This version of the form is not currently in use and is provided for reference only. Download this version of

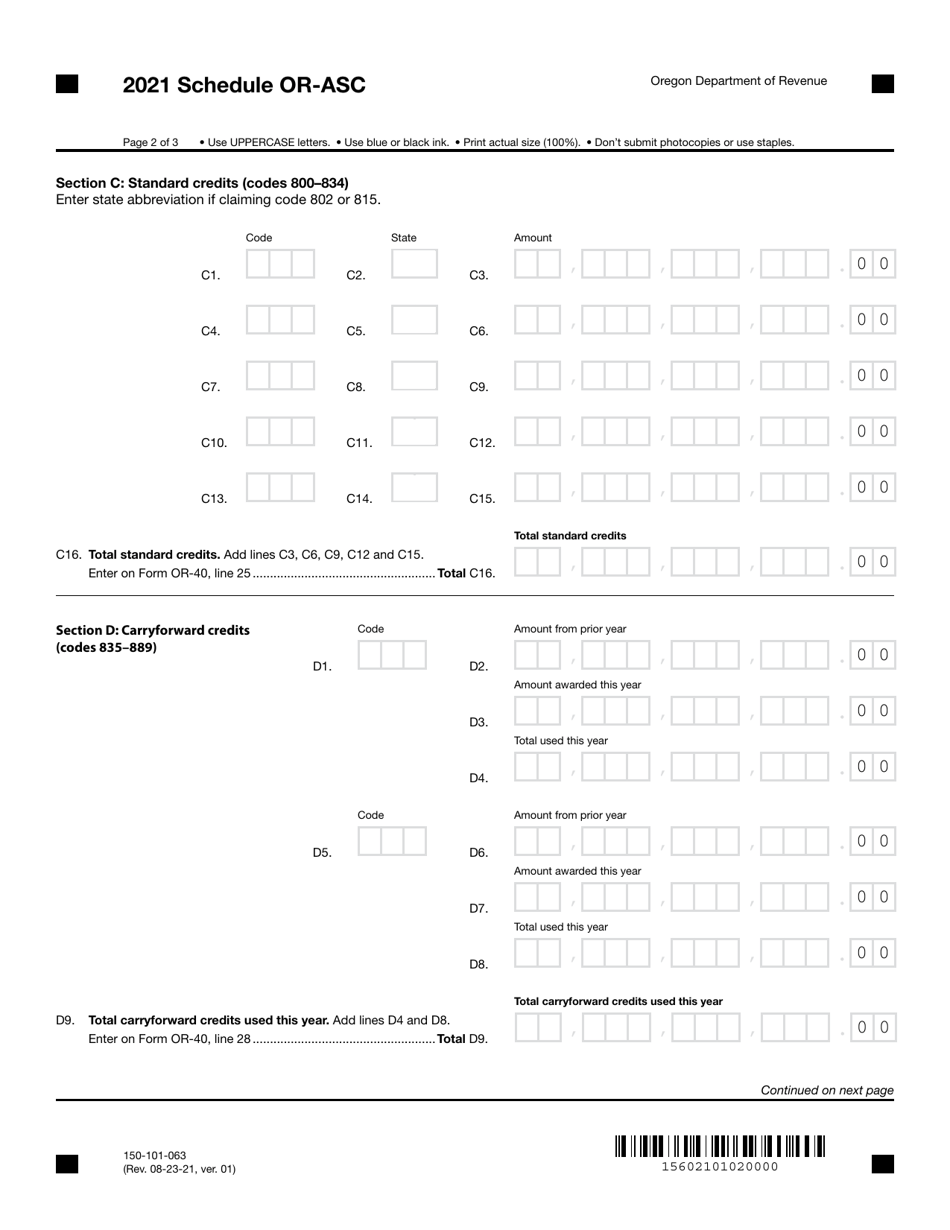

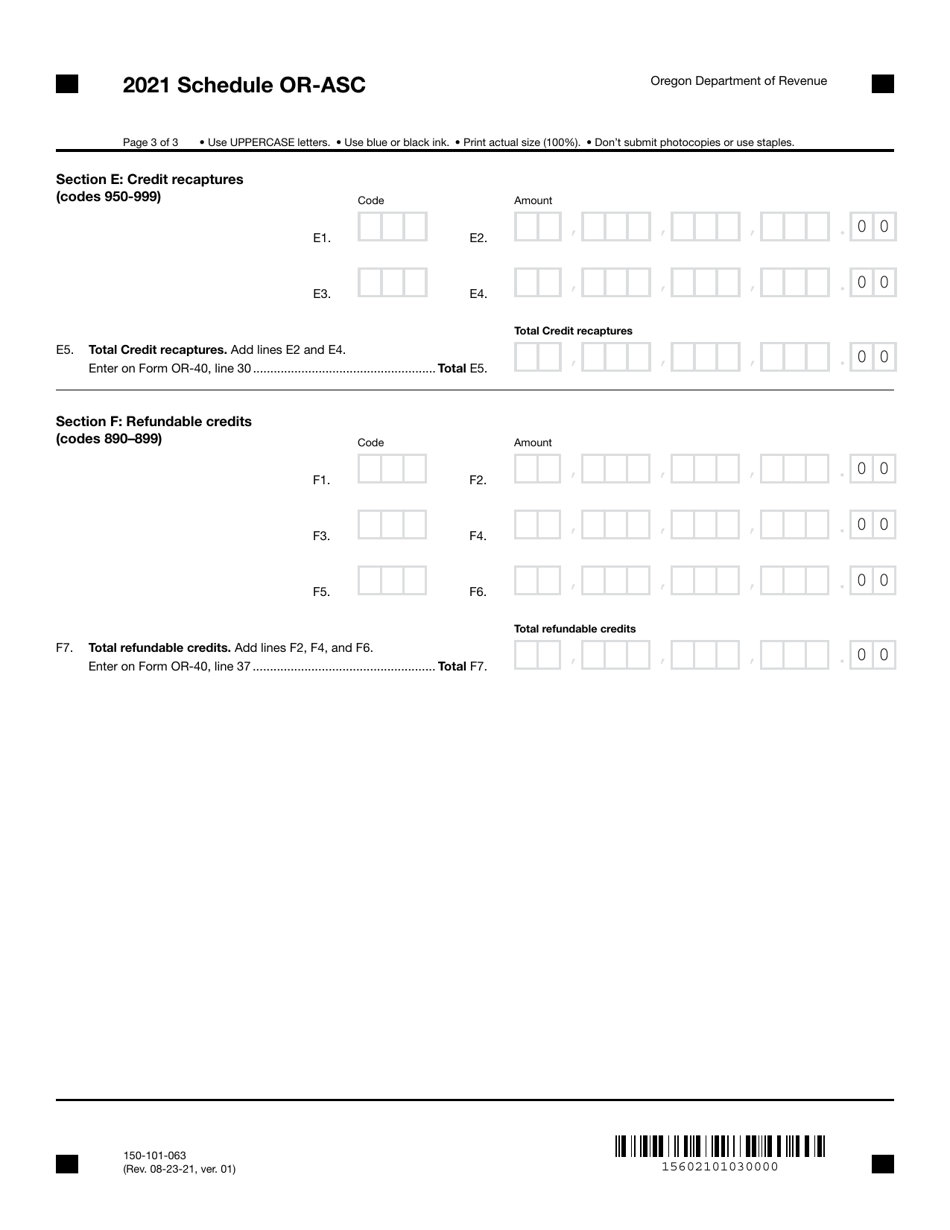

Form 150-101-063 Schedule OR-ASC

for the current year.

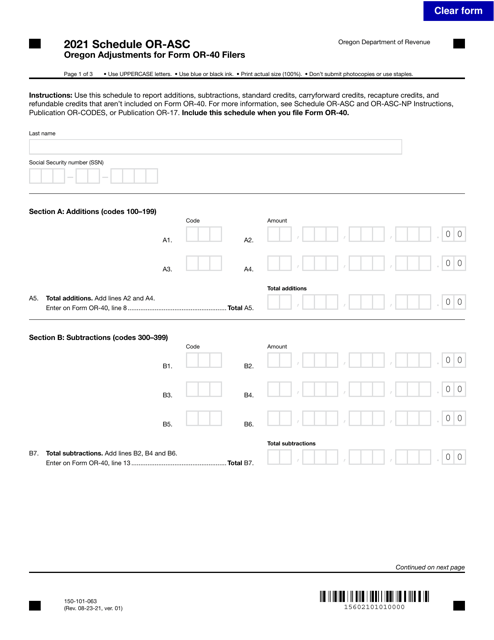

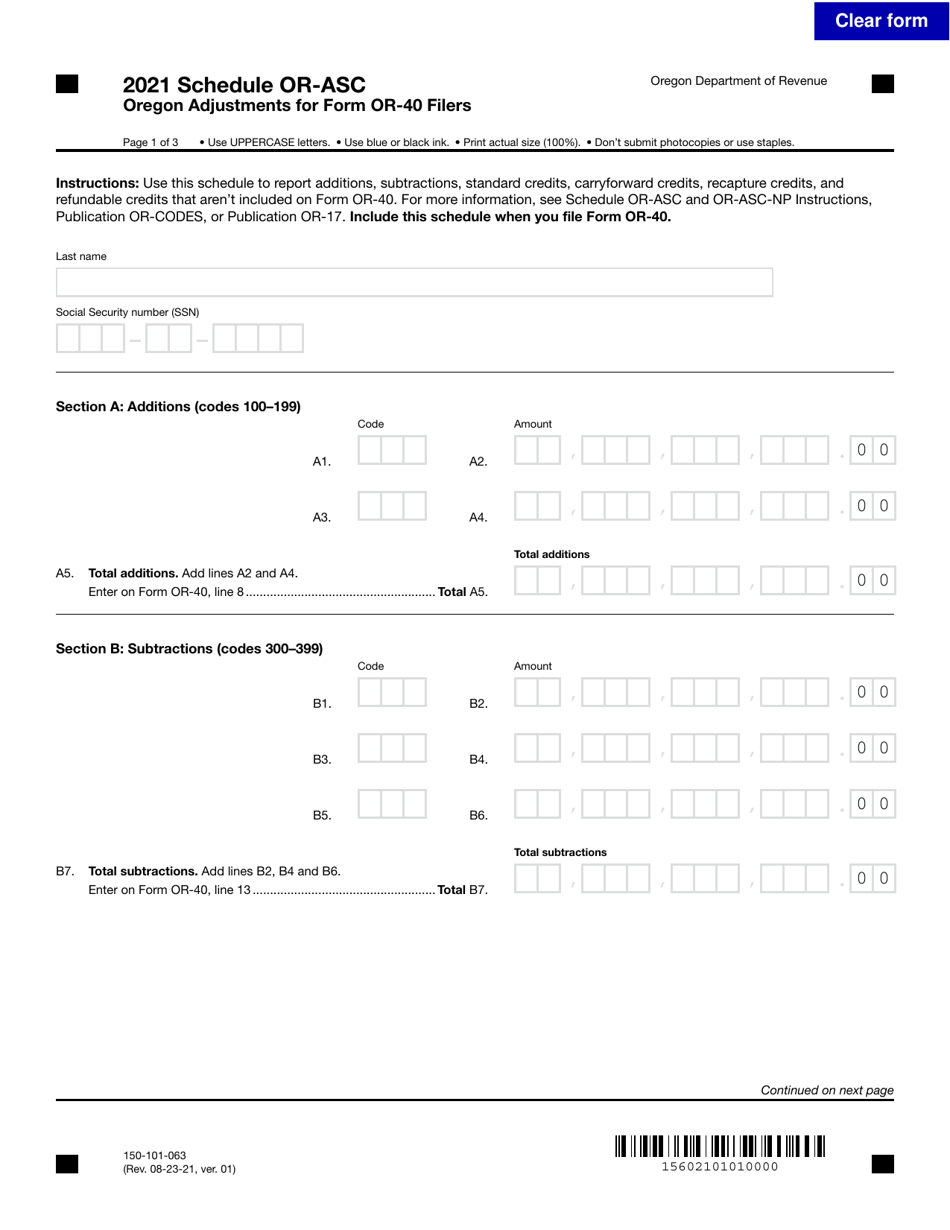

Form 150-101-063 Schedule OR-ASC Oregon Adjustments for Form or-40 Filers - Oregon

What Is Form 150-101-063 Schedule OR-ASC?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 150-101-063 Schedule OR-ASC?

A: Form 150-101-063 Schedule OR-ASC is a document used by Oregon residents who are filing Form OR-40 to report any adjustments to their income or deductions.

Q: Who needs to file Form 150-101-063 Schedule OR-ASC?

A: Oregon residents who are filing Form OR-40 and have adjustments to their income or deductions need to file Form 150-101-063 Schedule OR-ASC.

Q: What does Form 150-101-063 Schedule OR-ASC cover?

A: Form 150-101-063 Schedule OR-ASC covers adjustments to income or deductions that are specific to Oregon tax laws.

Q: Do I need to submit Form 150-101-063 Schedule OR-ASC with my tax return?

A: Yes, if you have adjustments to your income or deductions that are specific to Oregon tax laws, you need to submit Form 150-101-063 Schedule OR-ASC along with your Form OR-40.

Form Details:

- Released on August 23, 2021;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-101-063 Schedule OR-ASC by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.