This version of the form is not currently in use and is provided for reference only. Download this version of

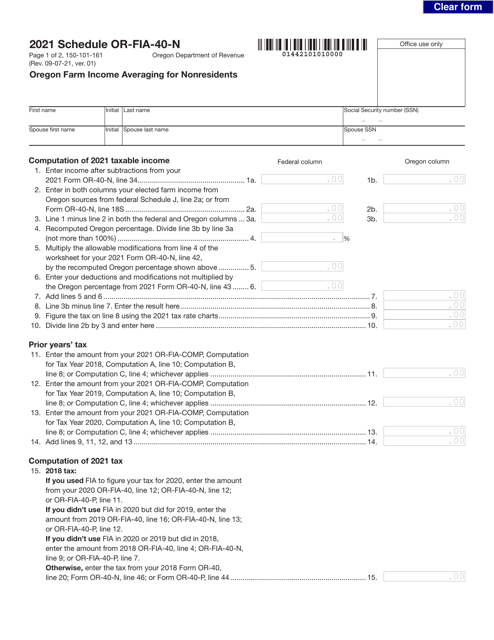

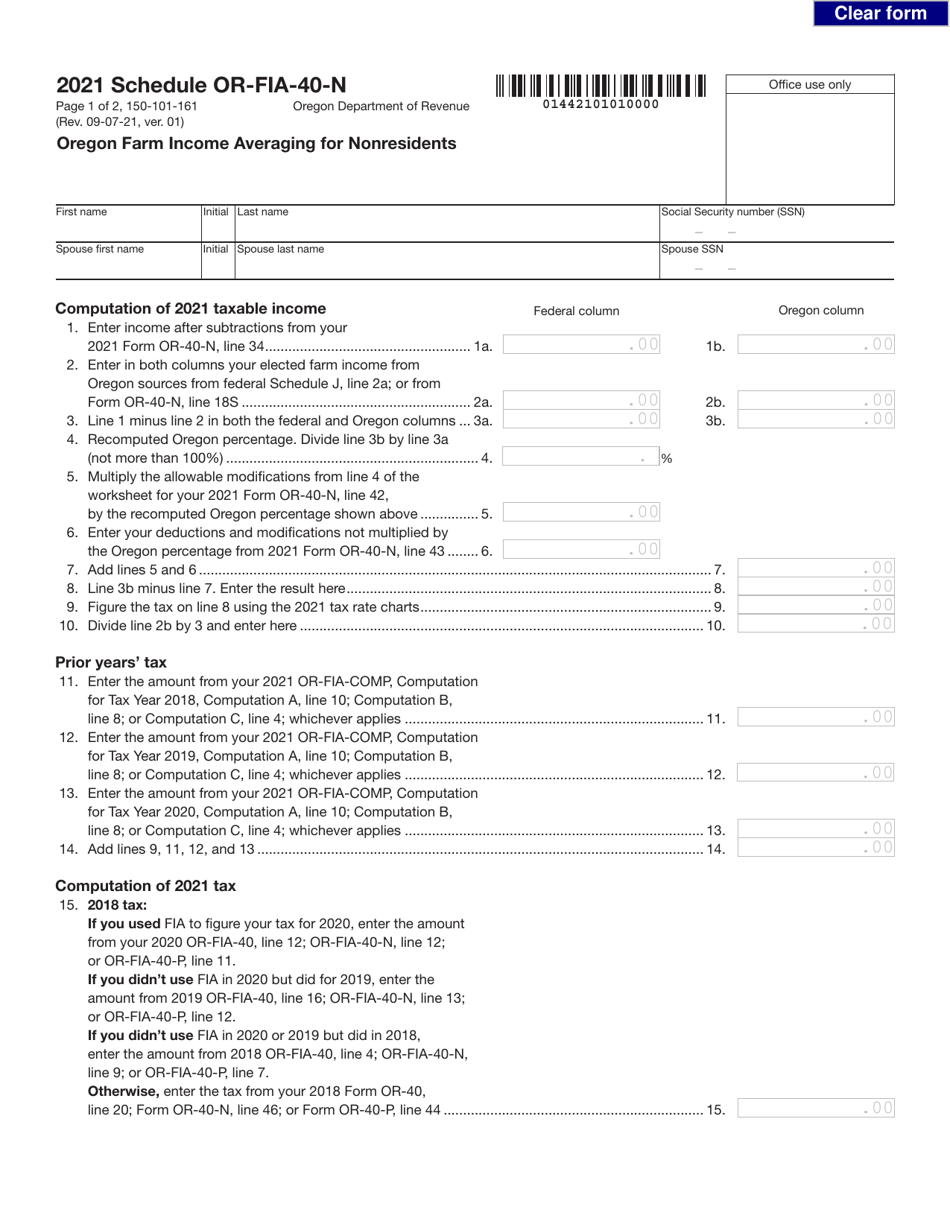

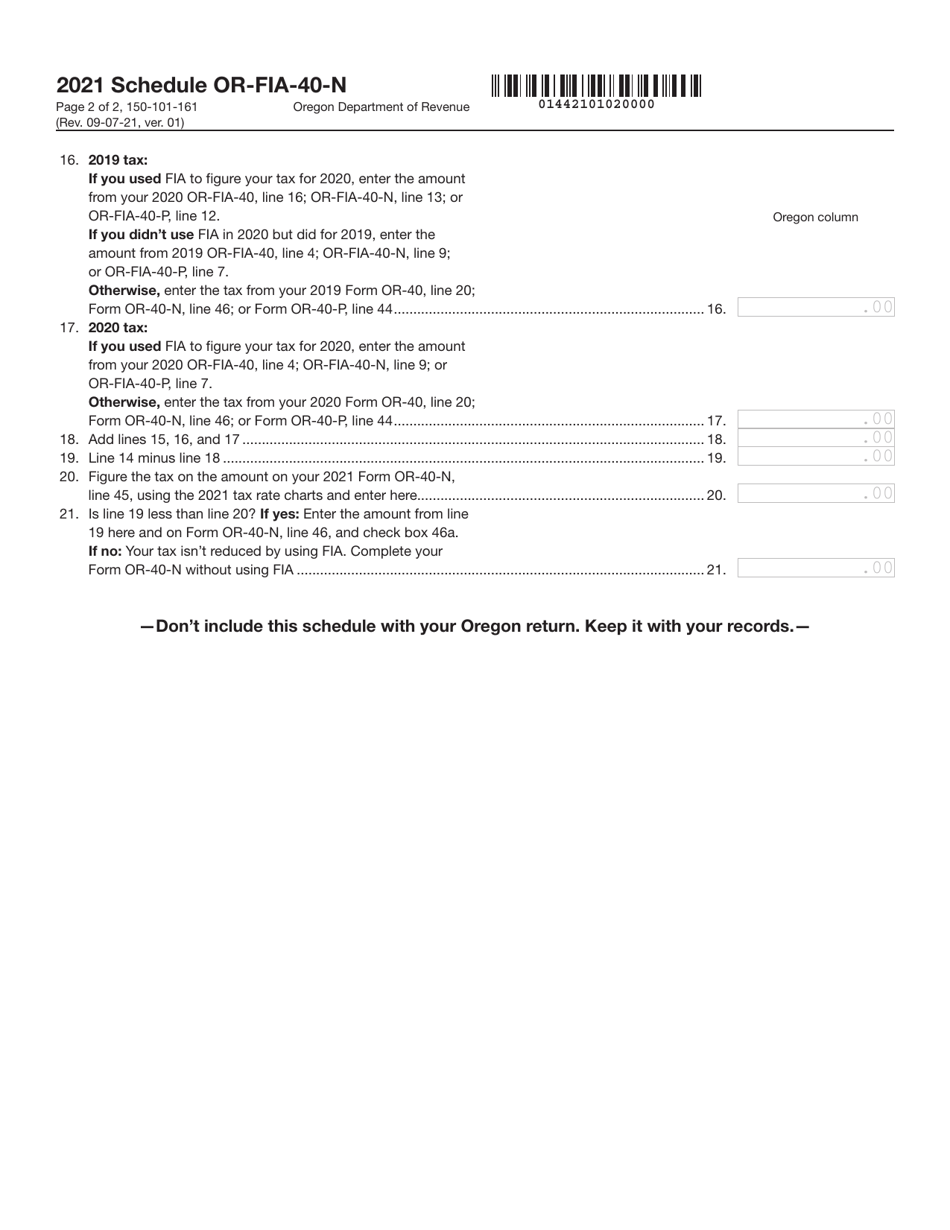

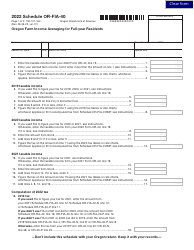

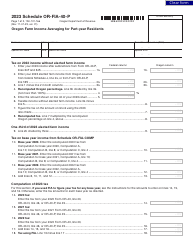

Form 150-101-161 Schedule OR-FIA-40-N

for the current year.

Form 150-101-161 Schedule OR-FIA-40-N Oregon Farm Income Averaging for Nonresidents - Oregon

What Is Form 150-101-161 Schedule OR-FIA-40-N?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form 150-101-161?

A: Form 150-101-161 is a schedule used for Oregon Farm Income Averaging for Nonresidents.

Q: What is the purpose of Form 150-101-161?

A: The purpose of Form 150-101-161 is to determine the average farm income of nonresidents in Oregon.

Q: Who should use Form 150-101-161?

A: Nonresidents who have farm income in Oregon should use Form 150-101-161.

Q: What is farm income averaging?

A: Farm income averaging is a method that allows farmers to spread their income over a period of years, potentially reducing their overall tax liability.

Q: Is Form 150-101-161 specific to Oregon?

A: Yes, Form 150-101-161 is specific to Oregon and is used to calculate farm income averaging for nonresidents in the state.

Q: Are there any eligibility requirements for using Form 150-101-161?

A: Yes, there are eligibility requirements for using Form 150-101-161. Nonresidents must meet certain criteria related to farm income in Oregon.

Q: Is there a deadline for filing Form 150-101-161?

A: Yes, there is a deadline for filing Form 150-101-161. Nonresidents should file the form by the due date of their Oregon income tax return.

Q: Can I use Form 150-101-161 if I am a resident of Oregon?

A: No, Form 150-101-161 is specifically for nonresidents of Oregon with farm income in the state.

Q: What other forms or documents may be required when using Form 150-101-161?

A: Other forms or documents that may be required when using Form 150-101-161 include federal income tax returns, schedules, and supporting documentation related to farm income in Oregon.

Form Details:

- Released on September 7, 2021;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-101-161 Schedule OR-FIA-40-N by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.