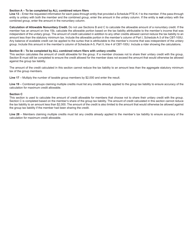

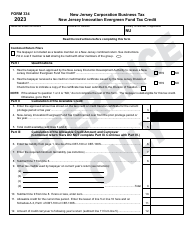

Form 329

for the current year.

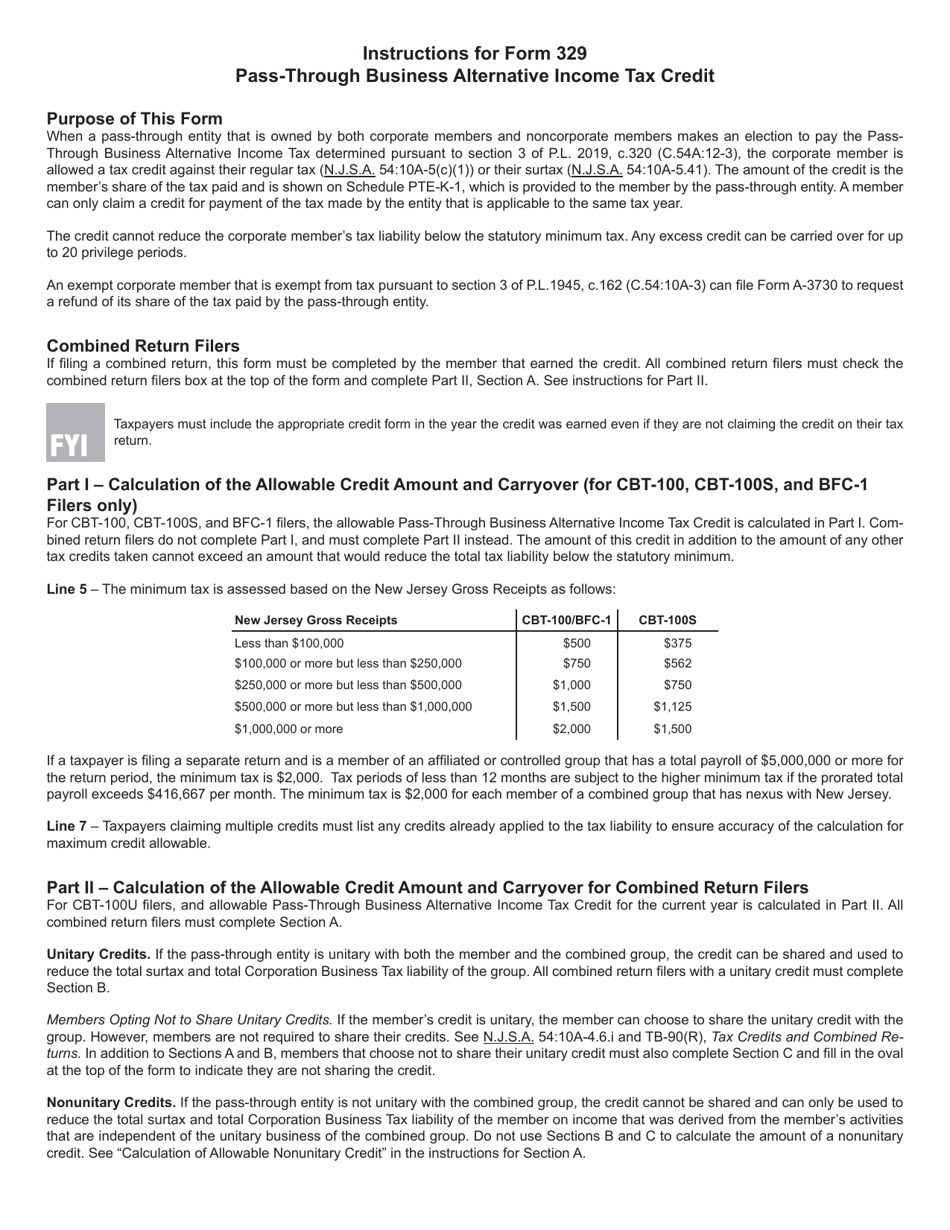

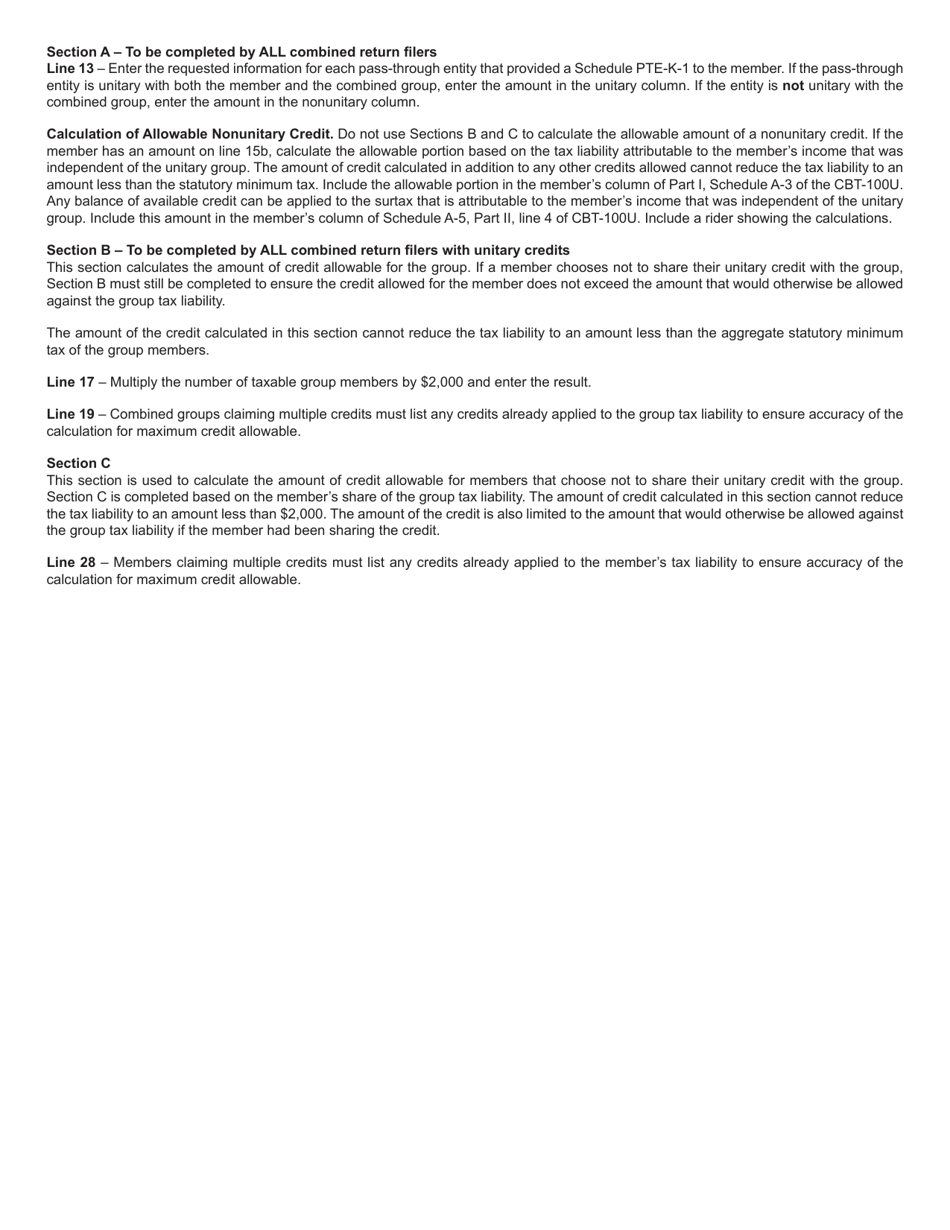

Form 329 Pass-Through Business Alternative Income Tax Credit - New Jersey

What Is Form 329?

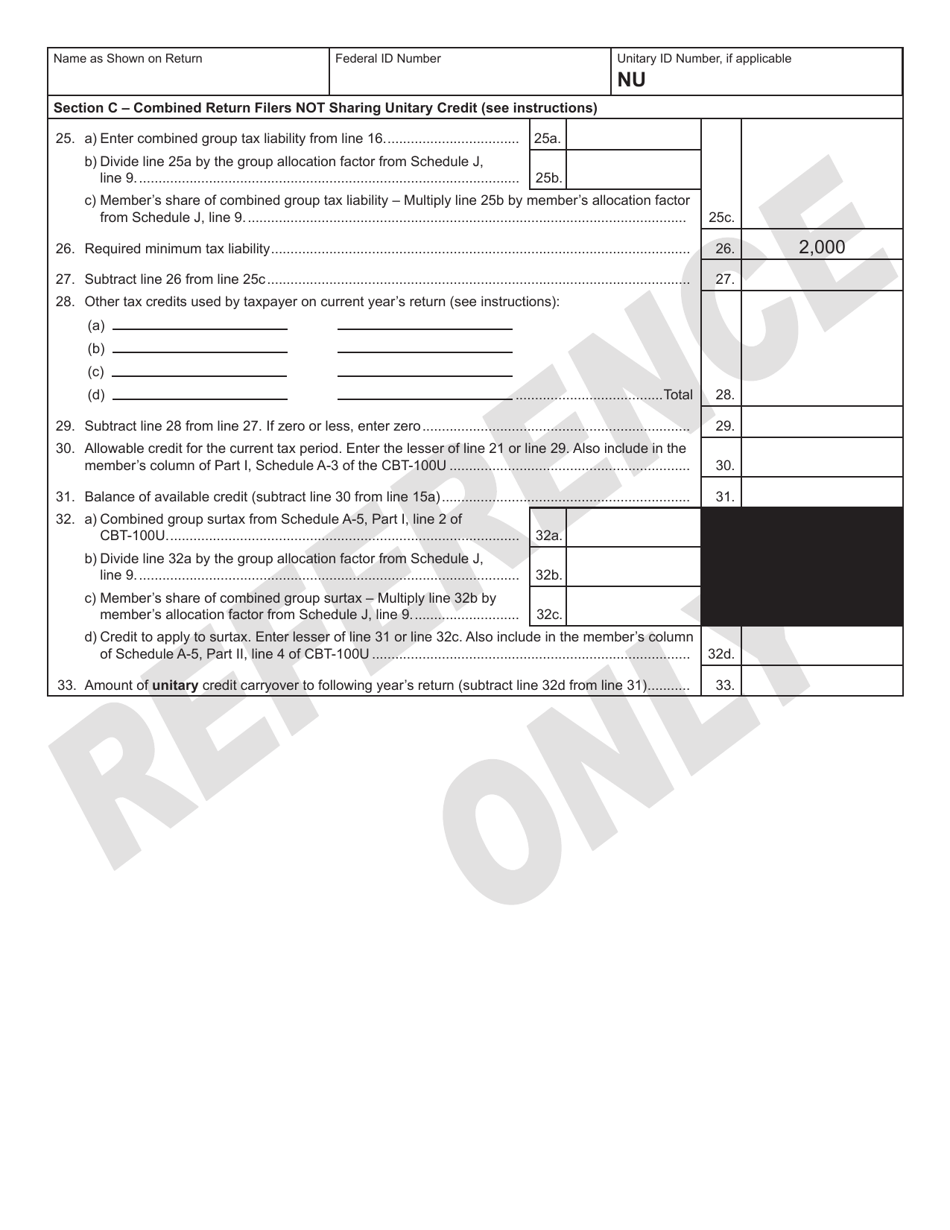

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 329?

A: Form 329 is the Pass-Through Business Alternative Income Tax Credit form in New Jersey.

Q: What is the purpose of Form 329?

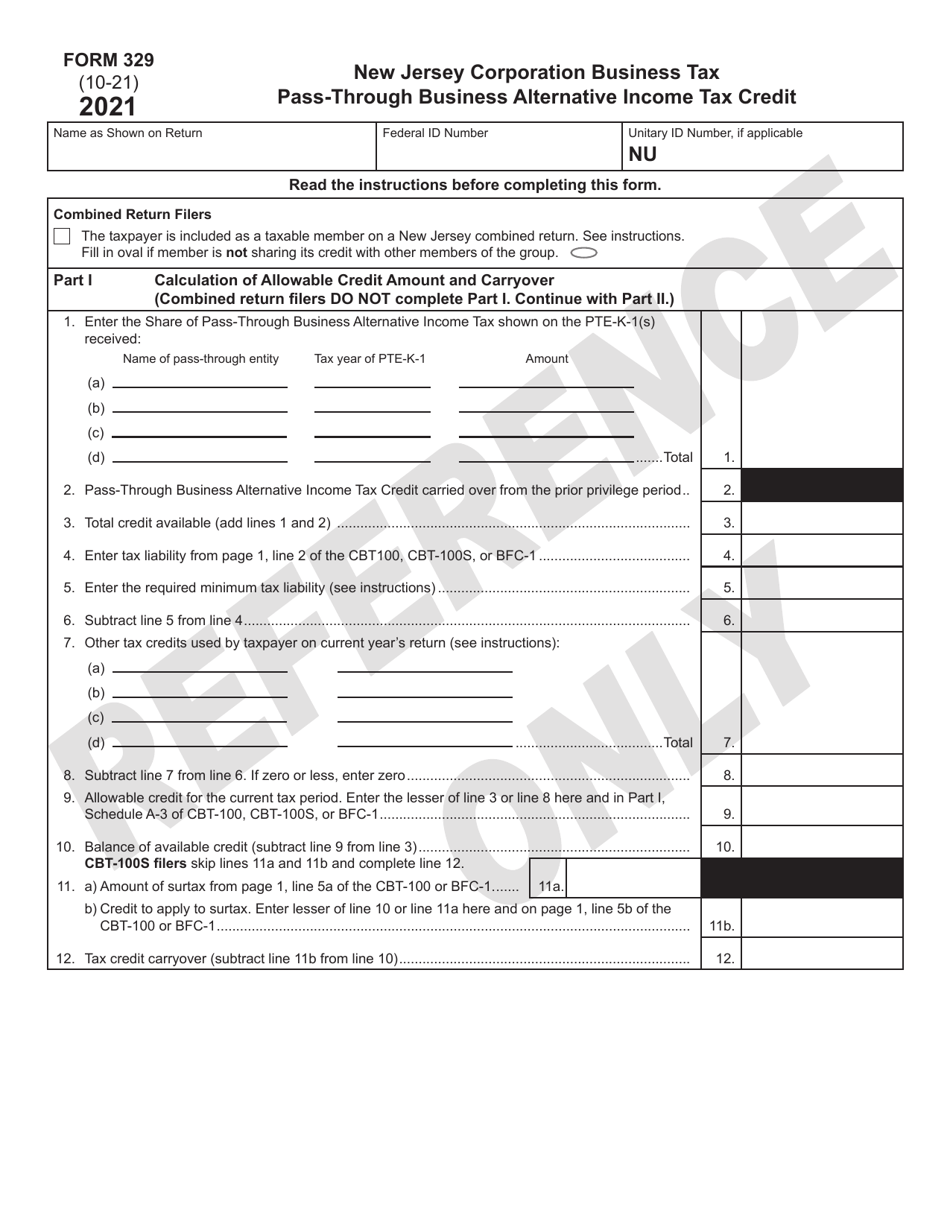

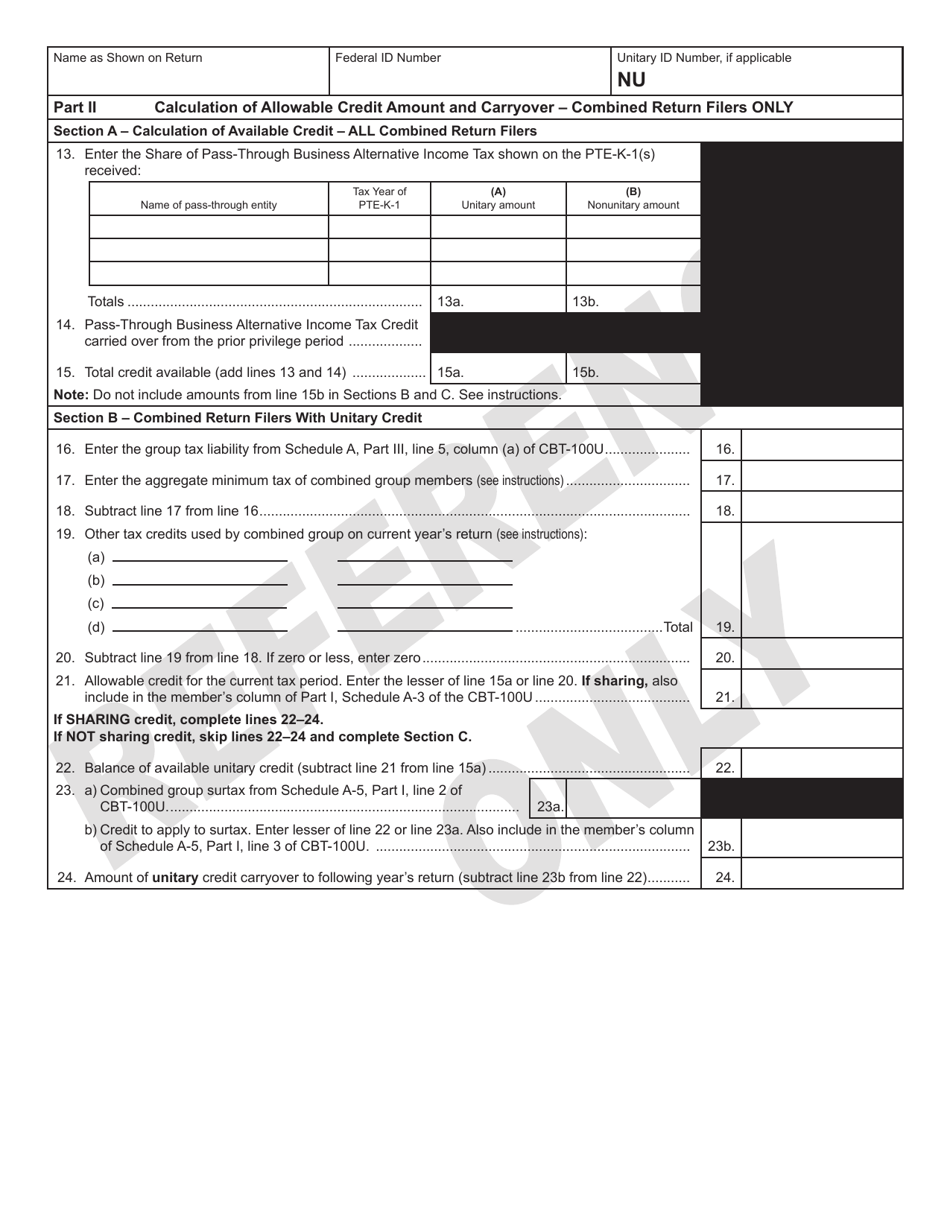

A: The purpose of Form 329 is to calculate the Pass-Through Business Alternative Income Tax Credit in New Jersey.

Q: Who needs to file Form 329?

A: Pass-through businesses in New Jersey that qualify for the Alternative Income Tax Credit must file Form 329.

Q: How do I qualify for the Pass-Through Business Alternative Income Tax Credit?

A: To qualify for the Pass-Through Business Alternative Income Tax Credit in New Jersey, you must meet the eligibility criteria set by the state.

Q: When is the deadline to file Form 329?

A: The deadline to file Form 329 is usually the same as the deadline for filing your New Jersey state tax return.

Q: Are there any penalties for late filing of Form 329?

A: Late filing of Form 329 may result in penalties and interest charges as per the rules of the New Jersey Division of Taxation.

Form Details:

- Released on October 1, 2021;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 329 by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.