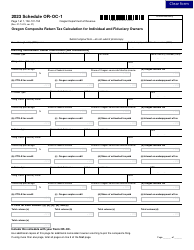

Form OR-OC (150-101-155) Oregon Composite Return Instructions for Pass-Through Entities - Oregon

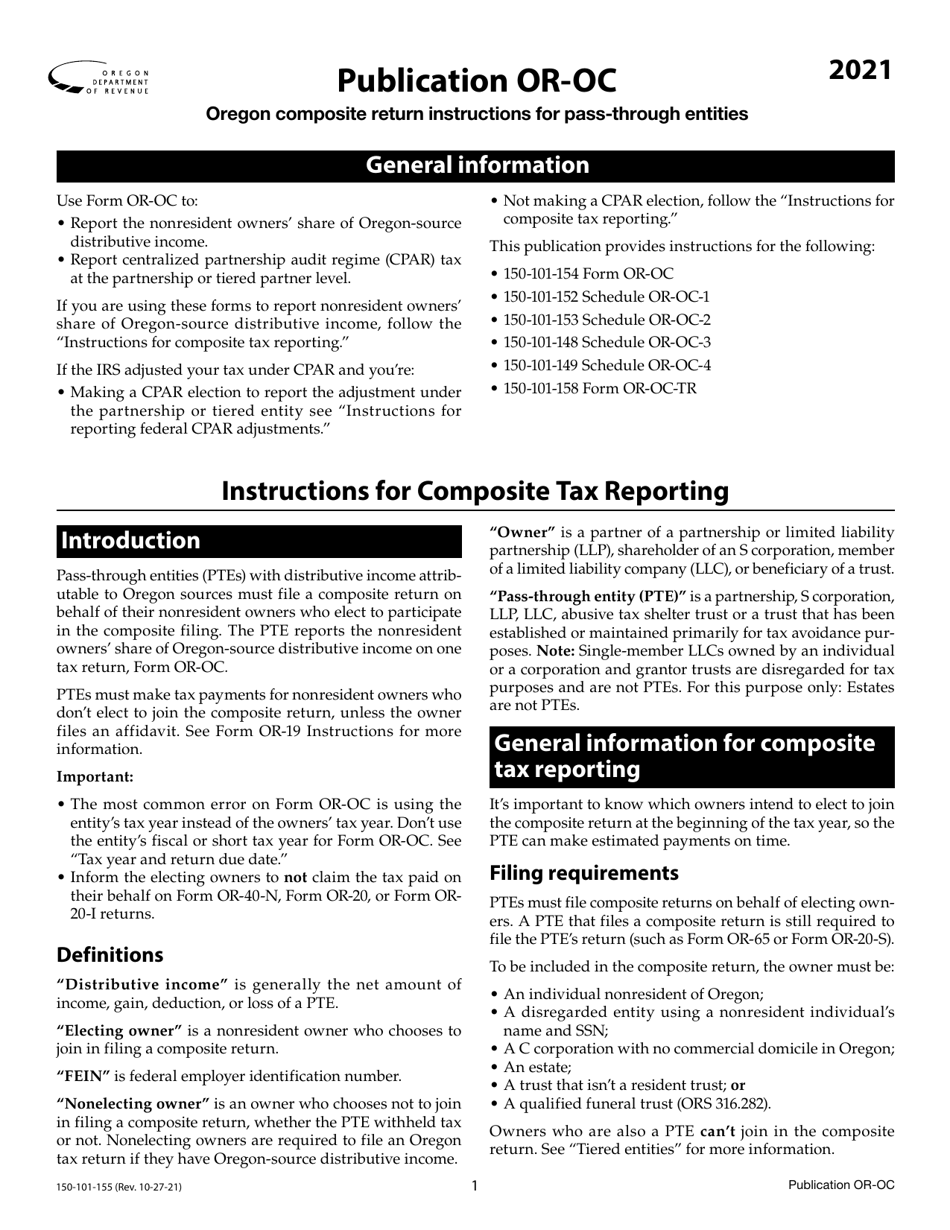

What Is Form OR-OC (150-101-155)?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form OR-OC?

A: Form OR-OC is the Oregon Composite Return for Pass-Through Entities.

Q: Which entities need to file Form OR-OC?

A: Pass-through entities, such as partnerships, limited liability companies (LLCs), and S corporations, need to file Form OR-OC.

Q: What is the purpose of Form OR-OC?

A: The purpose of Form OR-OC is to report the income, deductions, and credits for nonresident members of a pass-through entity who do not individually file an Oregon return.

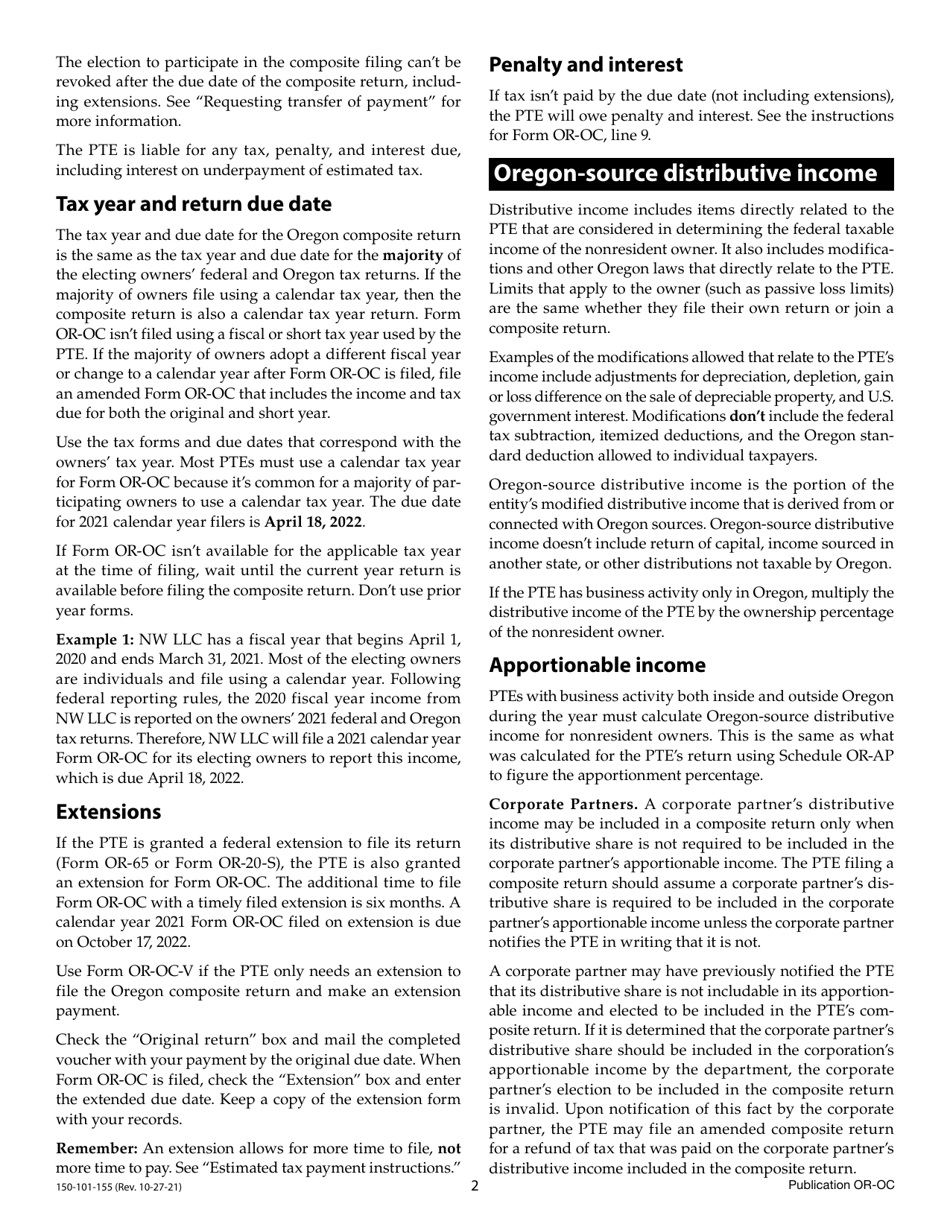

Q: When is Form OR-OC due?

A: Form OR-OC is due on or before the 15th day of the third month following the close of the tax year.

Q: Are there any penalties for late filing of Form OR-OC?

A: Yes, there are penalties for late filing of Form OR-OC. It is important to file the form on time to avoid these penalties.

Form Details:

- Released on October 27, 2021;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form OR-OC (150-101-155) by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.