This version of the form is not currently in use and is provided for reference only. Download this version of

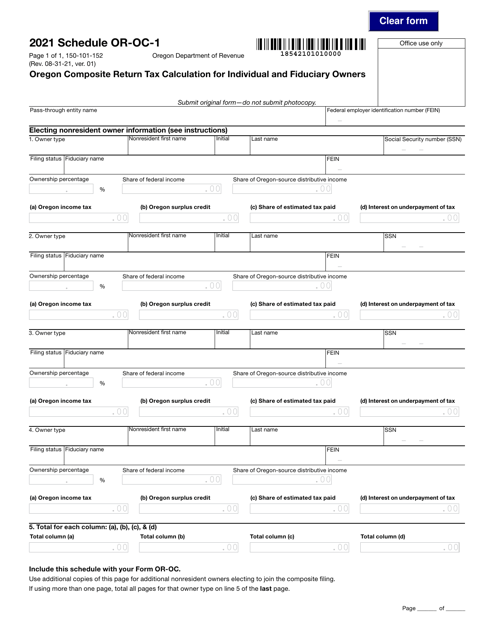

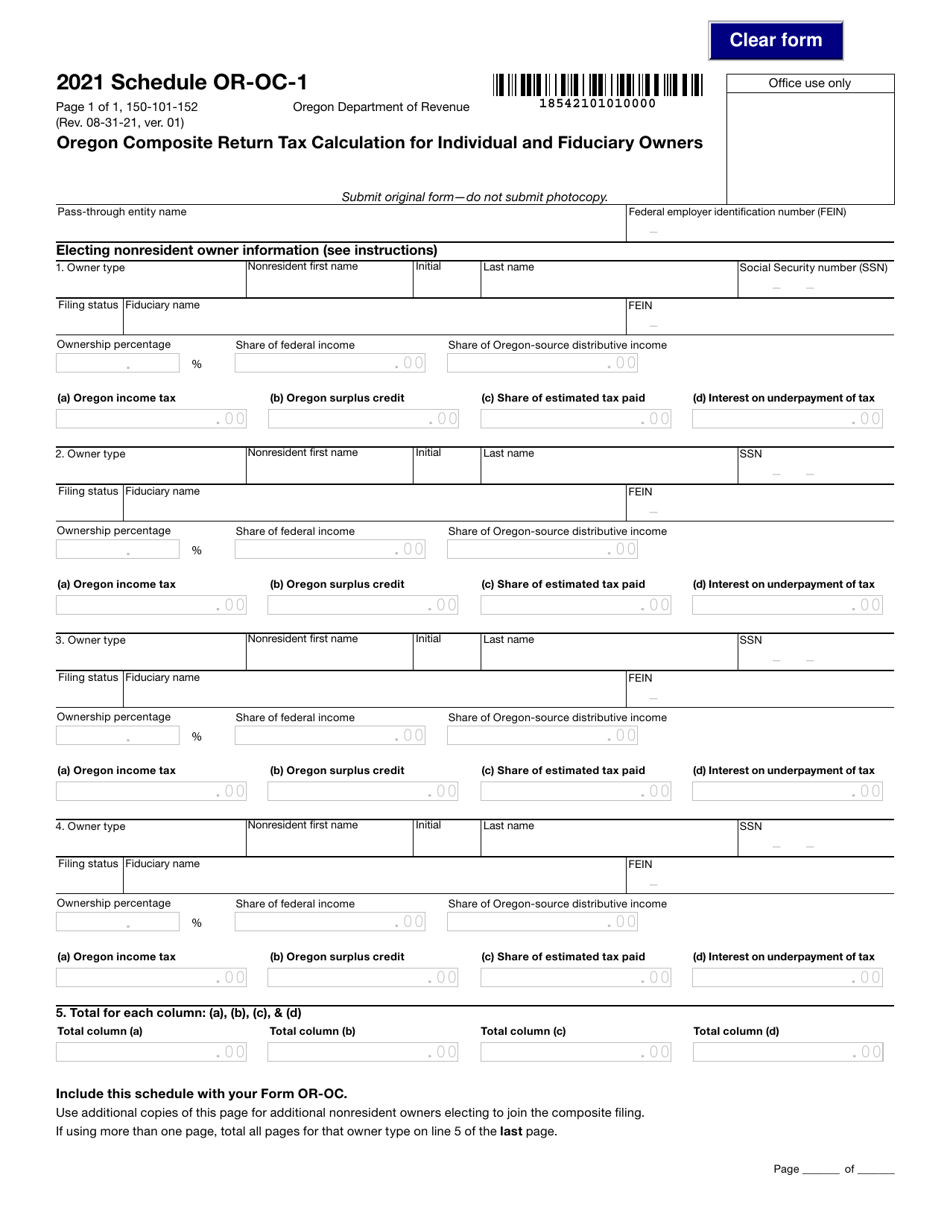

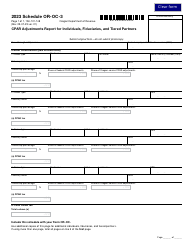

Form 150-101-152 Schedule OR-OC-1

for the current year.

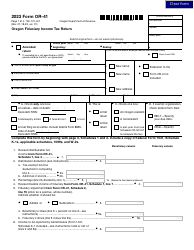

Form 150-101-152 Schedule OR-OC-1 Oregon Composite Return Tax Calculation for Individual and Fiduciary Owners - Oregon

What Is Form 150-101-152 Schedule OR-OC-1?

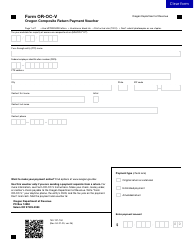

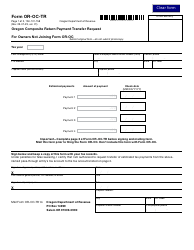

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 150-101-152?

A: Form 150-101-152 is the Schedule OR-OC-1, which is used for the tax calculation of individual and fiduciary owners on the Oregon Composite Return.

Q: Who needs to file Form 150-101-152?

A: Individual and fiduciary owners who need to calculate their tax liability on the Oregon Composite Return need to file Form 150-101-152.

Q: What is the purpose of Form 150-101-152?

A: The purpose of Form 150-101-152 is to calculate the tax owed by individual and fiduciary owners on the Oregon Composite Return.

Q: Can I use Form 150-101-152 for federal tax purposes?

A: No, Form 150-101-152 is specific to the Oregon Composite Return and cannot be used for federal tax purposes.

Form Details:

- Released on August 31, 2021;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-101-152 Schedule OR-OC-1 by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.