This version of the form is not currently in use and is provided for reference only. Download this version of

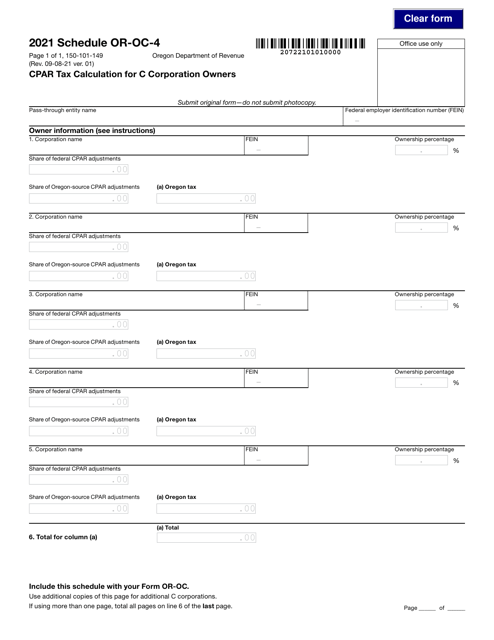

Form 150-101-149 Schedule OR-OC-4

for the current year.

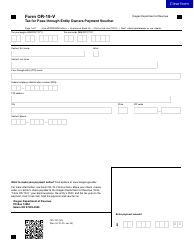

Form 150-101-149 Schedule OR-OC-4 Cpar Tax Calculation for C Corporation Owners - Oregon

What Is Form 150-101-149 Schedule OR-OC-4?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 150-101-149?

A: Form 150-101-149 is a tax form used in Oregon for C Corporation owners to calculate corporate tax.

Q: Who should use Form 150-101-149?

A: Form 150-101-149 should be used by C Corporation owners in Oregon.

Q: What is the purpose of Schedule OR-OC-4?

A: The purpose of Schedule OR-OC-4 is to calculate the tax liability of C Corporation owners in Oregon.

Q: What information is required on Schedule OR-OC-4?

A: Schedule OR-OC-4 requires information about the C Corporation's income, deductions, and apportionment factors.

Q: When is Form 150-101-149 due?

A: Form 150-101-149 is due on the 15th day of the month following the end of the corporation's tax year.

Form Details:

- Released on September 8, 2021;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-101-149 Schedule OR-OC-4 by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.