This version of the form is not currently in use and is provided for reference only. Download this version of

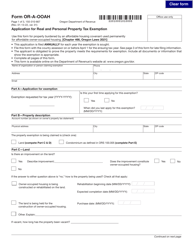

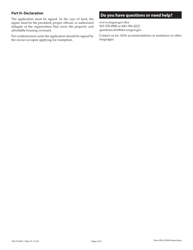

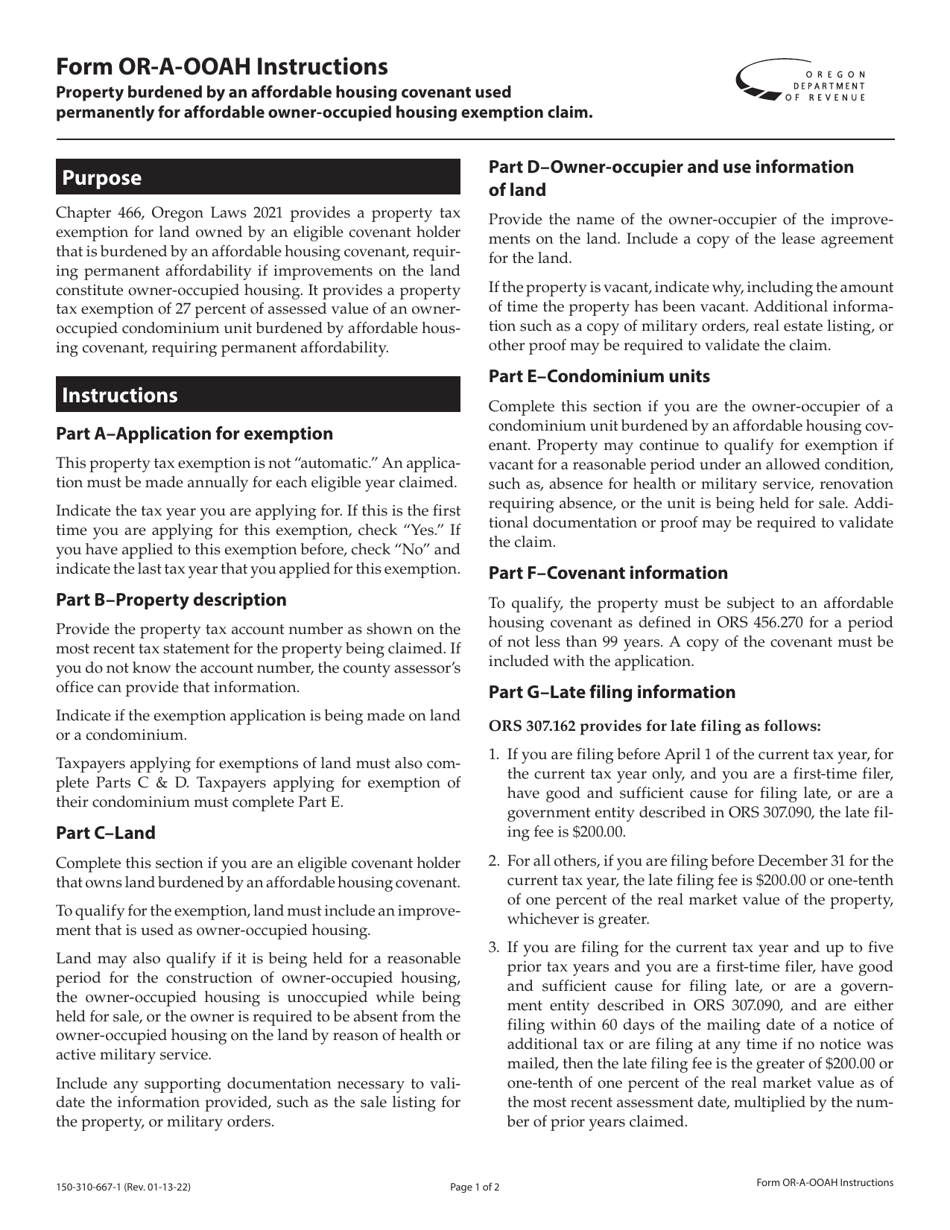

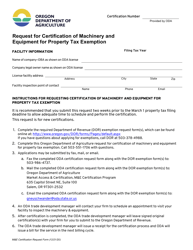

Instructions for Form OR-A-OOAH, 150-310-667

for the current year.

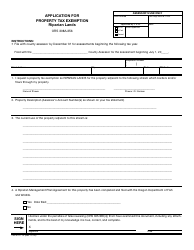

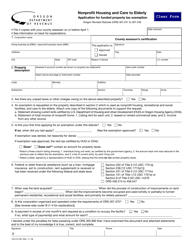

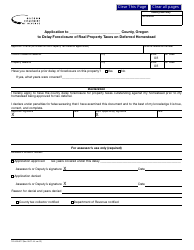

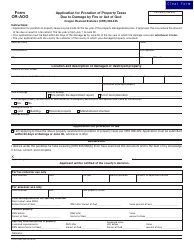

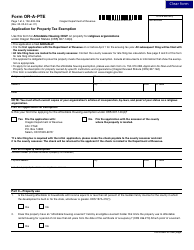

Instructions for Form OR-A-OOAH, 150-310-667 Application for Real and Personal Property Tax Exemption - Oregon

This document contains official instructions for Form OR-A-OOAH , and Form 150-310-667 . Both forms are released and collected by the Oregon Department of Revenue. An up-to-date fillable Form OR-A-OOAH (150-310-667) is available for download through this link.

FAQ

Q: What is Form OR-A-OOAH?

A: Form OR-A-OOAH is an application for real and personal property tax exemption in Oregon.

Q: What is the purpose of Form OR-A-OOAH?

A: The purpose of Form OR-A-OOAH is to apply for a tax exemption on real and personal property in Oregon.

Q: Who is eligible to apply for tax exemption with Form OR-A-OOAH?

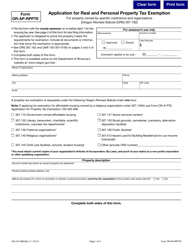

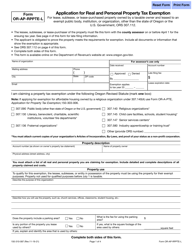

A: Individuals or organizations that meet certain criteria, such as being a non-profit or having specific types of property, may be eligible to apply for tax exemption using Form OR-A-OOAH.

Q: What information do I need to provide on Form OR-A-OOAH?

A: Form OR-A-OOAH requires you to provide detailed information about the property for which you are seeking a tax exemption, as well as information about your organization or yourself.

Q: Are there any fees associated with submitting Form OR-A-OOAH?

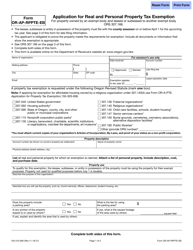

A: There is no fee to submit Form OR-A-OOAH.

Q: What is the deadline for submitting Form OR-A-OOAH?

A: The deadline for submitting Form OR-A-OOAH varies depending on the type of exemption you are applying for. It is important to check with the Oregon Department of Revenue or your local county assessor's office for the specific deadline.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Oregon Department of Revenue.