This version of the form is not currently in use and is provided for reference only. Download this version of

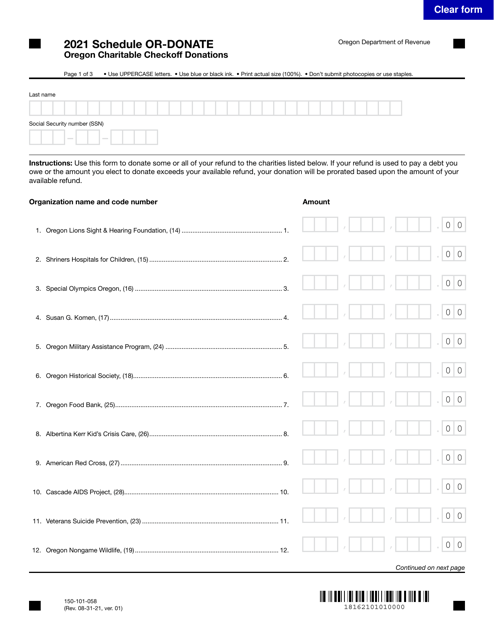

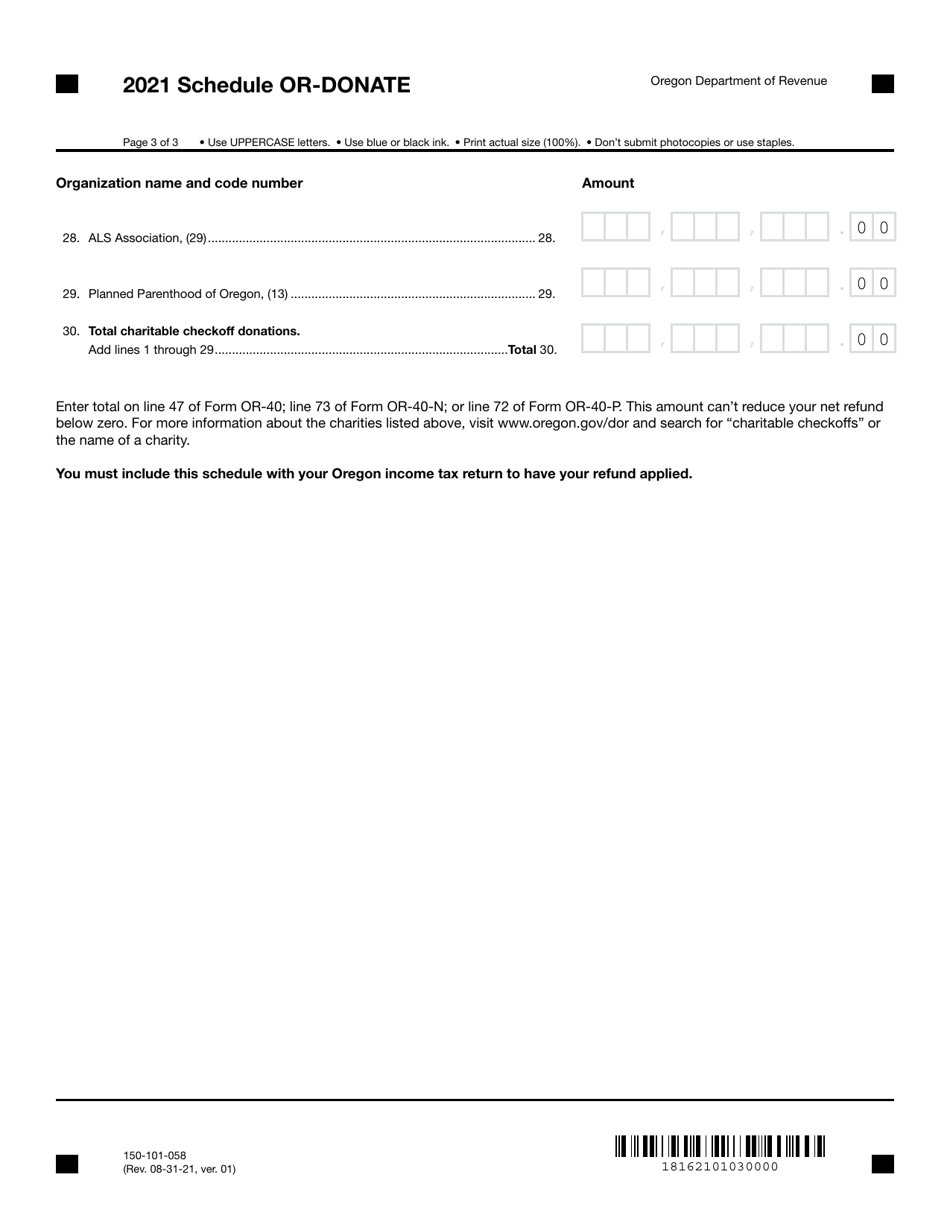

Form 150-101-058 Schedule OR-DONATE

for the current year.

Form 150-101-058 Schedule OR-DONATE Oregon Charitable Checkoff Donations - Oregon

What Is Form 150-101-058 Schedule OR-DONATE?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 150-101-058?

A: Form 150-101-058 is the Schedule OR-DONATE for Oregon Charitable Checkoff Donations.

Q: What is the purpose of Form 150-101-058?

A: The purpose of Form 150-101-058 is to report donations made through the Oregon charitable checkoff program.

Q: What are Oregon Charitable Checkoff Donations?

A: Oregon Charitable Checkoff Donations are voluntary contributions made by taxpayers on their state tax returns to support various charitable causes in Oregon.

Q: Who can use Form 150-101-058?

A: Any taxpayer who made charitable checkoff donations on their Oregon state tax return can use Form 150-101-058.

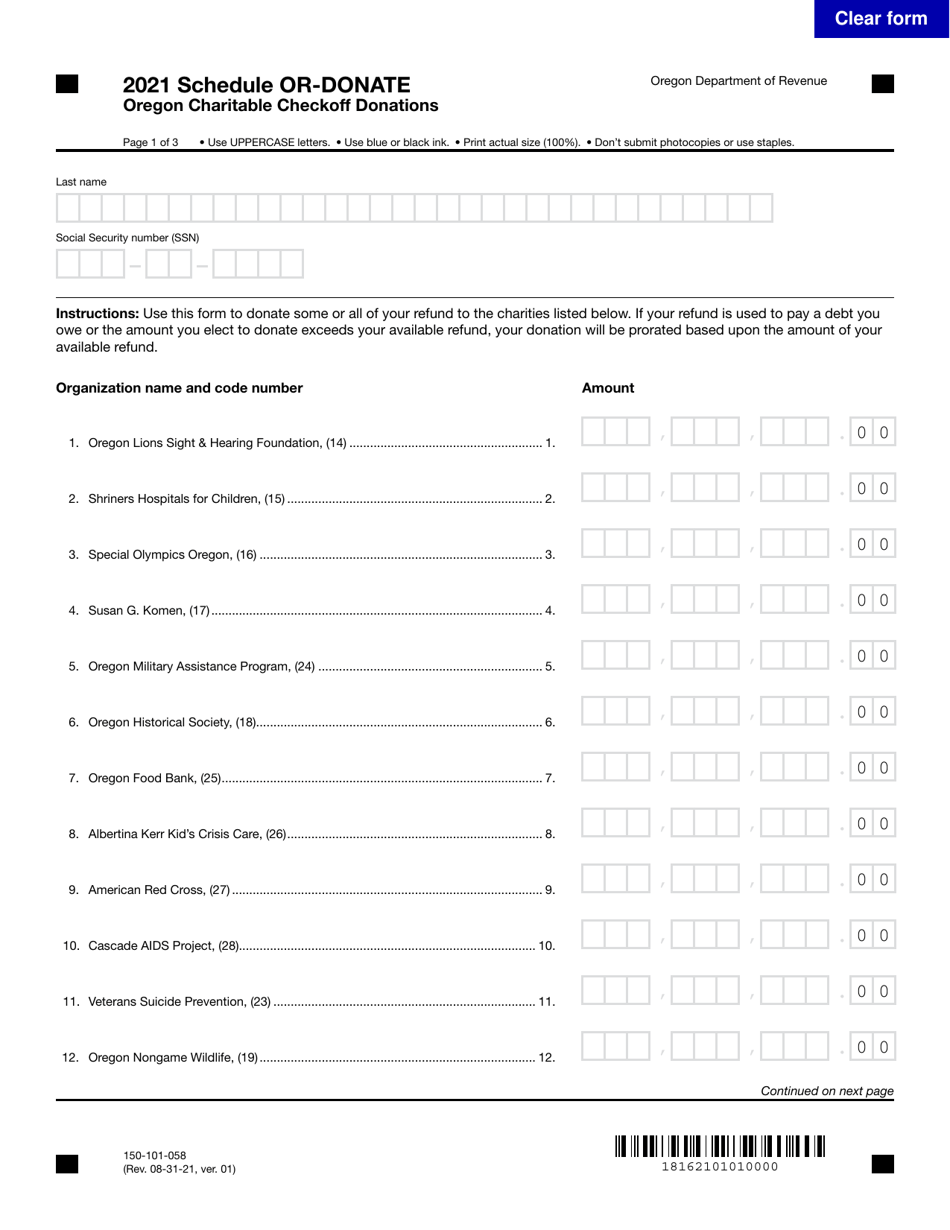

Q: How do I fill out Form 150-101-058?

A: To fill out Form 150-101-058, you will need to provide your personal information, information about the charitable organizations you donated to, and the amount of your donations.

Q: When is the deadline to file Form 150-101-058?

A: The deadline to file Form 150-101-058 is the same as the deadline for filing your Oregon state tax return, which is usually April 15th.

Q: Are the donations made through the charitable checkoff program tax-deductible?

A: Yes, donations made through the charitable checkoff program are generally tax-deductible.

Q: Can I claim a deduction for donations made to out-of-state charities?

A: No, Form 150-101-058 is specifically for donations made to Oregon charitable organizations.

Q: What happens to the donations made through the charitable checkoff program?

A: The Oregon Department of Revenue distributes the donations to the respective charitable organizations as designated by the taxpayers.

Form Details:

- Released on August 31, 2021;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-101-058 Schedule OR-DONATE by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.