This version of the form is not currently in use and is provided for reference only. Download this version of

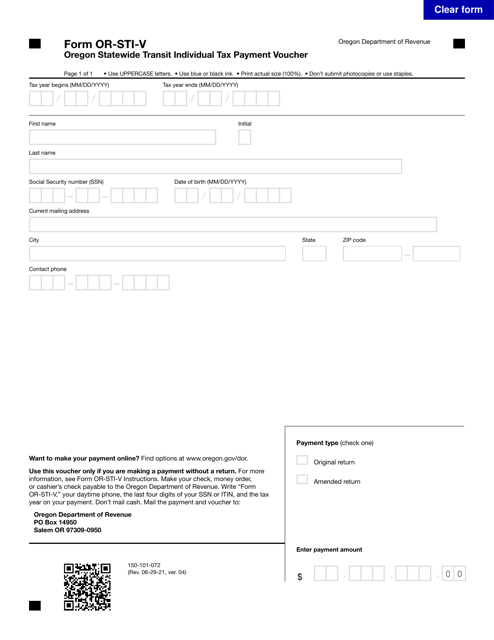

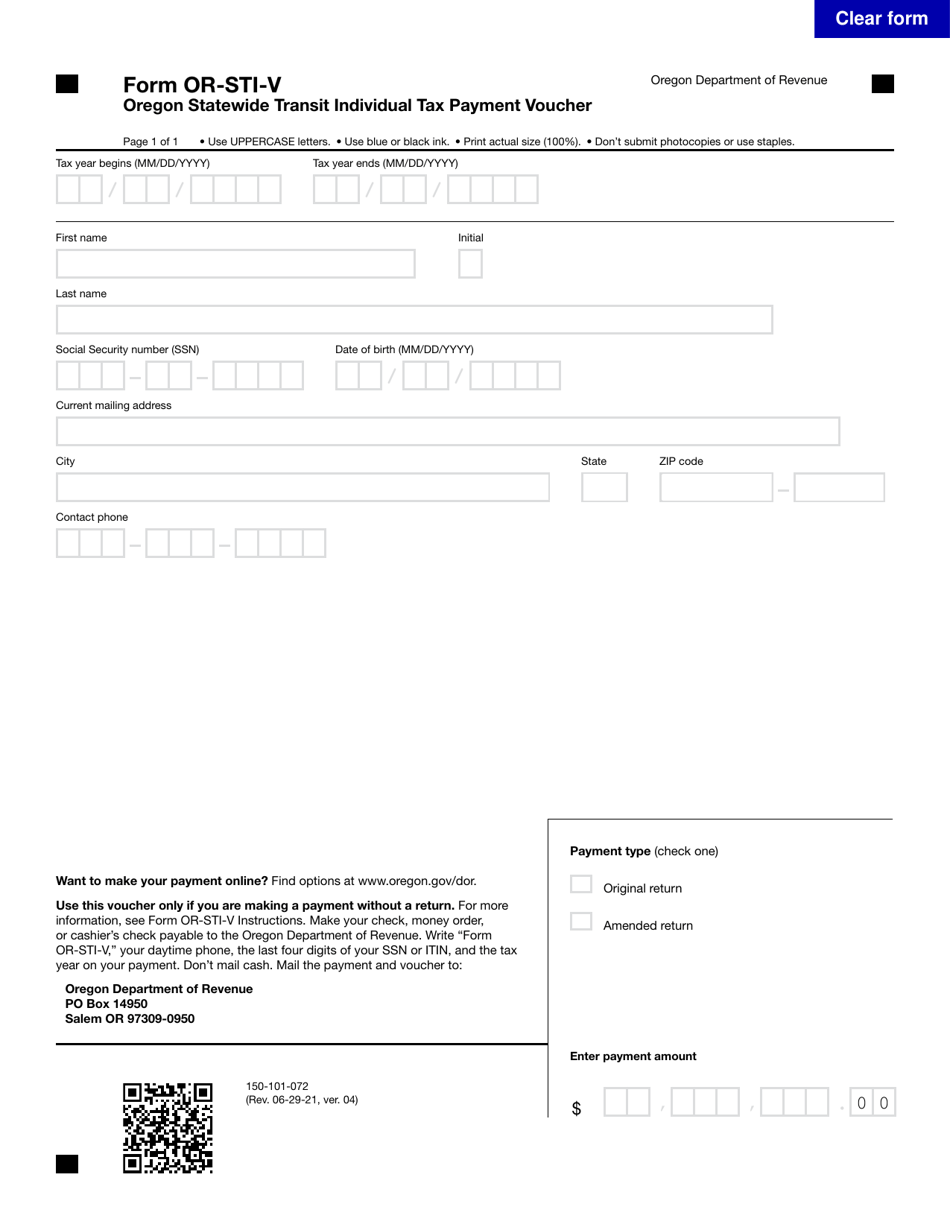

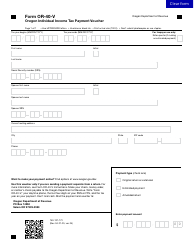

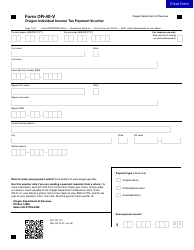

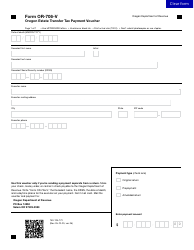

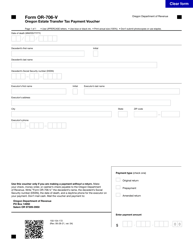

Form OR-STI-V (150-101-072)

for the current year.

Form OR-STI-V (150-101-072) Oregon Statewide Transit Individual Tax Payment Voucher - Oregon

What Is Form OR-STI-V (150-101-072)?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. Check the official instructions before completing and submitting the form.

FAQ

Q: What is OR-STI-V?

A: OR-STI-V stands for Oregon Statewide Transit Individual Tax Payment Voucher.

Q: What is the purpose of OR-STI-V?

A: OR-STI-V is used to make individual tax payments towards the Oregon Statewide Transit Tax.

Q: Who needs to use OR-STI-V?

A: Individuals who owe taxes towards the Oregon Statewide Transit Tax need to use OR-STI-V.

Q: How is OR-STI-V filled out?

A: OR-STI-V should be filled out with accurate taxpayer information and the correct amount of tax being paid.

Q: When is OR-STI-V due?

A: OR-STI-V payment is due on or before the deadline for filing individual income tax returns in Oregon.

Q: What happens if OR-STI-V is not paid on time?

A: Late payments may result in penalties and interest charges.

Q: Can OR-STI-V be used for business tax payments?

A: No, OR-STI-V is specifically for individual tax payments towards the Oregon Statewide Transit Tax.

Form Details:

- Released on June 29, 2021;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OR-STI-V (150-101-072) by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.