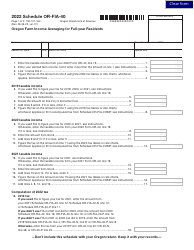

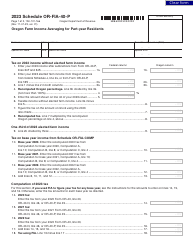

This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for Form 150-101-160 Schedule OR-FIA-40

for the current year.

Instructions for Form 150-101-160 Schedule OR-FIA-40 Oregon Farm Income Averaging for Full-Year Residents - Oregon

This document contains official instructions for Form 150-101-160 Schedule OR-FIA-40, Oregon Farm Income Averaging for Full-Year Residents - a form released and collected by the Oregon Department of Revenue. An up-to-date fillable Form 150-101-160 Schedule OR-FIA-40 is available for download through this link.

FAQ

Q: What is Form 150-101-160?

A: Form 150-101-160 is the Schedule OR-FIA-40 used for Oregon Farm Income Averaging for Full-Year Residents in Oregon.

Q: Who is required to use Form 150-101-160?

A: Full-year residents in Oregon who have farm income are required to use Form 150-101-160.

Q: What is Oregon Farm Income Averaging?

A: Oregon Farm Income Averaging is a method that allows farmers to average their income over three years to reduce tax liability.

Q: What is the purpose of Form 150-101-160?

A: The purpose of Form 150-101-160 is to calculate the average farm income and determine the tax liability for full-year residents in Oregon.

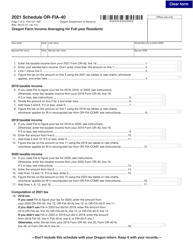

Q: How do I complete Form 150-101-160?

A: To complete Form 150-101-160, you will need to provide information about your farm income for the past three years and calculate the average.

Q: Are there any deadlines for filing Form 150-101-160?

A: Yes, the deadline for filing Form 150-101-160 is typically April 15th of the following tax year.

Q: What should I do if I need help with Form 150-101-160?

A: If you need help with Form 150-101-160, you can contact the Oregon Department of Revenue or seek assistance from a tax professional.

Q: Does using Form 150-101-160 guarantee a tax reduction?

A: Using Form 150-101-160 does not guarantee a tax reduction, but it allows farmers to potentially lower their tax liability by averaging their income over three years.

Instruction Details:

- This 4-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Oregon Department of Revenue.