This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Form 150-101-365 Schedule OR-PTE-FY

for the current year.

Instructions for Form 150-101-365 Schedule OR-PTE-FY Qualifying Business Income Reduced Tax Rate for Oregon Full-Year Residents - Oregon

This document contains official instructions for Form 150-101-365 Schedule OR-PTE-FY, Qualifying Business Income Reduced Tax Rate for Oregon Full-Year Residents - a form released and collected by the Oregon Department of Revenue. An up-to-date fillable Form 150-101-365 Schedule OR-PTE-FY is available for download through this link.

FAQ

Q: What is Form 150-101-365?

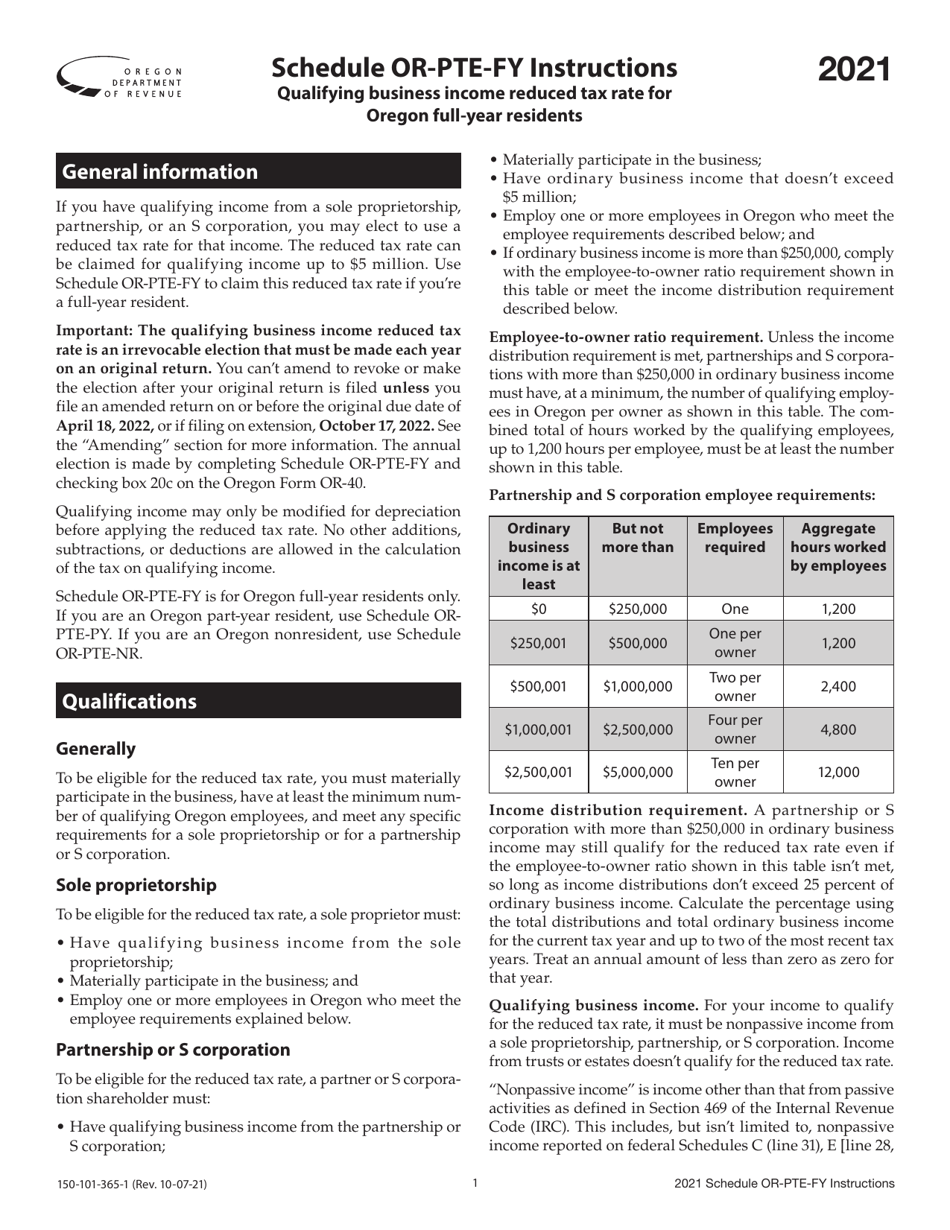

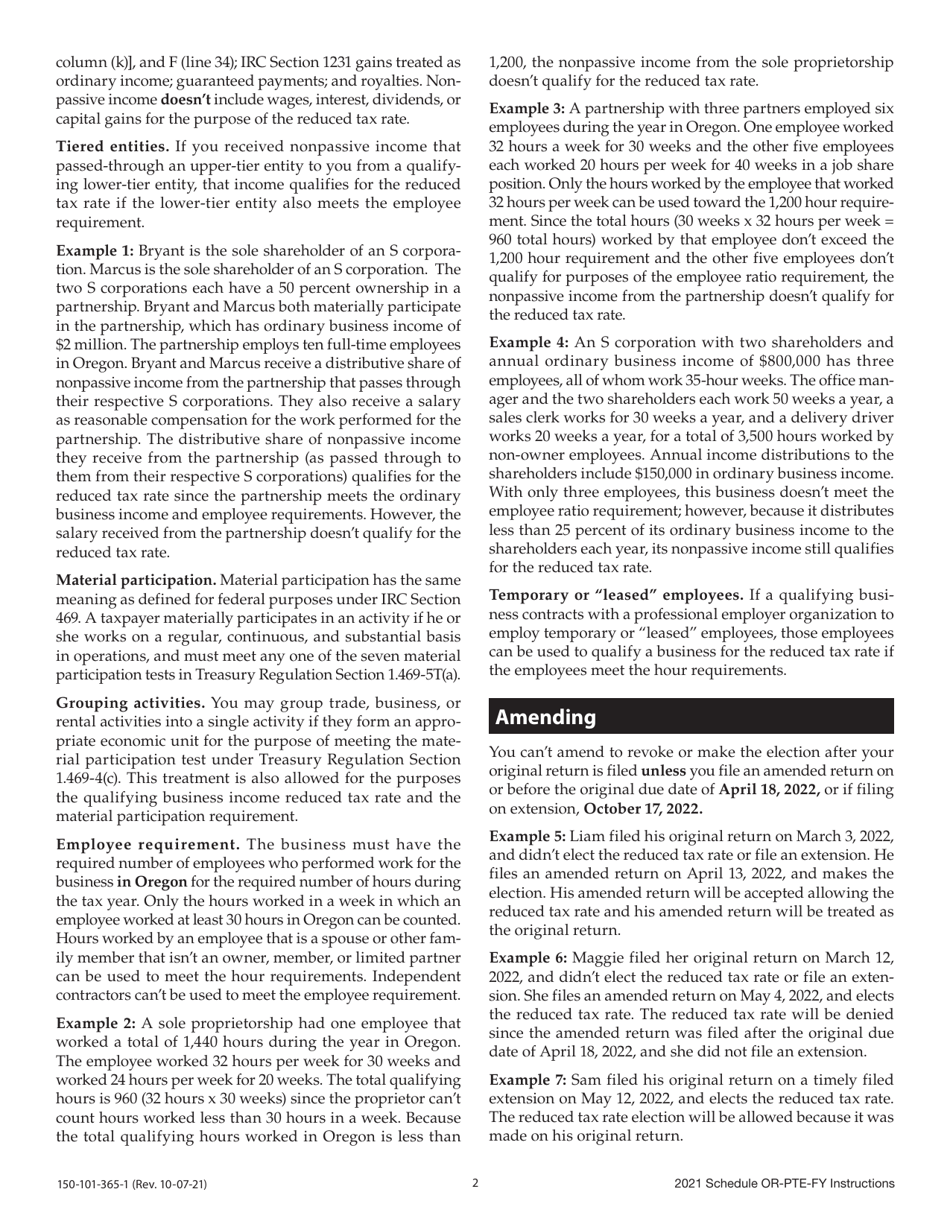

A: Form 150-101-365 is a schedule for Oregon full-year residents to calculate the qualifying business income reduced tax rate.

Q: Who can use Form 150-101-365?

A: Oregon full-year residents can use Form 150-101-365 to calculate their qualifying business income reduced tax rate.

Q: What is the purpose of Form 150-101-365?

A: The purpose of Form 150-101-365 is to determine the reduced tax rate for qualifying business income for Oregon residents.

Q: What is qualifying business income?

A: Qualifying business income refers to income generated from a qualified business entity.

Q: What is the reduced tax rate for qualifying business income?

A: The reduced tax rate for qualifying business income is 20%.

Q: Are there any eligibility requirements to use Form 150-101-365?

A: Yes, taxpayers must meet certain eligibility requirements to use Form 150-101-365, such as being an Oregon full-year resident and having qualifying business income.

Q: Are there any deadlines for filing Form 150-101-365?

A: Yes, Form 150-101-365 must be filed by the due date of the Oregon income tax return, which is generally April 15th.

Q: Is Form 150-101-365 required for all Oregon full-year residents?

A: No, Form 150-101-365 is only required for Oregon full-year residents who have qualifying business income and wish to apply for the reduced tax rate.

Q: Can I claim the reduced tax rate for qualifying business income on my federal tax return?

A: No, the reduced tax rate for qualifying business income is specific to the state of Oregon and cannot be claimed on federal tax returns.

Instruction Details:

- This 4-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Oregon Department of Revenue.