This version of the form is not currently in use and is provided for reference only. Download this version of

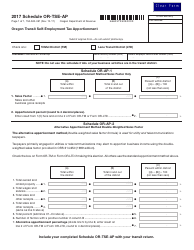

Form 150-500-051 Schedule OR-TSE-AP

for the current year.

Form 150-500-051 Schedule OR-TSE-AP Oregon Transit Self-employment Tax Apportionment - Oregon

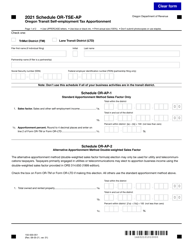

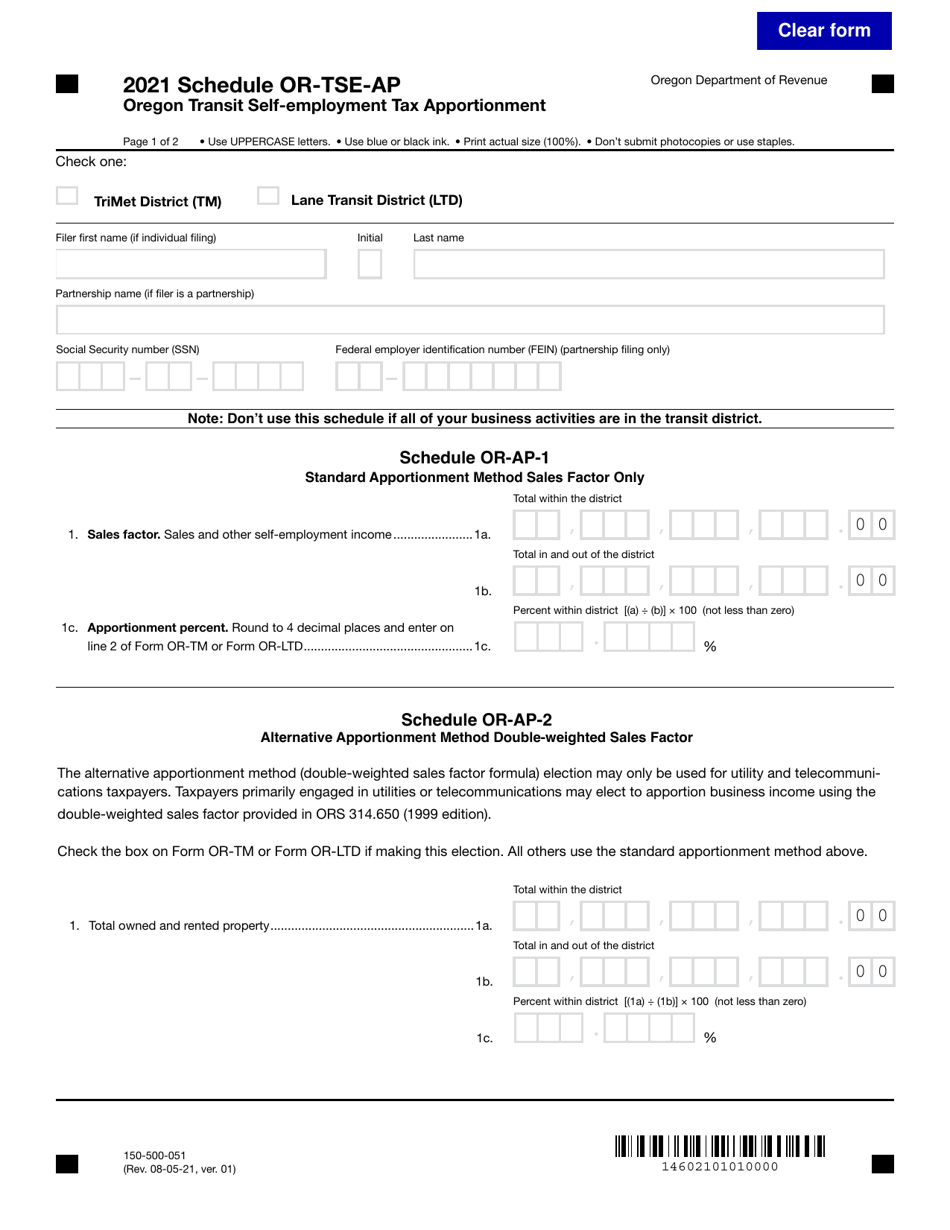

What Is Form 150-500-051 Schedule OR-TSE-AP?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 150-500-051?

A: Form 150-500-051 is the Oregon Transit Self-employment Tax Apportionment - Oregon form.

Q: What is the purpose of Form 150-500-051?

A: The purpose of Form 150-500-051 is to calculate and apportion the transit self-employment tax for Oregon.

Q: Who needs to file Form 150-500-051?

A: Self-employed individuals who are subject to transit self-employment tax in Oregon need to file Form 150-500-051.

Q: What is transit self-employment tax?

A: Transit self-employment tax is a tax imposed on self-employed individuals in Oregon to fund the state's transit systems.

Q: How do you complete Form 150-500-051?

A: To complete Form 150-500-051, you need to provide information about your self-employment income and calculate the apportionment of transit self-employment tax.

Form Details:

- Released on August 5, 2021;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-500-051 Schedule OR-TSE-AP by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.