This version of the form is not currently in use and is provided for reference only. Download this version of

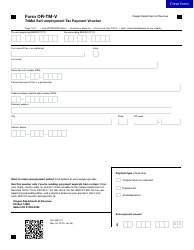

Form OR-TM (150-555-001)

for the current year.

Form OR-TM (150-555-001) Tri-County Metropolitan Transportation District Self-employment Tax - Oregon

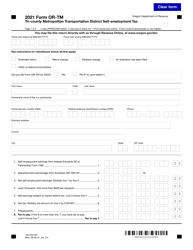

What Is Form OR-TM (150-555-001)?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. Check the official instructions before completing and submitting the form.

FAQ

Q: What is OR-TM (150-555-001)?

A: OR-TM (150-555-001) is a form used for reporting self-employment tax in Oregon.

Q: What is the Tri-County Metropolitan Transportation District?

A: The Tri-County Metropolitan Transportation District, also known as TriMet, is a public transit agency that serves the Portland metropolitan area in Oregon.

Q: What is self-employment tax?

A: Self-employment tax is a tax imposed on individuals who work for themselves, such as freelancers, independent contractors, and business owners.

Q: Why do I need to file OR-TM (150-555-001)?

A: You need to file OR-TM (150-555-001) if you are self-employed and earning income in Oregon. This form helps you report and pay your self-employment tax.

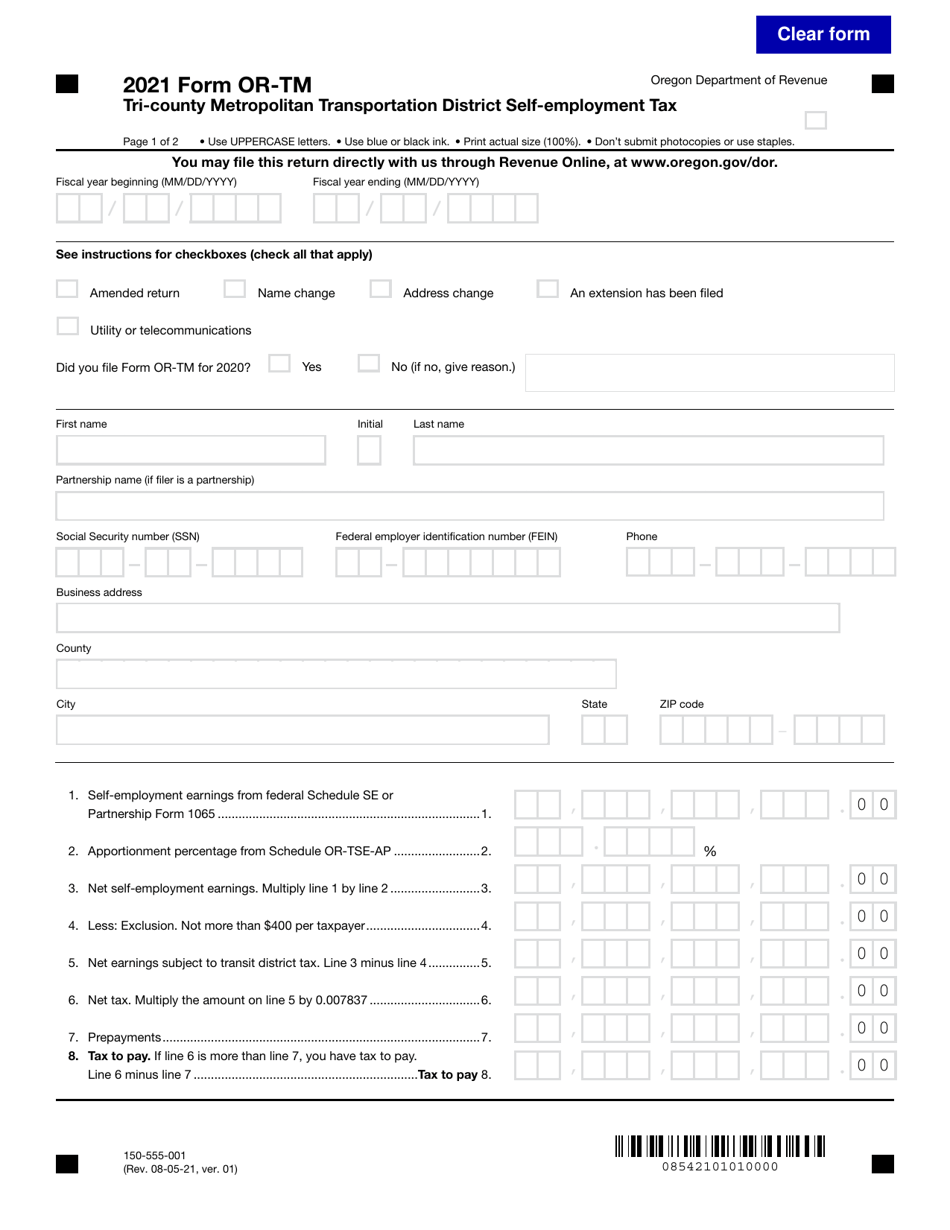

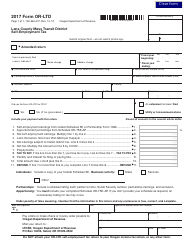

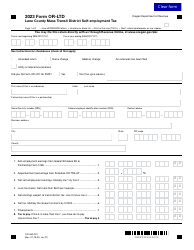

Q: What information do I need to complete OR-TM (150-555-001)?

A: To complete OR-TM (150-555-001), you will need to provide your personal information, details of your self-employment income, and calculate your self-employment tax liability.

Q: When is the deadline to file OR-TM (150-555-001)?

A: The deadline to file OR-TM (150-555-001) is April 15th of the following year, the same deadline as the federal income tax return.

Q: Are there any penalties for late filing of OR-TM (150-555-001)?

A: Yes, there may be penalties for late filing of OR-TM (150-555-001). It is important to file your form on time to avoid any penalties or interest charges.

Q: Can I e-file OR-TM (150-555-001)?

A: Yes, you can e-file OR-TM (150-555-001) if you choose to file your Oregon state tax return electronically.

Form Details:

- Released on August 5, 2021;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OR-TM (150-555-001) by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.