This version of the form is not currently in use and is provided for reference only. Download this version of

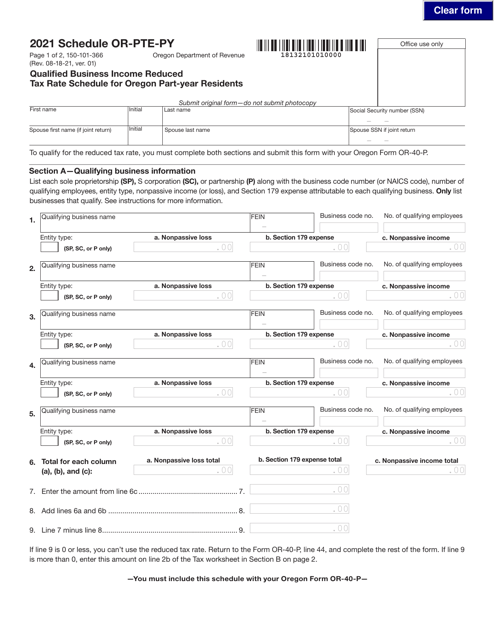

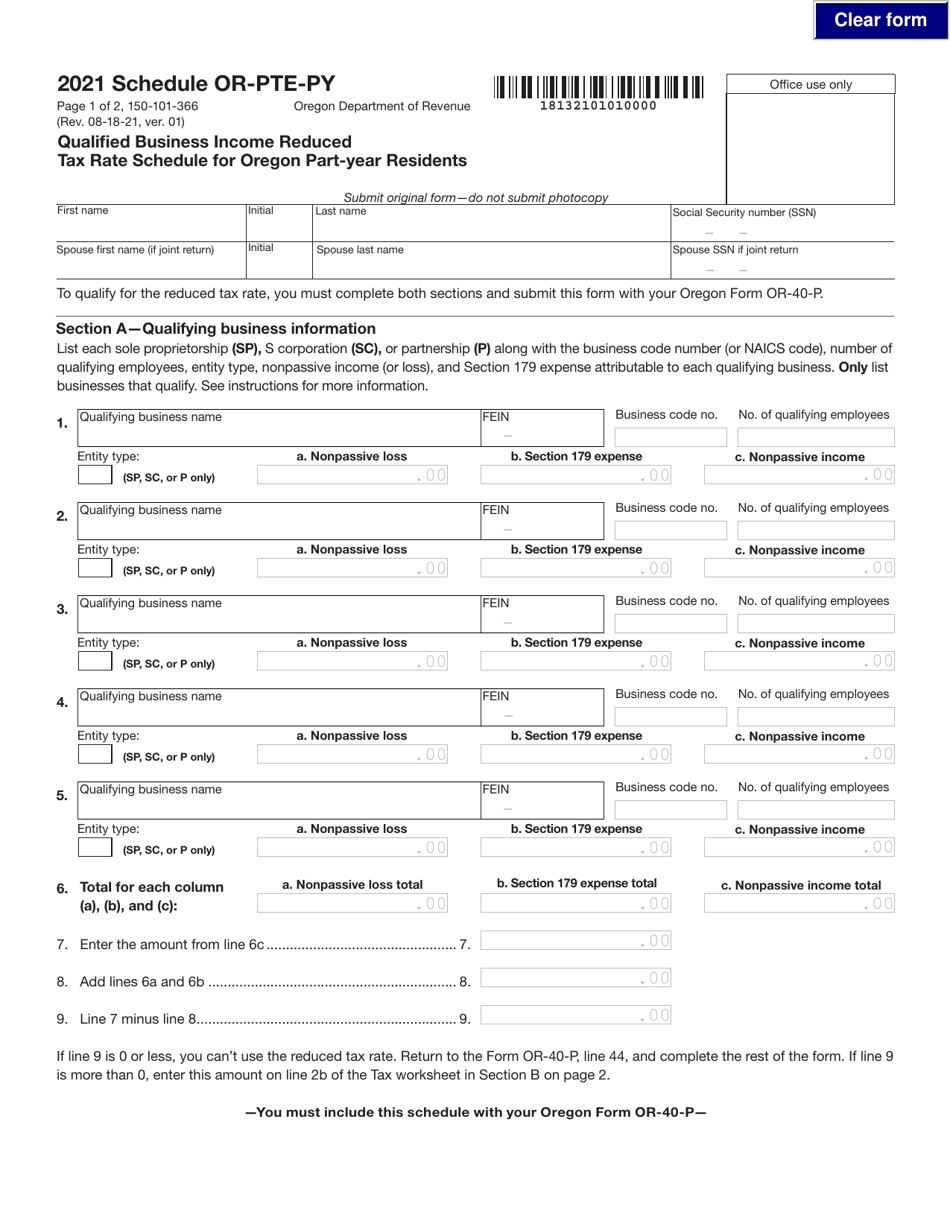

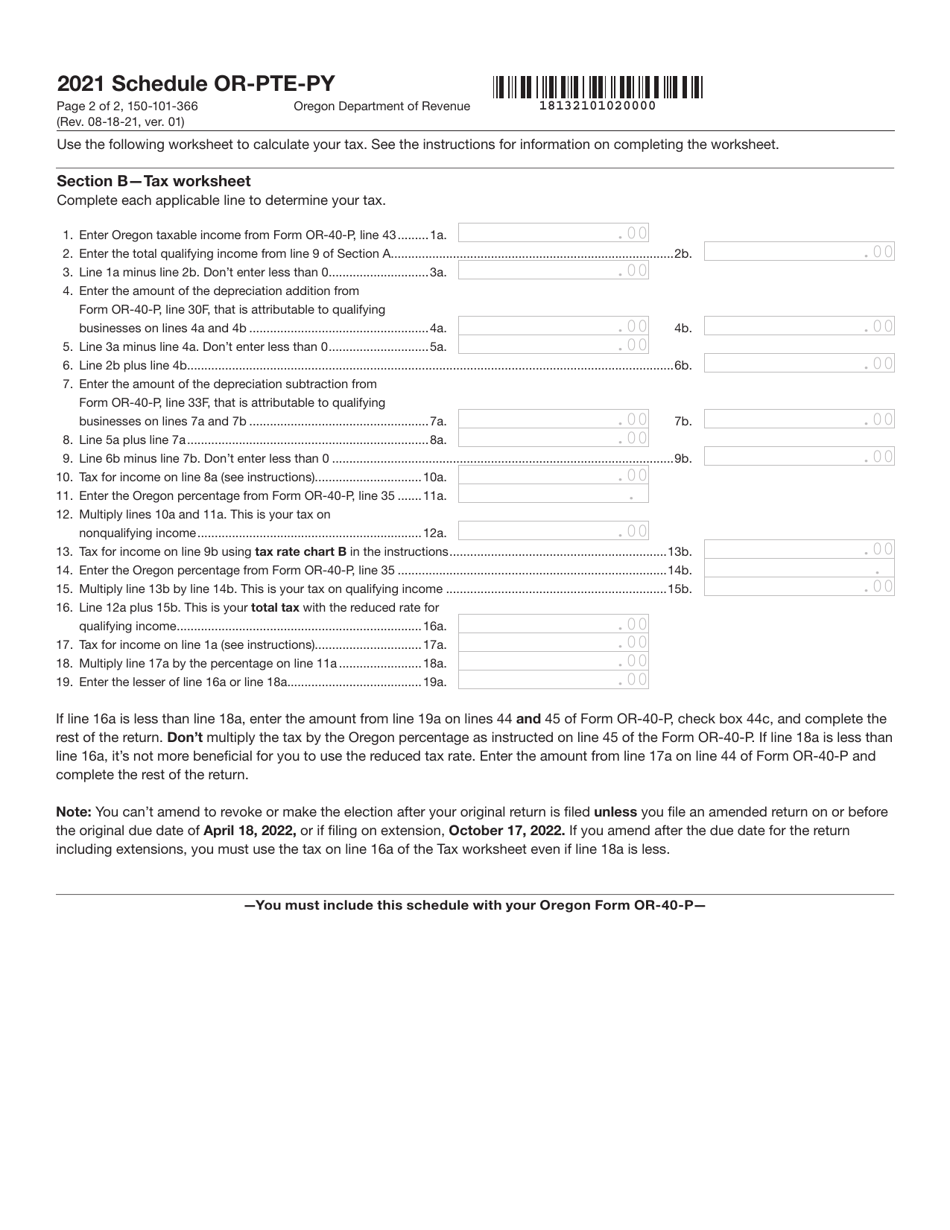

Form 150-101-366 Schedule OR-PTE-PY

for the current year.

Form 150-101-366 Schedule OR-PTE-PY Qualified Business Income Reduced Tax Rate Schedule for Oregon Part-Year Residents - Oregon

What Is Form 150-101-366 Schedule OR-PTE-PY?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form 150-101-366?

A: Form 150-101-366 is the Schedule OR-PTE-PY Qualified Business Income Reduced Tax Rate Schedule for Oregon Part-Year Residents.

Q: Who should use Form 150-101-366?

A: Form 150-101-366 should be used by Oregon part-year residents who have qualified business income.

Q: What is the purpose of Form 150-101-366?

A: The purpose of Form 150-101-366 is to calculate the reduced tax rate for qualified business income for Oregon part-year residents.

Q: What is qualified business income?

A: Qualified business income refers to income earned from a qualified trade or business.

Q: What is the reduced tax rate for qualified business income?

A: The reduced tax rate for qualified business income is 50% of the regular tax rate.

Q: Are there any eligibility requirements for using Form 150-101-366?

A: Yes, to be eligible to use Form 150-101-366, you must meet certain requirements, including being an Oregon part-year resident and having qualified business income.

Q: Is there a deadline for filing Form 150-101-366?

A: Yes, the deadline for filing Form 150-101-366 is the same as the deadline for filing your Oregon state tax return.

Q: Can Form 150-101-366 be filed electronically?

A: Yes, Form 150-101-366 can be filed electronically using the Oregon e-file system.

Q: What should I do if I have questions about Form 150-101-366?

A: If you have questions about Form 150-101-366, you can contact the Oregon Department of Revenue for assistance.

Form Details:

- Released on August 18, 2021;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-101-366 Schedule OR-PTE-PY by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.