This version of the form is not currently in use and is provided for reference only. Download this version of

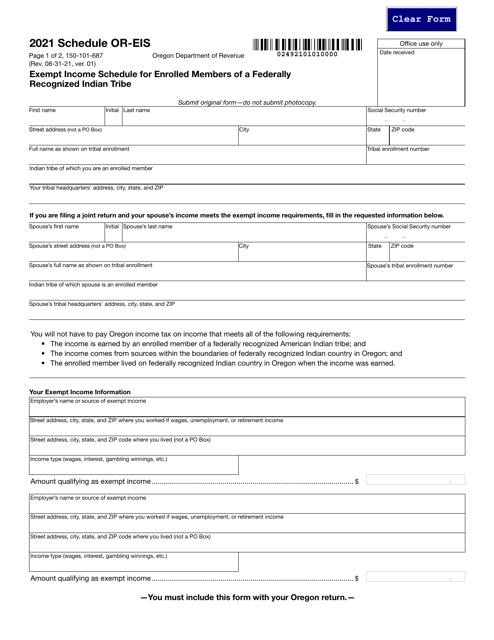

Form 150-101-687 Schedule OR-EIS

for the current year.

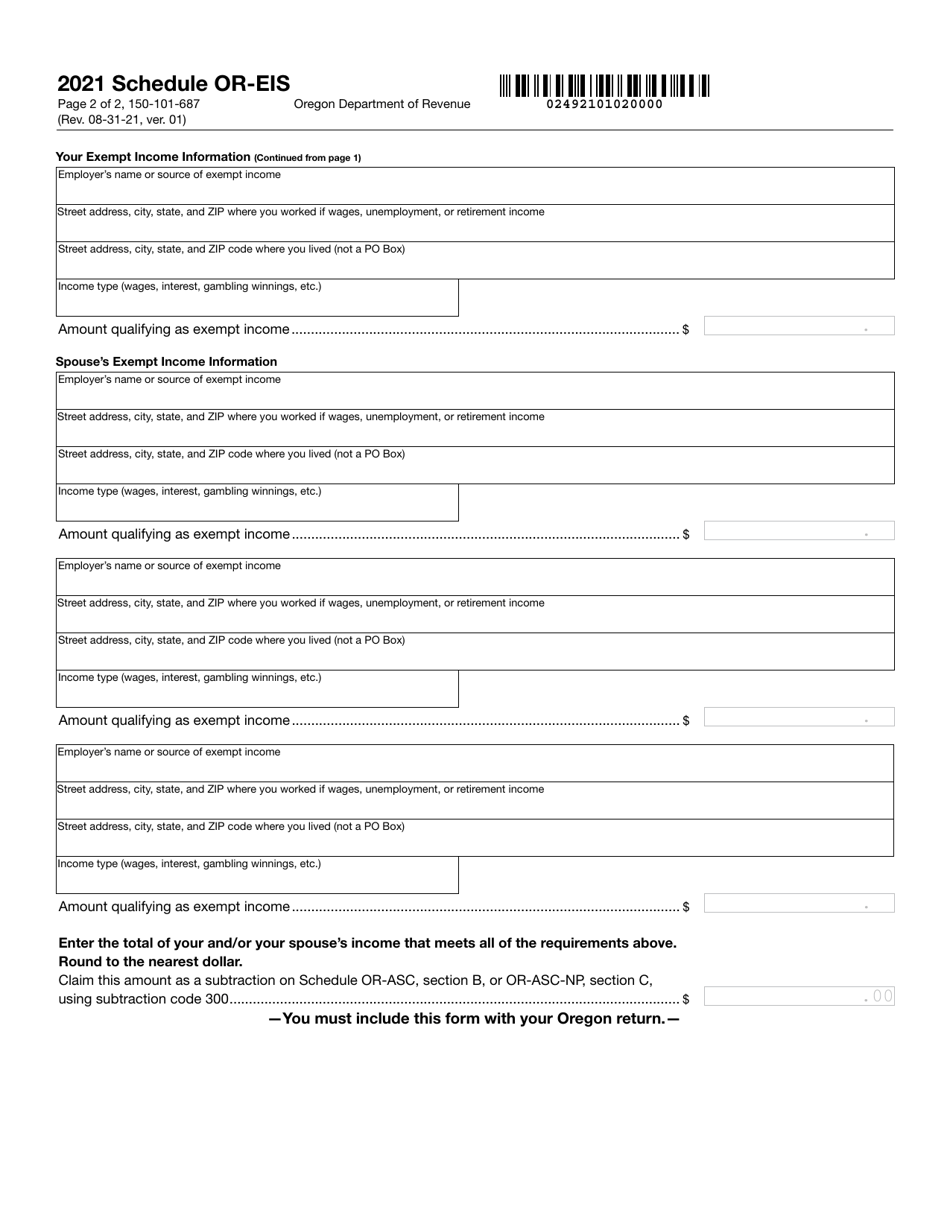

Form 150-101-687 Schedule OR-EIS Exempt Income Schedule for Enrolled Members of a Federally Recognized Indian Tribe - Oregon

What Is Form 150-101-687 Schedule OR-EIS?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 150-101-687?

A: Form 150-101-687 is the Schedule OR-EIS Exempt Income Schedule for Enrolled Members of a Federally Recognized Indian Tribe in Oregon.

Q: What is the purpose of Form 150-101-687?

A: The purpose of Form 150-101-687 is to report exempt income for enrolled members of a federally recognized Indian tribe in Oregon.

Q: Who needs to file Form 150-101-687?

A: Enrolled members of a federally recognized Indian tribe in Oregon who have exempt income should file Form 150-101-687.

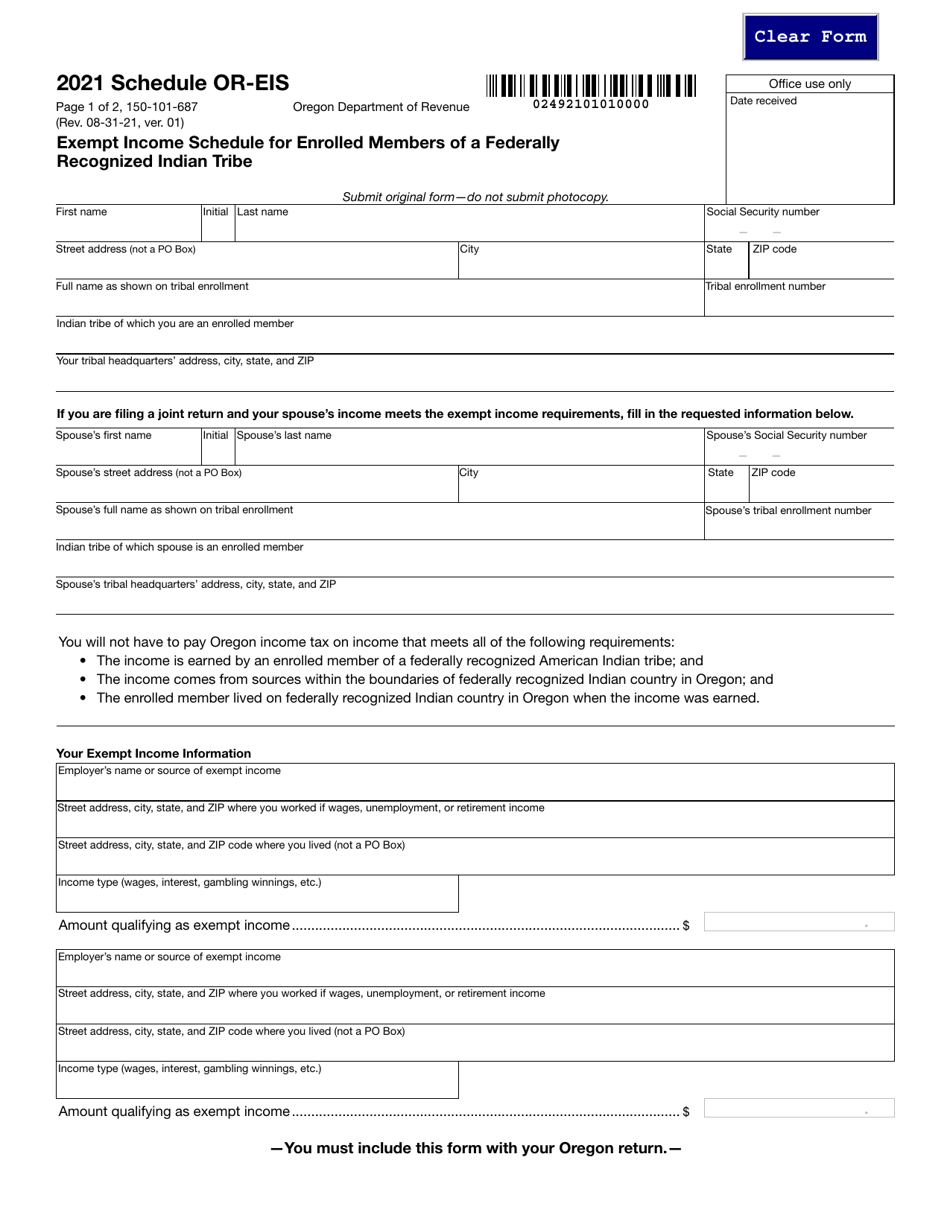

Q: What is exempt income?

A: Exempt income refers to the income that is not subject to taxation.

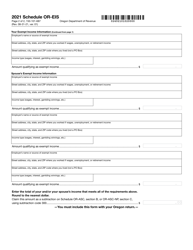

Q: What types of income are considered exempt?

A: Income derived from sources within an Indian reservation, including income from tribal businesses, employment income on the reservation, and income from trust resources, are considered exempt.

Form Details:

- Released on August 31, 2021;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-101-687 Schedule OR-EIS by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.