This version of the form is not currently in use and is provided for reference only. Download this version of

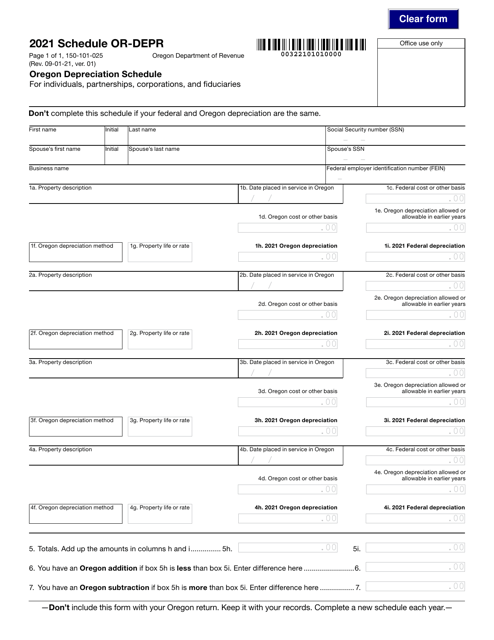

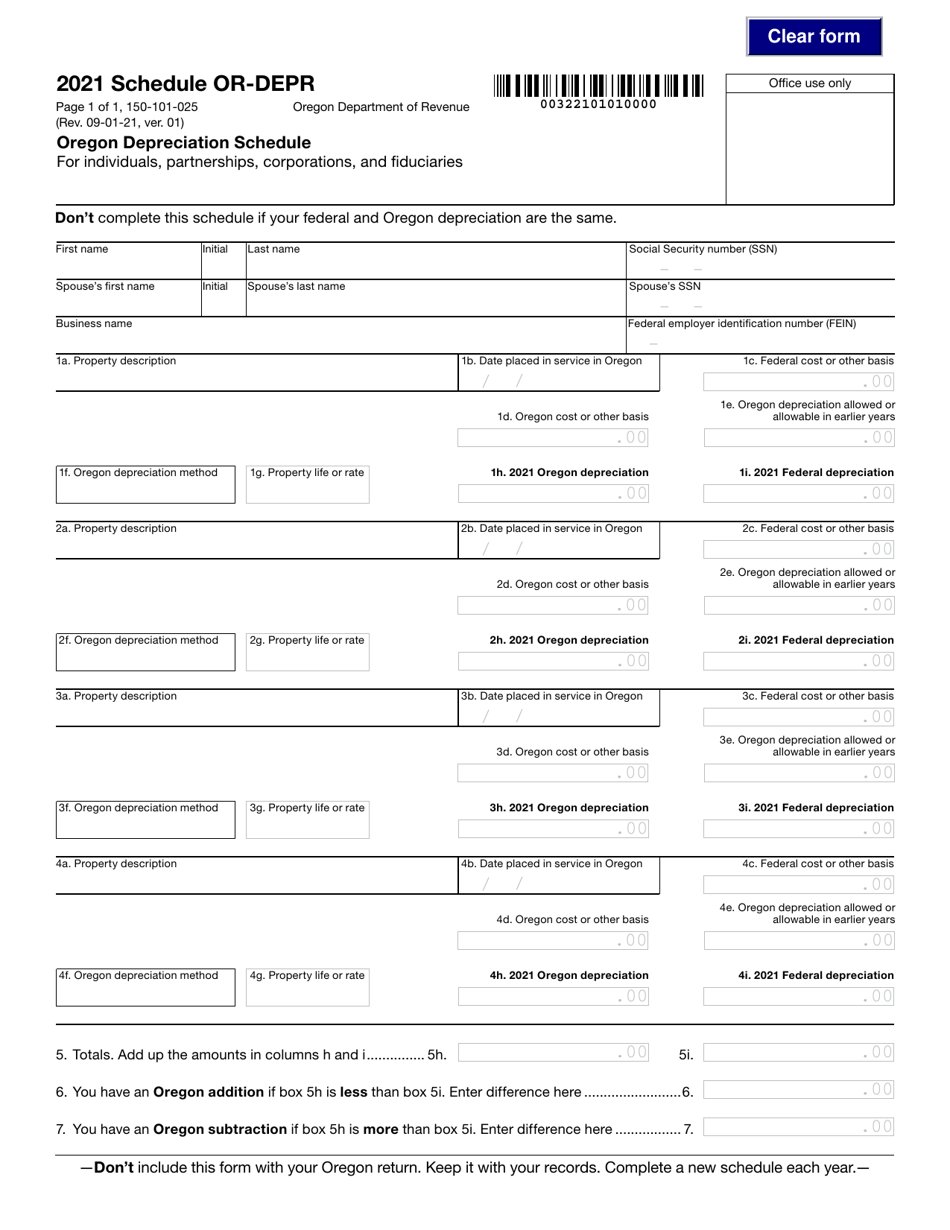

Form 150-101-025 Schedule OR-DEPR

for the current year.

Form 150-101-025 Schedule OR-DEPR Oregon Depreciation Schedule - Oregon

What Is Form 150-101-025 Schedule OR-DEPR?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form 150-101-025 Schedule OR-DEPR?

A: Form 150-101-025 Schedule OR-DEPR is the Oregon Depreciation Schedule.

Q: What is the purpose of Form 150-101-025 Schedule OR-DEPR?

A: The purpose of Form 150-101-025 Schedule OR-DEPR is to report the depreciation of assets for tax purposes in Oregon.

Q: Who needs to file Form 150-101-025 Schedule OR-DEPR?

A: Individuals or businesses in Oregon who have depreciable assets and want to report their depreciation for tax purposes need to file Form 150-101-025 Schedule OR-DEPR.

Q: Are there any specific instructions for filling out Form 150-101-025 Schedule OR-DEPR?

A: Yes, the Oregon Department of Revenue provides instructions for filling out Form 150-101-025 Schedule OR-DEPR. You should refer to these instructions to ensure accurate and complete reporting of depreciation.

Q: When is the deadline for filing Form 150-101-025 Schedule OR-DEPR?

A: The deadline for filing Form 150-101-025 Schedule OR-DEPR in Oregon is the same as the deadline for filing your Oregon income tax return, which is usually April 15th.

Q: What happens if I don't file Form 150-101-025 Schedule OR-DEPR?

A: If you don't file Form 150-101-025 Schedule OR-DEPR when required, you may be subject to penalties and interest on unreported or underreported depreciation.

Q: Can I e-file Form 150-101-025 Schedule OR-DEPR?

A: Yes, you can e-file Form 150-101-025 Schedule OR-DEPR if you are using approved tax software or working with a tax professional who offers e-filing services.

Q: Is there a fee for filing Form 150-101-025 Schedule OR-DEPR?

A: There is no separate fee for filing Form 150-101-025 Schedule OR-DEPR. However, you may need to pay a filing fee for your Oregon income tax return.

Q: Can I amend Form 150-101-025 Schedule OR-DEPR?

A: Yes, if you need to make changes or corrections to your previously filed Form 150-101-025 Schedule OR-DEPR, you can file an amended form.

Form Details:

- Released on September 1, 2021;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-101-025 Schedule OR-DEPR by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.