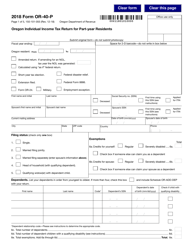

This version of the form is not currently in use and is provided for reference only. Download this version of

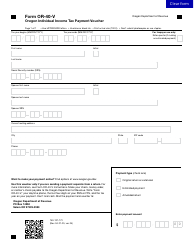

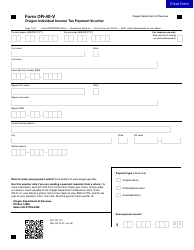

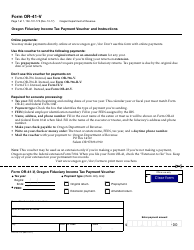

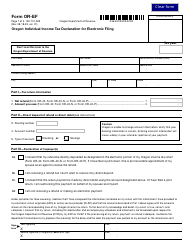

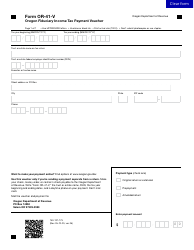

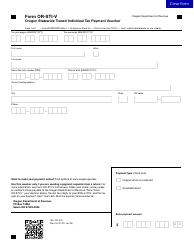

Instructions for Form OR-40-V, 150-101-172

for the current year.

Instructions for Form OR-40-V, 150-101-172 Oregon Individual Income Tax Payment Voucher - Oregon

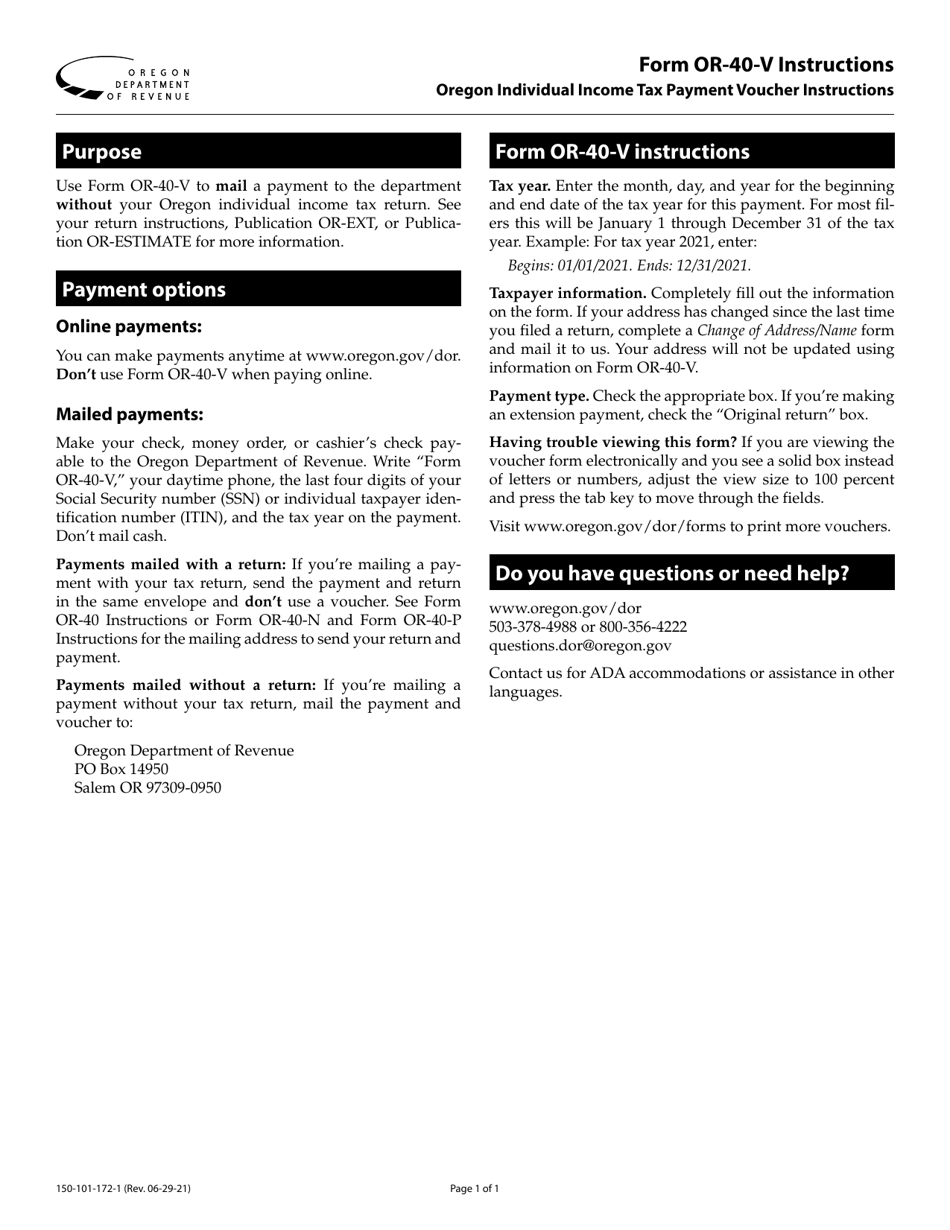

This document contains official instructions for Form OR-40-V , and Form 150-101-172 . Both forms are released and collected by the Oregon Department of Revenue. An up-to-date fillable Form 50-101-172 (OR-40-V) is available for download through this link. The latest available Form OR-40-V (150-101-172) can be downloaded through this link.

FAQ

Q: What is Form OR-40-V?

A: Form OR-40-V is the Oregon Individual Income Tax Payment Voucher.

Q: What is the purpose of Form OR-40-V?

A: The purpose of Form OR-40-V is to submit payment for Oregon individual income tax.

Q: Who needs to use Form OR-40-V?

A: Anyone who owes Oregon individual income tax and is filing Form OR-40 must use Form OR-40-V to make a payment.

Q: When is Form OR-40-V due?

A: Form OR-40-V is due on or before the original due date of your Oregon individual income tax return.

Q: How should I fill out Form OR-40-V?

A: You should enter your name, address, Social Security number, and the amount you are paying on Form OR-40-V.

Q: What happens if I don't file Form OR-40-V?

A: If you owe Oregon individual income tax and don't file Form OR-40-V or make a payment, you may incur penalties and interest.

Q: Can I request an extension to file Form OR-40-V?

A: No, Form OR-40-V is used for submitting payment and there is no extension available specifically for this form.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Oregon Department of Revenue.